Global Automotive NVH Materials Market Size, Share, and COVID-19 Impact Analysis, By Material Type (Rubber, Plastic & Foam, Fibers, and Others), By Application (Absorption, Damping, and Insulation), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Chemicals & MaterialsGlobal Automotive NVH Materials Market Insights Forecasts to 2033

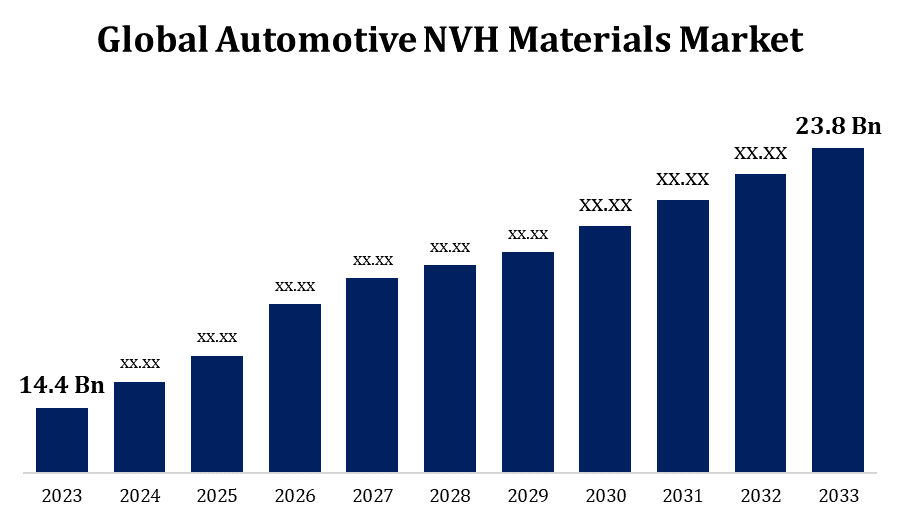

- The Automotive NVH Materials Market Size was valued at USD 14.4 Billion in 2023.

- The Market Size is growing at a CAGR of 5.15% from 2023 to 2033.

- The Global Automotive NVH Materials Market Size is expected to reach USD 23.8 Billion by 2033.

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

The Global Automotive NVH Materials Market Size is expected to reach USD 23.8 Billion bBy 2033, at a CAGR of 5.15% during the forecast period 2023 to 2033.

The automotive NVH (Noise, Vibration, and Harshness) materials market is witnessing steady growth, driven by increasing demand for quieter, more comfortable vehicles and stringent regulatory norms on noise pollution. NVH materials, such as rubber, foams, and polymers, play a crucial role in minimizing unwanted sound and vibrations, enhancing vehicle performance and passenger experience. The rise of electric vehicles (EVs) further fuels demand, as these vehicles require specialized NVH solutions to mitigate high-frequency noise from electric drivetrains. Lightweight and sustainable materials are also gaining traction to align with automotive manufacturers' focus on fuel efficiency and eco-friendliness. Leading regions in this market include North America, Europe, and Asia-Pacific, with significant contributions from emerging economies. Innovations in material technology continue to shape market dynamics, ensuring robust growth prospects.

Automotive NVH Materials Market Value Chain Analysis

The automotive NVH materials market value chain comprises raw material suppliers, manufacturers, distributors, and end-users (automobile OEMs). Raw material suppliers provide essential inputs like rubber, polymers, foams, and metals, which are further processed into NVH solutions by manufacturers. Manufacturers develop specialized products such as insulation mats, sound-deadening foams, and damping sheets tailored for noise and vibration control. These products are distributed through a network of wholesalers and distributors, who ensure availability to global markets. Automobile OEMs, the primary end-users, integrate these materials into vehicles during design and production, targeting enhanced comfort and compliance with noise regulations. The value chain is influenced by factors like material innovation, sustainability, and cost-effectiveness, with growing integration of lightweight and recycled materials reshaping market trends and partnerships.

Automotive NVH Materials Market Opportunity Analysis

The automotive NVH materials market offers significant growth opportunities driven by evolving consumer preferences, technological advancements, and industry trends. The shift toward electric vehicles (EVs) creates demand for innovative NVH solutions to address high-frequency noise and enhance cabin comfort. Increasing regulations on noise pollution and vehicle safety further amplify the need for advanced materials. The rising adoption of lightweight NVH materials aligns with automakers' focus on improving fuel efficiency and meeting emission standards. Emerging markets in Asia-Pacific, particularly India and China, provide lucrative prospects due to growing automobile production and urbanization. Additionally, the push for sustainable and recyclable materials opens doors for green NVH solutions. Ongoing R&D investments and collaborations between material manufacturers and OEMs are expected to unlock new applications and drive market expansion.

Global Automotive NVH Materials Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 14.4 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 5.15% |

| 2033 Value Projection: | USD 23.8 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 260 |

| Tables, Charts & Figures: | 160 |

| Segments covered: | By Material Type, By Application, By Region |

| Companies covered:: | BASF SE (Germany), The Dow Chemical Company (US), 3M Company (US), ElringKlinger AG (Germany), Huntsman Corporation (US), Sumitomo Riko Co. Ltd (Japan, and other key companies. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Automotive NVH Materials Market Dynamics

The growing demand from the electric vehicle industry is anticipated to propel market growth

The increasing adoption of electric vehicles (EVs) is a key driver for growth in the automotive NVH materials market. Unlike traditional internal combustion engine vehicles, EVs operate with quieter powertrains, which shifts the focus to addressing other noise sources such as tire, wind, and road noise. This creates a heightened demand for advanced NVH materials to enhance cabin comfort and minimize noise levels. Additionally, electric drivetrains generate high-frequency vibrations that require specialized damping and insulation solutions. As governments worldwide promote EV adoption through incentives and emission regulations, the demand for NVH materials tailored to electric vehicles continues to rise. Manufacturers are innovating lightweight, sustainable NVH solutions to meet these needs, aligning with the automotive industry’s focus on efficiency and eco-friendliness.

