Global Automotive Starter Motor and Alternator Market Size, Share, and COVID-19 Impact Analysis, By Types of Starter Motor (Electric, Pneumatic, Hydraulic), By Alternator Type (Claw Pole Alternator, Cylindrical Alternator), By Vehicle Type (Passenger Vehicles, Light Commercial Vehicles, Trucks, Buses & Coaches, Off-road Vehicles), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Automotive & TransportationGlobal Automotive Starter Motor and Alternator Market Insights Forecasts to 2033

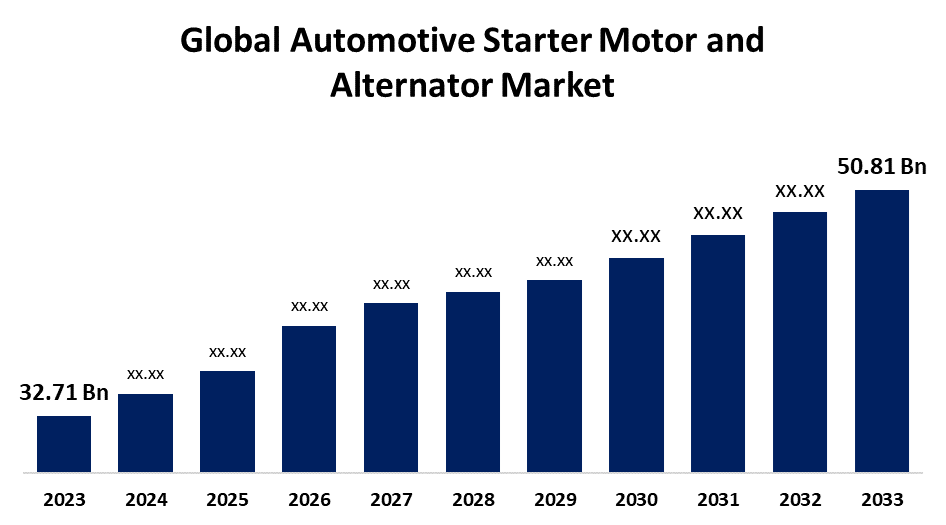

- The Global Automotive Starter Motor and Alternator Market Size was Valued at USD 32.71 Billion in 2023

- The Market Size is Growing at a CAGR of 4.50% from 2023 to 2033

- The Worldwide Automotive Starter Motor and Alternator Market Size is Expected to Reach USD 50.81 Billion by 2033

- North America is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Automotive Starter Motor and Alternator Market Size is Anticipated to Exceed USD 50.81 Billion By 2033, Growing at a CAGR of 4.50% from 2023 to 2033.

Market Overview

The automotive starter motor is an electric motor that initiates the engine's operation by turning the engine's flywheel. The alternator is a generator that produces electrical power for the vehicle once the engine is running. It converts mechanical energy from the engine into electrical energy, charging the battery and powering the vehicle's electrical systems. The automotive starter motor and alternator are essential components of a vehicle's electrical system, serving distinct functions. The starter motor converts battery energy into mechanical energy, while the alternator charges the battery and powers electrical systems. Both require efficient heat management for reliable operation and longevity.

The automotive starter motor and alternator are crucial components in vehicles, ensuring reliable engine starting and consistent power supply for all electrical systems. The starter motor initiates engine operation and assists in regenerative braking, while the alternator charges the battery and recharges the battery.

Report Coverage

This research report categorizes the market for automotive starter motor and alternator based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the automotive starter motor and alternator market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the automotive starter motor and alternator market.

Global Automotive Starter Motor and Alternator Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 32.71 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 4.50% |

| 2033 Value Projection: | USD 50.81 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 227 |

| Tables, Charts & Figures: | 119 |

| Segments covered: | By Types of Starter Motor, By Alternator Type, By Vehicle Type, By Region and COVID-19 Impact Analysis. |

| Companies covered:: | ASIMCO Technologies Ltd., BBB Industries LLC., Controlled Power Technologies Ltd., Cummins, Inc., Denso Corporation, Hitachi Automotive Systems, Ltd., Hella KGAA Hueck & Co., Lucas Electrical Ltd., Mitsubishi Electric Corporation, Mitsuba Corporation, Robert Bosch GmbH, Remy International, Inc., RFL Alternators, Unipoint Electric MFG Co., Ltd., Valeo SA, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The automotive starter motor and alternator market is propelled by several factors including the increasing global demand for vehicles, particularly in emerging markets, along with technological advancements that enhance efficiency and performance. The rise of electric and hybrid vehicles is reshaping the landscape, leading to the development of advanced starter-generator systems. Furthermore, consumer preferences for fuel-efficient and high-performance vehicles, along with stricter regulatory standards on emissions, further stimulate demand for innovative starter and alternator technologies. The growth of the aftermarket for vehicle parts and improvements in global supply chain logistics also contribute to the market's expansion.

Restraining Factors

The automotive starter motor and alternator market is constrained by several factors that can hinder its growth including the shift toward electric vehicles significantly reduces the demand for traditional starter motors and alternators, as these vehicles employ different systems. Intense competition among manufacturers can lead to price wars, affecting profit margins.

