Global Automotive Tire Pressure Monitoring System Market Size, Share, and COVID-19 Impact Analysis, By Vehicle Type (Passenger vehicles and Commercial Vehicles), By Type (Direct TPMS and Indirect TPMS), By Sales Channel (OEM and Aftermarket), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Automotive & TransportationGlobal Automotive Tire Pressure Monitoring System Market Insights Forecasts to 2033

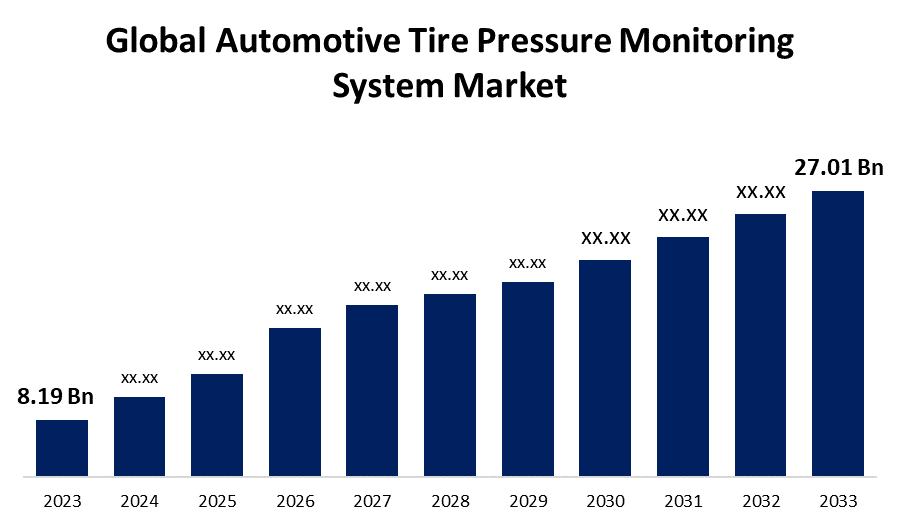

- The Global Automotive Tire Pressure Monitoring System Market Size was Valued at USD 8.19 Billion in 2023

- The Market Size is Growing at a CAGR of 12.67% from 2023 to 2033

- The Worldwide Automotive Tire Pressure Monitoring System Market Size is Expected to Reach USD 27.01 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Automotive Tire Pressure Monitoring System Market Size is Anticipated to Exceed USD 27.01 Billion by 2033, Growing at a CAGR of 12.67% from 2023 to 2033.

Market Overview

The automotive tire pressure monitoring system, uses tire pressure, sensors to keep track of the tire's air pressure. When this system detects that one or more tires aren't at the recommended pressure, it turns on the light or flashes the tire pressure monitoring system lights. A tire pressure monitoring system (TPMS) is an automotive safety device that continuously checks tire pressure. A tire pressure monitoring system informs the driver with a warning light or audible signal when tire pressure decreases below specified levels, helping to reduce accidents, increase fuel economy, and prolong the lifespan of tires. A TPMS sensor is an electronic component that monitors the air pressure and temperature in automotive tires, alerting drivers of underinflated tires or other safety issues at the moment. The majority of typical TPMS sensors use confidential or non-standard sub-GHz radios to transfer information to the vehicle's computer; however, by changing these radios with BLE connectivity, TPMS can now benefit from a global standard and the interoperability it brings, along with longer battery life and connectivity to smartphones. The TPMS industry has grown significantly in recent years due to a variety of causes. Especially in industrialized countries, government rules mandating the installation of TPMS in automobiles have been an important driver of business growth. Furthermore, government officials working on vehicle development and improving driving conditions for drivers and passengers are passing severe regulations requiring vehicle manufacturers to increase safety elements in their vehicles. Concerns about proper tire pressure and its impact on vehicle safety, carbon emissions, and fuel efficiency are not exclusive to any place; thus, different regions require varying improvements in the adoption of tire pressure monitoring systems.

Benefits of using a tire pressure monitoring system

- Reduces tire wear from inappropriate pressure levels.

- Minimizes the danger of tire failure by prior notification.

- A vehicle-integrated safety system that checks tire pressure in real-time.

- Improves tire wear from inappropriate pressure levels.

The significant automotive tire pressure monitoring system market share of the companies included in this report is Delphi Automotive, DENSO Corporation, Continental AG, NXP Semiconductors, NIRA Dynamics AB, Valor TPMS, Pacific Industrial, ZF Friedrichshafen AG, ATEQ, Sensata Technologies, Inc., Infineon Technologies AG, Knorr-Bremse AG, Bendix Commercial Vehicles Systems LLC, DUNLOP TECH GmbH, and others.

