Global Automotive Shielding Market Size, Share, and COVID-19 Impact Analysis, By Shielding Type (Heat Shield, Electromagnetic Interference [EMI] Shield), By Vehicle Type (Passenger Cars and Commercial Vehicles), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Automotive & TransportationGlobal Automotive Shielding Market Insights Forecasts to 2033

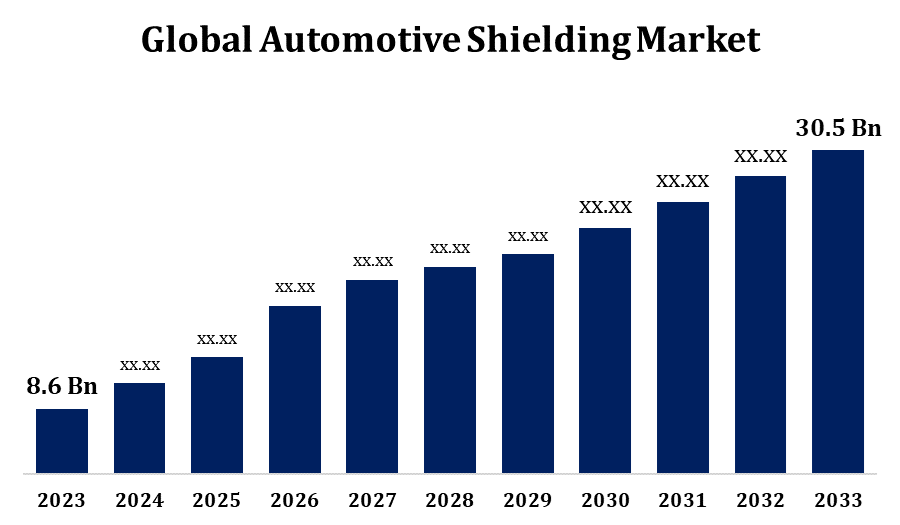

- The Global Automotive Shielding Market Size was valued at USD 8.6 Billion in 2023.

- The Market is Growing at a CAGR of 13.50% from 2023 to 2033.

- The Worldwide Automotive Shielding Market Size is expected to reach USD 30.5 Billion by 2033.

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Automotive Shielding Market Size is Expected to reach USD 30.5 Billion by 2033, at a CAGR of 13.50% during the forecast period 2023 to 2033.

The automotive shielding market is a critical segment within the automotive industry, focusing on materials and solutions that protect vehicles from electromagnetic interference (EMI), heat, and noise. As modern vehicles incorporate more electronic systems, such as advanced driver-assistance systems (ADAS) and electric powertrains, the demand for efficient shielding solutions has grown significantly. These shields prevent malfunction or degradation of sensitive components and improve overall vehicle performance and safety. The market is driven by the increasing need for lightweight, durable materials that can offer superior protection while supporting fuel efficiency and environmental goals. Key trends include the adoption of advanced materials like aluminum, copper, and composites. Additionally, the rising popularity of electric vehicles (EVs) further propels market growth, as EVs require enhanced shielding for battery management and electronic control systems.

Automotive Shielding Market Value Chain Analysis

The automotive shielding market value chain involves several key stages, starting with raw material suppliers who provide metals, composites, and polymers used in manufacturing shielding products. These materials are processed and transformed by manufacturers into various shielding solutions, such as EMI shields, thermal barriers, and acoustic insulation. Component suppliers then integrate these products into vehicle systems, such as wiring, batteries, and electronic control units. Original Equipment Manufacturers (OEMs) use these integrated systems to assemble vehicles, ensuring compliance with industry standards and regulations. After-market suppliers offer additional shielding solutions for vehicle maintenance or upgrades. Throughout the value chain, research and development (R&D) play a crucial role in driving innovation, focusing on materials that provide superior performance, lightweight properties, and sustainability. Collaboration between suppliers, OEMs, and R&D teams is essential for market growth.

