Global Automotive TIC Market Size, Share, and COVID-19 Impact Analysis, By Service Type (Testing, Inspection, and Certification), By Sourcing Type (In-House, and Outsourced), By Vehicle Type (Passenger Cars, and Commercial Vehicle), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Automotive & TransportationGlobal Automotive TIC Market Insights Forecasts to 2033

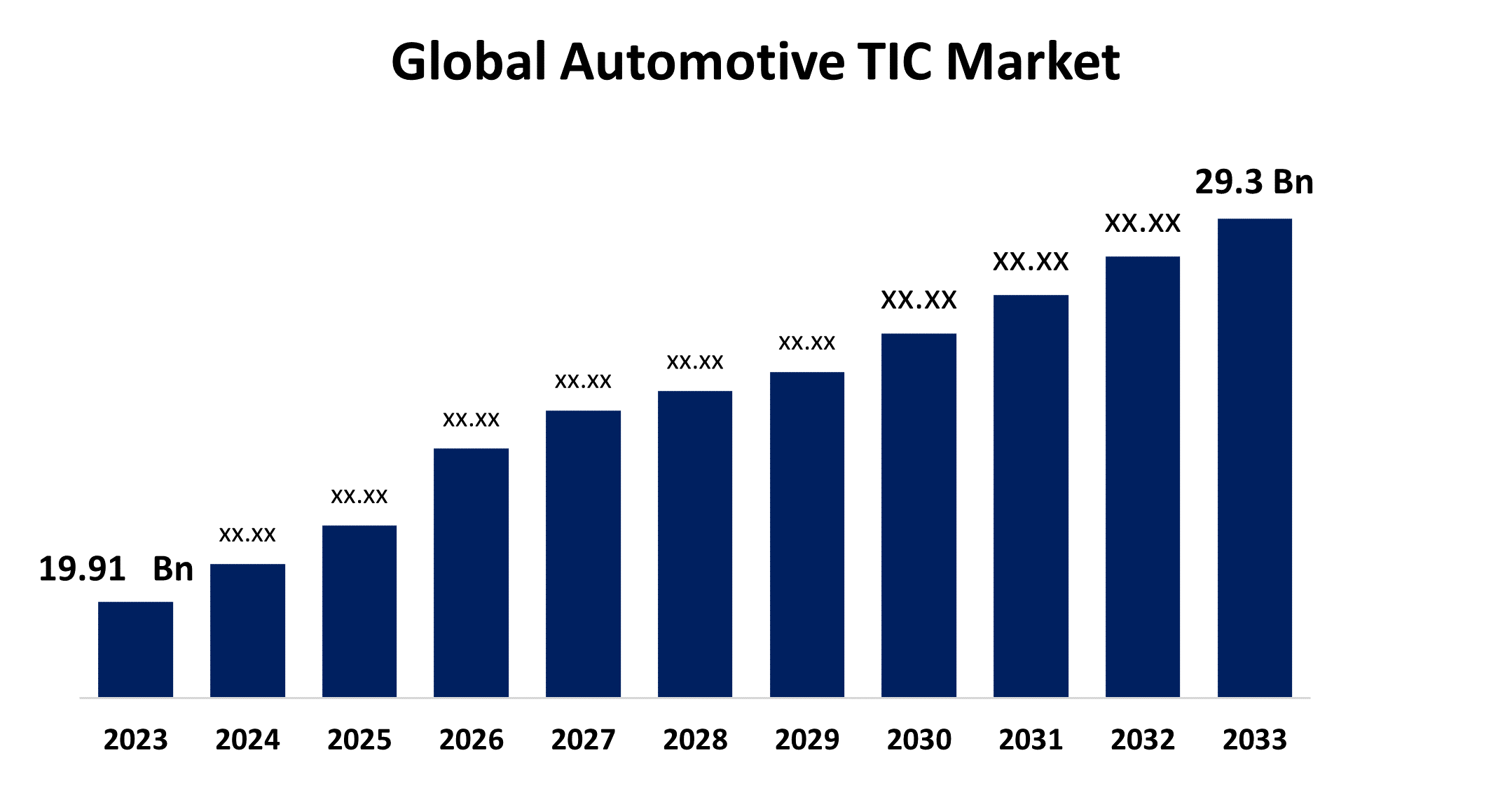

- The Global Automotive TIC Market Size was Valued at USD 19.91 Billion in 2023

- The Market Size is Growing at a CAGR of 3.94% from 2023 to 2033

- The Worldwide Automotive TIC Market Size is Expected to Reach USD 29.3 Billion by 2033

- North America is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Automotive TIC Market Size is Anticipated to Exceed USD 29.3 Billion by 2033, Growing at a CAGR of 3.94% from 2023 to 2033.

