Global Automotive Power Window Market Size, Share & Trend By Vehicle Type (Passenger Car and Commercial Vehicle), Regulator Type (Cable Type and Scissor Type), By Region (North America, Europe, Asia Pacific, Middle East & Africa, South America) , Analysis and Forecast 2021 - 2030

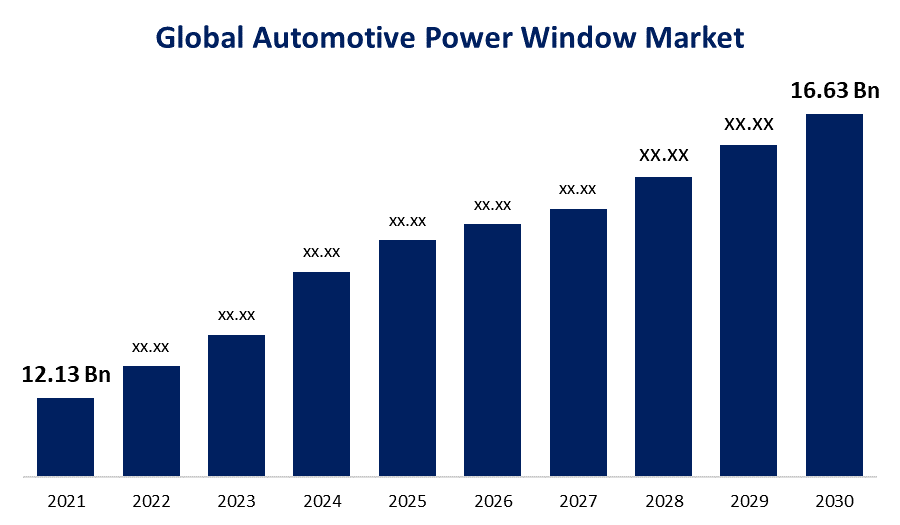

Industry: Automotive & TransportationIn 2021, the size of the Global Automotive Power Window Market was estimated to be USD 12.13 billion. The market is anticipated to increase by 4.1% CAGR from 2021 to 2030, rising from USD 12.54 billion in 2022 to USD 16.63 billion 2030

Get more details on this report -

With the use of electronic switches that are built into the power window system, an automotive power window is an electronic window system that is used to lower and raise the windows of an automobile. Any premium or luxury vehicle must have automotive power windows since they improve both the driver's and the passengers' comfort. Power windows contain switches and motors, and the motor provides the power that the switch uses to control the window's raising and lowering. The automobile's electronic control unit, which manages all of the vehicle's electronic components, is connected to the power windows.

These days, all reputable automakers are incorporating this technology into their cars to increase comfort for the occupants. Additionally, automakers are including power windows in mid-range vehicles for commercial trucks. The introduction of new technologies and innovations is accelerating the growth of the global market for automobile power windows.

Global Automotive Power Window Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2021 |

| Market Size in 2021: | USD 12.13 Billion |

| Forecast Period: | 2021 - 2030 |

| Forecast Period CAGR 2021 - 2030 : | 4.1% |

| 2030 Value Projection: | USD 16.63 Billion |

| Historical Data for: | 2017 - 2020 |

| No. of Pages: | 198 |

| Tables, Charts & Figures: | 119 |

| Segments covered: | By Vehicle Type, By Regulator Type, By Region |

| Companies covered:: | Aisin Seiki(Japan), Grupo Antolin(Spain), Denso Corporation(Japan), HI-LEX Corporation(Japan), Johnson Manufacturing Inc(Japan), Magna International Inc(Canada), Robert Bosch GmbH(Germany), Valeo Group(France) |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factor

Future auto sales are anticipated to increase due to an expanding middle-class population and greater disposable income.

One of the main factors driving the global market for automotive power windows is thought to be the development of modern technologies that encourage customer inclination toward automation. Power windows are a common feature in passenger cars for security and safety reasons. The operation of these windows is quite simple and comfortable for the driver and passengers as they are controlled by a variety of switches.

Auto power windows are a standard feature in today's cars, even those at the base level. Even entry-level vehicles today frequently include these windows. All across the world, there Windows are being put in automobiles.

The demand for cutting-edge technologies in cars, such as all-door power windows, power steering systems, climate control systems, anti-lock brake systems, and others, has surged during the past several years, according to the automotive industry.

The Anti-pinch system is a safety feature included in the auto power window system that detects any obstructions in the way when the window is being wound up and stops the glass from moving higher.

The increasing use of anti-pinch power window systems is anticipated to open up lucrative potential prospects for market participants.

Restraining Factor.

Among other materials, aluminium, plastic, rubber, and composites are used to make the parts of an automobile's power window. The cost of raw materials fluctuates constantly based on the state of the market economy.

