Global Automotive Gear Market Size, Share, and COVID-19 Impact Analysis, By Material (Metallic, Plastic), By Product Type (Planetary, Bevel, Helical, Non-Metallic, Other), By Vehicle Type (Passenger Vehicle, Commercial Vehicle), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Automotive & TransportationGlobal Automotive Gear Market Insights Forecasts to 2033

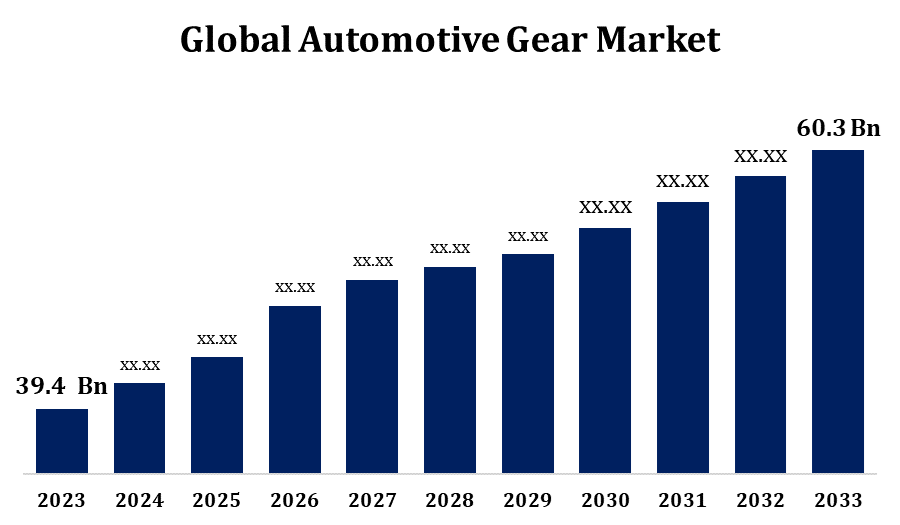

- The Global Automotive Gear Market was valued at USD 39.4 Billion in 2023.

- The Market is Growing at a CAGR of 4.35% from 2023 to 2033.

- The Worldwide Automotive Gear Market is expected to reach USD 60.3 Billion by 2033.

- Asia Pacific is Expected to Grow the fastest during the Forecast period.

Get more details on this report -

The Global Automotive Gear Market Size is expected to reach USD 60.3 billion by 2033, at a CAGR of 4.35% during the forecast period 2023 to 2033.

The automotive gear market is a key component of the global automotive industry, driven by advancements in vehicle technology and increasing demand for fuel efficiency. Gears play a crucial role in the transmission systems of vehicles, ensuring optimal power transfer and driving performance. The market is influenced by the growing adoption of electric vehicles (EVs), as well as the rising need for advanced gear technologies, such as continuously variable transmissions (CVT) and dual-clutch transmissions (DCT). Factors like stricter emission regulations, improved safety standards, and innovations in automated driving systems also contribute to market growth. The automotive gear market is highly competitive, with major manufacturers focusing on product innovation, cost efficiency, and sustainability to maintain a strong market position. The market is expected to grow steadily, with increasing vehicle production and technological upgrades.

Automotive Gear Market Value Chain Analysis

The automotive gear market value chain encompasses several stages, from raw material procurement to the final delivery of finished products. It begins with the extraction and processing of raw materials, such as steel and aluminum, which are essential for gear manufacturing. Next, suppliers provide these materials to gear manufacturers, who design and produce a wide variety of gears, including bevel, helical, and planetary gears. These components are then integrated into vehicle transmission systems by original equipment manufacturers (OEMs) or Tier 1 suppliers. Aftermarket players also contribute by supplying replacement gears and related services. Throughout the value chain, key activities include research and development, manufacturing, logistics, and distribution. The value chain is supported by factors like technological advancements, regulatory compliance, and cost optimization, ensuring smooth production and timely delivery.

