Global Automotive Telematics Market Size, Share, and COVID-19 Impact Analysis, By Technology (Embedded, Tethered, And Integrated), By Solution (Component and Service), By Sales Channel (OEM and Commercial), By Application (Information & Navigation, Safety & Security, Fleet Management, Insurance Telematics, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Automotive & TransportationGlobal Automotive Telematics Market Insights Forecasts to 2033

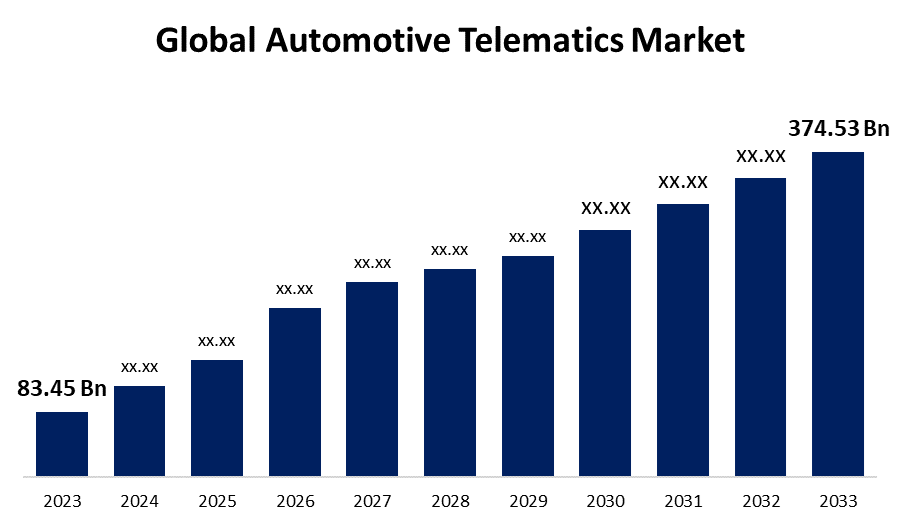

- The Global Automotive Telematics Market Size was Valued at USD 83.45 Billion in 2023

- The Market Size is Growing at a CAGR of 16.20% from 2023 to 2033

- The Worldwide Automotive Telematics Market Size is Expected to Reach USD 374.53 Billion by 2033

- North America is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Automotive Telematics Market Size is Anticipated to Exceed USD 374.53 Billion by 2033, Growing at a CAGR of 16.20% from 2023 to 2033.

Market Overview

Telematics is a concept that combines the words telecommunications and informatics to represent the use of communication and information technology to transport, save, and receive data from devices to remote objects over a network. Telematics originated with the confluence of telecommunications and information processing. Telematics is primarily utilized in the automotive industry, although other sectors have also found use for it. The procedure of communicating, receiving, and storing information utilizing telecommunication devices to control external subjects. Telematics is frequently utilized in commercial settings to refer to automotive telematics. Telematics is a term used in the automobile industry to define onboard communication services and applications. Cars, trucks, buses, and other vehicles have GPS receivers and telematics equipment accepted. Integrating telematics systems with sensors has created new potential in the automotive sector and beyond.

For example, telematics technology can help shipping companies monitor how much time vehicles spend inactive, while insurance firms for cars can offer lower premiums to customers who drive safely. Telematics can also benefit other businesses, such as automobile sharing. Companies such as Zipcar are implementing onboard, network-based services to provide usage-based pricing and self-service bookings.

The desire for high-performance, a fuel-efficient, technologically advanced vehicle is driving up the integration of automotive telematics systems. Furthermore, major participants in the automotive sector, such as Ford Motors Company, are making numerous efforts to enhance their present telematics solutions. They are building a telematics system that is compatible with a variety of car models, which will help to drive market expansion.

For example, in February 2022, SRM Tech and Zonar announced a strategic relationship to expand the telematics-enabled insights to more fleets. With this collaboration, firms are bound to add powered by artificial intelligence predictive analytics to light-duty fleet telematics, enabling actionable data analytics for increased vehicle maintenance.

Report Coverage

This research report categorizes the market for the automotive telematics market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the automotive telematics market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the automotive telematics market.

Global Automotive Telematics Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 83.45 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 16.20% |

| 2033 Value Projection: | USD 374.53 Billion |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 260 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Technology, By Solution, By Sales Channel, By Application, By Region |

| Companies covered:: | LG Electronics, Continental AG, AT&T Inc., Verizon, Masternaut Limited, Ford Motor Company, Toyota Motor Corporation, Mercedes-Benz AG, Volkswagen AG, General Motors Company, BMW Motors, Teletrac Navman, Airbiquity Inc., Robert Bosch and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, and Analysis |

Get more details on this report -

Driving Factors

Strict security requirements, greater public awareness of safety concerns, and the expanding affordability of telematics features all help to drive market expansion. The future of automobile telematics appears optimistic, especially with the rise of electric vehicles (EVs). Leading manufacturers are optimistic about the potential of EVs, and incorporating telematics technology into these vehicles is expected to be a significant driver of industry growth. Furthermore, telematics systems are being used by businesses to handle their vehicle fleets as they can help them optimize their routes, track the cars in real-time, and evaluate driver behavior, resulting in substantial savings in expenses and opening up new market opportunities.

Restraining Factors

Automotive telematics provides interesting abilities, but some drivers are afraid to use them because of data privacy and security issues. Telematics systems collect a lot of data, including where you operate, how you get around, and how frequently you use your automobile.

Market Segmentation

The automotive telematics market share is classified into technology, solution and sales channel, and application.

- The embedded segment is predicted to hold the largest market revenue share through the forecast period.

