Global Automotive Power Electronics Market Size, Share, and COVID-19 Impact Analysis, By Component (MCU, Power IC, Sensor), By Application (Body Electronics, Chassis & Powertrain, Infotainment & Telematics, and Safety & Security System), By Vehicle Type (Passenger car and Commercial Vehicle), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Automotive & TransportationGlobal Automotive Power Electronics Market Insights Forecasts to 2033

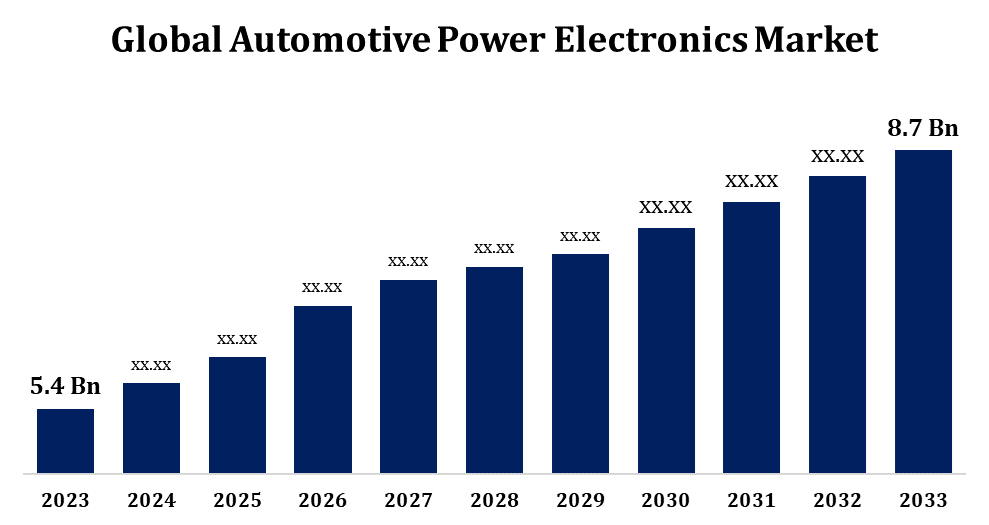

- The Global Automotive Power Electronics Market Size was valued at USD 5.4 Billion in 2023.

- The Market is Growing at a CAGR of 4.88% from 2023 to 2033.

- The Worldwide Automotive Power Electronics Market Size is Expected to reach USD 8.7 Billion by 2033.

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Automotive Power Electronics Market Size is Expected to reach USD 8.7 Billion by 2033, at a CAGR of 4.88% during the forecast period 2023 to 2033.

The automotive power electronics market is witnessing significant growth driven by the increasing adoption of electric vehicles (EVs), advancements in autonomous driving technologies, and stringent emission regulations worldwide. Power electronics play a crucial role in managing and converting electrical energy efficiently within vehicles, including EVs and hybrids. Key applications include inverters, converters, onboard chargers, and battery management systems. The rising demand for energy-efficient solutions and the integration of advanced features, such as regenerative braking and advanced driver assistance systems (ADAS), are further fueling market expansion. Asia-Pacific leads the market due to high EV production in China and Japan, while Europe and North America are also key contributors. The market is highly competitive, with players focusing on innovations like silicon carbide (SiC) and gallium nitride (GaN) technologies.

Automotive Power Electronics Market Value Chain Analysis

The automotive power electronics market value chain involves several key stages, from raw material suppliers to end-users. At the upstream level, raw material suppliers provide semiconductors, substrates, and packaging materials essential for manufacturing power electronic components. Component manufacturers develop critical devices such as power modules, IGBTs, MOSFETs, and diodes, integrating technologies like silicon carbide (SiC) and gallium nitride (GaN). These components are supplied to system integrators or Tier 1 suppliers who design inverters, converters, and control units for automotive applications. Automotive OEMs incorporate these systems into vehicles, ensuring compliance with performance and efficiency standards. The value chain is supported by software developers and testing service providers, enabling advanced functionalities and reliability. Collaboration and innovation at each stage are vital to addressing market demands for high efficiency and sustainability.

