Global Automotive Shock Absorber Market Size, Share, and COVID-19 Impact Analysis, By Type (Hydraulic Shock Absorber and Gas-Filled Shock Absorber), By Design Type (Mono Tube and Twin Tube), By Vehicle Type (Passenger Cars, Commercial Vehicles, Electronics Vehicles, and Two Wheelers), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Automotive & TransportationGlobal Automotive Shock Absorber Market Insights Forecasts to 2033

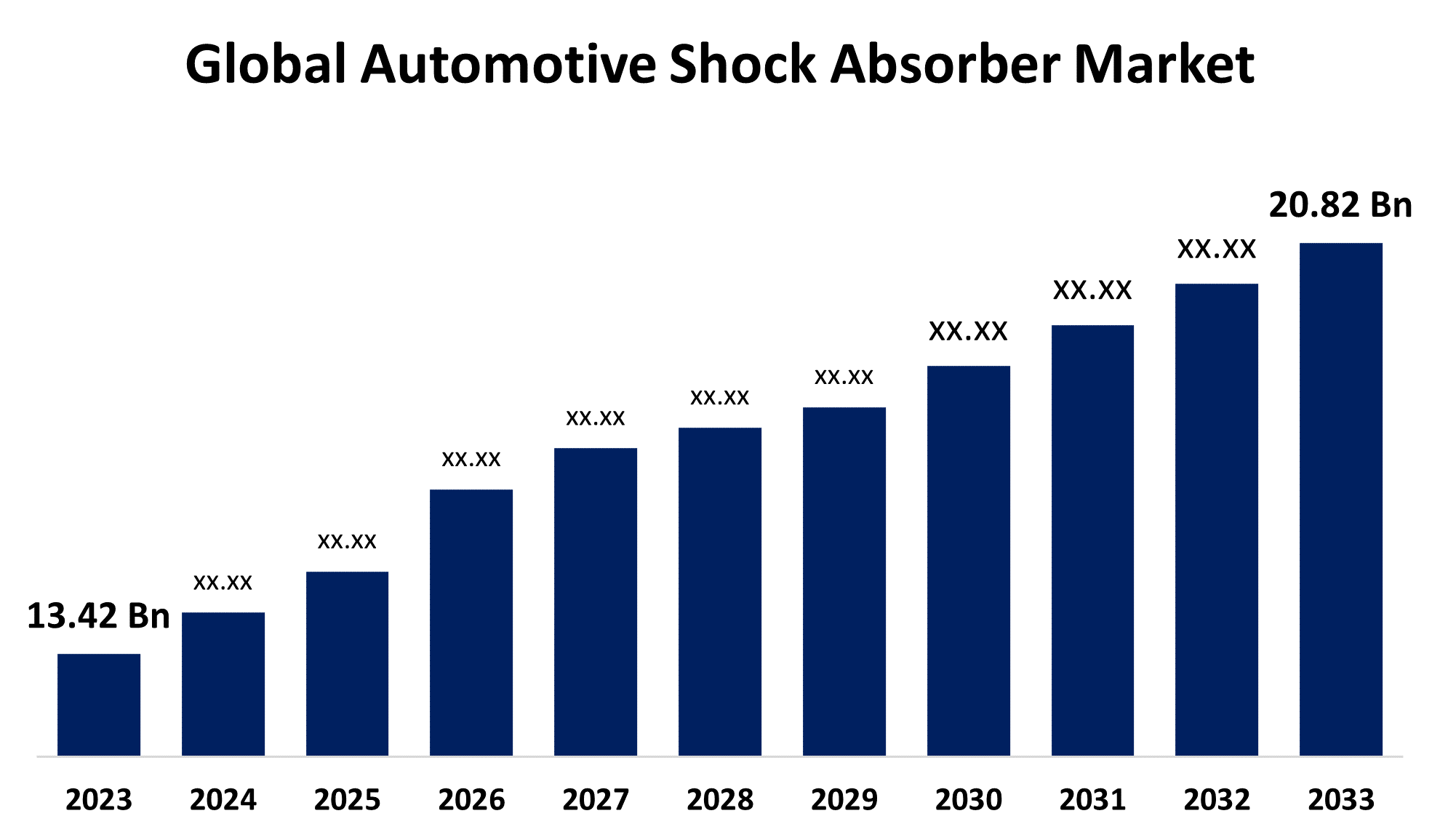

- The Global Automotive Shock Absorber Market Size was Valued at USD 13.42 Billion in 2023

- The Market Size is Growing at a CAGR of 4.49% from 2023 to 2033

- The Worldwide Automotive Shock Absorber Market Size is Expected to Reach USD 20.82 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Automotive Shock Absorber Market Size is Anticipated to Exceed USD 20.82 Billion by 2033, Growing at a CAGR of 4.49% from 2023 to 2033.

