Global Automotive Simulation Market Size, Share, and COVID-19 Impact Analysis, By Application (Drive Systems, Mechanical Components, and Fluid Power), By Deployment (On-premises and Cloud), By Component (Software and Services), By End users (OEM, Suppliers), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Automotive & TransportationGlobal Automotive Simulation Market Insights Forecasts to 2033

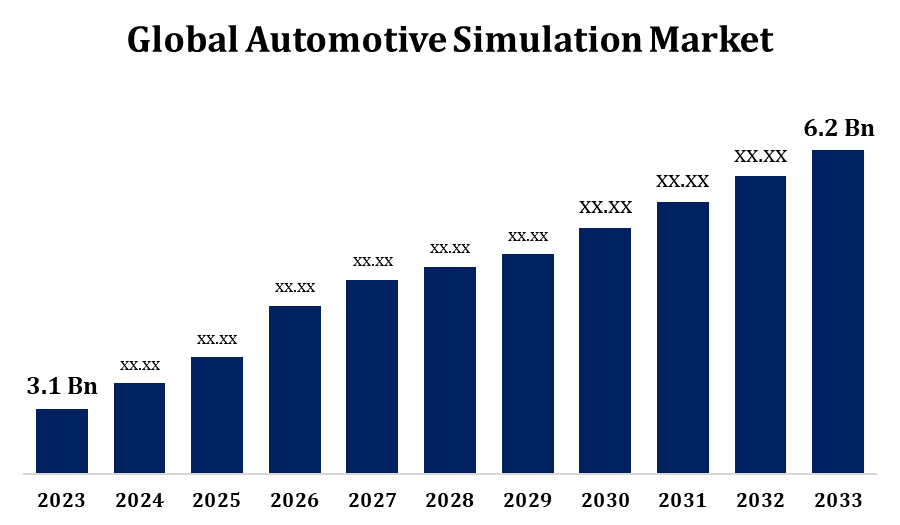

- The Automotive Simulation Market Size Was Valued at USD 3.1 Billion in 2023.

- The Market Size is Growing at a CAGR of 7.18% from 2023 to 2033.

- The Global Automotive Simulation Market Size is Expected to reach USD 6.2 Billion By 2033.

- Asia Pacific is Expected to Grow the fastest during the orecast period.

Get more details on this report -

The Global Automotive Simulation Market Size is Expected to reach USD 6.2 Billion By 2033, at a CAGR of 7.18% during the Forecast Period 2023 to 2033.

The automotive simulation market is growing rapidly, driven by advancements in autonomous vehicles, electric mobility, and digital twin technology. Automakers and suppliers use simulation tools to enhance vehicle design, safety testing, and performance optimization while reducing costs and development time. Key applications include crash testing, aerodynamics, powertrain efficiency, and driver assistance systems. The rise of artificial intelligence and machine learning further enhances predictive analytics in vehicle simulations. Additionally, regulatory requirements for safety and emission standards are fueling demand for virtual testing. Leading companies such as Siemens, Ansys, and Dassault Systèmes dominate the market, offering advanced simulation solutions. The increasing adoption of connected and software-defined vehicles is expected to propel further growth. The market is anticipated to expand significantly, driven by continuous technological innovation and industry digitalization.

Automotive Simulation Market Value Chain Analysis

The automotive simulation market value chain consists of several key stages, from software development to end-user applications. It begins with software providers such as Ansys, Siemens, and Dassault Systèmes, who develop simulation tools for vehicle design, testing, and validation. Hardware providers supply high-performance computing systems to support complex simulations. Automakers and Tier 1 suppliers integrate these solutions to optimize vehicle performance, safety, and efficiency. Regulatory bodies play a crucial role by setting safety and emission standards that drive simulation adoption. Research institutions and testing labs contribute by refining models and ensuring accuracy. Finally, end-users, including OEMs, component manufacturers, and autonomous vehicle developers, utilize these tools for real-world applications. The value chain is increasingly shaped by AI, digital twins, and cloud-based simulation platforms.