Automotive Power Electronics Market Opportunity Analysis

The automotive power electronics market presents significant growth opportunities driven by the transition to electric mobility and increasing integration of advanced technologies. The rapid adoption of electric vehicles (EVs) and hybrid vehicles creates demand for efficient power management systems, such as inverters, converters, and onboard chargers. Advancements in silicon carbide (SiC) and gallium nitride (GaN) technologies offer opportunities to develop compact, high-performance, and energy-efficient solutions. Emerging markets in Asia-Pacific, particularly China and India, are poised for rapid EV adoption, further boosting demand. Additionally, the rise of autonomous vehicles and advanced driver assistance systems (ADAS) requires sophisticated power electronics for sensor fusion and control units. Market players focusing on innovation, cost reduction, and partnerships can leverage these opportunities to address sustainability and performance demands.

Global Automotive Power Electronics Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 5.4 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 4.88% |

| 2033 Value Projection: | USD 8.7 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 237 |

| Tables, Charts & Figures: | 121 |

| Segments covered: | By Component, By Application, By Vehicle Type, By Region and COVID-19 Impact Analysis. |

| Companies covered:: | Infineon Technologies AG (Germany), Texas Instruments Inc. (U.S.), ON Semiconductor Corp. (U.S.), Renessa Electronics Corp. (Japan), Mitsubishi Heavy Industries Ltd. (Japan), Maxim Products Inc. (U.S.), NXP Semiconductors N.V. (Netherlands), Qualcomm Ins. (U.S.), Robert Bosch GmbH (Germany), Vishay Intertechnology Inc. (U.S.), and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Automotive Power Electronics Market Dynamics

The market is poised to benefit from the robust demand for passenger vehicles

The automotive power electronics market is set to gain from the strong and growing demand for passenger vehicles worldwide. As the automotive industry shifts toward electrification and advanced technologies, power electronics are becoming essential for efficient energy management and enhanced vehicle performance. Passenger vehicles, particularly electric and hybrid models, rely heavily on components like inverters, converters, and battery management systems to support advanced functionalities. The rise in consumer preferences for technologically advanced, energy-efficient, and environmentally friendly vehicles further drives this demand. Additionally, the integration of features such as advanced driver assistance systems (ADAS), infotainment systems, and regenerative braking highlights the importance of power electronics. With increasing vehicle production in emerging markets and the global push for electrification, passenger vehicle demand will significantly boost market growth.

Restraints & Challenges

High development and production costs of advanced components, such as silicon carbide (SiC) and gallium nitride (GaN) technologies, pose affordability issues for manufacturers and end-users. Additionally, the complex design and integration processes for power electronics in electric vehicles (EVs) and advanced driver assistance systems (ADAS) demand significant expertise, increasing time-to-market. Supply chain disruptions and semiconductor shortages further constrain production, while fluctuating raw material prices impact profitability. Compatibility and reliability concerns with high-voltage systems also present technical hurdles. Moreover, the market must address regional disparities in EV adoption and charging infrastructure availability. To overcome these challenges, industry players must focus on cost optimization, innovation, and collaborative strategies to meet rising demands sustainably.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Automotive Power Electronics Market from 2023 to 2033. The automotive power electronics market in North America is experiencing robust growth, driven by increasing adoption of electric vehicles (EVs) and stringent emission regulations. Governments in the region, particularly in the United States and Canada, are promoting EV adoption through tax incentives, subsidies, and investments in charging infrastructure. This fosters demand for power electronics components like inverters, converters, and onboard chargers, essential for efficient energy management in EVs and hybrid vehicles. Additionally, the rise of advanced driver assistance systems (ADAS) and autonomous vehicle technologies enhances the integration of power electronics. Key industry players are focusing on R&D and manufacturing within the region to address local demand. Despite challenges such as semiconductor shortages, the market benefits from technological advancements, consumer awareness, and supportive policies accelerating the transition to sustainable mobility.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. China, Japan, and South Korea are leading EV markets, driven by strong government incentives, emission reduction targets, and investments in charging infrastructure. China, the largest EV market globally, significantly contributes to the demand for power electronics components, including inverters, converters, and battery management systems. Japan and South Korea are key innovators in semiconductor and power module technologies, enabling advancements in energy efficiency and miniaturization. Emerging markets like India are also gaining traction with supportive policies promoting EV adoption. Despite challenges such as cost pressures and supply chain constraints, Asia-Pacific remains a vital hub for power electronics innovation and production.

