Global Automotive Logistics Market Size, Share, and COVID-19 Impact Analysis, By Activity (Warehousing & Handling, Transportation & Handling), By Type (Finished Vehicle, Automobile Parts), By Mode of Transport (Roadways, Airways, Maritime, Railways), By Distribution (Domestic, International), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Automotive & TransportationGlobal Automotive Logistics Market Insights Forecasts to 2033

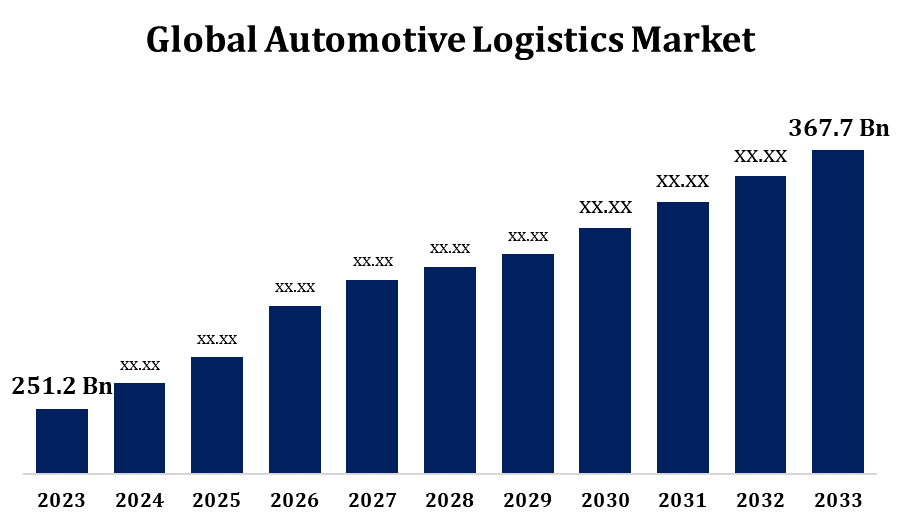

- The Automotive Logistics Market Size was valued at USD 251.2 Billion in 2023.

- The Market Size is growing at a CAGR of 3.88% from 2023 to 2033.

- The Global Automotive Logistics Market Size is expected to reach USD 367.7 Billion by 2033.

- Asia Pacific is expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Automotive Logistics Market Size is expected to reach USD 367.7 Billion by 2033, at a CAGR of 3.88% during the forecast period 2023 to 2033.

The automotive logistics market plays a crucial role in the global automotive industry, encompassing the efficient planning, execution, and management of the transportation and storage of vehicles and components. Driven by increasing vehicle production, global trade, and the growing adoption of electric vehicles, the market is witnessing steady growth. Key services include inbound logistics, outbound logistics, aftermarket logistics, and reverse logistics. Technological advancements like IoT, AI, and real-time tracking are enhancing supply chain transparency and operational efficiency. Asia-Pacific dominates the market due to high vehicle production in countries like China, India, and Japan. However, challenges such as supply chain disruptions, labor shortages, and rising fuel costs persist. Strategic partnerships and digitization are expected to drive future growth and innovation in this evolving sector.

Automotive Logistics Market Value Chain Analysis

The automotive logistics market value chain involves a complex network of processes ensuring the seamless movement of automotive components and finished vehicles. It begins with raw material suppliers, followed by parts manufacturers who supply components to OEMs (Original Equipment Manufacturers). Inbound logistics manages the transport of parts to assembly plants, where vehicles are manufactured. Post-production, outbound logistics handles the distribution of finished vehicles to dealers or end customers via road, rail, sea, or air. Aftermarket logistics covers the delivery of spare parts and accessories, while reverse logistics manages returns, recycling, or disposal. Logistics service providers, including 3PL and 4PL companies, play a crucial role across all stages, supported by digital technologies such as telematics and automation, which enhance supply chain visibility, efficiency, and responsiveness.