Market Overview

Automotive shock absorbers are essential components of a vehicle's suspension a shock absorber is intended to absorb or soften the rebounding and compression forces of the springs and suspension. They control undesirable and excessive spring motion. Some shock absorbers are dashpots a type of damper that resists action by viscous friction. Mechanical and hydraulic shock absorbers operate in combination with cushions and springs. A vehicle shock absorber includes spring-loaded check valves and orifices that control the flow of oil through an internal cylinder. Increasing vehicle production, rising demand for improved vehicle comfort and stability, and stringent rules governing vehicle safety requirements are projected to fuel market expansion. Shock absorbers help significantly to a smooth ride by minimizing vibrations and hence decreasing the chance of accidents. The shock absorber technology reduces vibration and shocks on difficult surfaces, increasing the rider's comfort and safety while driving or riding. Growing concerns about vehicle driver comfort and security are pushing innovation in shock absorbers. Furthermore, authorities and regulatory organizations throughout the world are enacting stricter standards for automotive performance and safety. These restrictions often demand changes to automotive suspension systems, such as shock absorbers, which support industry growth.

In August 2023, Hendrickson produced air and mechanical suspensions for trailer applications. These are intended to meet the current road conditions and growing infrastructure in India.

Report Coverage

This research report categorizes the market for the automotive shock absorber market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the automotive shock absorber market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the automotive shock absorber market.

Global Automotive Shock Absorber Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 13.42 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 4.49% |

| 2033 Value Projection: | USD 20.82 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 188 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Design Type, By Vehicle Type, By Region |

| Companies covered:: | ITT Corporation, Mando Corporation, Meritor Inc., Sachs, Showa Corporations, Tenneco Inc., Apollo, Arnott Inc., Bilstein, Duro Shox Pvt. Ltd., Gabriel India Ltd., Hitachi, KYB Group, Magneti Marelli SPA, and Others Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Increasing urbanization and smart cities, as well as longer daily commute distances, are among the primary reasons driving demand for new autos, which has a favorable indirect effect on the automotive shock absorbers sector. Furthermore, the rising demand for automotive shock absorbers is directly proportional to the increase in vehicle production and sales. The need for suspension components, particularly shock absorbers, grows in conjunction with the expansion of the automotive industry.

Restraining Factors

The automotive shock absorber market is constrained by factors such as changing raw material prices, which can affect overall production costs and shock absorber pricing.

Market Segmentation

The automotive shock absorber market share is classified into type, design type, and vehicle type.

- The hydraulic shock absorber segment holds the largest market share through the forecast period.

Based on the type, the automotive shock absorber market is categorized into hydraulic shock absorber and gas-filled shock absorber. Among these, the hydraulic shock absorber segment holds the largest market share through the forecast period. Hydraulic shock absorbers tend to be less expensive to build than advanced technology, resulting in an ideal alternative for low-cost automobiles and mass-market types. Hydraulic shock absorbers reduce shocks and impacts from road irregularities, resulting in a smooth and comfortable ride. This feature is especially enticing to consumers looking for a pleasant drive.

- The twin tube segment holds the highest market share through the forecast period.

The automotive shock absorber market is categorized by design type into mono tube and twin tube. Among these, the twin tube segment holds the highest market share through the forecast period. Twin-tube shock absorbers maintain an inner and outer tube that facilitates the movement of hydraulic fluid among them. Twin-tube shocks are responsive and can be fitted to a range of vehicle applications. They are widely utilized in a variety of vehicles, from compact automobiles to light trucks, giving manufacturers versatility.

- The passenger cars segment is anticipated to grow at the highest CAGR during the forecast period.

Based on the vehicle type, the automotive shock absorber market is categorized into passenger cars, commercial vehicles, electronics vehicles, and two wheelers. Among these, the passenger cars segment is anticipated to grow at the highest CAGR during the forecast period. Shock absorbers play an essential role in ensuring an easy and stable ride for passengers, making them a vital component of passenger car suspension systems. The shock absorbers serve an important role in decreasing vibrations and moderating the impact of road irregularities, which improves overall comfort for both drivers and passengers. The growing demand for cutting-edge shock absorber technologies in passenger vehicles demonstrates the industry's commitment to improving safety and the driving experience for daily commuters.

