Global Automotive Suppliers Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Powertrain Components, Chassis Systems, Interior Components, Exterior Components, Electrical and Electronic Components, Safety Systems), By Vehicle Type (Passenger Vehicles, Commercial Vehicles, Others), By Sales Channel (OEM Market, Aftermarket, Retail), By Propulsion (IC Engine, Electric Vehicles, and Hybrid Vehicles), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Automotive & TransportationGlobal Automotive Suppliers Market Insights Forecasts to 2033

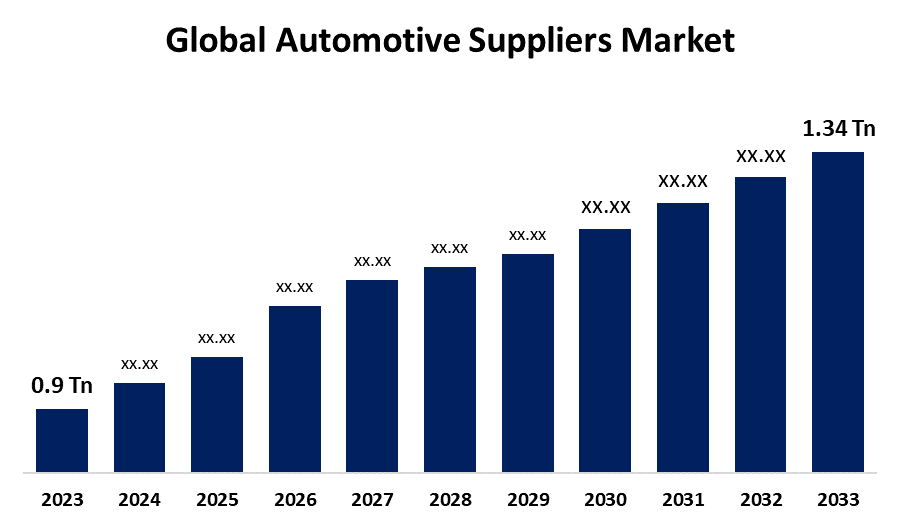

- The Global Automotive Suppliers Market Size was Valued at USD 0.9 Trillion in 2023

- The Market Size is Growing at a CAGR of 4.06% from 2023 to 2033

- The Worldwide Automotive Suppliers Market Size is Expected to Reach USD 1.34 Trillion by 2033

- North America is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Automotive Suppliers Market Size is Anticipated to Exceed USD 1.34 Trillion by 2033, Growing at a CAGR of 4.06% from 2023 to 2033.

Market Overview

An automotive supplier is a company or organization that offers parts, components, or services to vehicle manufacturers (OEMs) or other entities in the automotive sector. Automotive suppliers might range from those who make simple components like brake pads or engines to those who provide complex systems like infotainment or advanced driver assistance systems (ADAS). Automotive suppliers play an important part in the automotive supply chain, helping to produce and improve automobiles.

According to the Department of Scientific and Industrial Research (DSIR) in India around 400 major players in the auto component sector, most of them are distributed in the north, south, and, western parts of India around major Automotive Vehicle Manufacturers (AVMs). Tamil Nadu's current automotive annual output is projected to be $3-3.5 billion, with a 25% share of the Indian automotive industry and a 7–8% contribution to the state's GDP.

According to the Automotive Component Manufacturers Association of India (ACMA), the Indian auto component industry recorded its highest-ever turnover of Rs. 5.6 lakh crore (USD 69.7 billion) and grew by 32.8% in FY 2022-2023. The OEM sales grow 39.5% due to strong vehicle sales, exports remain steady, auto component aftermarket grows 15% to Rs. 85,333 crore (USD 10.6 billion), and EVs account for 2.7% of Auto Components industry turnover, up from 1% in FY22.

For Instance, In August 2024, Hanon Systems, a major global automotive thermal management supplier for electrified mobility, announced the creation of the world's first fourth-generation heat pump system, a critical thermal management component for electric cars (EVs).

Report Coverage

This research report categorizes the market for automotive suppliers based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the automotive suppliers market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the automotive suppliers market.

Automotive Suppliers Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 0.9 Trillion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 4.06% |

| 2033 Value Projection: | USD 1.34 Trillion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 230 |

| Tables, Charts & Figures: | 121 |

| Segments covered: | By Product Type, By Vehicle Type, By Sales Channel, By Propulsion, By Region and COVID-19 Impact Analysis. |

| Companies covered:: | Aisin Seiki Co., Ltd., Continental AG, Denso Corporation, Faurecia S.A., Hyundai Mobis Co., Ltd., Lear Corporation, Magna International Inc., Robert Bosch GmbH, Valeo S.A., ZF Friedrichshafen AG, and other key vendors. |

Get more details on this report -

Driving Factors

The automotive suppliers market is driven by a range of dynamic factors including technological advancements, such as the rise of electric and hybrid vehicles, autonomous driving systems, and increased connectivity, which drives demand for new components and systems. Regulatory pressures, including stricter emissions and safety standards, also play a significant role. Consumer preferences for sustainable and customizable vehicles, along with economic factors like fuel prices and growth in emerging markets, further influence the market. Innovation driven by R&D, market competition, geopolitical and trade factors, industry consolidation, infrastructure development, and evolving consumer behavior all contribute to the complex environment of automotive suppliers.

Restraining Factors

The automotive suppliers market faces several challenges that can impede growth and profitability including economic fluctuations and supply chain disruptions that might negatively affect demand and availability of components. Rapid technological advancements, such as the rise of electric vehicles and autonomous driving, require substantial investment and adaptation. Regulatory compliance with stringent safety and environmental standards requires continuous adaptation and investment.

