Global Automotive Start-Stop System Market Size, Share, Growth, and Industry Analysis, By Component (Engine Control Unit, 12V DC Converter, Battery, Neutral Position Sensor, Wheel Speed Sensor, and Crankshaft Sensor), By Vehicle Type (Passenger Cars, Light Commercial Vehicles, and Heavy Commercial Vehicles), By Sales Channel (OEM and Aftersales), and Regional Automotive Start-Stop System and Forecast to 2033

Industry: Automotive & TransportationGlobal Automotive Start-Stop System Market Insights Forecasts to 2033

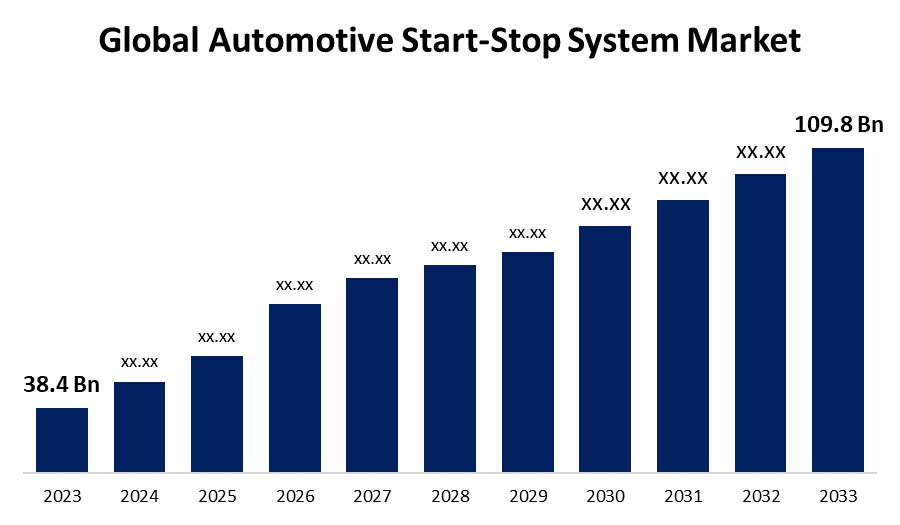

- The Global Automotive Start-Stop System Market Size was Valued at USD 38.4 Billion in 2023

- The Market Size is Growing at a CAGR of 11.08% from 2023 to 2033

- The Worldwide Automotive Start-Stop System Market Size is Expected to Reach USD 109.8 Billion by 2033

- Asia-Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Automotive Start-Stop System Market Size is Anticipated to Exceed USD 109.8 Billion by 2033, Growing at a CAGR of 11.08% from 2023 to 2033.

AUTOMOTIVE STAR-STOP SYSTEM MARKET REPORT OVERVIEW

A feature that automatically cuts the engine when the car is stopped and resumes it when necessary can be described as an automotive start-stop system. It is made up of a starter motor, transmission system, sensors, control module, and batteries. To determine whether the car is moving or still, sensors are used. Automotive start-stop systems are a cutting-edge technology that contributes to modern cars' increased efficiency and less environmental impact. Shutting off the engine while the car is idling, also helps to lower fuel consumption, lower emissions of dangerous pollutants like carbon dioxide and nitrogen oxides, increase overall economy and make driving more comfortable. Automakers are using technologies that increase fuel efficiency and lower emissions as governments around the world impose strict emission rules to address air pollution and climate change. This law promotes the installation of modern start-stop technology, which guarantees increased fuel economy and lower emissions. The growing vehicle production and rising fuel efficiency are propelling the growth of the automotive start-stop system market. Through automatic engine shutdown in periods of high traffic, these technologies lower fuel consumption and increase total miles per gallon. The worldwide population's growing disposable income, economic growth, and the automobile industry's acceleration of development have all contributed to a rise in demand for sales of cars and motorcycles, which is ultimately fueling the industry's expansion.

Report Coverage

This research report categorizes the market for the global automotive start-stop system market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global automotive start-stop system market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global automotive start-stop system market.