Regional Segment Analysis of the Automotive Shock Absorber Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

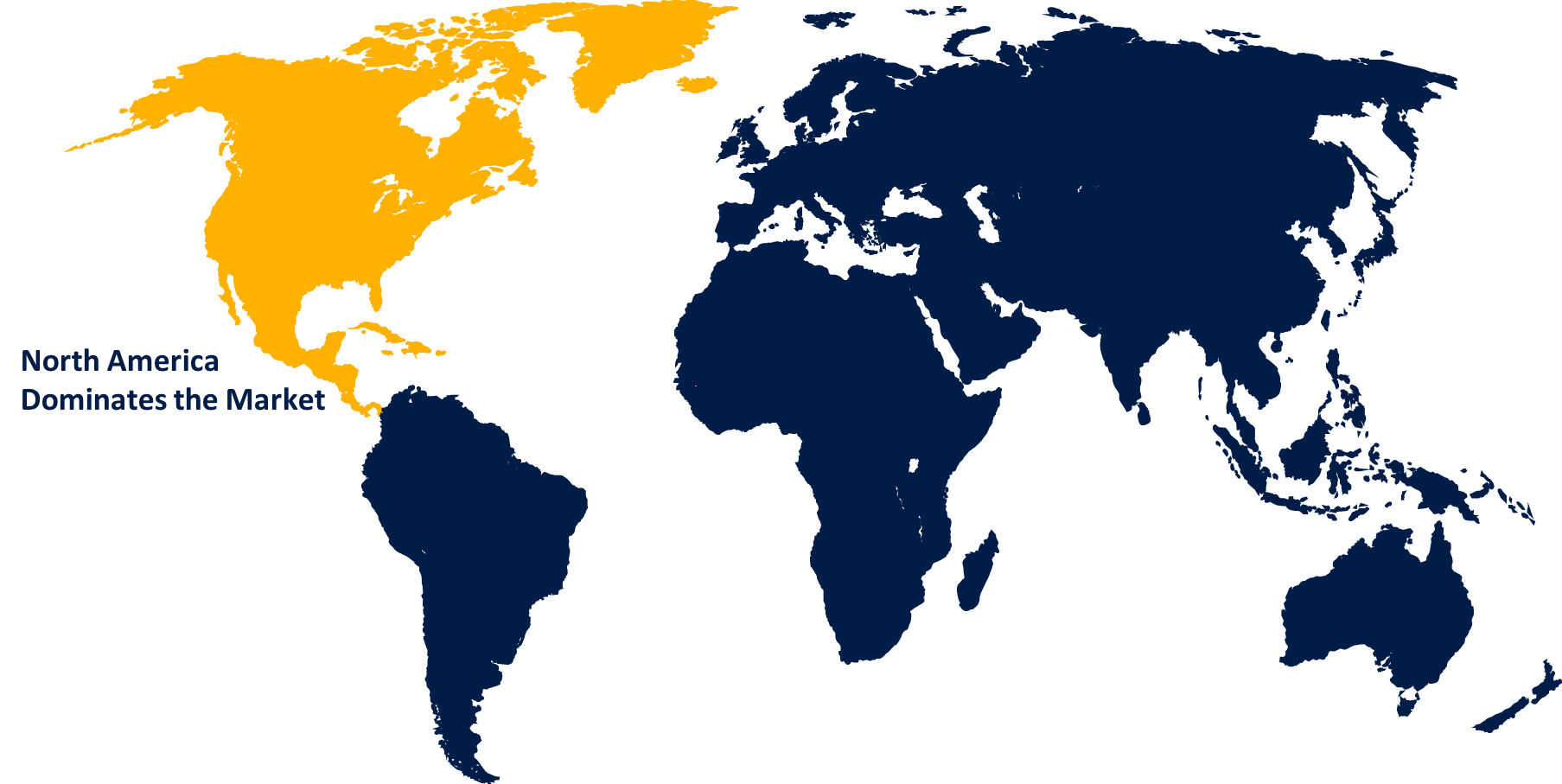

North America is anticipated to hold the largest share of the automotive shock absorber market over the predicted timeframe.

