Global Automotive Heat Shield Market Size, Share, and COVID-19 Impact Analysis, By Application (Exhaust System, Turbocharger, Engine Compartment), By Material (Metallic, Non-Metallic), By Vehicle (Passenger Car, Light Commercial Vehicle), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Automotive & TransportationGlobal Automotive Heat Shield Market Insights Forecasts to 2033

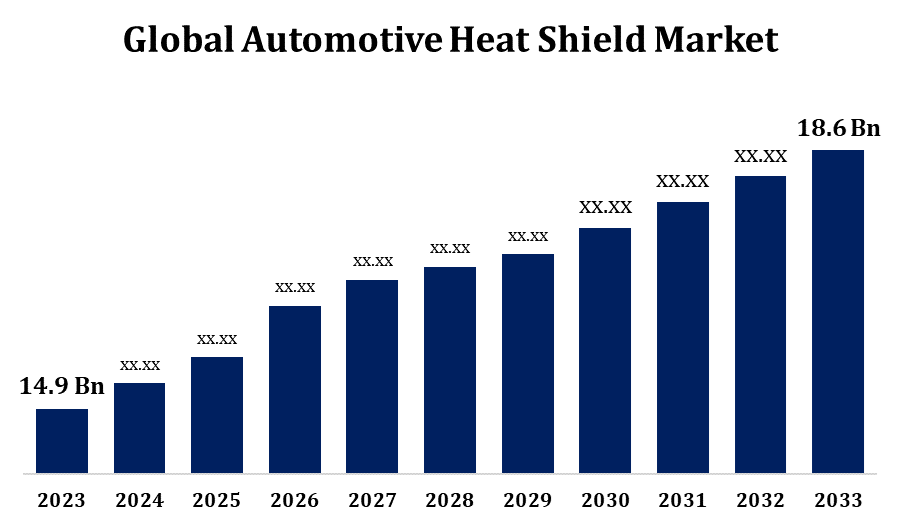

- The Global Automotive Heat Shield Market Size was valued at USD 14.9 Billion in 2023.

- The Market is Growing at a CAGR of 2.24% from 2023 to 2033.

- The Worldwide Automotive Heat Shield Market Size is Expected to reach USD 18.6 Billion By 2033.

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Automotive Heat Shield Market Size is Expected to Reach USD 18.6 Billion By 2033, at a CAGR of 2.24% during the forecast period 2023 to 2033.

The automotive heat shield market is experiencing significant growth, driven by the rising demand for fuel-efficient vehicles and stringent emission regulations. Heat shields play a critical role in protecting vehicle components from excessive heat generated by engines, exhaust systems, and turbochargers. The adoption of lightweight materials like aluminum and composites enhances vehicle performance and fuel economy, further boosting market demand. The growing trend of electric and hybrid vehicles, which require advanced thermal management solutions, also contributes to market expansion. Major advancements in manufacturing technologies, such as 3D printing, allow for customized and efficient heat shield designs. Geographically, Asia-Pacific leads the market due to robust automotive production, while North America and Europe follow with increased adoption of eco-friendly technologies. Competition remains intense among key players innovating to meet evolving industry needs.

Automotive Heat Shield Market Value Chain Analysis

The automotive heat shield market value chain comprises raw material suppliers, manufacturers, distributors, and end-users. Raw material suppliers provide essential components like aluminum, composites, and thermal insulating materials that form the basis of heat shield production. Manufacturers transform these materials into customized solutions, utilizing advanced technologies such as stamping, 3D printing, and laser cutting for precision. The production process emphasizes lightweight designs to meet fuel efficiency and emission standards. Distributors, including wholesalers and specialized dealers, bridge the gap between manufacturers and OEMs or aftermarket retailers. OEMs integrate heat shields into vehicles during production, while the aftermarket caters to repair and replacement needs. End-users, including automotive companies and consumers, drive demand for innovative heat shield solutions to enhance vehicle performance, safety, and compliance with environmental regulations.

