Global Automotive Fuel Cell Market Size, Share, and COVID-19 Impact Analysis, By Type (PEMFC, PAFC & AFC), By Power (< 100 kW, 100 - 200 kW, > 200 kW), By Application (Buses, Trucks, LCVs, Passenger Cars), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Automotive & TransportationGlobal Automotive Fuel Cell Market Insights Forecasts to 2033

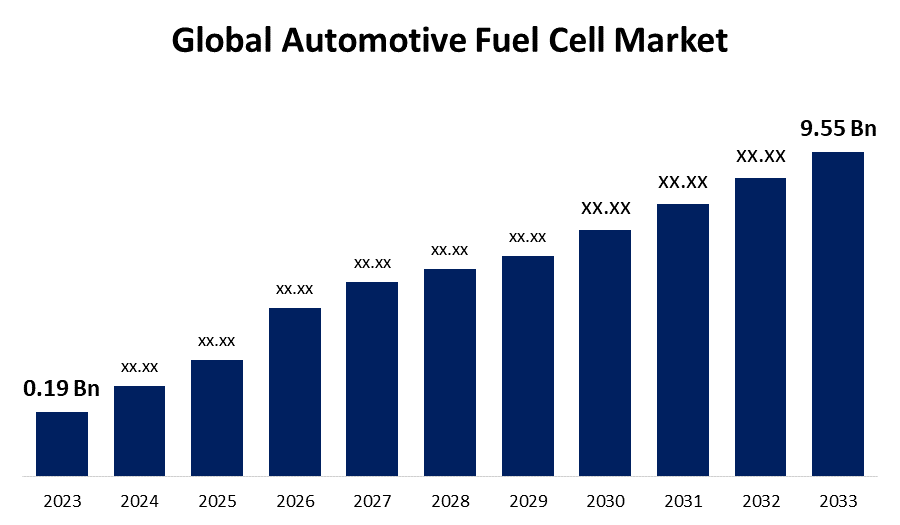

- The Global Automotive Fuel Cell Market Size was Valued at USD 0.19 Billion in 2023

- The Market Size is Growing at a CAGR of 47.95% from 2023 to 2033

- The Worldwide Automotive Fuel Cell Market Size is Expected to Reach USD 9.55 Billion by 2033

- Europe is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Automotive Fuel Cell Market Size is Anticipated to Exceed USD 9.55 Billion by 2033, Growing at a CAGR of 47.95% from 2023 to 2033.

Market Overview

A fuel cell is an electrochemical device that produces electricity through the reaction of chemicals between hydrogen and oxygen. It powers electric vehicles (EVs), which include cars, trucks, and buses. In a fuel cell, hydrogen is supplied to the anode while oxygen from the air is delivered to the cathode. The industrial outlook will be boosted by a shift towards clean and sustainable transportation solutions, as well as large-scale investments from the government, automakers, and energy corporations. For instance, in January 2024, Advent Technologies Holdings, Inc., an innovation-driven leader in fuel cell and hydrogen technology, is pleased to announce that its subsidiary, Advent Technologies, A/S, has received funding from the Danish Energy Technology Development and Demonstration Programmer for its most recent research and development project. Furthermore, governments throughout the world are implementing huge steps to encourage fuel-cell technology and invest in hydrogen infrastructure. Regions such as Europe, China, and North America, as well as US states such as California and New York, are actively promoting the establishment of hydrogen hubs. Furthermore, the market is seeing advances in mobile and communal hydrogen fueling systems, making hydrogen more accessible for residential and small-scale applications. Companies like Air Liquide, Linde, and Powertech Labs are pioneering the development of low-cost, transportable refueling solutions to help fuel-cell electric vehicles gain commercial traction.

Report Coverage

This research report categorizes the market for the global automotive fuel cell market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global automotive fuel cell market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global automotive fuel cell market.