Report Coverage

This research report categorizes the market for the automotive tire pressure monitoring system market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the automotive tire pressure monitoring system market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the automotive tire pressure monitoring system market.

Global Automotive Tire Pressure Monitoring System Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 8.19 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 12.67% |

| 2033 Value Projection: | USD 27.01 Billion |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 288 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Vehicle Type, By Type, By Sales, By Region |

| Companies covered:: | Delphi Automotive, DENSO Corporation, Continental AG, NXP Semiconductors, NIRA Dynamics AB, Valor TPMS, Pacific Industrial, ZF Friedrichshafen AG, ATEQ, Sensata Technologie, Inc., Infineon Technologies AG, Knorr-Bremse AG, Bendix Commercial Vehicles Systems LLC, DUNLOP TECH GmbH, Others, and |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, and Analysis |

Get more details on this report -

Driving Factors

Enhancing fuel efficiency is a major driving force behind the development of vehicle tire pressure monitoring systems. TPMS closely monitors tire pressure and helps to maximize fuel efficiency by ensuring that tires are properly inflated. Insufficient tire pressure increases the resistance to rolling and requires more energy to push the vehicle, resulting in higher fuel consumption. Government officials working on vehicle development and improving driving conditions for drivers and passengers are passing severe regulations requiring vehicle manufacturers to increase safety elements in their vehicles. Concerns about proper tire pressure and its impact on vehicle safety, carbon emissions, and fuel efficiency are not exclusive to any place thus; different regions require varying advances in the acceptance of tire pressure monitoring systems.

Restraining Factors

Sensors used in TPMS are expensive, and their replacement costs are considerable, which may limit market expansion. When the sensor's battery on one tire dies, the three sensors on the other tires fail in addition hence, users would need to replace all four sensors, which might be inconvenient and limit market expansion.

Market Segmentation

The automotive tire pressure monitoring system market share is classified into vehicle type, type, and sales channel.

- The passenger vehicles segment holds the largest market share through the forecast period.

Based on the vehicle type, the automotive tire pressure monitoring system market is categorized into passenger vehicles and commercial vehicles. Among these, the passenger vehicles segment holds the largest market share through the forecast period. Automotive tire pressure monitoring system is frequently utilized in passenger vehicles, where tire pressure is an important safety component. Furthermore, increased demand for passenger vehicles in the automotive sector, along with cheap safety features such as tire pressure monitors, contribute to market growth.

- The direct TPMS segment holds the highest market share through the forecast period.

Based on the type, the automotive tire pressure monitoring system market is categorized into direct TPMS and indirect TPMS. Among these, the direct TPMS segment holds the highest market share through the forecast period. This is facilitated by characteristics such as providing exact pressure for each tire, no compromise of tire pressure information, sensor batteries that often last the life of the vehicle, and the capacity to monitor spare tires. The direct system includes a sensor inside every wheel that gives precise warnings and warns the driver quickly when the pressure in any tire drops below the set value due to rapid air loss caused by a puncture or other factors, while also detecting gradual air loss over time.

- The OEM segment is anticipated to grow at the highest CAGR during the forecast period.

Based on the sales channel, the automotive tire pressure monitoring system market is categorized into OEM and aftermarket. Among these, the OEM segment is anticipated to grow at the highest CAGR during the forecast period. Whenever acquiring a new vehicle, car consumers are increasingly searching for modern safety systems such as TPMS. OEMs are capitalizing on this trend by including TPMS in standard and optional safety packages. Furthermore, technological improvements in TPMS, such as the creation of intelligent and linked systems that give real-time tire pressure data and alarms, are propelling OEM adoption.

Regional Segment Analysis of the automotive tire pressure monitoring system market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the automotive tire pressure monitoring system market over the predicted timeframe.

Get more details on this report -

North America is projected to hold the largest share of the automotive tire pressure monitoring system market over the forecast period. The North American market for tire pressure monitoring systems is mainly governed by strict government regulations and safety requirements. Furthermore, customers' growing awareness of vehicle safety and the benefits of maintaining proper tire pressure, such as greater fuel efficiency and longer tire existence, has fueled demand for TPMS. Some major vehicle manufacturers and a significant aftermarket sector in North America further help to drive the TPMS market in this area. Furthermore, North America dominates the automotive TPMS market, owing to strong safety rules that require automotive tire pressure monitoring system market installation in automobiles.