Segmentation Analysis

Insights by Component

The sensor segment accounted for the largest market share over the forecast period 2023 to 2033. The sensor segment in the automotive power electronics market is witnessing substantial growth, driven by the increasing adoption of advanced vehicle technologies such as electric vehicles (EVs), autonomous driving, and advanced driver assistance systems (ADAS). Sensors play a critical role in ensuring energy efficiency, safety, and performance by monitoring parameters like temperature, pressure, current, and voltage in various power electronics systems, including inverters, converters, and battery management systems. The rise of smart sensors with enhanced accuracy and real-time data processing capabilities further fuels this growth. With the global push for electrification and connected vehicles, the demand for sensors is expected to surge. Additionally, innovations in sensor technologies, such as miniaturization and integration of artificial intelligence, are expanding their applications, making them indispensable in modern automotive power electronics.

Insights by Application

The body electronics segment accounted for the largest market share over the forecast period 2023 to 2033. The growth is driven by the rising demand for comfort, convenience, and advanced safety features in vehicles. Body electronics encompass systems such as power windows, lighting, seat controls, climate control, and keyless entry, all of which rely on efficient power management solutions. The shift toward electric and hybrid vehicles further boosts this segment, as these vehicles require optimized power distribution to support additional electronic systems. Innovations in semiconductor technologies, including silicon carbide (SiC) and gallium nitride (GaN), enhance the efficiency and miniaturization of body electronics components. Additionally, the growing integration of connected car technologies and automation in vehicles increases the reliance on body electronics, ensuring sustained growth in this segment across developed and emerging markets.

Insights by Vehicle Type

The passenger car segment accounted for the largest market share over the forecast period 2023 to 2033. The passenger car segment is a key driver of growth in the automotive power electronics market, spurred by the increasing adoption of electric vehicles (EVs) and hybrid electric vehicles (HEVs). As consumers demand more energy-efficient and environmentally friendly options, the need for advanced power electronics components such as inverters, converters, and battery management systems becomes crucial. These technologies enable effective energy conversion, storage, and distribution, improving vehicle performance and extending the range of EVs. Additionally, the integration of advanced driver assistance systems (ADAS) and connectivity features in passenger cars further drives the demand for sophisticated power electronics to manage power requirements efficiently. The global shift toward sustainable mobility solutions and supportive government policies contribute to the robust growth of the passenger car segment in the automotive power electronics market.

Recent Market Developments

- In January 2024, Infineon recently announced the launch of their new automotive power module specifically designed for electric vehicles (EVs), aimed at improving efficiency and reducing weight. The company also introduced a new family of integrated circuits that target enhancements in battery management systems for EVs.

Competitive Landscape

Major players in the market

- Infineon Technologies AG (Germany)

- Texas Instruments Inc. (U.S.)

- ON Semiconductor Corp. (U.S.)

- Renessa Electronics Corp. (Japan)

- Mitsubishi Heavy Industries Ltd. (Japan)

- Maxim Products Inc. (U.S.)

- NXP Semiconductors N.V. (Netherlands)

- Qualcomm Ins. (U.S.)

- Robert Bosch GmbH (Germany)

- Vishay Intertechnology Inc. (U.S.)

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Automotive Power Electronics Market, Component Analysis

- MCU

- Power IC

- Sensor

Automotive Power Electronics Market, Application Analysis

- Body Electronics

- Chassis & Powertrain

- Infotainment & Telematics

- Safety & Security System

Automotive Power Electronics Market, Vehicle Type Analysis

- Passenger Car

- Commercial Vehicle

Automotive Power Electronics Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Automotive Power Electronics Market?The global Automotive Power Electronics Market is expected to grow from USD 5.4 billion in 2023 to USD 8.7 billion by 2033, at a CAGR of 4.88% during the forecast period 2023-2033.

-

2. Who are the key market players of the Automotive Power Electronics Market?Some of the key market players of the market are Infineon Technologies AG (Germany), Texas Instruments Inc. (U.S.), ON Semiconductor Corp. (U.S.), Renessa Electronics Corp. (Japan), Mitsubishi Heavy Industries Ltd. (Japan), Maxim Products Inc. (U.S.), NXP Semiconductors N.V. (Netherlands), Qualcomm Ins. (U.S.), Robert Bosch GmbH (Germany), and Vishay Intertechnology Inc. (U.S.) and other key vendors.

-

3. Which segment holds the largest market share?The passenger car segment holds the largest market share and is going to continue its dominance.

-

4. Which region dominates the Automotive Power Electronics Market?North America dominates the Automotive Power Electronics Market and has the highest market share.

Need help to buy this report?