Automotive Shielding Market Opportunity Analysis

The automotive shielding market presents significant opportunities driven by the increasing complexity of modern vehicles. With the rise of electric vehicles (EVs) and advanced driver-assistance systems (ADAS), there is a growing demand for enhanced electromagnetic interference (EMI) shielding, thermal management, and noise reduction solutions. The shift toward lightweight materials such as aluminum and composites offers opportunities for companies to innovate and provide cost-effective, high-performance solutions. Additionally, the increasing focus on fuel efficiency and environmental sustainability in the automotive sector opens doors for advanced shielding materials that contribute to these goals. Emerging markets, particularly in Asia-Pacific, represent untapped potential due to rapid automotive industry growth. Furthermore, evolving regulatory standards for vehicle safety and environmental performance will continue to drive demand for advanced shielding technologies.

Global Automotive Shielding Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 8.6 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 13.50% |

| 2033 Value Projection: | USD 30.5 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 238 |

| Tables, Charts & Figures: | 107 |

| Segments covered: | By Shielding Type, By Vehicle Type, By Region and COVID-19 Impact Analysis. |

| Companies covered:: | Laird PLC (UK), ElringKlinger AG (Germany), Federal-Mogul Corporation (US), Morgan Advanced Materials (UK), Dana Limited (US), Henkel AG & Company, KGaA (Germany), Kitagawa Europe (Japan), Schaffner Holding (Switzerland), Autoneum (Switzerland), Progress-WerkOberkirch AG (Germany), and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Automotive Shielding Market Dynamics

Growing production and sales of automobiles are expected to fuel market growth

The growing production and sales of automobiles are poised to drive significant growth in the automotive shielding market. As the global automotive industry expands, particularly with the rise of electric vehicles (EVs) and advanced technologies like autonomous driving, the demand for effective shielding solutions becomes crucial. These technologies require enhanced protection from electromagnetic interference (EMI), heat, and noise, fueling the need for high-performance shielding materials. Moreover, the increasing focus on vehicle safety, fuel efficiency, and environmental sustainability further boosts the demand for lightweight and durable shielding solutions. As automotive manufacturers strive to meet these evolving demands, the market for shielding solutions is expected to grow rapidly, creating ample opportunities for suppliers to innovate and cater to the diverse needs of modern vehicles.

Restraints & Challenges

The automotive shielding market faces several challenges that could impact its growth. One of the primary obstacles is the increasing complexity of vehicle electronics, which demands more sophisticated and cost-effective shielding solutions. The development and integration of advanced shielding materials, such as composites and metals, can be costly, which may limit adoption, particularly among smaller manufacturers. Additionally, the need to balance shielding effectiveness with lightweight and compact design remains a challenge, especially in electric vehicles (EVs) where weight reduction is crucial. The stringent regulatory requirements for safety and environmental sustainability add complexity to manufacturing processes. Moreover, the global supply chain disruptions and rising raw material costs can further increase production costs, affecting the overall market dynamics. Overcoming these hurdles requires continuous innovation, cost management, and adherence to evolving standards.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Automotive Shielding Market from 2023 to 2033. The rise of electric vehicles (EVs) and autonomous driving systems in North America is a key factor propelling the demand for shielding solutions to manage electromagnetic interference (EMI), thermal protection, and noise reduction. U.S. and Canadian manufacturers are focusing on developing lightweight, high-performance shielding materials to meet the evolving needs of modern vehicles. Additionally, stringent regulations around vehicle safety, fuel efficiency, and environmental standards encourage the adoption of advanced shielding technologies. The growing trend toward vehicle electrification and connectivity further fuels the need for effective shielding, positioning North America as a key market for automotive shielding solutions in the coming years.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. The automotive shielding market in the Asia-Pacific region is experiencing rapid growth, driven by the booming automotive industry in developing countries. The increasing production and sales of vehicles, especially electric vehicles (EVs) and hybrid models, are driving the demand for effective shielding solutions to manage electromagnetic interference (EMI), heat, and noise. Asia-Pacific is a hub for automotive manufacturing, and the region's emphasis on technological advancements, such as autonomous driving and vehicle electrification, creates opportunities for innovative shielding materials. Additionally, stringent regulations concerning vehicle safety and environmental standards fuel the need for advanced shielding technologies. As the region continues to expand its automotive market, the demand for high-performance, lightweight, and cost-effective shielding solutions is expected to rise significantly, positioning Asia-Pacific as a key growth area for the automotive shielding market.

