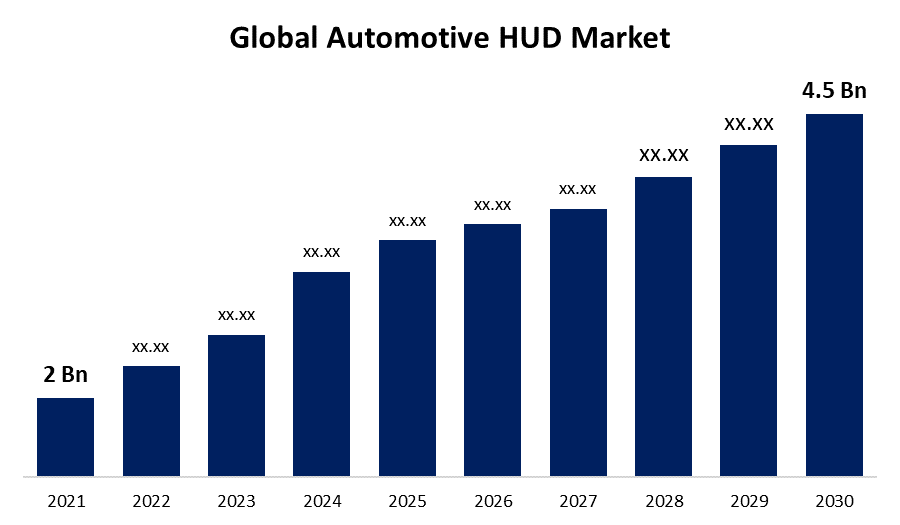

Global Automotive HUD Market Size, Share, and COVID-19 Impact Analysis, By HUD Type (Windshield, Combiner), By Vehicle Type (Passenger Cars, Commercial Vehicle), By Region (North America, Europe, Asia Pacific, Middle East & Africa, and South America) Analysis and Forecast 2021 - 2030

Industry: Automotive & TransportationThe Global Automotive HUD Market size was valued at USD 2 Billion in 2021 and is expected to reach USD 4.5 Billion in 2030 at a CAGR of 31% from 2021 to 2030. The desire for a better driving experience, rising consumer awareness of vehicle and road safety, and strong growth in the premium automobile segments are the drivers propelling the Automotive HUD Market.

Get more details on this report -

Demand for high-end luxury and mid-size vehicles with cutting-edge safety features, such as head-up displays, is expected to increase due to the rapid expansion of smart phone and navigation system usage. Additionally, the advent of strict government safety rules, ongoing head-up display price reductions, technological advancements, and organic increase in auto manufacturing will all support market expansion during the projection period. The current head up display system is being improved by automakers and HUD market participants. Geological positioning system (GPS)-enabled HUDs of the present can display error and warning messages on the windshield. The government's severe safety rules, coupled with a growth in the sales of luxury automobiles, have led to an increase in the use of head-up displays (HUD) as a driver and passenger safety system, creating lucrative prospects for market participants.

Driving Factors

The demand for a better driving experience, increased consumer awareness of the importance of vehicle and road safety, and the rapid expansion of the luxury car market are the main factors propelling the market's expansion. Bright and vivid graphics may now be seen on the windshield thanks to the development of modern technology like LEDs and liquid crystal displays (LCDs).

The cost of production has decreased as a result of ongoing technological advancements. To assist develop brighter screens with more colours, new projection technologies, such as micro mirror-based devices based on electromechanical systems, are now available on the market. The Automotive HUD Market is anticipated to expand as a result of low cost and cutting-edge display technology. The absence of qualities such as low brightness, low light, and excessive power consumption are the reasons limiting the growth of the automotive HUD industry.

Numerous factors, such as rising connected car demand, rising driver and vehicle safety awareness, rising vehicle expertise, and rising demand for premium and luxury cars, are propelling the growth of the automotive HUD market. Additionally, the introduction of electric and semi-automatic vehicles as well as the rising demand for portable HUDs may open up new potential for the growth of the automotive HUD market.