Automotive Simulation Market Opportunity Analysis

The automotive simulation market presents significant growth opportunities driven by advancements in electric vehicles, autonomous driving, and connected car technologies. The increasing complexity of modern vehicles demands robust simulation tools for virtual prototyping, crash testing, and real-time performance analysis, reducing costs and development time. The rise of AI and digital twin technology enhances predictive modeling, improving vehicle efficiency and safety. Growing regulatory requirements for emissions and safety standards further boost the demand for simulation solutions. Cloud-based simulation and high-performance computing are expanding accessibility for small and mid-sized manufacturers. Additionally, emerging markets in Asia-Pacific are witnessing rapid adoption of simulation technologies. As automakers shift toward software-defined vehicles and over-the-air updates, the need for advanced simulation tools is expected to surge, driving continuous market expansion.

Global Automotive Simulation Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 3.1 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 7.18% |

| 2033 Value Projection: | USD 6.2 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Application, By Deployment, By End users, By Region and COVID-19 Impact Analysis |

| Companies covered:: | Altair Engineering, Inc., Autodesk Inc., ANSYS, Inc., PTC, Dassault Systèmes, The MathWorks, Inc., Rockwell Automation, Simulations Plus, ESI Group, Applied Intuition, Inc. and others key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Automotive Simulation Market Dynamics

Advancements in technology are fueling market growth

Advancements in technology are fueling automotive simulation market growth by enhancing vehicle design, safety, and performance optimization. The integration of artificial intelligence, digital twin technology, and high-performance computing enables automakers to conduct virtual prototyping, crash testing, and real-time performance analysis with greater accuracy and efficiency. The growing adoption of electric and autonomous vehicles further drives demand for simulation tools to test complex systems in a cost-effective and time-efficient manner. Cloud-based simulation platforms are expanding accessibility, allowing manufacturers to streamline development processes. Additionally, stringent regulatory requirements for emissions and safety standards are increasing the need for advanced simulation solutions. As the automotive industry shifts toward software-defined vehicles and over-the-air updates, simulation technology continues to evolve, playing a crucial role in innovation and market expansion.

Restraints & Challenges

The automotive simulation market faces several challenges despite its rapid growth. High initial investment costs for advanced simulation software and hardware can be a barrier, especially for small and mid-sized manufacturers. Ensuring the accuracy and reliability of simulation models is another challenge, as real-world conditions can be complex and difficult to replicate. The integration of AI, machine learning, and digital twins requires skilled professionals, creating a talent gap in the industry. Additionally, cybersecurity concerns arise as cloud-based and connected simulations become more prevalent. Compliance with evolving safety and emission regulations adds further complexity, requiring frequent software updates. Moreover, interoperability between different simulation platforms and existing automotive systems remains a hurdle. Addressing these challenges is essential for unlocking the full potential of automotive simulation technology.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Automotive Simulation Market from 2023 to 2033. The U.S. dominates the market due to strong R&D investments, a robust automotive industry, and government regulations emphasizing vehicle safety and emissions reduction. Cloud-based simulation and digital twin technology are gaining traction, enabling cost-effective and real-time testing. The market is witnessing increased adoption in OEMs, suppliers, and mobility startups focusing on virtual prototyping and crash testing. As the industry shifts toward EVs and connected cars, demand for simulation software is expected to surge, ensuring faster and safer vehicle development.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. China, Japan, and South Korea lead the market due to strong automotive manufacturing, government support for EV adoption, and increasing investments in AI-driven simulation technologies. Automakers and suppliers are leveraging simulation software for vehicle design, crash testing, and performance optimization, reducing costs and development time. Digital twin technology and cloud-based simulations are becoming more popular, enabling real-time data analysis and predictive maintenance. With a surge in connected vehicles and stricter safety regulations, demand for simulation solutions is rising. The growing presence of global players, along with domestic innovations, is set to further accelerate the expansion of the automotive simulation market in the region.