Market Overview

Automotive Testing, Inspection, and Certification (TIC) is the inclusive procedure of evaluating, reviewing, and certifying that automotive products and machinery justify regulatory standards, safety measures, and quality standards. Furthermore, this systematic procedure contains difficult testing, comprehensive inspection, and certification procedures to ensure that cars and their connected parts meet industry requirements and customer expectations. Moreover, to support manufacturers to produce cars that gratify the highest standards and surge customer trust and company reputation, automotive TIC is also a critical component of quality control. In most areas, it is necessary to get TIC certification to export automotive products or components. The global automotive TIC market is expected to rise in the coming years due to increasing digitalization in the automotive industry. Along with this, the swelling automobile production and implementation in advanced and emerging countries, the mounting need for outsourcing TIC services, and several policies of governments to apply safety and environmental standards to the automotive industry will drive market growth in the future. In addition, the rise in the automobile electronics market to maintain passenger and vehicle safety and increasing awareness among consumers regarding product quality and safety are also driving the market growth. Moreover, the increased usage of electric vehicles and hybrid electric vehicles along with authorization of periodic technical inspection (PTI) of vehicles by governments will boost the growth of the automotive TIC market.

Report Coverage

This research report categorizes the market for the global automotive TIC market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global automotive TIC market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global automotive TIC market.

Global Automotive TIC Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 19.91 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 3.94% |

| 2033 Value Projection: | USD 29.3 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 180 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Service Type, By Sourcing Type, By Vehicle Type, By Region |

| Companies covered:: | Dekara SE, Intertek Group, TUV Rheinland Group, Applus Group, TUV SUD Group, TUV Nord, Eurofins Group, SGS Group, Bureau Group, Mistras Group, Element Material Technology Ltd, British Standards Institution, DNV GL, Norges Elekriske Materiellkontroll, and Others Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The demand for specific automotive TIC facilities is being obsessed with the increase of electric vehicles (EVs) and autonomous vehicles (AVs). To assurance performance, safety, and adherence to varying rules, these cultured systems must endure strict testing and certification. Businesses that offer facilities like functional safety testing for advanced driver-assistance systems (ADAS), cybersecurity valuations for autonomous vehicles (AVs), and battery safety testing might benefit from this trend. Furthermore, companies are gradually applying software programs, cloud-based infrastructures, and data analytics instruments to improve testing and inspection events, augment productivity, and save expenses. This method also includes using automation to advance evaluation speed and accuracy in areas like virtual imitations and robotic testing. Moreover, with the growth in connected vehicle technologies, there is mounting focus on cybersecurity, interoperability testing, and over-the-air (OTA) updates, among others. TIC providers are integrating inclusive testing and certification to recognize exposures and alleviate risks. TIC providers also test interoperability to ensure seamless communication and compatibility between different devices, platforms, and networks. In addition, prompt growth of the automobile sector, mainly in China and India, generates massive demand for TIC services. The complex worldwide trade and supply chains, as a result, highlight the need for TIC services, which certified quality control as a significant stimulus on the automotive TIC market.

Restraining Factors

The high installation and maintenance price of automotive TIC services performs as a barrier for budget-constrained minor producers. Also, the demand for extremely adjustable TIC services to screen evolving technologies such as electric vehicles is expected to hinder the growth of the automotive TIC market. Correspondingly, inadequate access to critical testing and certification is probable to limit innovation and overall market growth. Furthermore, the huge volume of data formed throughout the testing and inspection operation needs operative integration and management. Thus, rationalization data processes are critical for swelling efficiency, detecting patterns, and creating sound decisions posturing a big hindrance in the automotive TIC market.

Market Segmentation

The global automotive TIC market share is classified into service type, sourcing type, and vehicle type.

- The testing segment is expected to hold the largest share of the global automotive TIC market during the forecast period.

Based on the service type, the global automotive TIC market is divided into testing, inspection, and certification. Among these, the testing segment is expected to hold the largest share of the global automotive TIC market during the forecast period. This can be attributed to the growing need to certify the quality, safety, and performance of vehicles and automotive components and the mounting focus on innovation in the automotive industry. Furthermore, numerous companies operating in this market are progressively investing in research and development to develop their offering and offer progressive testing environments, conducive to the growth of this segment.

- The in-house segment is expected to hold the largest share of the global automotive TIC market during the forecast period.

Based on the sourcing type, the global automotive TIC market is divided into in-house and outsourced. Among these, the in-house segment is expected to hold the largest share of the global automotive TIC market during the forecast period. This can be attributed to the high prominence and degree of control over procedures and enhanced delivery performance provided by in-house TIC. Furthermore, the cost efficiency offered by these systems to large producers, and the tactical importance of key procedures like prototype testing, and homologation. Moreover, for high-volume inventions and renowned businesses, the primary expenditure in emerging internal TIC infrastructure can be enclosed by long-term cost savings over outsourcing.

- The passenger cars segment is expected to hold the largest share of the global automotive TIC market during the forecast period.