Automotive Logistics Market Opportunity Analysis

The automotive logistics market is poised for significant growth, driven by several key opportunities. The surge in electric vehicle (EV) production necessitates specialized logistics solutions, including temperature-controlled storage for batteries and tailored transportation methods. Emerging markets, particularly in Asia-Pacific, Latin America, and Africa, present lucrative prospects due to rapid urbanization, rising disposable incomes, and increasing vehicle demand. The integration of advanced technologies like artificial intelligence (AI) and automation enhances efficiency in warehousing, inventory management, and transportation, offering competitive advantages. Additionally, the shift towards sustainable practices, such as adopting electric and alternative fuel vehicles for logistics fleets, aligns with environmental goals and improves operational efficiency. The rise of e-commerce and omnichannel distribution channels further amplifies the need for agile and responsive logistics solutions.

Global Automotive Logistics Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 251.2 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 3.88% |

| 2033 Value Projection: | USD 367.7 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Activity, By Type, By Mode of Transport, By Distribution and By Region |

| Companies covered:: | Kintetsu World Express, Inc., BLG LOGISTICS GROUP AG & Co. KG, CMA CGM Group, DHL, DSV, Expeditors International of Washington, Inc., CEVA Logistics, Hellmann Worldwide Logistics SE & Co. KG, LOGISTEED, Imperial, KERRY LOGISTICS NETWORK LIMITED, Kuehne+Nagel, NIPPON EXPRESS HOLDINGS, Penske Automotive Group, Inc., Ryder System, and Inc. |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Automotive Logistics Market Dynamics

Digital transformation of operations is set to drive market growth

Digital transformation of operations is poised to significantly drive growth in the automotive logistics market. The integration of technologies such as artificial intelligence, the Internet of Things (IoT), big data analytics, and blockchain is enhancing real-time tracking, route optimization, and inventory management. These innovations improve supply chain transparency, reduce operational costs, and increase efficiency. Automation in warehousing and transport processes is also streamlining operations and minimizing human error. Moreover, cloud-based logistics platforms enable seamless communication between stakeholders, improving coordination and decision-making. As vehicle production becomes more global and complex, digital tools offer the agility and scalability needed to manage intricate logistics networks. The shift toward digitalization is not only enhancing customer experience but also creating opportunities for new service models, making it a key growth driver in the sector.

Restraints & Challenges

The automotive logistics market faces several challenges that impact its efficiency and growth. One of the primary issues is supply chain disruption caused by geopolitical tensions, natural disasters, and global crises like the COVID-19 pandemic. Rising fuel costs and fluctuating transportation rates also increase operational expenses. Labor shortages, especially in trucking and warehousing, further strain the system. Additionally, the growing complexity of global trade regulations and customs procedures leads to delays and compliance issues. Managing the logistics of electric vehicles, particularly battery transport and handling, presents new technical and safety challenges. Limited infrastructure in emerging markets and the need for digital transformation also pose barriers. Furthermore, sustainability pressures demand greener operations, requiring investment in eco-friendly technologies. These challenges require strategic planning and innovation to overcome.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Automotive Logistics Market from 2023 to 2033. The North American automotive logistics market is experiencing steady growth, driven by factors such as increased vehicle production, the rise of electric vehicles (EVs), and advancements in digital technology. The region benefits from a well-established transportation infrastructure and strong presence of major automotive manufacturers and suppliers. Technologies like artificial intelligence, IoT, and automation are being increasingly adopted to streamline supply chain operations and enhance visibility. The evolving needs of the EV segment, including battery logistics and specialized handling, are creating new operational demands.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. China and India are at the forefront, with China leading in vehicle production and India rapidly advancing in automotive exports. The surge in electric vehicle (EV) production, supported by government incentives and investments in EV infrastructure, is reshaping logistics requirements, particularly in battery handling and specialized transport. Technological advancements, including real-time tracking and automation, are enhancing operational efficiency and transparency.

Segmentation Analysis

Insights by Activity

The transportation & handling segment accounted for the largest market share over the forecast period 2023 to 2033. This segment is growing rapidly due to the increasing global production of vehicles and the rising demand for efficient logistics solutions. Technological advancements, such as real-time tracking systems, automation, and IoT-based solutions, are improving the efficiency, visibility, and accuracy of transportation operations. Additionally, the growing electric vehicle (EV) market is introducing new logistics needs, particularly for battery transportation and specialized handling. The demand for fast, reliable, and cost-effective transportation services is expected to continue driving the growth of this segment, making it a key factor in the expansion of the overall automotive logistics market.