Global Automotive Fuel Cell Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 0.19 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 47.95% |

| 2033 Value Projection: | USD 9.55 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Power, By Application, By Region |

| Companies covered:: | Acumentrics, Panasonic Holdings Corporation, Bloom Energy, Convion Ltd, Hyster-Yale Group, Inc., Advent Technologies, Altergy, Ballard Power Systems, FuelCell Energy, Inc, Hyzon, Toshiba Energy Systems & Solutions Corporation, Plug Power Inc., Cummins Inc., BorgWarner Inc., and Others |

| Pitfalls & Challenges: | Covid 19 Impact Challanges, Future, Growth and Analysis |

Get more details on this report -

Driving Factors

The rise in greenhouse gas emissions and the depletion of fossil fuel supplies have prompted the development of zero-emission cars such as electric vehicles and fuel cell electric vehicles. Various research and development activities are underway to expedite the adoption of FCEVs, which have greater driving ranges than their non-zero emission counterparts, battery-based electric vehicles. FCEVs generate energy using hydrogen fuel cells, generating only water vapor as a byproduct, alleviating concerns about air pollution and climate change. Furthermore, in order to reach sustainability standards, governments around the world have tightened laws on car emissions, resulting in an increase in the number of fuel cell electric vehicles. For example, during COP27, the United States declared the goal of only selling and producing zero-emissions medium and heavy-duty vehicles.

Restraining Factors

High manufacturing costs for fuel cell vehicles may potentially hinder their adoption in different nations. However, many governmental and private organizations are constantly working to close the gap between these deficiencies.

Market Segmentation

The global automotive fuel cell market share is classified into type, power, and application.

- The PEMFC segment is expected to hold the largest share of the global automotive fuel cell market during the forecast period.

Based on the type, the global automotive fuel cell market is categorized into PEMFC, PAFC & AFC. Among these, the PEMFC segment is expected to hold the largest share of the global automotive fuel cell market during the forecast period. Because of its capacity to provide advantages like high efficiency, minimal emissions, and short refueling times. Several government incentives and subsidies will continue to encourage product adoption. Furthermore, coordination among automakers, fuel cell producers, and infrastructure developers will strengthen industry dynamics.

- The > 200 kW segment is expected to grow at the fastest CAGR during the forecast period.

Based on the power, the global automotive fuel cell market is categorized into< 100 kW, 100 – 200 kW, > 200 kW. Among these, the > 200 kW segment is expected to grow at the fastest CAGR during the forecast period. The usage of larger fuel cell systems in commercial vehicles, heavy-duty trucks, buses, and industrial applications, together with increased efforts to reduce carbon emissions in the transportation sector, will positively impact the automotive fuel cell market growth. Marketing activities and consumer outreach programmer, together with advancements in fuel cell technology, will have a positive impact on the commercial scenario. Furthermore, incentives, tax credits, and regulatory measures encourage fleet operators to invest in fuel cell technology, which contributes to business trends.

- The passenger cars segment is expected to hold a significant share of the global automotive fuel cell market during the forecast period.

Based on the application, the global automotive fuel cell market is categorized into buses, trucks, LCVs, and passenger cars. Among these, the passenger cars segment is expected to hold a significant share of the global automotive fuel cell market during the forecast period. Expanding customer access to a greater choice of fuel cell vehicles, as well as the availability of many zero-emission mobility alternatives. Shifting consumer attitudes towards sustainable freight, which includes passenger transportation, will drive industry changes. Furthermore, novel peer-to-peer car-sharing platforms, along with improved features and systems to ensure a safe and dependable driving experience, will accelerate technology adoption.