Based on the technology, the automotive telematics market is categorized into embedded, tethered, and integrated. Among these, the embedded segment is predicted to hold the largest market revenue share through the forecast period. Embedded telematics contains a built-in system for monitoring car performance and ensuring continuous connectivity. These systems integrate completely with the vehicle's existing electronics, delivering real-time data insights, navigation help, and remote-control functionality without the need for additional hardware or aftermarket maintenance.

- The component segment is anticipated to grow at the highest CAGR during the forecast period.

Based on the solution, the automotive telematics market is categorized into component and service. Among these, the component segment is anticipated to grow at the highest CAGR during the forecast period. Government efforts that increase safety on the roads and establish smart transportation networks by expanding automobile connectivity and enhancing existing driving monitoring technology are contributing to the components significant growth.

- The OEM segment is expected to hold a significant share of the automotive telematics market during the forecast period.

Based on the sales channel, the automotive telematics market is categorized into OEM and commercial. Among these, the OEM segment is expected to hold a significant share of the automotive telematics market during the forecast period. Automobile manufacturers are increasingly focusing on the integration of modern telematics systems in upcoming vehicles to align them with insurance premium businesses and increase driver and passenger safety, which is contributing to a large segment share.

- The fleet management segment is expected to hold the highest market share through the forecast period.

Based on the application, the automotive telematics market is categorized into information & navigation, safety & security, fleet management, insurance telematics, and others. Among these, the fleet management segment is expected to hold the highest market share through the forecast period. Fleet management systems offer affordable and efficient services that include GPS vehicle tracking, driving behavior analysis, fleet alarms, route planning and monitoring, and fuel management to consumers, automobile manufacturers, and insurance firms, so they are commonly utilized in the automobile market.

Regional Segment Analysis of the Automotive Telematics Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the automotive telematics market over the predicted timeframe.

Get more details on this report -

Asia Pacific is projected to hold the largest share of the automotive telematics market over the forecast period. According to the World Health Organization (WHO), Urbanization represents one of the most important global developments of the twenty-first century, with a considerable impact on health. More than 55% of the world's population lives in cities, and that figure is anticipated to rise to 68% by 2050. Rapid growth in urbanization and rising car sales are expected to propel the Asia-Pacific region ahead in the automotive telematics market. As urban populations and cities grow, there is a greater demand for appropriate transportation solutions to address traffic congestion, pollution, and mobility challenges. Furthermore, as additional automobiles reach the road, there is a higher demand for telematics solutions that promote vehicle safety, streamline fleet management, and boost behavior among drivers. The Asia Pacific area is witnessing a faster implementation of telematics systems due to government initiatives that promote digitalization and smart mobility. These elements work together to establish the area as a major auto telematics growth market, offering telematics companies and automakers an alluring opportunity to profit from the region's expanding need for cutting-edge transportation solutions.

North America is expected to grow at the fastest CAGR growth of the automotive telematics market during the forecast period. The increasing awareness of drivers and passengers about security and safety, as well as the growing emphasis on preventing accidents, are the primary drivers of global market growth and demand, along with the emerging trend of fuel-efficient vehicles, particularly in developed countries such as the United States and Canada. Furthermore, the rise in the frequency of add-on features such as Global Positioning System, as a standard option for addressing several problems such as an increase in the number of accidents and rising fuel prices across the entire region, will drive market expansion.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the automotive telematics market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- LG Electronics

- Continental AG

- AT&T Inc.

- Verizon

- Masternaut Limited

- Ford Motor Company

- Toyota Motor Corporation

- Mercedes-Benz AG

- Volkswagen AG

- General Motors Company

- BMW Motors

- Teletrac Navman

- Airbiquity Inc.

- Robert Bosch

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In July 2024, Najm for the Insurance Services Company, a Saudi producer of complete insurance solutions, unveiled a new telematics project to improve road safety in Saudi Arabia. This effort is being launched in collaboration with Cambridge Mobile Telematics (CMT), which is known for its AI-powered DriveWell Fusion platform, and AiGeNiX, a leader in AI-based analytics with a strong regional presence.

- In April 2024, ATrack Technology Inc., a telematics business that developed vehicle monitoring and management systems, unveiled new developments in AI vision telematics solutions at Embedded World 2024. The AK750 AI telematics box is the announcement's standout feature, as it integrates with both GEO (Geostationary Earth Orbit) and LEO (Low Earth Orbit) satellite networks to address connectivity issues in remote areas. These systems use cutting-edge technology to deliver accurate real-time monitoring and tracking.

- In February 2024, MWC HARMAN, the Samsung-owned linked vehicle software vendor, disclosed the release of a new telematics control unit (TCU) that uses Qualcomm-linked car technologies to "democratize the automotive connection market."

- In January 2024, Continental AG and Google Cloud collaborated at IAA Mobility to showcase a new age of customized travel at CES 2024. Google Cloud's generative AI voice assistant is integrated into Continental's Smart Cockpit High-Performance Computer (HPC), allowing for an effortless and natural connection between the user and the assistant. Conversational navigation, driver customization, and in-car control are among its capabilities, which allow users to ask specific vehicle-related queries, identify points of interest, and participate in exchanges of information for a more convenient travel experience.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the automotive telematics market based on the below-mentioned segments:

Global Automotive Telematics Market, By Technology

- Embedded

- Tethered

- Integrated

Global Automotive Telematics Market, By Solution

- Component

- Service

Global Automotive Telematics Market, By Sales Channel

- OEM

- Commercial

Global Automotive Telematics Market, By Application

- Information & Navigation

- Safety & Security

- Fleet Management

- Insurance Telematics

- Others

Global Automotive Telematics Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?