Automotive Gear Market Opportunity Analysis

The automotive gear market offers significant growth opportunities driven by various factors. The rise in electric vehicle (EV) production presents a promising opportunity as EVs require advanced transmission systems, creating demand for specialized gears. Additionally, the increasing focus on fuel efficiency and reduced emissions is driving the adoption of innovative gear technologies, such as continuously variable transmissions (CVT) and dual-clutch transmissions (DCT), which are more energy-efficient. The shift toward autonomous vehicles also opens new avenues for advanced gear systems that support automation and improved driving performance. Emerging markets, especially in Asia-Pacific, are experiencing rapid urbanization and increased vehicle sales, providing a growing customer base. Furthermore, the automotive aftermarket sector offers a continuous demand for replacement gears, enhancing long-term market prospects.

Global Automotive Gear Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 39.4 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 4.35% |

| 2033 Value Projection: | USD 60.3 billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 230 |

| Tables, Charts & Figures: | 95 |

| Segments covered: | By Material, By Product Type, By Vehicle Type, By Region and COVID-19 Impact Analysis |

| Companies covered:: | American Axle and Manufacturing Holdings Inc., Bharat Gears Ltd., GKN Powder Metallurgy, JTEKT Corporation, Robert Bosch GmbH, Hitachi Astemo, IMS Gear, Univance Corporation, Eaton, Cummins Inc, RSB Global, Schaeffler India, Toyota, ZF., and others key players. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Automotive Gear Market Dynamics

Rising demand for technologies with a low carbon footprint

The automotive gear market is experiencing a rising demand for technologies with a low carbon footprint, driven by global sustainability initiatives and stricter emissions regulations. As the automotive industry shifts toward environmentally friendly practices, manufacturers are increasingly focusing on producing gears that enhance fuel efficiency and reduce overall vehicle emissions. This trend is particularly prominent in the development of lightweight gears made from sustainable materials, which help improve vehicle performance while lowering energy consumption. The growing popularity of electric vehicles (EVs) further accelerates this demand, as EVs require optimized gear systems to maximize energy efficiency. Additionally, consumer preference for eco-friendly vehicles is pushing gear manufacturers to adopt greener production methods, fostering innovation in gear technologies that contribute to a more sustainable automotive future.

Restraints & Challenges

One major hurdle is the increasing complexity of gear technologies, driven by advancements such as electric vehicle (EV) transmissions and autonomous driving systems. Manufacturers must invest heavily in research and development to meet these demands, which can lead to higher production costs. Additionally, the volatility of raw material prices, especially for metals like steel and aluminum, poses a challenge to cost-efficiency. The shift to lightweight, high-performance materials also requires specialized manufacturing processes, further increasing costs. Another issue is the global supply chain disruptions, affecting timely delivery and increasing operational costs. Moreover, the rising focus on environmental sustainability adds pressure to develop low-carbon-footprint technologies, requiring additional investments and innovation to stay competitive in a rapidly evolving market.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Automotive Gear Market from 2023 to 2033. The United States and Canada are key players, with strong automotive manufacturing bases and a growing focus on electric vehicles (EVs). As EV adoption increases, there is rising demand for specialized gear systems that improve energy efficiency and performance. Moreover, the shift toward advanced transmissions, such as continuously variable transmissions (CVT) and dual-clutch transmissions (DCT), is further fueling market growth. North America's emphasis on sustainability and emissions regulations also drives the demand for low-carbon-footprint gear technologies. The presence of major automotive manufacturers and suppliers, along with a robust aftermarket industry, enhances the market's growth potential. Additionally, ongoing investments in automation and smart technologies are shaping the future of the automotive gear sector in the region.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. APAC is the largest automotive manufacturing hub globally, with a strong presence of both original equipment manufacturers (OEMs) and suppliers. The region's focus on electric vehicle (EV) development is also driving demand for specialized gear systems, including energy-efficient transmission technologies. Furthermore, the growing emphasis on fuel efficiency and reducing carbon emissions is pushing manufacturers to innovate with lightweight and low-carbon-footprint gears. In addition to OEM demand, the aftermarket sector is expanding due to rising vehicle ownership and the need for replacement parts. APAC’s competitive pricing, coupled with technological advancements, makes it a key player in the global automotive gear market.