Restraints & Challenges

One key issue is the high cost of advanced NVH materials, which can increase production expenses for automakers, especially in price-sensitive markets. The shift towards lightweight vehicles for improved fuel efficiency poses another challenge, as traditional NVH materials may not align with weight reduction goals, prompting the need for costly material innovations. Additionally, the growing adoption of electric vehicles introduces complexities in addressing high-frequency noise, requiring specialized solutions that may not yet be cost-effective or widely available. Environmental concerns and regulatory pressures on non-recyclable materials further complicate the market, driving the need for sustainable alternatives. Supply chain disruptions and raw material price volatility also present obstacles, impacting production timelines and profitability.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Automotive NVH Materials Market from 2023 to 2033. North America is a significant market for automotive NVH materials, driven by the presence of major automobile manufacturers and a strong focus on advanced vehicle technologies. The region's stringent regulatory standards for noise pollution and vehicle safety have fueled the demand for high-performance NVH solutions. Growing consumer preference for quieter, more comfortable vehicles further supports market expansion. Additionally, the rise of electric vehicles (EVs) in North America has created new opportunities for specialized NVH materials to address unique challenges such as high-frequency noise and vibration from electric drivetrains. Innovation in lightweight and sustainable materials is a key trend, aligning with the automotive industry's push for fuel efficiency and environmental compliance. The United States dominates the regional market, followed by Canada and Mexico, contributing to steady growth.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. The growing adoption of electric vehicles (EVs) across the region has heightened demand for specialized NVH materials to mitigate noise and vibration challenges unique to EVs. Government initiatives promoting eco-friendly vehicles and stricter noise pollution regulations further boost the market. Additionally, the rising preference for lightweight materials to improve fuel efficiency aligns with industry trends. The availability of low-cost raw materials and manufacturing capabilities in Asia-Pacific makes it a hub for NVH material production, attracting global players and fostering regional market growth.

Segmentation Analysis

Insights by Material Type

The rubber segment accounted for the largest market share over the forecast period 2023 to 2033. The rubber segment is experiencing robust growth in the automotive NVH materials market, driven by its superior properties such as durability, flexibility, and excellent noise and vibration absorption. Rubber is extensively used in applications like gaskets, seals, bushings, and mounts to reduce vibrations and enhance cabin comfort. The rise in electric vehicle (EV) adoption is further boosting demand, as EVs require advanced damping solutions to address high-frequency noise and drivetrain vibrations. Additionally, the trend toward lightweight vehicles has increased the focus on rubber composites and blends that provide efficient NVH performance without adding significant weight. Innovations in sustainable rubber materials, including recycled and bio-based variants, are gaining traction, aligning with industry goals of reducing environmental impact while maintaining high performance standards.

Insights by Application

The absorption segment accounted for the largest market share over the forecast period 2023 to 2033. Absorptive materials, such as foams, mats, and composites, are widely used in car interiors, including door panels, headliners, and floor systems, to absorb sound energy and reduce vibrations. The growing focus on passenger experience and the stricter noise regulations in various regions have accelerated the need for efficient sound-absorbing materials. Additionally, the rise of electric vehicles (EVs), which require solutions to manage high-frequency noise and vibrations from electric drivetrains, is further fueling growth in this segment. Innovations in lightweight, eco-friendly, and high-performance absorption materials are also contributing to market expansion, offering automakers sustainable and cost-effective options for reducing NVH levels.

Recent Market Developments

- On December 2022, Vibracoustic has developed a battery isolation pack system designed to isolate the body from the chassis in electric vehicles. This system is applicable to various vehicles, including light commercial vehicles, large SUVs, and off-road vehicles.

Competitive Landscape

Major players in the market

- BASF SE (Germany)

- The Dow Chemical Company (US)

- 3M Company (US)

- ElringKlinger AG (Germany)

- Huntsman Corporation (US)

- Sumitomo Riko Co. Ltd (Japan)

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Automotive NVH Materials Market, Material Type Analysis

- Rubber

- Plastic & Foam

- Fibers

- Others

Automotive NVH Materials Market, Application Analysis

- Absorption

- Damping

- Insulation

Automotive NVH Materials Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Automotive NVH Materials Market?The global Automotive NVH Materials Market is expected to grow from USD 14.4 billion in 2023 to USD 23.8 billion by 2033, at a CAGR of 5.15% during the forecast period 2023-2033.

-

2. Who are the key market players of the Automotive NVH Materials Market?Some of the key market players of the market are BASF SE (Germany), The Dow Chemical Company (US), 3M Company (US), ElringKlinger AG (Germany), Huntsman Corporation (US), and Sumitomo Riko Co. Ltd (Japan).

-

3. Which segment holds the largest market share?The absorption segment holds the largest market share and is going to continue its dominance.

-

4. Which region dominates the Automotive NVH Materials Market?North America dominates the Automotive NVH Materials Market and has the highest market share.

Need help to buy this report?