Automotive Heat Shield Market Opportunity Analysis

The automotive heat shield market presents significant growth opportunities, driven by advancements in vehicle technologies and evolving regulatory landscapes. The surge in demand for electric and hybrid vehicles opens avenues for heat shield manufacturers to develop innovative thermal management solutions tailored to battery systems and electric motors. Lightweight heat shields using advanced materials like composites and ceramics address the dual needs for fuel efficiency and reduced emissions, aligning with global sustainability goals. Emerging markets in Asia-Pacific and Latin America, with rising automotive production and urbanization, offer lucrative opportunities for expansion. Additionally, the growing aftermarket segment for heat shield replacements highlights potential for sustained revenue. The integration of technologies like 3D printing enables customization and cost efficiency, encouraging manufacturers to capitalize on design flexibility to cater to diverse automotive requirements.

Global Automotive Heat Shield Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 14.9 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 2.24% |

| 2033 Value Projection: | USD 18.6 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 245 |

| Tables, Charts & Figures: | 119 |

| Segments covered: | By Application, By Material, By Vehicle, By Region and COVID-19 Impact Analysis. |

| Companies covered:: | Dana Incorporated, Lydall Inc., Morgan Advanced Materials, Autoneum Holding AG, ElringKlinger AG, Federal-Mogul LLC, Tenneco Inc., UGN Inc., Progress-Werk Oberkirch AG, Heatshield Products, Inc., and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Automotive Heat Shield Market Dynamics

The increasing demand for electric and hybrid vehicles to propel the market growth

The rising demand for electric and hybrid vehicles is set to drive significant growth in the automotive heat shield market. These vehicles rely on advanced thermal management systems to ensure optimal performance and safety, as their batteries, electric motors, and power electronics generate substantial heat. Heat shields play a crucial role in protecting sensitive components, preventing thermal runaway, and maintaining efficiency. With governments worldwide enforcing stringent emissions regulations and offering incentives for adopting eco-friendly vehicles, the shift towards electrification is accelerating. This trend creates a strong demand for lightweight and high-performance heat shield materials, such as composites and ceramics, to enhance energy efficiency. Manufacturers are also leveraging innovative technologies, like 3D printing, to produce customized heat shields for electric vehicle architectures, ensuring sustained market expansion.

Restraints & Challenges

The automotive heat shield market faces several challenges that could impact its growth. One major hurdle is the fluctuating cost and availability of raw materials such as aluminum, composites, and thermal insulators, which directly affect production costs and profitability. Additionally, the increasing demand for lightweight and compact heat shields requires significant investment in research and development, posing a barrier for smaller manufacturers. The shift toward electric and hybrid vehicles presents unique challenges, as these vehicles require advanced, customized thermal management solutions, increasing design complexity. Stringent government regulations on material recycling and disposal further complicate manufacturing processes. Moreover, intense competition among market players drives price pressures, reducing profit margins. Lastly, global economic uncertainties and supply chain disruptions, exacerbated by geopolitical tensions, pose risks to market stability and growth.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Automotive Heat Shield Market from 2023 to 2033. The automotive heat shield market in North America is experiencing steady growth, driven by the region's robust automotive industry and advancements in vehicle technologies. The increasing production and adoption of electric and hybrid vehicles in the United States and Canada amplify the demand for efficient thermal management solutions. Stringent regulations on fuel efficiency and emissions, enforced by agencies like the EPA, push manufacturers to adopt lightweight and high-performance heat shields. Technological innovations, such as the integration of advanced materials like composites and multilayer aluminum, cater to these evolving requirements. Additionally, the strong aftermarket for vehicle repairs and replacements further boosts demand. Key players in the region focus on R&D and strategic partnerships to deliver customized solutions, positioning North America as a vital market for heat shield innovations.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. China, India, Japan, and South Korea dominate the market due to their strong manufacturing bases, rapid urbanization, and growing middle-class population. The increasing adoption of electric and hybrid vehicles in the region further drives demand for advanced thermal management solutions to ensure vehicle safety and efficiency. Stringent emission norms, such as China's VI and India's BS-VI standards, are prompting manufacturers to develop lightweight and eco-friendly heat shields. Moreover, cost-effective production capabilities and investments in R&D for innovative materials like composites enhance the region's competitive edge. The growing aftermarket for replacement parts adds another dimension to market growth, making Asia-Pacific a key player globally.