Segmentation Analysis

Insights by Material

The metallic segment accounted for the largest market share over the forecast period 2023 to 2033. The metallic segment in the automotive gears market is expected to experience significant growth due to the ongoing demand for high-strength, durable, and reliable gear components. Metals such as steel, aluminum, and titanium are widely used in gear manufacturing due to their ability to withstand high stress, temperature fluctuations, and wear. As vehicles, particularly electric vehicles (EVs), require more efficient transmission systems, the demand for metallic gears that enhance performance and longevity is rising. Additionally, innovations in lightweight alloys and advanced metal processing techniques are driving growth in this segment. The automotive industry's focus on fuel efficiency, emission reduction, and increased vehicle performance further supports the need for metallic gears. As manufacturers strive for enhanced strength-to-weight ratios and sustainable practices, the metallic segment remains a critical driver of growth in the automotive gear market.

Insights by Product Type

The helical segment accounted for the largest market share over the forecast period 2023 to 2033. The helical gear segment in the automotive gears market is experiencing notable growth, driven by its superior performance characteristics, including smooth operation, high torque capacity, and minimal noise. Helical gears are increasingly preferred in automotive applications due to their ability to handle higher loads and operate more efficiently than straight-cut gears. This makes them ideal for use in advanced transmission systems, such as those found in electric vehicles (EVs) and hybrid vehicles, where performance and efficiency are crucial. Furthermore, the growing demand for high-performance, fuel-efficient, and low-emission vehicles is driving the adoption of helical gears, particularly in automatic transmissions and hybrid powertrains. Their ability to reduce vibrations and improve driving comfort also contributes to their rising popularity. As technology advances, the helical gear segment is set to continue expanding in the automotive market.

Insights by Vehicle Type

The passenger vehicle segment accounted for the largest market share over the forecast period 2023 to 2033. The passenger vehicle segment in the automotive gears market is experiencing robust growth, fueled by rising global demand for personal transportation and technological advancements in vehicle design. With the increasing emphasis on fuel efficiency, reduced emissions, and enhanced performance, automotive manufacturers are incorporating advanced gear technologies into passenger vehicles. The growing adoption of electric vehicles (EVs) and hybrid vehicles, which require specialized transmission systems, is also driving demand for high-quality automotive gears. Furthermore, the shift towards automatic transmissions and dual-clutch systems in passenger vehicles is boosting the need for more efficient and reliable gear components. In addition, consumer preferences for improved driving comfort and vehicle performance are contributing to the growing demand for advanced gear technologies in the passenger vehicle segment, ensuring sustained market growth in the coming years.

Recent Market Developments

- In January 2023, for a future Suzuki electric car, Suzuki and Inmotive Inc. inked a joint development agreement to create a two-speed EV gearbox. By effectively utilising motor torque, cutting expenses by using a smaller electric powertrain unit, and enhancing driving performance in a variety of situations, this agreement seeks to increase the EV range.

Competitive Landscape

Major players in the market

- American Axle and Manufacturing Holdings Inc.

- Bharat Gears Ltd.

- GKN Powder Metallurgy

- JTEKT Corporation

- Robert Bosch GmbH

- Hitachi Astemo

- IMS Gear

- Univance Corporation

- Eaton

- Cummins Inc

- RSB Global

- Schaeffler India

- Toyota

- ZF.

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Automotive Gear Market, Material Analysis

- Metallic

- Plastic

Automotive Gear Market, Product Type Analysis

- Planetary

- Bevel

- Helical

- Non-Metallic

- Other

Automotive Gear Market, Vehicle Type Analysis

- Passenger Vehicle

- Commercial Vehicle

Automotive Gear Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Automotive Gear Market?The global Automotive Gear Market is expected to grow from USD 39.4 billion in 2023 to USD 60.3 billion by 2033, at a CAGR of 4.35% during the forecast period 2023-2033.

-

2. Who are the key market players of the Automotive Gear Market?Some of the key market players of the market are American Axle and Manufacturing Holdings Inc., Bharat Gears Ltd., GKN Powder Metallurgy, JTEKT Corporation, Robert Bosch GmbH, Hitachi Astemo, IMS Gear, Univance Corporation, Eaton, Cummins Inc, RSB Global, Schaeffler India, Toyota, and ZF.

-

3. Which segment holds the largest market share?The helical segment holds the largest market share and is going to continue its dominance.

-

4. Which region dominates the Automotive Gear Market?North America dominates the Automotive Gear Market and has the highest market share.

Need help to buy this report?