Global Automotive Steering Sensors Market Size, Share, and COVID-19 Impact Analysis, By Sensor Type (Health Monitoring Systems, Torque Sensors, Intelligent Multi-Functional Sensor Systems, Position Sensors/Angle Sensors, And Other Sensor Types), By Vehicle Type (Passenger Cars, Light Commercial Vehicles, and Heavy Commercial Vehicles), By Technology (Contacting and Magnetic), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Automotive & TransportationGlobal Automotive Steering Sensors Market Insights Forecasts to 2033

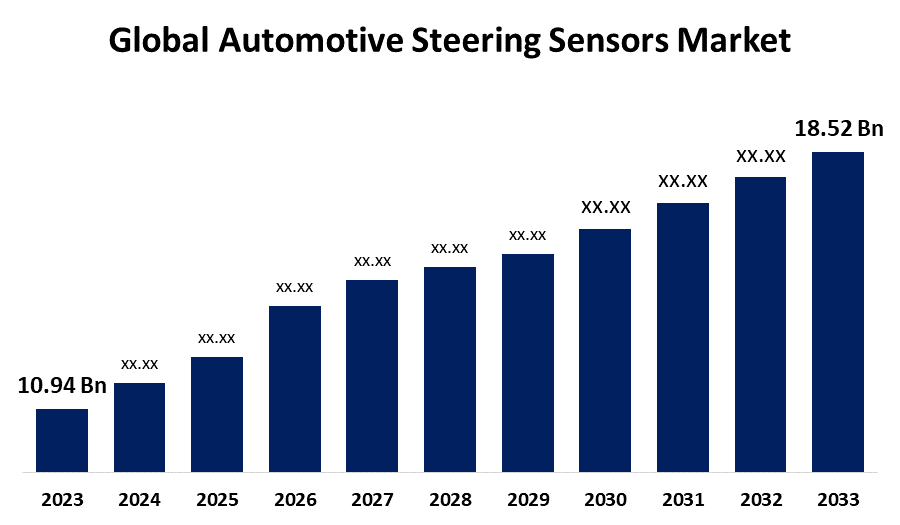

- The Global Automotive Steering Sensors Market Size was Valued at USD 10.94 Billion in 2023

- The Market Size is Growing at a CAGR of 5.41% from 2023 to 2033

- The Worldwide Automotive Steering Sensors Market Size is Expected to Reach USD 18.52 Billion by 2033

- North America is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Automotive Steering Sensors Market Size is Anticipated to Exceed USD 18.52 Billion by 2033, Growing at a CAGR 5.41% from 2023 to 2033.

Market Overview

The automobile steering angle sensor (SAS) detects where the driver wishes to steer by aligning the steering wheel with the vehicle's wheels. The steering angle sensor, for instance, is positioned within the steering column and is always made up of many sensors that are combined into a single unit for redundancy, accuracy, and diagnostic functions. Steering applies to the control of motion's direction or the components that permit it to be controlled. Ailerons for airplanes, rudders for boats, tilting rotors for helicopters, and other systems all contribute to steering sensors. A car's steering system provides more than just the steering wheel it involves a steering box, a linkage connecting the steering box to the wheel assembly, and a steering sensor. Steering sensors are required to measure the angle of a steering wheel's revolution and communicate this information to the navigation system. These sensors are used in automated systems including electronic command steering (ECS) and electric power steering (EPS).

Over 40 million vehicles on the roadways now have electronic command steering (ECS) that necessitates the recalibration of the steering angle sensor after a wheel alignment or the installation of a suspension or steering component, as directed by the original manufacturer of the vehicle. Resetting the steering angle sensor can be done in two ways: vehicle self-calibration and scan tool reset. Autonomous vehicles (particularly level 4 and level 5 vehicles) with self-driving systems typically handle massive amounts of data to provide input to the steering system drive smoothly, clear obstacles, and perform turning actions by traffic signs. As a result, it is projected that a greater number of sensors will be included in these types of vehicles, driving the market for these products.

To improve sales, the automotive steering system market's top players are focusing on improving and broadening their product offerings. Companies in the automotive steering sensors system market are striving harder to exploit competitive advantages. The key market players of automotive steering sensors market Robert Bosch GmbH, DENSO Corporation, HELLA GmbH & Co. KgaA, Methode Electronics Inc., Continental AG, Honeywell Inc., China Automotive Systems Inc., Mitsubishi Electric Corporation, Hyundai Mobis Co. Ltd., Mando Corporation, Federal-Mogul Corporation, and others.