Segmentation Analysis

Insights by Application

The Engine Compartment segment accounted for the largest market share over the forecast period 2023 to 2033. As engines become more compact and powerful to meet performance and emission standards, the demand for effective thermal insulation rises. Heat shields in the engine compartment protect surrounding components, including wiring, sensors, and fuel systems, from heat damage, ensuring safety and reliability. The transition to electric and hybrid vehicles has further bolstered this segment, as their powertrains require advanced heat shielding to manage thermal loads effectively. Lightweight materials like aluminum and composites are increasingly used to improve fuel efficiency while meeting regulatory standards. Innovations in design and manufacturing, such as multi-layered and 3D-printed shields, support the segment's sustained growth.

Insights by Material

The metallic segment accounted for the largest market share over the forecast period 2023 to 2033. Metallic heat shields, typically made from aluminum and stainless steel, are widely used in internal combustion engines, turbochargers, and exhaust systems due to their ability to withstand extreme temperatures. Their lightweight properties also contribute to improved fuel efficiency and reduced vehicle emissions, aligning with stringent environmental regulations. The increasing adoption of electric and hybrid vehicles has created demand for advanced metallic shields tailored to battery and motor thermal management. Innovations such as multi-layered metallic shields enhance insulation performance while maintaining structural integrity. Additionally, the recyclability of metals supports sustainability goals, further boosting their adoption across OEMs and aftermarket applications, ensuring consistent growth in this segment.

Insights by Vehicle

The passenger cars segment accounted for the largest market share over the forecast period 2023 to 2033. As modern passenger cars prioritize performance, safety, and fuel efficiency, the need for effective thermal management solutions has become critical. Heat shields are essential for protecting components like exhaust systems, engines, and turbochargers from heat damage while ensuring passenger safety. The growing popularity of electric and hybrid passenger vehicles has amplified this demand, as these vehicles require advanced thermal solutions to manage battery and motor heat. Stringent emission norms and the shift towards lightweight vehicle designs are pushing manufacturers to adopt innovative materials like composites and aluminum. Additionally, expanding middle-class populations in emerging markets further propel growth in this segment.

Recent Market Developments

- In April 2023, Autoneum has finalized its acquisition of Borgers Automotive, expanding its operational footprint to include 67 production facilities worldwide. This development brings Autoneum's workforce to approximately 16,100 employees across 24 countries.

Competitive Landscape

Major players in the market

- Dana Incorporated

- Lydall Inc.

- Morgan Advanced Materials

- Autoneum Holding AG

- ElringKlinger AG

- Federal-Mogul LLC

- Tenneco Inc.

- UGN Inc.

- Progress-Werk Oberkirch AG

- Heatshield Products, Inc.

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Automotive Heat Shield Market, Application Analysis

- Exhaust System

- Turbocharger

- Engine Compartment

Automotive Heat Shield Market, Material Analysis

- Metallic

- Non-Metallic

Automotive Heat Shield Market, Vehicle Analysis

- Passenger Car

- Light Commercial Vehicle

Automotive Heat Shield Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Automotive Heat Shield Market?The global Automotive Heat Shield Market is expected to grow from USD 14.9 billion in 2023 to USD 18.6 billion by 2033, at a CAGR of 2.24% during the forecast period 2023-2033.

-

2. Who are the key market players of the Automotive Heat Shield Market?Some of the key market players of the market are Dana Incorporated, Lydall Inc., Morgan Advanced Materials, Autoneum Holding AG, ElringKlinger AG, Federal-Mogul LLC, Tenneco Inc., UGN Inc., Progress-Werk Oberkirch AG, Heatshield Products, Inc., and other key vendors.

-

3. Which segment holds the largest market share?The metallic segment holds the largest market share and is going to continue its dominance.

-

4. Which region dominates the Automotive Heat Shield Market?North America dominates the Automotive Heat Shield Market and has the highest market share.

Need help to buy this report?