Global Automotive HUD Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2021 |

| Market Size in 2021: | USD 2 Billion |

| Forecast Period: | 2021 - 2030 |

| Forecast Period CAGR 2021 - 2030 : | 31% |

| 2030 Value Projection: | USD 4.5 Billion |

| Historical Data for: | 2017 - 2020 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 119 |

| Segments covered: | By HUD Type, By Vehicle Type, By Region |

| Companies covered:: | Continental AG, Denso Corporation, Bosch, Nippon Seiki, Yazaki Corporation, Hudway Glass, Visteon Corporation, Panasonic Corporation, Pioneer Corporation, Garmin, Delphi Automotive LLP, Nippon Seikhi Co. Ltd., MicroVision, Inc., Hyundai Mobis, Harman International, LG Display Co. Ltd, JVCKENWOOD Corporation. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Restraining Factors

Modern, expensive advanced HUDs with augmented reality capabilities are only found in high-end and luxury vehicles. Due to the integration of modern display systems with augmented reality capabilities increasing the overall cost of the vehicle, market participants are finding it challenging to introduce the most recent HUDs in economy and mid-segment vehicles. In the next years, regulatory agencies want these technologies to be a standard feature. Therefore, OEMs are concentrating on lowering the price of these items to get over the cost barrier. The pandemic will prevent OEMs from using pricey automotive technologies in the vehicles due to decreased demand for luxury automobiles and a fall in new vehicle sales. The demand for HUDs will be hampered by these considerations.

COVID 19 Impact

The COVID-19 pandemic had a negative effect on the market in 2020 as a result of a suspension of manufacturing activity and supply chain disruptions brought on by worldwide limitations. However, after the pandemic, as the economy began to recover, demand began to pick up steam as a result of a noticeable increase in car production and sales in important nations like the United States, China, India, and others.

Segmentation

The global automotive HUD market is segmented into HUD Type, Vehicle Type, End User, and Region.

Global Automotive HUD Market, By HUD Type

The market is divided into the Windshield and Combiner segments based on HUD type. Because OEMs and Tier 1 suppliers concentrate their research and development efforts on creating complete windshield HUDs for future model vehicles, the windshield segment commands a substantial market share. The entire windshield HUD takes up more room inside the automobile. As the automobile sector transitions to driverless vehicles, this presents a huge hurdle. The automobile HUD Market is growing because the automotive cockpit electronics sector is moving in the direction of lowering the amount of electronics in the vehicle cockpit.

Global Automotive HUD Market, By Vehicle Type

The market is divided into two categories based on the kind of vehicle: passenger cars and commercial vehicles. Because passenger cars are produced and sold more widely than commercial vehicles, they continue to have high levels of advanced technology and hold a sizable portion of the market. Additionally, OEMs now offer such technologies in their vehicles due to the growing consumer demand for premium amenities and convenience, which is one of the factors driving the Automotive HUD Market's expansion.

Global Automotive HUD Market, By Region

The Global Automotive HUD Market is divided into four regions based on geography: North America, Europe, Asia Pacific, and the Rest of the World. Due to the rise in advanced technology in the region, the Japanese automobile sector holds a sizable portion of the market, which gives the Asia Pacific region a sizable stake. Additionally, the Chinese market, which favours smaller and more cheap passenger cars, attracts investment from practically all key OEMs.

Recent Developments in Global Automotive HUD Market

- May 2022: Volkswagen is looking at a partnership to provide Mahindra & Mahindra, an Indian automaker, with electric HUD components.

- January 2022: In partnership with Swiss holographic AR display pioneer WayRay, HARMAN International, a recognised connected technology provider for the automotive and enterprise markets, unveiled a complete windshield heads-up display proof of concept for the automotive HUD industry.

- January 2022: EyeRide is a heads-up display unit that the French company EyeLights claims is compatible with all motorcycle helmets.

List of Key Market Players

- Continental AG

- Denso Corporation

- Bosch

- Nippon Seiki

- Yazaki Corporation

- Hudway Glass

- Visteon Corporation

- Panasonic Corporation

- Pioneer Corporation

- Garmin

- Delphi Automotive LLP

- Nippon Seikhi Co. Ltd.

- MicroVision, Inc.

- Hyundai Mobis

- Harman International

- LG Display Co. Ltd

- JVCKENWOOD Corporation

Segmentation

By HUD Type

- Windshield

- Combiner

By Vehicle Type

- Passenger Cars

- Commercial Vehicles

By Region

North America

- North America, by Country

- U.S.

- Canada

- Mexico

- North America, by HUD Type

- North America, by Vehicle Type

Europe

- Europe, by Country

- Germany

- Russia

- U.K.

- France

- Italy

- Spain

- The Netherlands

- Rest of Europe

- Europe, by HUD Type

- Europe, by Vehicle Type

Asia Pacific

- Asia Pacific, by Country

- China

- India

- Japan

- South Korea

- Australia

- Indonesia

- Rest of Asia Pacific

- Asia Pacific, by HUD Type

- Asia Pacific, by Vehicle Type

Middle East & Africa

- Middle East & Africa, by Country

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

- Middle East & Africa, by HUD Type

- Middle East & Africa, by Vehicle Type

South America

- South America, by Country

- Brazil

- Argentina

- Colombia

- Rest of South America

- South America, by HUD Type

- South America, by Vehicle Type

Need help to buy this report?