Market Segmentation

The automotive starter motor and alternator market share is classified into types of starter motor, alternator type, and vehicle type.

- The electric segment is estimated to hold the highest market revenue share through the projected period.

Based on the types of starter motor, the automotive starter motor and alternator market is classified into electric, pneumatic, and hydraulic. Among these, the electric segment is estimated to hold the highest market revenue share through the projected period. The segment's dominance is largely attributed to the widespread adoption of electric starter motors in modern vehicles due to their reliability, efficiency, and ease of integration with advanced automotive technologies. Furthermore, electric starter motors are favored for their compact design and ability to provide consistent performance across various engine types.

- The claw pole alternator segment is anticipated to hold the largest market share through the forecast period.

Based on the alternator type, the automotive starter motor and alternator market is divided into claw pole alternator and cylindrical alternator. Among these, the claw pole alternator segment is anticipated to hold the largest market share through the forecast period. The widespread use in various automotive applications, particularly in traditional internal combustion engine vehicles. Claw pole alternators are known for their efficiency, compact design, and ability to provide high power output, making them a popular choice among manufacturers. Furthermore, as the automotive industry continues to evolve, claw pole alternators are often preferred for their reliability and performance, further solidifying their leading position in the market.

- The passenger vehicles segment dominates the market with the largest market share through the forecast period.

Based on the vehicle type, the automotive starter motor and alternator market is categorized into passenger vehicles, light commercial vehicles, trucks, buses & coaches, and off-road vehicles. Among these, the passenger vehicles segment dominates the market with the largest market share through the forecast period. The segment dominance is propelled by the high production and sales volumes of passenger vehicles globally, coupled with the increasing demand for fuel-efficient and technologically advanced automotive systems. Furthermore, the growing trend towards electrification and the incorporation of advanced features in passenger cars further bolster the demand for reliable starter motors and alternators.

Regional Segment Analysis of the Automotive Starter Motor and Alternator Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the automotive starter motor and alternator market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the automotive starter motor and alternator market over the predicted timeframe. Rapid urbanization, increasing vehicle production, and a growing middle-class population contribute to the rising demand for automotive starter motors and alternators. Furthermore, major automotive manufacturers are investing heavily in production facilities in countries like China, India, and Japan, further boosting market growth.

North America is expected to grow at the fastest CAGR growth of the automotive starter motor and alternator market during the forecast period. North America's region is driven by several factors such as increasing vehicle production, advancements in automotive technology, and rising demand for electric and hybrid vehicles. Furthermore, the focus on fuel efficiency and emissions regulations might also play a significant role.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the automotive starter motor and alternator market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- ASIMCO Technologies Ltd.

- BBB Industries LLC.

- Controlled Power Technologies Ltd.

- Cummins, Inc.

- Denso Corporation

- Hitachi Automotive Systems, Ltd.

- Hella KGAA Hueck & Co.

- Lucas Electrical Ltd.

- Mitsubishi Electric Corporation

- Mitsuba Corporation

- Robert Bosch GmbH

- Remy International, Inc.

- RFL Alternators

- Unipoint Electric MFG Co., Ltd.

- Valeo SA

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In March 2022, Nexteer Automotive introduced a new eDrive product line, including a 48-volt Integrated Belt-Driven Starter Generator (iBSG), which hybridizes conventional internal combustion engine (ICE) automobiles. Nexteer's innovative, cost-effective strategy assists OEMs in meeting emissions and fuel economy criteria while also improving driving comfort for consumers.

- In April 2022, Maserati launched the Maserati Grecale, a moderate hybrid vehicle, in Italy. The hybrid powertrain is available in two outputs, 296 horsepower for the entry-level Grecale GT and 325 horsepower for the higher-level Modena trim levels. All variants come with all-wheel drive and eight-speed automatic transmissions.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the automotive starter motor and alternator market based on the below-mentioned segments:

Global Automotive Starter Motor and Alternator Market, By Types of Starter Motor

- Electric

- Pneumatic

- Hydraulic

Global Automotive Starter Motor and Alternator Market, By Alternator Type

- Claw Pole Alternator

- Cylindrical Alternator

Global Automotive Starter Motor and Alternator Market, By Vehicle Type

- Passenger Vehicles

- Light Commercial Vehicles

- Trucks

- Buses & Coaches

- Off-road Vehicles

Global Automotive Starter Motor and Alternator Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the automotive starter motor and alternator market over the forecast period?The automotive starter motor and alternator market is projected to expand at a CAGR of 4.50% during the forecast period.

-

2. What is the market size of the automotive starter motor and alternator market?The Global Automotive Starter Motor and Alternator Market Size is Expected to Grow from USD 32.71 Billion in 2023 to USD 50.81 Billion by 2033, Growing at a CAGR of 4.50% during the forecast period 2023-2033.

-

3. Which region holds the largest share of the automotive starter motor and alternator market?North America is anticipated to hold the largest share of the automotive starter motor and alternator market over the predicted timeframe.

Need help to buy this report?