Segmentation Analysis

Insights by Shielding Type

The heat shield segment accounted for the largest market share over the forecast period 2023 to 2033. The heat shield segment of the automotive shielding market is experiencing robust growth, driven by the increasing demand for thermal management solutions in modern vehicles. With advancements in engine technologies, electric powertrains, and high-performance components, there is a growing need to protect sensitive parts from excessive heat. Heat shields are essential in preventing damage to critical components like batteries, wiring, and exhaust systems, particularly in electric vehicles (EVs) and hybrid models. The focus on improving fuel efficiency, reducing emissions, and enhancing vehicle performance further boosts the need for effective thermal protection. Additionally, stringent regulations regarding vehicle safety and environmental standards encourage the adoption of advanced heat shielding solutions. As a result, the heat shield segment is expected to expand significantly, contributing to the overall growth of the automotive shielding market.

Insights by Vehicle Type

The passenger car segment accounted for the largest market share over the forecast period 2023 to 2033. The passenger car segment is witnessing significant growth in the automotive shielding market, driven by the increasing demand for advanced technologies and enhanced vehicle performance. As passenger cars evolve with the integration of electric powertrains, autonomous driving systems, and connectivity features, the need for effective shielding solutions to manage electromagnetic interference (EMI), heat, and noise has risen. Additionally, the growing emphasis on safety, fuel efficiency, and environmental sustainability in passenger vehicles is fueling the demand for lightweight, durable, and high-performance shielding materials. Regulations regarding vehicle safety and emissions standards further accelerate the adoption of advanced shielding technologies. As consumer preferences shift toward eco-friendly, high-tech vehicles, the passenger car segment is expected to remain a key driver of growth in the automotive shielding market, particularly with the rise of electric and hybrid models.

Recent Market Developments

- In April 2019, Toyochem Co., Ltd., a prominent member of the Toyo Ink Group in Japan, introduced the LIOELM FTS series of thermally conductive adhesive sheets as a heat-dissipation solution for high-power electronic devices.

Competitive Landscape

Major players in the market

- Laird PLC (UK)

- ElringKlinger AG (Germany)

- Federal-Mogul Corporation (US)

- Morgan Advanced Materials (UK)

- Dana Limited (US)

- Henkel AG & Company, KGaA (Germany)

- Kitagawa Europe (Japan)

- Schaffner Holding (Switzerland)

- Autoneum (Switzerland)

- Progress-WerkOberkirch AG (Germany)

- Others

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Automotive Shielding Market, Shielding Type Analysis

- Heat Shield

- Electromagnetic Interference [EMI] Shield

Automotive Shielding Market, Vehicle Type Analysis

- Passenger Cars

- Commercial Vehicles

Automotive Shielding Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Automotive Shielding Market?The Global Automotive Shielding Market Size is expected to grow from USD 8.6 billion in 2023 to USD 30.5 billion by 2033, at a CAGR of 13.50% during the forecast period 2023-2033.

-

2. Who are the key market players of the Automotive Shielding Market?Some of the key market players of the market are Laird PLC (UK), ElringKlinger AG (Germany), Federal-Mogul Corporation (US), Morgan Advanced Materials (UK), Dana Limited (US), Henkel AG & Company, KGaA (Germany), Kitagawa Europe (Japan), and Schaffner Holding (Switzerland), Autoneum (Switzerland), Progress-WerkOberkirch AG (Germany).

-

3. Which segment holds the largest market share?The passenger car segment holds the largest market share and is going to continue its dominance.

-

4. Which region dominates the Automotive Shielding Market?North America dominates the Automotive Shielding Market and has the highest market share.

Need help to buy this report?