Global Automotive Test Equipment Market Size, Share, and COVID-19 Impact Analysis, By Location (Production Testing and Service Testing), By Propulsion (ICE and EV), By Vehicle Type (Passenger Cars and Commercial Vehicles), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Automotive & TransportationGlobal Automotive Test Equipment Market Insights Forecasts to 2033

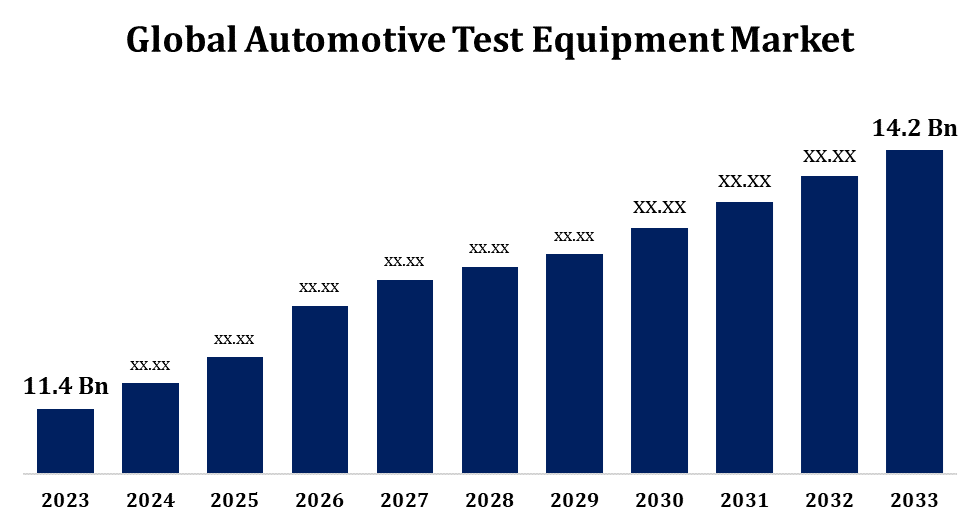

- The Global Automotive Test Equipment Market Size was valued at USD 11.4 Billion in 2023.

- The Market is Growing at a CAGR of 2.22% from 2023 to 2033.

- The Worldwide Automotive Test Equipment Market Size is Expected to reach USD 14.2 Billion by 2033.

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Automotive Test Equipment Market Size is Expected to reach USD 14.2 Billion by 2033, at a CAGR of 2.22% during the forecast period 2023 to 2033.

The automotive test equipment market is a vital segment of the automotive industry, driven by the increasing demand for vehicle safety, performance optimization, and adherence to stringent regulatory standards. This market encompasses tools and systems used to inspect, diagnose, and maintain vehicles, ensuring their efficiency and safety. Key products include emission testers, engine analyzers, dynamometers, and onboard diagnostic tools. The rise in electric and autonomous vehicles has further propelled advancements in test equipment to meet evolving technological requirements. Growing consumer awareness about vehicle health and government initiatives for reducing emissions also contribute to market growth. Major players are focusing on innovation and integration of IoT and AI for enhanced testing accuracy. The market is set for robust growth, underpinned by rapid automotive sector advancements worldwide.

Automotive Test Equipment Market Value Chain Analysis

The automotive test equipment market value chain consists of several interconnected stages, starting with raw material suppliers who provide essential components like sensors, semiconductors, and hardware for test systems. Manufacturers of test equipment design and produce devices such as dynamometers, emission analyzers, and diagnostic tools, integrating software and hardware for advanced functionalities. Distributors and suppliers play a key role in delivering these products to automotive OEMs, service centers, and aftermarket vendors. Automotive manufacturers and repair service providers use these tools to ensure vehicle compliance with safety and environmental standards. Technological advancements like IoT and AI are enhancing the efficiency and accuracy of testing systems. Feedback loops from end-users drive innovation, making the value chain dynamic and focused on quality, performance, and sustainability.