Additionally, the battery, switch, motor, actuators, regulator, and gears are among the several parts that make up an automobile's motorised windows. To avoid failure and extend service life, these components need regular maintenance, which raises maintenance expenses.

Thus, a long-term decline in vehicle sales is anticipated as public transit and shared mobility services become more widely used. As a result, it is anticipated that this will slow the market's expansion.

COVID 19 Impact

The International Organization of Motor Vehicle Manufacturers (OICA) reports that there was a 5% decrease in worldwide car production in 2019.

The second half of 2020 saw an unexpected sales rebound, nevertheless. Due to the extensive lead periods for different semiconductors used in automobiles, OEMs were unable to meet demand.

The lack of essential parts has forced suppliers and OEMs to reconsider design and construction criteria for their cars. For instance, in order to manage the problem, Tesla has been recoding its products to make use of substitute parts and has even temporarily deleted some functionality. Additionally, sales of electric vehicles have kept growing tremendously despite the decline in sales of vehicles powered by internal combustion engines. Therefore, in the mid- to long-term, these factors will have a positive impact on the market's recovery.

Segmentation

The global Automatic power window market is segmented into Vehicle Type, Regulatory Type and Region.

Global Automatic power window, By Vehicle Type

On basis of vehicle type the market type is segmented into Passenger Car and Commercial Vehicles.

In terms of revenue during the projected period, the passenger car segment led the market in 2021 and will continue to do so through 2029 due to an increase in the adoption of trying to cut technology in these vehicles because of their safe and practical features.

Over the course of the projection period, the commercial vehicle industry is anticipated to have consistent market expansion.

Global Automatic power window, By Regulator Type

On basis of vehicle type the market type is segmented is segmented into cable type and scissor type.

The cable type category, which dominated the market in 2021, is predicted to increase at the quickest rate throughout the forecast period. This is a result of the rising use of cable type window regulators, which have a number of benefits including being less expensive and easier to use, having a simpler design, and requiring less maintenance, among

Due to the high cost of replacing these window regulators in vehicles after accidents, the scissor type segment is anticipated to experience slow, steady expansion in the market over the course of the projection period.

Global Automatic power window, By Region

Automobiles are in high demand in developed nations like North America and Western Europe. Governments and governmental bodies in these areas have enacted strict restrictions pertaining to passenger safety. This element is anticipated to increase demand for power windows on the international market.

Get more details on this report -

A second reason that is anticipated to contribute to the expansion of the automotive power window market over the course of the forecast period is the rising purchasing power of the middle-class population in emerging nations of Asia Pacific, such as China.

The market for automotive power windows is anticipated to expand more quickly because of the Middle East's rising demand for luxury vehicles.

Recent Developments In The Global Automatic power window Market

In April 2020: Aisin Corporation announced the launch of a completely new window regulator programme Aisin Corporation of America announced the launch of a brand-new window regulator programme in April 2020, encompassing 90% of the most popular Asian, American, and European vehicles with more than 1400 SKUs.

In September 2019: The creation of a new generation of door control devices was announced by Brose. The creation of a new generation of door control devices, incorporating cutting-edge capabilities like speech recognition, was announced by Brose in September 2019. These devices would manage all door actions locally.

List of Key Market Players

- Aisin Seiki(Japan)

- Grupo Antolin(Spain)

- Denso Corporation(Japan)

- HI-LEX Corporation(Japan)

- Johnson Manufacturing Inc(Japan)

- Magna International Inc(Canada)

- Robert Bosch GmbH(Germany)

- Valeo Group(France)

Segmentation

By Vehicle Type

- Passenger Car

- Commercial Vehicle

By Regulator Type

- Cable Type

- Scissor Type

By Region

North America

- North America, by Country

- U.S.

- Canada

- Mexico

- North America, By Vehicle Type

- North America, By Regulator Type

Europe

- Europe, by Country

- Germany

- Russia

- U.K.

- France

- Italy

- Spain

- The Netherlands

- Rest of Europe

- Europe, By Vehicle Type

- Europe, By Regulator Type

Asia Pacific

- Asia Pacific, by Country

- China

- India

- Japan

- South Korea

- Australia

- Indonesia

- Rest of Asia Pacific

- Asia Pacific, By Vehicle Type

- Asia Pacific, By Regulator Type

Middle East & Africa

- Middle East & Africa, by Country

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

- Middle East & Africa, By Vehicle Type

- Middle East & Africa, By Regulator Type

South America

- South America, by Country

- Brazil

- Argentina

- Colombia

- Rest of South America

- South America, By Vehicle Type

- South America, By Regulator Type

Need help to buy this report?