Segmentation Analysis

Insights by Application

The drive systems segment accounted for the largest market share over the forecast period 2023 to 2033. Automakers are increasingly using simulation tools to optimize powertrain efficiency, battery management, and thermal performance. With the shift toward electrification, simulation software plays a crucial role in developing high-performance electric motors, inverters, and regenerative braking systems. Advanced simulation technologies help manufacturers reduce costs, accelerate R&D, and improve vehicle range by optimizing drivetrain components. Digital twin technology and AI-powered simulations are gaining traction, enabling real-time testing and predictive maintenance. As regulations for fuel efficiency and emissions tighten globally, the need for precise and cost-effective drive system simulations is increasing, further driving market expansion in the coming years.

Insights by Deployment

The on-premises segment accounted for the largest market share over the forecast period 2023 to 2033. Many companies prefer on-premises solutions to maintain full control over sensitive design and testing data, especially in areas like crash simulations, powertrain optimization, and ADAS development. This segment is particularly strong among large OEMs and Tier 1 suppliers that require robust simulation environments with minimal latency and high computational power. While cloud-based solutions are gaining traction, on-premises systems remain crucial for handling complex simulations that demand real-time processing and integration with in-house hardware. As the automotive industry continues to invest in advanced vehicle technologies, the need for secure, high-performance simulation infrastructure is expected to sustain the growth of the on-premises segment.

Insights by Component

The service segment accounted for the largest market share over the forecast period 2023 to 2033. With increasing adoption of simulation tools for vehicle design, testing, and validation, companies require specialized services to optimize performance and ensure compliance with evolving regulations. Service providers assist in customizing simulation models, offering cloud-based solutions, and maintaining high-performance computing infrastructure. The rise of electric vehicles, autonomous driving, and connected car technologies is further driving demand for simulation-as-a-service, enabling cost-effective and scalable solutions. As automotive firms focus on reducing development cycles and improving efficiency, the need for consulting, technical support, and training services is expanding, making the service segment a key contributor to overall market growth.

Insights by End Users

The suppliers segment accounted for the largest market share over the forecast period 2023 to 2033. With the rise of electric vehicles, autonomous driving, and connected technologies, suppliers are using simulation software to enhance product performance, durability, and compliance with safety standards. Virtual prototyping enables cost-effective development of critical components like batteries, sensors, powertrains, and braking systems, reducing reliance on physical testing. Digital twin technology and AI-driven simulations are further streamlining production and predictive maintenance. As OEMs demand faster innovation cycles and higher-quality components, suppliers are leveraging advanced simulation solutions to stay competitive, improve efficiency, and meet evolving regulatory and performance requirements in the automotive industry.

Recent Market Developments

- In January 2024, ANSYS, Inc. announced the integration of its AVxcelerate Sensors into NVIDIA DRIVE Sim, a scenario-based autonomous vehicle (AV) simulator built on NVIDIA Omniverse.

Competitive Landscape

Major players in the market

- Altair Engineering, Inc.

- Autodesk Inc.

- ANSYS, Inc.

- PTC

- Dassault Systèmes

- The MathWorks, Inc.

- Rockwell Automation

- Simulations Plus

- ESI Group

- Applied Intuition, Inc.

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Automotive Simulation Market, Application Analysis

- Drive Systems

- Mechanical Components

- Fluid Power

Automotive Simulation Market, Deployment Analysis

- On-premises

- Cloud

Automotive Simulation Market, Component Analysis

- Software

- Services

Automotive Simulation Market, End Users Analysis

- OEM

- Suppliers

Automotive Simulation Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Automotive Simulation Market?The global Automotive Simulation Market is expected to grow from USD 3.1 billion in 2023 to USD 6.2 billion by 2033, at a CAGR of 7.18% during the forecast period 2023-2033.

-

2. Who are the key market players of the Automotive Simulation Market?Some of the key market players of the market are Altair Engineering, Inc.; Autodesk Inc.; ANSYS, Inc.; PTC; Dassault Systèmes; The MathWorks, Inc.; Rockwell Automation; Simulations Plus; ESI Group; Applied Intuition, Inc.

-

3. Which segment holds the largest market share?The on-premises segment holds the largest market share and is going to continue its dominance.

Need help to buy this report?