Automotive Test Equipment Market Opportunity Analysis

The automotive test equipment market presents significant opportunities driven by evolving automotive technologies and regulatory pressures. The rapid adoption of electric vehicles (EVs) and autonomous vehicles has created a demand for specialized testing tools to ensure safety, performance, and compliance with global standards. Growth in vehicle production, particularly in emerging markets, fuels the need for efficient diagnostic and maintenance solutions. Innovations in IoT, AI, and connectivity offer prospects for developing smart, automated testing equipment, enhancing accuracy and operational efficiency. Additionally, stringent emission norms worldwide are boosting demand for advanced emission testing systems. The increasing focus on preventive maintenance and the rise of connected vehicles provide opportunities for aftermarket solutions. Companies investing in R&D and offering integrated, sustainable testing systems can gain a competitive edge in this expanding market.

Global Automotive Test Equipment Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 11.4 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 2.22% |

| 2033 Value Projection: | USD 14.2 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 235 |

| Tables, Charts & Figures: | 119 |

| Segments covered: | By Location, By Propulsion, By Vehicle Type, By Region and COVID-19 Impact Analysis. |

| Companies covered:: | Robert Bosch GmbH (Germany), Honeywell International Inc. (US), ABB Ltd (Switzerland), Delphi Automotive PLC (UK), Actia S.A. (France), Advantest Corp (Japan), Horiba Ltd. (Japan), Softing AG (Germany), Teradyne Inc. (US), Siemens (Germany), and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Automotive Test Equipment Market Dynamics

The growing adoption of electric vehicles (EVs) and autonomous vehicles (AVs) is anticipated to drive increased demand in the market

The increasing adoption of electric vehicles (EVs) and autonomous vehicles (AVs) is significantly boosting demand in the automotive test equipment market. EVs require specialized testing solutions for batteries, electric motors, and powertrains to ensure efficiency and safety, while AVs demand advanced systems to test sensors, software, and connectivity components integral to autonomous operation. The transition toward these technologies is driven by stricter environmental regulations and a global push for sustainable mobility, creating opportunities for innovative test equipment tailored to evolving automotive designs. As vehicle complexity rises, the need for precise, automated, and efficient testing tools becomes critical. Market players focusing on cutting-edge technologies like AI, IoT, and simulation systems are well-positioned to cater to this expanding demand, driving long-term market growth.

Restraints & Challenges

The automotive test equipment market faces several challenges despite its growth potential. High costs associated with advanced testing systems and frequent updates to keep pace with evolving vehicle technologies pose significant barriers for manufacturers and end-users. The rapid shift toward electric and autonomous vehicles demands specialized, complex testing tools, increasing development and implementation costs. Adhering to stringent global regulations and maintaining compatibility with diverse vehicle platforms add to the complexity. Limited awareness and adoption of advanced test equipment in emerging markets further constrain growth. Additionally, the integration of technologies like IoT and AI requires substantial R&D investment and expertise. Market players also face stiff competition, requiring constant innovation to stay relevant. Addressing these challenges is essential for sustained growth and technological advancements in the sector.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Automotive Test Equipment Market from 2023 to 2033. The presence of major automakers and technology companies fuels demand for sophisticated testing solutions to support the development of electric and autonomous vehicles. Stringent government regulations on emissions and vehicle safety further necessitate the use of advanced diagnostic and testing equipment. Growing consumer awareness of vehicle performance and maintenance, coupled with the rising popularity of connected cars, is also boosting demand. Key players in the region focus on innovation, integrating AI, IoT, and real-time analytics to enhance testing accuracy. The North American market benefits from robust R&D infrastructure, making it a critical hub for automotive testing advancements.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. China, India, Japan, and South Korea are key contributors, with rising demand for electric vehicles (EVs) and advanced driver-assistance systems (ADAS). The push for stricter emission regulations and enhanced safety standards has increased the adoption of advanced testing tools. Emerging markets in the region benefit from growing investments in automotive manufacturing and aftersales services. Additionally, the increasing focus on EV infrastructure development creates opportunities for specialized battery and powertrain testing equipment. Overall, Asia-Pacific remains a dynamic and lucrative region for growth in the automotive test equipment market.