Regional Segment Analysis of the Global Automotive Fuel Cell Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

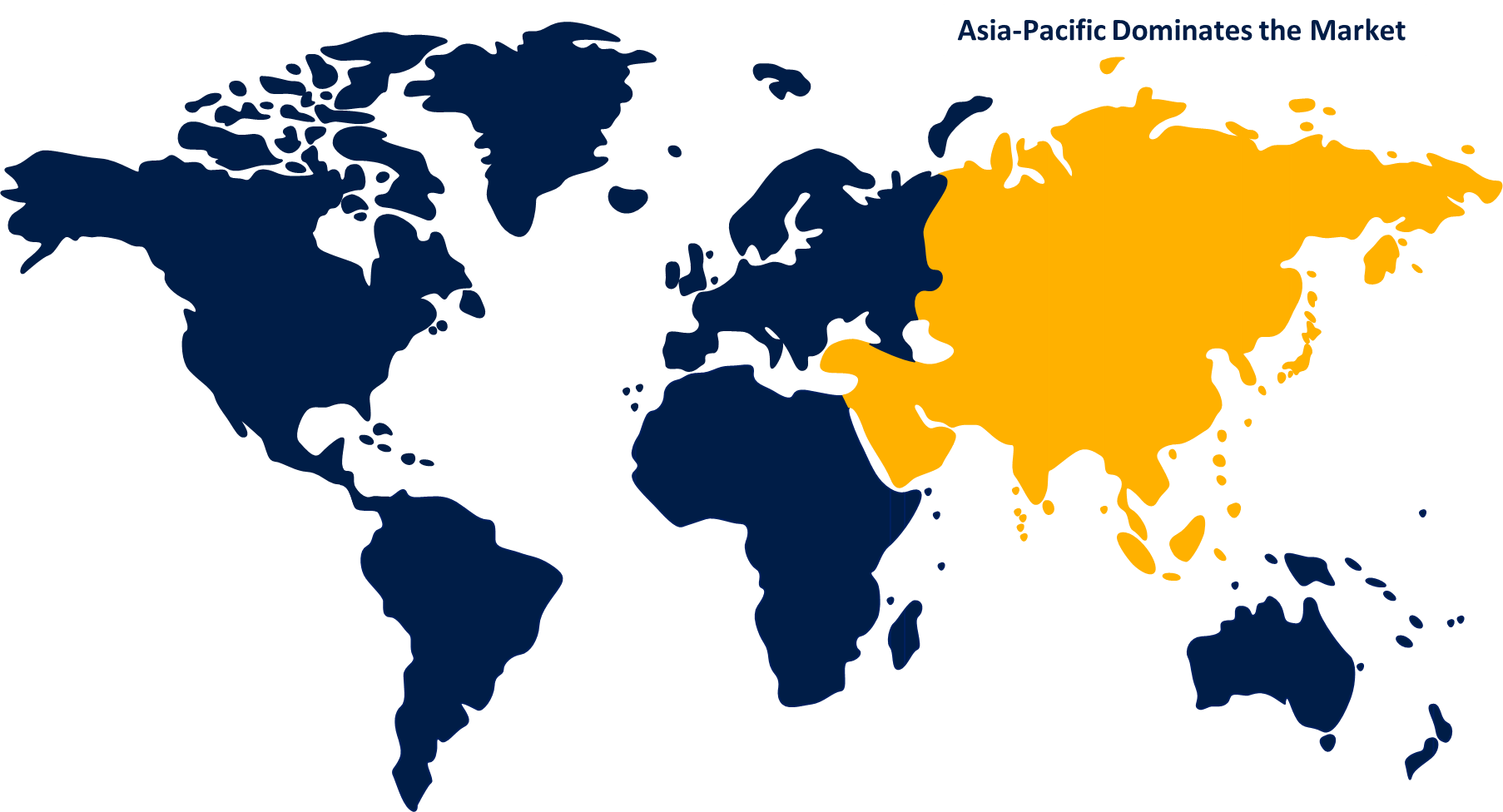

Asia Pacific is projected to hold the largest share of the global automotive fuel cell market over the forecast period.