Global Automotive Start-Stop System Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 38.4 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 11.08% |

| 2033 Value Projection: | USD 109.8 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Component, By Vehicle Type, By Sales |

| Companies covered:: | DENSO CORPORATION., Hitachi, Ltd., Schaeffler AG, Delphi Technologies, Mitsubishi Electric Corporation, Tenneco Inc., EXEDY Corporation, ZF Friedrichshafen AG, Magna International Inc, Fiat Chrysler Automobiles, Bosch SanayiVeTicaret A.S., Continental AG, BorgWarner Inc., AISIN SEIKI Co., Ltd., Valeo, and other key companies. |

| Growth Drivers: | Technological developments in control systems and componentry have accelerated market expansion. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

DRIVING FACTORS:

Technological developments in control systems and componentry have accelerated market expansion.

Refined control algorithms, upgraded starting motors, and cutting-edge batteries like lithium-ion and absorbent glass mat all help to make engine restarts smoother and more effective. By reducing the strain on vital components, these developments allay earlier worries regarding system performance and durability. For instance, Bosch Ltd. is aiming to increase investments in research and development and local production of components like hub motors used in electric two-wheelers. Furthermore, improvements in battery technology have increased the dependability and efficiency of start-stop systems, increasing their attractiveness to manufacturers and customers.

RESTRAINING FACTORS

The system's optional nature and expensive installation costs could restrict the market's expansion.

The cost of the car is significantly increased by the automatic start-stop system. The majority of people who purchase cars do so for conventional vehicles. These cars tend to be more expensive than standard cars if they come with a start-stop technology installed. Because of this, not all buyers are inclined to purchase a vehicle that has a start-stop system installed. Additionally, if the engines in these cars are not properly maintained on a regular basis, they cannot last as long, which raises the expense of maintenance. Therefore, the engine's excessive start-stop function could potentially pose a barrier to the market's growth.

Market Segmentation

The automotive start-stop system market share is classified into component, vehicle type, and fuel.

The wheel speed segment has the largest market share over the forecast period.

Based on components, the automotive start-stop system is classified into the engine control unit, 12V DC converter, battery, neutral position sensor, wheel speed sensor, and crankshaft sensor. The wheel speed sensor category is anticipated to hold the biggest revenue share in the worldwide market. This is a result of an increase in traffic accidents brought on by fast driving. Wheel speed sensors are becoming more and more in demand due to a number of factors, including the growing use of anti-lock brakes in automobiles, stringent government laws requiring anti-lock braking systems to be used, and a rise in automobile sales globally. Moreover, rising customer awareness and the introduction of the anti-lock braking system in developing nations are anticipated to fuel this segment's revenue growth over the projection period. The advancement in technology is expected to boost the market growth. For instance, Sumitomo Rubber Industries (SRI) has created a system that can precisely identify loose wheel nuts on automobiles, even if they are only a millimeter loose. SRI's SENSING CORE technology, a sophisticated sensorless analysis and monitoring platform, has this wheel detachment feature.

The passenger car segment has the highest market share over the forecast period.

Based on vehicle type, the automotive start-stop system is classified into passenger cars, light commercial vehicles, and heavy commercial vehicles. The passenger car segment is anticipated to show consistently strong revenue growth in the worldwide automotive start-stop system market. This is due to the growing number of government efforts aimed at reducing fuel consumption. Moreover, growing populations, rising disposable income, and shifting lifestyle choices in developing nations are anticipated to fuel this segment's revenue growth over the projection period. In Europe, stop-start technology has been available for passenger automobiles with gasoline engines. The engines of passenger cars do not like being started and stopped frequently. Constantly accelerating and decelerating moving parts can shorten the time between engine overhauls and increase bearing wear, necessitating more frequent repairs.

The OEM segment has the biggest market share during the projected timeframe.

Based on the sales channel, the automotive start-stop system is classified into OEM and aftersales. The OEM segment had the biggest revenue share since they included these systems in new car models. To comply with regulatory requirements and satisfy consumer demand, automakers are progressively implementing start-stop technology as fuel economy and emission reduction have become critical considerations. Many new automobiles now come equipped with this system by default, which reduces idling time by stopping and starting the engine automatically. Manufacturers gain a competitive edge in the market by making use of economies of scale and the capacity to seamlessly integrate sophisticated start-stop technologies into the design of their cars.