Report Coverage

This research report categorizes the market for the automotive steering sensors market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the automotive steering sensors market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the automotive steering sensors market.

Automotive Steering Sensors Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 10.94 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 5.41% |

| 2033 Value Projection: | USD 18.52 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 219 |

| Tables, Charts & Figures: | 121 |

| Segments covered: | By Sensor Type, By Vehicle Type, By Technology, and By Region |

| Companies covered:: | Robert Bosch GmbH, DENSO Corporation, HELLA GmbH & Co. KgaA, Methode Electronics Inc., Continental AG, Honeywell Inc., China Automotive Systems Inc., Mitsubishi Electric Corporation, Hyundai Mobis Co. Ltd., Mando Corporation, Federal-Mogul Corporation, MTS Systems Corporation, Sensor Developments Inc., TE Connectivity Ltd., and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growing use of electric and self-driving vehicles is revolutionizing the automotive steering sector. Emerging electric and autonomous technologies need primarily improved sensor systems, such as vehicle steering sensors, to provide accurate control and monitoring. As a result, it acts as a significant stimulus for market expansion. The implementation of challenging environmental rules around the world is projected to expand the market for electric vehicles, increasing in demand for automotive steering systems. It is the primary element driving market expansion.

Restraining Factors

Commodity price fluctuations might have an impact on profit margins and operational costs, providing financial risks for automotive steering sensors market players. Furthermore, it can be extremely inconvenient and dangerous for the driver and passengers when the power steering system fails. To prevent accidents and maintain vehicle operation, power steering system maintenance is essential.

Market Segmentation

The automotive steering sensors market share is classified into sensor type, vehicle type, and technology.

- The torque sensors segment accounted for the largest revenue share over the forecast period.

The automotive steering sensors market is categorized by sensor type into health monitoring systems, torque sensors, intelligent multi-functional sensor systems, position sensors/angle sensors, and other sensor types. Among these, the torque sensors segment accounted for the largest revenue share over the forecast period. Torque sensors monitor the steering torque applied by the driver. The torque sensor and motor provide input to the vehicle's electronic control elements, and the pump applies the appropriate torque or assistance to the steering column. Torque sensors are utilized in automotive electronics and hydraulic power steering systems.

- The passenger cars segment dominates the market with the highest market share through the forecast period.

Based on the vehicle type, the automotive steering sensors market is categorized into passenger cars, light commercial vehicles, and heavy commercial vehicles. Among these, the passenger cars segment dominates the market with the highest market share through the forecast period. Due to a greater focus on safety and comfort, manufacturers are implementing EPS technology into entry-level vehicles, increasing demand for steering sensors in passenger cars. Power steering is becoming increasingly popular in passenger cars because of its multiple advantages, including the elimination of tubes and fluids throughout the steering system.

- The magnetic segment is anticipated to grow at the highest CAGR during the forecast period.

Based on the technology, the automotive steering sensors market is categorized into contacting and magnetic. Among these, the magnetic segment is anticipated to grow at the highest CAGR during the forecast period. Magnetic sensors possess various advantages, including monitoring mechanical characteristics such as rotation angle and angular speed without physically touching them. Magnetic sensor technology, such as giant magneto-resistance (GMR) thin film systems, provides several advantages, such as longer working distances, higher accuracy angular position measurement throughout a wider range, smaller and less expensive sensor chips, and cost-effective system solutions due to increased signal output.

Regional Segment Analysis of the Automotive Steering Sensors Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the automotive steering sensors market over the predicted timeframe.

Get more details on this report -

Asia Pacific is projected to hold the largest share of the automotive steering sensors market over the predicted timeframe. The automobile sector in the Asia-Pacific region has grown significantly in recent years, owing primarily to increased middle-class per capita earnings and cost advantages enjoyed by original equipment manufacturers (OEMs). Companies that distribute and market steering sensors predict significant development in additional potential areas. The primary factors impacting the growth of the Indian automotive steering sensors market are an increase in preference for motor vehicles across the country as consumer disposable income rises and an increase in desire for fuel-efficient automobiles. Other factors projected to impact the market during the forecast period substantially include an increase in customer demand for ease of driving and agility, the high cost of power steering systems, and drive-by-wire technology.