Get more details on this report -

Asia Pacific is projected to hold the largest share of the global automotive fuel cell market over the forecast period. Japan, China, South Korea, India, and Australia are leading the drive to expand hydrogen infrastructure. These countries are actively promoting the growth of Fuel Cell Electric Vehicles (FCEVs) with fast-evolving changing systems on the market. Leading Original Equipment Manufacturers (OEMs) such as Toyota, Hyundai, and Honda are critical to accelerating the regional adoption of fuel-cell automobiles. In addition, certain countries have launched FCEV buses and trucks, with Ballard playing an important part in creating China's huge FCEV bus and truck network. Noteworthy initiatives in the bus sector include Kansai Airport in Japan and companies like Solaris and the West Midlands deploying hydrogen fuel cell buses. As of September 2023, ENEOS manages 43 hydrogen refueling stations across four major metropolitan areas in Japan.

Europe is expected to grow at the fastest CAGR growth of the global automotive fuel cell market during the forecast period. Strict carbon reduction standards are combined with ambitious ambitions for FCEV implementation. The European Union has enacted many rules that require member states to considerably reduce carbon emissions at various time intervals. In June 2018, the French government unveiled a new plan to promote hydrogen and other forms of renewable energy. The strategy specifies the country's medium and long-term ambitions, which include deploying over 5,000 FCEVs by 2023 and about 52,000 FCEVs by 2028. The region's key countries are the United Kingdom, Germany, France, Italy, and Sweden.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global automotive fuel cell market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Acumentrics

- Panasonic Holdings Corporation

- Bloom Energy

- Convion Ltd

- Hyster-Yale Group, Inc.

- Advent Technologies

- Altergy

- Ballard Power Systems

- FuelCell Energy, Inc

- Hyzon

- Toshiba Energy Systems & Solutions Corporation

- Plug Power Inc.

- Cummins Inc.

- BorgWarner Inc.

- Others

Key Market Developments

- On March 2024, Hyzon, a leading developer of hydrogen fuel cell technology in the United States and a global supplier of zero-emission heavy-duty fuel cell electric vehicles, unveiled its single stack 200kW fuel cell system and powertrain in a vehicle at a ceremony attended by government officials, heavy-duty fleet operators, and company employees and executives.

- On February 2024, Panasonic Corporation declared that its Electric Works Company will accept orders for the ultrasonic flow and concentration metre for hydrogen, a novel product intended for the Chinese market that can detect hydrogen flow and concentration in high-humidity situations.

- In May 2023, Hyundai Motor Company has launched its new XCIENT fuel cell tractor for the North American commercial vehicle market. The development of the class 8 fuel cell electric model enabled the corporation to promote hydrogen mobility while being carbon neutral. Thus, the introduction of this product strengthened the company's standing in the region.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global automotive fuel cell market based on the below-mentioned segments:

Global Automotive Fuel Cell Market, By Type

- PEMFC

- PAFC

- AFC

Global Automotive Fuel Cell Market, By Power

- < 100 kW

- 100 – 200 kW

- > 200 kW

Global Automotive Fuel Cell Market, By Application

- Buses

- Trucks

- LCVs

- Passenger Cars

Global Automotive Fuel Cell Market, By Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the global automotive fuel cell market over the forecast period?The Global Automotive Fuel Cell Market Size is Expected to Grow from USD 0.19 Billion in 2023 to USD 9.55 Billion by 2033, at a CAGR of 47.95% during the forecast period 2023-2033.

-

2. Which region is expected to hold the highest share in the global automotive fuel cell market?Asia Pacific is projected to hold the largest share of the global automotive fuel cell market over the forecast period.

-

3. Who are the top key players in the automotive fuel cell market?Acumentrics, Panasonic Holdings Corporation, Bloom Energy, Convion Ltd, Hyster-Yale Group, Inc., Advent Technologies, Altergy, Ballard Power Systems, FuelCell Energy, Inc, Hyzon, Toshiba Energy Systems & Solutions Corporation, Plug Power Inc., Cummins Inc., BorgWarner Inc., and others.

Need help to buy this report?