Global Automotive Glazing Market Size, Share, and COVID-19 Impact Analysis, By Application (Windscreen, Sidelite, Backlite, Others), By End Use (Passenger Vehicles, LCV, HCV), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Automotive & TransportationGlobal Automotive Glazing Market Insights Forecasts to 2033

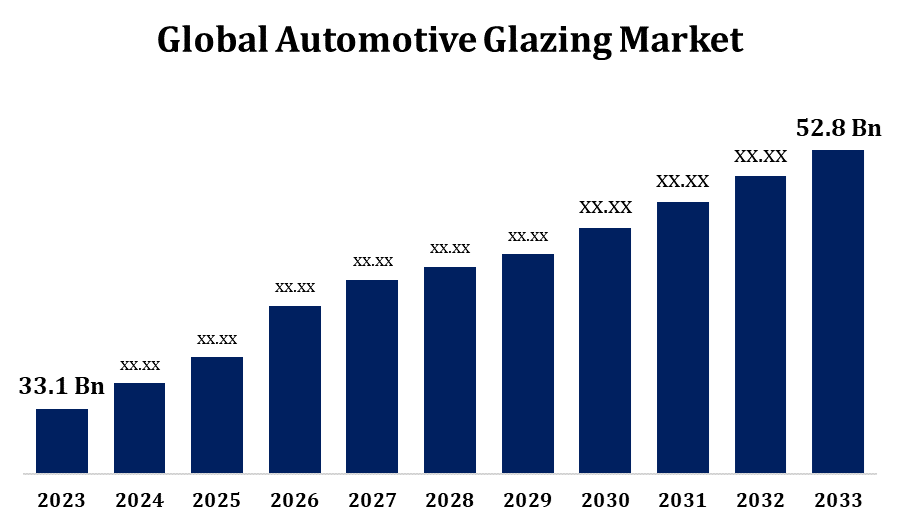

- The Global Automotive Glazing Market Size was valued at USD 33.1 Billion in 2023.

- The Market is Growing at a CAGR of 4.78% from 2023 to 2033.

- The Worldwide Automotive Glazing Market Size is Expected to reach USD 52.8 Billion By 2033.

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Automotive Glazing Market Size is Expected to reach USD 52.8 Billion By 2033, at a CAGR of 4.78% during the forecast period 2023 to 2033.

The automotive glazing market is experiencing significant growth, driven by advancements in vehicle design, increased safety standards, and rising consumer demand for enhanced aesthetics and functionality. Glazing materials, such as tempered glass, laminated glass, and polycarbonate, are widely used in windshields, windows, and sunroofs, offering durability, thermal insulation, and improved visibility. The shift towards electric and autonomous vehicles has further propelled the demand for lightweight and high-performance glazing solutions, aiding in energy efficiency and better sensor integration. Regions like Asia-Pacific dominate the market due to expanding automotive production and technological adoption. Environmental concerns and regulations are encouraging the development of recyclable and energy-efficient materials, further shaping the market. Overall, innovation and sustainability are key drivers influencing the automotive glazing industry’s evolution.

Automotive Glazing Market Value Chain Analysis

The automotive glazing market value chain encompasses several interconnected stages, ensuring the seamless production and distribution of glazing products. It begins with raw material suppliers, providing essential inputs like silica, soda ash, and advanced polymers for glass and polycarbonate manufacturing. Glass manufacturers transform these materials into tempered, laminated, or specialty glazing through processes such as cutting, shaping, and coating. Component suppliers integrate features like UV protection, defrosting, and sound insulation. Automotive OEMs (original equipment manufacturers) incorporate these glazing products into vehicles during assembly. Distributors and retailers ensure product availability across global markets. The value chain is influenced by innovations in material technology, sustainability efforts, and stringent regulatory standards. Collaboration among stakeholders fosters cost-efficiency, quality enhancement, and the development of advanced glazing solutions for modern vehicles.

Automotive Glazing Market Opportunity Analysis

The automotive glazing market presents lucrative opportunities driven by trends in electric vehicles (EVs), autonomous driving, and consumer demand for enhanced aesthetics and functionality. Lightweight materials such as polycarbonate are gaining traction, aiding in fuel efficiency and reducing carbon emissions. Innovations in smart glazing, including switchable glass and solar control technologies, offer avenues for value addition. Emerging markets in Asia-Pacific and Latin America provide growth potential due to rising vehicle production and urbanization. The push for sustainability is encouraging the development of recyclable and energy-efficient materials. Additionally, advanced driver assistance systems (ADAS) require high-performance glazing for optimal sensor integration, opening new avenues for manufacturers. Strategic investments in R&D and collaborations can help businesses capitalize on these opportunities and address evolving industry needs effectively.

Global Automotive Glazing Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 33.1 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 4.78% |

| 2033 Value Projection: | USD 52.8 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 231 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Application, By End Use, By Region and COVID-19 Impact Analysis. |

| Companies covered:: | Central Glass Co., Ltd., Corning Incorporated, Fuyao Group, KRD Sicherheitstechnik GmbH, Mitsubishi Electric Corporation, Pilkington (Nippon Sheet Glass Co., Ltd.), SABIC, Saint-Gobain Sekurit, SCHOTT, Trinseo, and Other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Automotive Glazing Market Dynamics

The adoption of polycarbonate glazing is increasing due to its lighter weight compared to traditional glass

The growing adoption of polycarbonate glazing is significantly influencing the automotive glazing market, primarily due to its lighter weight compared to traditional glass. Lightweight materials are critical for improving fuel efficiency and reducing emissions, aligning with stringent environmental regulations and the global shift toward sustainable transportation. Polycarbonate also offers enhanced impact resistance, design flexibility, and thermal insulation, making it a preferred choice for modern vehicle applications such as sunroofs, side windows, and rear windshields. Its compatibility with advanced technologies like integrated sensors and smart glazing further supports its demand, particularly in electric and autonomous vehicles. As automakers prioritize lightweight and high-performance materials to optimize vehicle efficiency and functionality, polycarbonate glazing is emerging as a key driver of growth in the automotive glazing market.