Based on the vehicle type, the global automotive TIC market is divided into passenger cars and commercial vehicles. Among these, the passenger cars segment is expected to hold the largest share of the global automotive TIC market during the forecast period. Growing disposable income is increasing the purchase of sophisticated passenger cars, thus driving the need for comprehensive TIC services. However, the high difficulty near the use of progressive and shrunken systems in these advanced vehicles is unlocking new doors of opportunities for automated TIC solutions. In addition to this, the high return margin and excellent after-sale services offered by the passenger car are anticipated to skyrocket its sales over the forecast period.

Regional Segment Analysis of the Global Automotive TIC Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

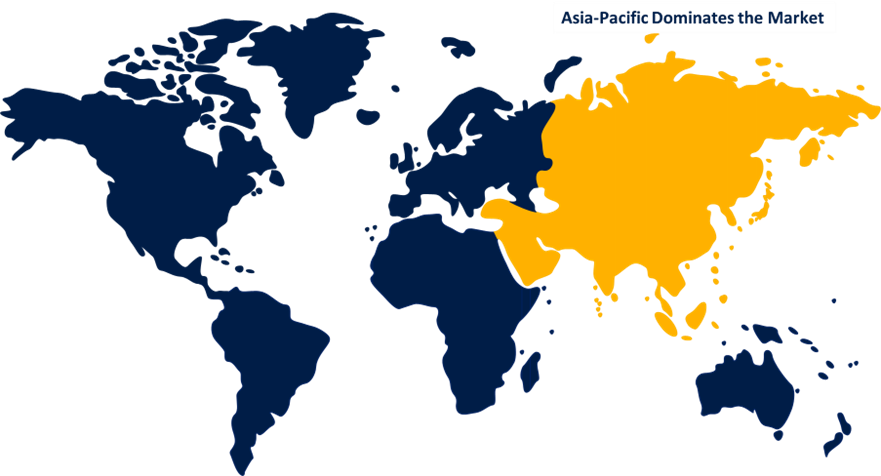

Asia Pacific is anticipated to hold the largest share of the global automotive TIC market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the global automotive TIC market over the predicted timeframe. The growing demography of countries, such as China and India, which accounts for more than 38% of the world population is a crucial element driving the region’s growth. This development is due to augmented urbanization and superior disposable income, which give rise to changing customer preferences. The automotive sector is growing in South Korea, India, and China, owing to enlarged car production. Furthermore, the automotive TIC market growth in the region is fueled by a strong automotive sector and an increasing number of car producers. As a result, Asia Pacific is anticipated to lead the market during the forecast period.

North America is expected to grow at the fastest pace in the global automotive TIC market during the forecast period. This can be attributed to the high growth of the automotive TIC market in North America is determined by the easy accessibility of automotive TIC services, the occurrence of major automotive producers, and easy access to progressive services. Similarly, constantly increasing vehicle production and increasing research and development expenditures in the automotive industry to expand labs and manufacturing facilities contribute to the high growth of this regional market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global automotive TIC market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Dekara SE

- Intertek Group

- TUV Rheinland Group

- Applus Group

- TUV SUD Group

- TUV Nord

- Eurofins Group

- SGS Group

- Bureau Group

- Mistras Group

- Element Material Technology Ltd

- British Standards Institution

- DNV GL

- Norges Elekriske Materiellkontroll

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In May 2024, DEKRA built the first Wi-Fi Allianc Authorized Test Laboratory (ATL) in Stuttgart, Germany, focusing on the automobile industry. The strategic location near automotive manufacturers and suppliers enables customers to have authorized Wi-Fi CERTIFIED testing performed for their products, ensuring high-quality, interoperability, security, and industry-agreed standards compliance.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global automotive TIC market based on the below-mentioned segments:

Global Automotive TIC Market, By Service Type

- Testing

- Inspection

- Certification

Global Automotive TIC Market, By Sourcing Type

- In-House

- Outsourced

Global Automotive TIC Market, By Vehicle Type

- Passenger Cars

- Commercial Vehicle

Global Automotive TIC Market, Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1.Which are the key companies that are currently operating within the market?Dekara SE, Intertek Group, TUV Rheinland Group, Applus Group, TUV SUD Group, TUV Nord, Eurofins Group, SGS Group, Bureau Group, Mistras Group, Element Material Technology Ltd, British Standards Institution, DNV GL, Norges Elekriske Materiellkontroll, and Others.

-

2.What is the size of the global automotive TIC market?The Global Automotive TIC Market is expected to grow from USD 19.91 Billion in 2023 to USD 29.3 Billion by 2033, at a CAGR of 3.94% during the forecast period 2023-2033.

-

3.Which region is holding the largest share of the market?Asia Pacific is anticipated to hold the largest share of the global automotive TIC market over the predicted timeframe.

Need help to buy this report?