Get more details on this report -

North America is projected to hold the largest share of the automotive shock absorber market over the forecast period. The demand for shock absorbers is strongly connected to vehicle production and sales in North America. Economic conditions, consumer confidence, and the introduction of new vehicles all have an impact on shock absorber demand. The North American market strongly prefers light trucks, SUVs, and crossovers. These vehicles have different suspension requirements than smaller automobiles, which influences the need for shock absorbers developed for larger and heavier vehicles. The popularity of performance and sports cars in North America increases the demand for high-performance shock absorbers. This trend is driven by consumers seeking better handling, reactivity, and a more athletic driving experience.

Asia Pacific is expected to grow at the fastest CAGR growth in the automotive shock absorber market during the forecast period. The business in Asia Pacific is expected to grow at a significant CAGR over the next few years. The region's business is booming as China's automotive sales rise. For example, the International Motor Vehicle Manufacturers Association (OICA) reports that China sold more vehicles than any other country in 2021, with over 26 million. Rising sales and manufacturing of electric vehicles in China and India throughout the predicted period would contribute to regional market development. Furthermore, the region's market is rising due to abundant raw resources, a thriving automobile sector, a growing population, and low manufacturing costs.

The automotive shock absorber market in Europe, particularly in the United Kingdom, Germany, and France, is expected to increase steadily. The presence of significant automotive manufacturers and suppliers in these countries, together with an increased emphasis on vehicle safety and comfort, is driving higher demand for shock absorbers. Furthermore, strict government rules on vehicle emissions and safety standards have the potential to fuel market expansion in Europe.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the automotive shock absorber market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- ITT Corporation

- Mando Corporation

- Meritor Inc.

- Sachs

- Showa Corporations

- Tenneco Inc.

- Apollo

- Arnott Inc.

- Bilstein

- Duro Shox Pvt. Ltd.

- Gabriel India Ltd.

- Hitachi

- KYB Group

- Magneti Marelli SPA

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In June 2024, DRiV Integrated revealed an important new investment in its popular Monroe Steering and Suspension line, with 750 new part numbers on the way that will increase coverage by approximately 20% and reinforce the Monroe brand's distinct commitment to providing parts designed to keep customers safe on the road and built for strength to reduce returns.

- In May 2024, TracTive Suspension collaborated with Wunderlich to introduce a new suspension series called Wunderlich. Wunderlich Suspension is driven by TracTive. This new suspension line is the result of a firm collaboration between TracTive Suspension of the Netherlands and Wunderlich. Since 2010, TracTive Suspension has been at the forefront of suspension technology, developing and producing aftermarket and customized OEM suspension solutions for the motorcycle, sports car, and snowmobile markets, setting new benchmarks.

- In March 2024, Hendrickson launched the Roadmaax Z, the company's smallest-weight rear air suspension with a capacity of 46,000 pounds. Hendrickson states that its Roadmaax Z system is the first drive axle suspension to feature its patented Zero Maintenance Damping (ZMD) ride technology, which eliminates conventional shock absorbers and incorporates reducing into the air springs, reducing lifetime downtime and maintenance costs.

- In April 2023, ZF Aftermarket, a renowned automobile parts supplier in India, introduced TRW shock absorbers, brake pads, and brake discs. The brake pads and shock absorbers are devoid of toxic chemicals and help to minimize carbon emissions by producing a lower temperature.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the automotive shock absorber market based on the below-mentioned segments:

Global Automotive Shock Absorber Market, By Type

- Hydraulic Shock Absorber

- Gas-Filled Shock Absorber

Global Automotive Shock Absorber Market, By Design Type

- Mono Tube

- Twin Tube

Global Automotive Shock Absorber Market, By Vehicle Type

- Passenger Cars

- Commercial Vehicles

- Electronics Vehicles

- Two Wheelers

Global Automotive Shock Absorber Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1.What is the CAGR of the global automotive shock absorber market over the forecast period?The Global Automotive Shock Absorber Market is to expand at 4.49% during the forecast period.

-

2.Which region is expected to hold the highest share in the global automotive shock absorber market?The North America region is expected to hold the largest share of the global automotive shock absorber market.

-

3.Who are the top key players in the automotive shock absorber market?The key players in the global automotive shock absorber market are ITT Corporation, Mando Corporation, Meritor Inc., Sachs, Showa Corporations, Tenneco Inc., Apollo, Arnott Inc., Bilstein, Duro Shox Pvt. Ltd., Gabriel India Ltd., Hitachi, KYB Group, Magneti Marelli SPA, and others.

Need help to buy this report?