Restraints & Challenges

High production costs associated with advanced materials like polycarbonate and smart glazing technologies make these products less accessible for budget vehicles. Additionally, stringent regulatory standards for safety and environmental compliance require manufacturers to invest in extensive testing and certification, increasing development timelines and costs. Polycarbonate glazing, despite its advantages, struggles with issues like lower scratch resistance compared to glass, necessitating additional coatings that raise costs. The growing push for sustainability also demands innovations in recyclable and eco-friendly materials, which require significant R&D investment. Furthermore, fluctuating raw material prices and supply chain disruptions pose risks to consistent production. Addressing these challenges is crucial for the market to sustain its growth and meet evolving consumer and regulatory demands.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Automotive Glazing Market from 2023 to 2033. The region's well-established automotive industry, combined with significant R&D investments, supports the development of innovative glazing solutions, including lightweight polycarbonate and smart glazing technologies. Stringent safety and environmental regulations encourage the use of advanced materials with improved durability, energy efficiency, and recyclability. The rising popularity of large panoramic sunroofs and enhanced visibility features also boosts demand for high-performance glazing. The United States dominates the regional market, supported by a robust automotive manufacturing base and consumer demand for premium vehicles. As EVs gain momentum, North America remains a key market for lightweight and advanced automotive glazing solutions.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. The region, led by countries like China, Japan, South Korea, and India, is a global automotive manufacturing hub, benefiting from large-scale investments and technological advancements. Increasing demand for electric vehicles (EVs) and autonomous driving technologies drives the adoption of lightweight and high-performance glazing materials, such as polycarbonate and smart glass. Stringent safety regulations and environmental policies encourage the use of durable, energy-efficient, and recyclable glazing solutions. Additionally, growing consumer preferences for premium features like panoramic sunroofs and noise-reducing windows boost market demand. With its vast market potential and focus on innovation, Asia-Pacific remains a key player in shaping the future of automotive glazing technologies.

Segmentation Analysis

Insights by Application

The windscreen segment accounted for the largest market share over the forecast period 2023 to 2033. Windscreens, being critical for visibility and structural integrity, are benefiting from innovations like laminated glass, which offers enhanced impact resistance and UV protection. The integration of advanced driver assistance systems (ADAS), requiring high-quality glazing for sensors and cameras, further boosts demand. In electric and autonomous vehicles, windscreens with features such as solar control, heads-up displays, and acoustic insulation are gaining popularity. Stringent safety regulations worldwide mandate the use of durable and energy-efficient materials, encouraging manufacturers to innovate. As consumers seek premium and functional features, the windscreen segment continues to grow, driving overall advancements in the automotive glazing market.

Insights by End Use

The passenger vehicles segment accounted for the largest market share over the forecast period 2023 to 2033. This segment benefits from innovations in glazing materials such as laminated and tempered glass, which enhance safety, aesthetics, and energy efficiency. Growing adoption of electric and hybrid vehicles has amplified the need for lightweight glazing solutions, like polycarbonate, to improve vehicle efficiency and reduce emissions. Premium features such as panoramic sunroofs, acoustic insulation, and UV-protected windows are increasingly in demand, boosting the segment further. Additionally, stringent safety and environmental regulations require advanced glazing technologies to meet compliance standards. As automakers prioritize passenger comfort and sustainability, the passenger vehicles segment remains a vital driver of market growth.

Recent Market Developments

- In June 2024, Guardian Glass, a key player in the glass industry, and Webasto Luxembourg (part of the Webasto Group), a manufacturer of sunroofs, batteries, heating, and cooling solutions, have announced an agreement in which Guardian Glass will supply its innovative coated glass solution, including the Guardian SilverGuard family, for Webasto’s panoramic sunroofs.

Competitive Landscape

Major players in the market

- Central Glass Co., Ltd.

- Corning Incorporated

- Fuyao Group

- KRD Sicherheitstechnik GmbH

- Mitsubishi Electric Corporation

- Pilkington (Nippon Sheet Glass Co., Ltd.)

- SABIC

- Saint-Gobain Sekurit

- SCHOTT

- Trinseo

- Others

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Automotive Glazing Market, Application Analysis

- Windscreen

- Sidelite

- Backlite

- Others

Automotive Glazing Market, End Use Analysis

- Passenger Vehicles

- LCV

- HCV

Automotive Glazing Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Automotive Glazing Market?The global Automotive Glazing Market is expected to grow from USD 33.1 billion in 2023 to USD 52.8 billion by 2033, at a CAGR of 4.78% during the forecast period 2023-2033.

-

2. Who are the key market players of the Automotive Glazing Market?Some of the key market players of the market are Central Glass Co., Ltd., Corning Incorporated, Fuyao Group, KRD Sicherheitstechnik GmbH, Mitsubishi Electric Corporation, Pilkington (Nippon Sheet Glass Co., Ltd.), SABIC, Saint-Gobain Sekurit, SCHOTT, Trinseo and other key vendors.

-

3. Which segment holds the largest market share?The windscreen segment holds the largest market share and is going to continue its dominance.

-

4. Which region dominates the Automotive Glazing Market?North America dominates the Automotive Glazing Market and has the highest market share.

Need help to buy this report?