Regional Segment Analysis of the Global Automotive Start-Stop System Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

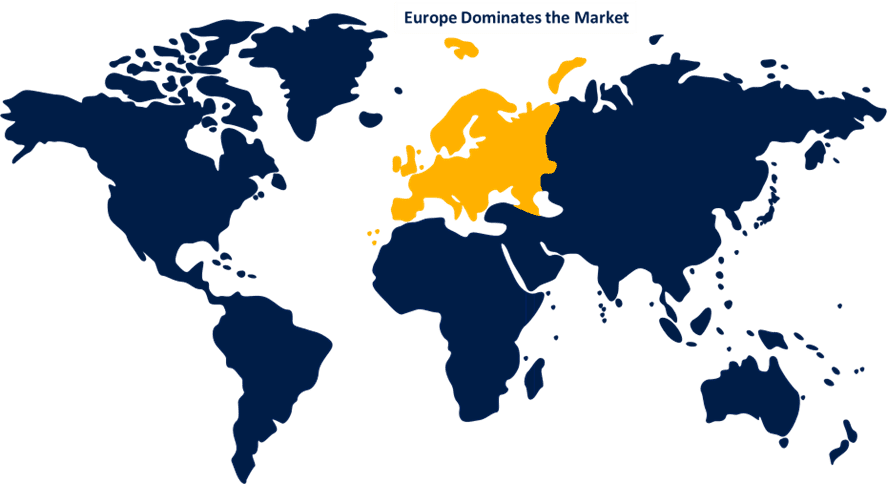

Europe has had the biggest share of the automotive start-stop system market throughout the forecast period.

Get more details on this report -

The Europe region accounted for the largest share of the market and dominated due in part to the European Union's dedication to lowering carbon footprints and the region's strict emissions rules. Although start-stop systems have better fuel economy and lower CO2 emissions, European consumers are embracing them more frequently. Market expansion is also aided by the region's robust automotive sector, which is defined by the presence of top automakers and a rapid pace of technical advancement. The growing desire for hybrid and electric cars, many of which come with start-stop mechanisms is further driving the European industry.

The Asia-Pacific is the fastest-growing region over the projected timeframe.

The Asia Pacific region is also anticipated to contribute to the market's growth due to the rise in car production and sales in developing nations like China and India. Additionally, the global automotive start/stop system market is growing due to rigorous government regulations regarding driver and passenger safety as well as growing public awareness of safety issues. The region's market has grown as a result of technological advancements made by China's top automakers to incorporate safety features.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global automotive start-stop system market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- DENSO CORPORATION.

- Hitachi, Ltd.

- Schaeffler AG

- Delphi Technologies

- Mitsubishi Electric Corporation

- Tenneco Inc.

- EXEDY Corporation

- ZF Friedrichshafen AG

- Magna International Inc

- Fiat Chrysler Automobiles

- Bosch SanayiVeTicaret A.S.

- Continental AG

- BorgWarner Inc.

- AISIN SEIKI Co., Ltd.

- Valeo

- Others

Key Market Developments

- In December 2022, The Burgman Street maxi-scooter from Suzuki Motorcycle India has a new top-of-the-line edition that has just been released. The scooter is equipped with a brand-new Suzuki Eco Performance Alpha (SEP-a) engine that features a silent starter mechanism and an automated stop-start function.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global automotive start-stop system market based on the below-mentioned segments:

Global Automotive Start-Stop System Market, By Component

- Engine Control Unit

- 12V DC Converter

- Battery

- Neutral Position Sensor

- Wheel Speed Sensor

- Crankshaft Sensor

Global Automotive Start-Stop System Market, By Vehicle Type

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

Global Automotive start-stop System Market, By Sales Channel

- OEM

- Aftersales

Global Automotive Start-Stop System Market, By Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the global automotive start-stop system market over the forecast period?The global automotive start-stop system market size is expected to grow from USD 38.4 Billion in 2023 to USD 109.8 Billion by 2033, at a CAGR of 11.08% during the forecast period 2023-2033.

-

2. Which region is expected to hold the highest share in the global automotive start-stop system market?Europe is projected to hold the largest share of the global automotive start-stop system market over the forecast period.

-

3. Who are the top key players in the automotive start-stop system market?DENSO CORPORATION, Hitachi, Ltd, Schaeffler AG, Delphi Technologies, Mitsubishi Electric Corporation, Tenneco Inc, EXEDY Corporation, ZF Friedrichshafen AG, Magna International Inc, Fiat Chrysler Automobiles, Bosch SanayiVeTicaret A.S, Continental AG, BorgWarner Inc, AISIN SEIKI Co., Ltd, Valeo, and Others.

Need help to buy this report?