Market Segmentation

The automotive suppliers market share is classified into product type, vehicle type, and sales channel.

- The electrical and electronic components segment is estimated to hold the highest market revenue share through the projected period.

Based on the product type, the automotive supplier market is classified into powertrain components, chassis systems, interior components, exterior components, electrical and electronic components, and safety systems. Among these, the electrical and electronic components segment is estimated to hold the highest market revenue share through the projected period. Electrical and electronic components segment dominance is driven by the increasing incorporation of advanced technologies in vehicles, such as electric powertrains, autonomous driving systems, and high-tech infotainment systems. The demand for these components is further fueled by consumer preferences for enhanced features and regulatory requirements for safety and emissions. Additionally, the growth of electric vehicles (EVs) and hybrid models, which rely heavily on sophisticated electronic systems, further propels this segment's leading position in the market.

- The passenger vehicles segment is anticipated to hold the largest market share through the forecast period.

Based on the vehicle type, the automotive supplier market is divided into passenger vehicles, commercial vehicles, and others. Among these, the passenger vehicles segment is anticipated to hold the largest market share through the forecast period. This segment dominates due to the high volume of passenger vehicles produced compared to commercial vehicles. Passenger vehicles include cars, SUVs, and light trucks. The growing demand for personal mobility, technological advancements, and increasing consumer preferences for features like infotainment systems, safety technologies, and fuel efficiency drive the demand for parts and components in the passenger vehicle segment.

- The OEM market segment dominates the market with the largest market share through the forecast period.

Based on the sales channel, the automotive supplier market is categorized into OEM market, aftermarket, and retail. Among these, the OEM market segment dominates the market with the largest market share through the forecast period. This segment involves supplying parts and components directly to vehicle manufacturers for use in the production of new vehicles. The OEM market often dominates due to the high volume of parts required for vehicle assembly and the long-term contracts and relationships established between suppliers and manufacturers. OEM parts are typically characterized by strict quality standards and specifications. The OEM market segment's dominance is driven by the ongoing production of new vehicles and the need for reliable, high-quality components.

Regional Segment Analysis of the Automotive Supplier Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the automotive suppliers market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the automotive supplier market over the predicted timeframe. This region's dominance is driven by several key factors, including its robust automotive manufacturing base, significant investments in automotive technology, and a rapidly growing consumer market. The presence of major automotive manufacturers and suppliers, combined with a strong emphasis on innovation and production efficiency, positions Asia Pacific as a critical hub for the automotive supply chain. Additionally, the region's economic growth and increasing vehicle production rates further bolster its leading position in the global market.

North America is expected to grow at the fastest CAGR growth of the automotive suppliers market during the forecast period. This growth is driven by several factors, including increasing investment in advanced automotive technologies, such as electric and autonomous vehicles. Additionally, North America benefits from a strong automotive manufacturing sector, with the significant presence of major automakers and a well-established supply chain network. The region's emphasis on innovation, along with supportive government policies and consumer demand for new vehicle technologies, contributes to its rapid expansion in the automotive suppliers market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the automotive suppliers market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Aisin Seiki Co., Ltd.

- Continental AG

- Denso Corporation

- Faurecia S.A.

- Hyundai Mobis Co., Ltd.

- Lear Corporation

- Magna International Inc.

- Robert Bosch GmbH

- Valeo S.A.

- ZF Friedrichshafen AG

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In July 2024, HARMAN, alongside CARIAD, the automotive software company of Volkswagen Group, announced new collaborations across key industries to enrich the in-cabin experience with newly available apps.

- In July 2024, NOVOSENSE Microelectronics, a global automotive chip vendor, announced the debut of its latest product line, which includes high-quality solutions for vehicle lighting, powertrain, BMS, and thermal management systems.

- In May 2024, Leapmotor announced a joint venture named Leapmotor International, with Stellantis holding a 51% stake. The venture aims to extend the sales of Leapmotor EVs beyond China and establish production facilities outside the country, leveraging Stellantis's manufacturing capabilities.

- In April 2024, ZF Friedrichshafen AG, one of the world's largest automotive suppliers, and Hon Hai Technology Group, the world's largest electronics manufacturer, successfully launched their joint venture in the field of passenger car chassis systems.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the automotive suppliers market based on the below-mentioned segments:

Global Automotive Suppliers Market, By Product Type

- Powertrain Component

- Chassis Systems

- Interior Components

- Exterior Components

- Electrical and Electronic Components

- Safety Systems

Global Automotive Suppliers Market, By Vehicle Type

- Passenger Vehicles

- Commercial Vehicles

- Others

Global Automotive Suppliers Market, By Sales Channel

- OEM Market

- Aftermarket

- Retail

Global Automotive Suppliers Market, By Propulsion

- IC Engine

- Electric Vehicles

- Hybrid Vehicles

Global Automotive Suppliers Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the automotive suppliers market over the forecast period?The automotive suppliers market is projected to expand at a CAGR of 4.06% during the forecast period.

-

2. What is the market size of the automotive suppliers market?The Global Automotive Suppliers Market Size is Expected to Grow from USD 0.9 Trillion in 2023 to USD 1.34 Trillion by 2033, at a CAGR of 4.06% during the forecast period 2023-2033.

-

3. Which region holds the largest share of the automotive suppliers market?Asia Pacific is anticipated to hold the largest share of the automotive suppliers market over the predicted timeframe.

Need help to buy this report?