Segmentation Analysis

Insights by Location

The production testing segment accounted for the largest market share over the forecast period 2023 to 2033. The production testing segment in the automotive test equipment market is poised for significant growth, driven by rising global vehicle production and the increasing complexity of modern vehicles. As automakers integrate advanced technologies like electric powertrains, autonomous systems, and connected features, the demand for precise and efficient production testing tools has surged. These systems ensure components and vehicles meet quality, safety, and performance standards before reaching the market. Automated and high-speed testing solutions are particularly in demand to enhance production efficiency and reduce downtime. Additionally, the shift towards electric vehicles (EVs) has created a need for specialized testing equipment for batteries, inverters, and electric motors. Investments in smart factories and Industry 4.0 are further boosting the adoption of advanced production testing equipment worldwide.

Insights by Propulsion

The ICE segment accounted for the largest market share over the forecast period 2023 to 2033. The internal combustion engine (ICE) segment continues to hold a significant share in the automotive test equipment market, driven by the steady production of ICE vehicles, particularly in emerging markets. Despite the global shift toward electric vehicles (EVs), ICE vehicles remain dominant in many regions due to their affordability, established infrastructure, and evolving fuel-efficient technologies. Demand for advanced emission testing systems is growing as governments enforce stricter environmental regulations. Additionally, improvements in engine performance, fuel economy, and hybrid powertrain integration require precise testing equipment. The aftermarket for ICE vehicle diagnostics also supports growth, driven by increasing vehicle longevity and consumer awareness of maintenance. While the transition to EVs accelerates, the ICE segment remains a critical area of focus for test equipment manufacturers adapting to evolving market demands.

Insights by Vehicle

The passenger cars segment accounted for the largest market share over the forecast period 2023 to 2033. The passenger cars segment in the automotive test equipment market is experiencing robust growth, driven by increasing vehicle production and the demand for advanced vehicle technologies. As consumers seek safer, more efficient, and connected cars, the need for specialized testing equipment to ensure compliance with stringent safety and emission standards has risen. This includes tools for testing powertrains, ADAS, and infotainment systems, which are crucial for validating vehicle performance and safety. The transition towards electric vehicles (EVs) further fuels the demand for testing systems for battery management, electric motors, and power electronics. Moreover, regulatory pressures on emissions and safety, along with the growing aftermarket for diagnostics and maintenance, contribute to the segment’s expansion. This dynamic environment makes passenger cars a key growth driver in the automotive test equipment market.

Recent Market Developments

- In July 2023, Suzhou Chunfen Test Technology Services Co., Ltd (CFI), a prominent automotive testing service provider based in China, was acquired by Applus Reliable Analysis Inc.

Competitive Landscape

Major players in the market

- Robert Bosch GmbH (Germany)

- Honeywell International Inc. (US)

- ABB Ltd (Switzerland)

- Delphi Automotive PLC (UK)

- Actia S.A. (France)

- Advantest Corp (Japan)

- Horiba Ltd. (Japan)

- Softing AG (Germany)

- Teradyne Inc. (US)

- Siemens (Germany)

- Others

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Automotive Test Equipment Market, Location Analysis

- Production Testing

- Service Testing

Automotive Test Equipment Market, Propulsion Analysis

- ICE

- EV

Automotive Test Equipment Market, Vehicle Analysis

- Passenger Car

- Commercial Vehicles

Automotive Test Equipment Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Automotive Test Equipment Market?The global Automotive Test Equipment Market is expected to grow from USD 11.4 billion in 2023 to USD 14.2 billion by 2033, at a CAGR of 2.22% during the forecast period 2023-2033.

-

2. Who are the key market players of the Automotive Test Equipment Market?Some of the key market players of the market are Robert Bosch GmbH (Germany), Honeywell International Inc. (US), ABB Ltd (Switzerland), Delphi Automotive PLC (UK), Actia S.A. (France), Advantest Corp (Japan), Horiba Ltd. (Japan), Softing AG (Germany), Teradyne Inc. (US), and Siemens (Germany) and other key vendors.

-

3. Which segment holds the largest market share?The ICE segment holds the largest market share and is going to continue its dominance.

-

4. Which region dominates the Automotive Test Equipment Market?North America dominates the Automotive Test Equipment Market and has the highest market share.

Need help to buy this report?