North America is expected to grow at the fastest CAGR growth in the automotive steering sensors market during the forecast period. The automotive steering sensor market is rapidly developing as a result of North America's strong economic expansion. North American businesses can benefit from lucrative growth prospects by focusing on increasing market share through alliances, mergers, and acquisitions. The vehicle steering sensor market in North America is being driven by increased consumer spending power. A growth in vehicle manufacturing across North America is also affecting the automobile steering sensor industry. Technological advances, investments from key players, rising passenger car demand, and continued fleet expansion are projected to drive the automotive steering sensor motor industry. In addition, numerous big OEMs are cooperating with technology companies to advance their products.

In Europe, future development is bound to be driven by rising demand for electric and driverless vehicles, as well as expanded regulatory regulations. Similarly, R&D investments in new technologies, in addition to reliance on features such as ESC, Advanced Driver Assistance Systems (ADAS), Lane Keep Assist (LKA), Autonomous Emergency Braking (AEB), and other safety features based on SAS accuracy and changing client demand, are expected to propel the market forward in the future.

In Middle East and Africa, Saudi Arabia dominates the market. Saudi Arabia's economy is expanding, due to high individual income levels and a strong banking and finance industry. As a result, sales of luxury things including autos and other luxury goods have risen. The country is also seeing rapid population growth, and younger customers are currently the most significant drivers of the luxury industry. Furthermore, foreign firms are entering Saudi Arabia, raising demand for advanced and novel electronic sensor technologies, such as steering sensors in the automotive industry, and favorably impacting market growth throughout the projection period.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the automotive steering sensors market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Robert Bosch GmbH

- DENSO Corporation

- HELLA GmbH & Co. KgaA

- Methode Electronics Inc.

- Continental AG

- Honeywell Inc.

- China Automotive Systems Inc.

- Mitsubishi Electric Corporation

- Hyundai Mobis Co. Ltd.

- Mando Corporation

- Federal-Mogul Corporation

- MTS Systems Corporation

- Sensor Developments Inc.

- TE Connectivity Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In January 2024, Lumotive, a leader in optical semiconductor technology, declared that it plans to work with three of the world's leading technology brands to demonstrate its award-winning digital beam steering capabilities at the upcoming Consumer Electronics Show (CES). Lumotive's revolutionary Light Control Metasurface (LCM) technology, can also earn a prestigious CES 2024 Innovation Award.

- In June 2023, Bosch planned to launch steer-by-wire systems by the middle of the decade. The technology and service supplier has signed on with the startup Arnold NextG. These two firms have formed a collaboration to combine their development capabilities and accelerate the process of preparing market solutions.

- In September 2023, UltraSense Systems announced UltraSense TouchPoint Q, the world's first piezoelectric strain sensor developed to improve the touch experience in car interfaces. TouchPoint Q has been adopted by automotive tier suppliers to improve the user experience of their solid-state capacitive touch systems for the center and overhead consoles, steering wheels, and floorboards.

- In October 2022, Hitachi Astemo, Ltd. designed a prototype for a novel steer-by-wire steering device that substitutes the traditional steering wheel and increases interior space. Steer-by-wire technology provides electric signals to connect the steering and turning sensors to steer the vehicle, offering greater safety and comfort in addition to interior design flexibility.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the automotive steering sensors market based on the below-mentioned segments:

Global Automotive Steering Sensors Market, By Sensor Type

- Health Monitoring Systems

- Torque Sensors

- Intelligent Multi-functional Sensor Systems

- Position Sensors/Angle Sensors

- Other Sensor Types

Global Automotive Steering Sensors Market, By Vehicle Type

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

Global Automotive Steering Sensors Market, By Technology

- Contacting

- Magnetic

Global Automotive Steering Sensors Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the global automotive steering sensors market?The global automotive steering sensors market is projected to expand at 5.41% during the forecast period.

-

2. Who are the top key players in the global automotive steering sensors market?The key players in the automotive steering sensors market are Robert Bosch GmbH, DENSO Corporation, HELLA GmbH & Co. KgaA, Methode Electronics Inc., Continental AG, Honeywell Inc., China Automotive Systems Inc., Mitsubishi Electric Corporation, Hyundai Mobis Co. Ltd., Mando Corporation, Federal-Mogul Corporation, MTS Systems Corporation, Sensor Developments Inc., TE Connectivity Ltd., and others.

-

3. Which region is expected to hold the largest share of the global automotive steering sensors market?The Asia Pacific region is expected to hold the largest share of the global automotive steering sensors market.

Need help to buy this report?