Insights by Distribution

The domestic segment accounted for the largest market share over the forecast period 2023 to 2033. This segment's growth is significantly influenced by factors such as supportive government policies, including local sourcing mandates and tax incentives, aimed at promoting domestic production. For instance, countries like India and China have implemented initiatives to bolster local manufacturing, thereby enhancing domestic logistics activities. Additionally, the European Union's facilitation of seamless movement across member states has further strengthened this segment. The expansion of road infrastructure, improvement in warehousing facilities, and the adoption of digital tracking solutions have streamlined intra-country logistics, contributing to the segment's growth.

Insights by Type

The automobile parts segment accounted for the largest market share over the forecast period 2023 to 2033. This surge is fueled by the expanding global vehicle fleet and the necessity for regular maintenance and repairs. The rise of e-commerce platforms has further bolstered the distribution of automotive parts, enhancing accessibility for consumers and repair shops alike. Technological advancements, such as real-time tracking and automated inventory management, have improved the efficiency and reliability of parts logistics. Overall, the automobile parts segment continues to be a pivotal and expanding component of the automotive logistics industry, driven by technological innovation and the essential nature of vehicle maintenance.

Insights by Mode of Transport

The roadways segment accounted for the largest market share over the forecast period 2023 to 2033. This segment benefits from the widespread availability of road infrastructure, enabling efficient distribution within countries and regions. Advancements in intelligent transportation systems, such as route optimization and real-time tracking, have further enhanced operational efficiency and reduced delivery times. Additionally, the rise of e-commerce and direct-to-consumer delivery models has increased demand for road-based logistics solutions. The segment's growth is also supported by government investments in road infrastructure and the adoption of sustainable practices, including the use of electric and hybrid vehicles for transportation.

Recent Market Developments

- In February 2024, ORTEC, a global leader in providing comprehensive supply chain solutions tailored to the operational needs of manufacturers, retailers, and distributors, has launched an advanced solution specifically designed for the operational requirements of the manufacturing and finished goods logistics sectors.

Competitive Landscape

Major players in the market

- Kintetsu World Express, Inc.

- BLG LOGISTICS GROUP AG & Co. KG

- CMA CGM Group

- DHL

- DSV

- Expeditors International of Washington, Inc.

- CEVA Logistics

- Hellmann Worldwide Logistics SE & Co. KG

- LOGISTEED

- Imperial

- KERRY LOGISTICS NETWORK LIMITED

- Kuehne+Nagel

- NIPPON EXPRESS HOLDINGS

- Penske Automotive Group, Inc.

- Ryder System, Inc.

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Automotive Logistics Market, Activity Analysis

- Warehousing & Handling

- Transportation & Handling

Automotive Logistics Market, Type Analysis

- Finished Vehicle

- Automobile Parts

Automotive Logistics Market, Mode of Transport Analysis

- Roadways

- Airways

- Maritime

- Railways

Automotive Logistics Market, Distribution Analysis

- Domestic

- International

Automotive Logistics Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Automotive Logistics Market?The global Automotive Logistics Market is expected to grow from USD 251.2 billion in 2023 to USD 367.7 billion by 2033, at a CAGR of 3.88% during the forecast period 2023-2033.

-

2. Who are the key market players of the Automotive Logistics Market?Some of the key market players of the market are Kintetsu World Express, Inc.; BLG LOGISTICS GROUP AG & Co. KG; CMA CGM Group; DHL; DSV; Expeditors International of Washington, Inc.; CEVA Logistics; Hellmann Worldwide Logistics SE & Co. KG; LOGISTEED; Imperial; KERRY LOGISTICS NETWORK LIMITED; Kuehne+Nagel; NIPPON EXPRESS HOLDINGS; Penske Automotive Group, Inc.; Ryder System, Inc.

-

3. Which segment holds the largest market share?The roadways segment holds the largest market share and is going to continue its dominance.

Need help to buy this report?