Asia Pacific is expected to grow at the fastest CAGR growth in the automotive tire pressure monitoring system market during the forecast period. Asia Pacific is the dominant region in the tire pressure monitoring system (TPMS) industry, with China and India expected to be the regional market leaders. Rising premium automobile market penetration, rapid automotive sector expansion, severe safety standards, and more safety installations per vehicle all contribute to the growing demand for automotive tire pressure monitoring systems market and other safety systems. Furthermore, technological developments in the region have reduced the cost of integration, making it more accessible to the growing middle class. Furthermore, the region's premium and mid-segment car sales are increasing, hastening the adoption of TPMS technology.

Europe's tire pressure monitoring systems market is driven by stringent regulations and a strong emphasis on vehicle safety and environmental requirements. The European Union's ECE-R64 rule requires all new passenger cars to have TPMS, resulting in the widespread use of TPMS throughout the area. Furthermore, European consumers are becoming more aware of the environmental impact of their vehicles, and adequate tire pressure is regarded as a critical aspect in lowering CO2 emissions and boosting fuel efficiency. The existence of automobile OEMs and a well-established automotive industry infrastructure help to drive the growth of the TPMS market in Europe.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the automotive tire pressure monitoring system market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Delphi Automotive

- DENSO Corporation

- Continental AG

- NXP Semiconductors

- NIRA Dynamics AB

- Valor TPMS

- Pacific Industrial

- ZF Friedrichshafen AG

- ATEQ

- Sensata Technologie, Inc.

- Infineon Technologies AG

- Knorr-Bremse AG

- Bendix Commercial Vehicles Systems LLC

- DUNLOP TECH GmbH

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In June 2024, Bridgestone, an international innovator in premium tires and sustainable mobility solutions, disclosed the release of its EV-ready Turanza All Season 6 ENLITEN tire featuring DriveGuard Run-Flat Technology (RFT). The most recent addition to Bridgestone's portfolio is a hassle-free tire solution that allows drivers to keep in charge of their cars and travel safely for up to 80km/h following a puncture.

- In June 2024, Continental doubled the amount of Tyre Pressure Monitoring Systems (TPMS) it can produce in India's Bangalore factory, doubling capacity to 3.3 million wheel units per year. With this venture, Continental becomes India's first Tier 1 TPMS manufacturer, with a focus on the domestic vehicle market.

- In January 2024, Magna Tyres revealed the debut of Magna TPMS, which it describes as a unique tire pressure monitoring system capable of extracting the most out of your fleet, regardless of size. Magna TPMS gives the fleet manager complete control at all times. Receive notifications by smartphone or smartwatch, and use the specialized portal to change parameters and produce automatic reports.

- In September 2023, Infineon Technologies AG combined its renowned automotive information with its proprietary glass-silicon-glass MEMS sensor for the automotive tire pressure monitoring system (TPMS) sector to introduce the XENSIV SP49 tire pressure monitoring sensor.

- In July 2022, Sensata Technologies unveiled a new Bluetooth Low Energy (BLE) Tire Pressure Monitoring System (TPMS) for automobile OEMs.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the automotive tire pressure monitoring system market based on the below-mentioned segments:

Global Automotive Tire Pressure Monitoring System Market, By Vehicle Type

- Passenger Vehicles

- Commercial Vehicles

Global Automotive Tire Pressure Monitoring System Market, By Type

- Direct TPMS

- Indirect TPMS

Global Automotive Tire Pressure Monitoring System Market, By Sales Channel

- OEM

- Aftermarket

Global Automotive Tire Pressure Monitoring System Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1.What is the CAGR of the global automotive tire pressure monitoring system market over the forecast period?The global automotive tire pressure monitoring system market is to expand at 12.67% during the forecast period.

-

2.Which region is expected to hold the highest share in the global automotive tire pressure monitoring system market?The North America region is expected to hold the largest share of the global automotive tire pressure monitoring system market.

-

3.Who are the top key players in the Automotive Tire Pressure Monitoring System Market?The key players in the global automotive tire pressure monitoring system market are Delphi Automotive, DENSO Corporation, Continental AG, NXP Semiconductors, NIRA Dynamics AB, Valor TPMS, Pacific Industrial, ZF Friedrichshafen AG, ATEQ, Sensata Technologies, Inc., Infineon Technologies AG, Knorr-Bremse AG, Bendix Commercial Vehicles Systems LLC, DUNLOP TECH GmbH, and others.

Need help to buy this report?