Global Automotive Tubeless Tire Market Size, Share, and COVID-19 Impact Analysis, By Type (Radial, and Bias), By Application (Two- Wheeler, Passenger Car, and Commercial Vehicle), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Automotive & TransportationGlobal Automotive Tubeless Tire Market Insights Forecasts to 2033

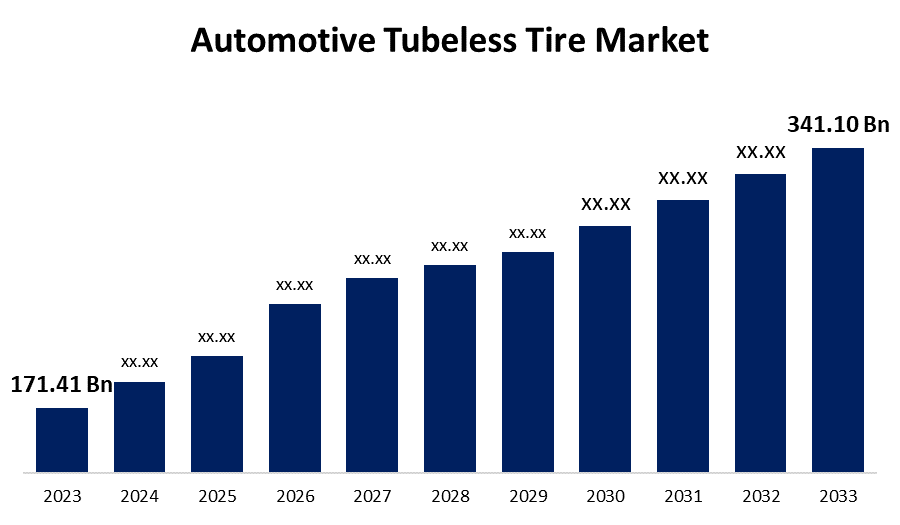

- The Global Automotive Tubeless Tire Market Size was Valued at USD 171.41 Billion in 2023

- The Market Size is Growing at a CAGR of 7.12% from 2023 to 2033

- The Worldwide Automotive Tubeless Tire Market Size is Expected to Reach USD 341.10 Billion by 2033

- Europe is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Automotive Tubeless Tire Market Size is Anticipated to Exceed USD 341.10 Billion by 2033, Growing at a CAGR 7.12% from 2023 to 2033.

Market Overview

Tubeless tires, as the name indicates, without a tube. The tire is designed to hold air by itself. The inner of the tire is lined with halo or chloro-butyl, which is airtight. The membrane, together with the airtight connection between the tire and the wheel, forms a container that stores the tire's air. When driving at high speeds, the temperature within the tire rises substantially. This raises the pressure on the tire tube. In such conditions, an average tire is quite vulnerable. With tubeless tires, this is prevented from occurring. They are better at holding air than a much thinner tube. The tubeless tire is made up of tread, a steel belt, and a spiral layer. It helps cars perform a variety of activities, including supporting vehicle load, transmitting traction and braking force to the road surface, absorbing road shocks, and changing and maintaining the direction of travel. Furthermore, to provide these basic responsibilities a tubeless tire is constructed of a steel belt coated in tough rubber and pumped with high-pressure air. The major factor driving market expansion is an increase in vehicle production by rising consumer demands, in addition to the additional security and reliability given by tubeless tires. Furthermore, the tubeless tire market is predicted to rise significantly throughout the forecast period, owing to advantages such as easy puncture repair, increased comfort at higher speeds, lower tire pressure, greater bump absorption, and less rotating weight as compared to standard tires.

The key companies in the worldwide automotive tubeless tire market include Sumitomo Rubber Industries Ltd., Cheng Shin Rubber Industry Co., The Goodyear Tyre & Rubber Company, Apollo Tires, Bridgestone Corporation, Maxxis International, Cooper Tire & Rubber Company, Continental Corporation, Madras Rubber Factory Limited, Toyo Tire & Rubber Co. Ltd., CEAT Ltd., MRF Limited, Yokohama Tire Corporation, Kumho Tire Co., Inc., and others.

Report Coverage

This research report categorizes the market for the automotive tubeless tire market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the automotive tubeless tire market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the automotive tubeless tire market.

Automotive Tubeless Tire Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 171.41 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 7.12% |

| 2033 Value Projection: | USD 341.10 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 230 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Application, By Region |

| Companies covered:: | Sumitomo Rubber Industries Ltd., Cheng Shin Rubber Industry Co., The Goodyear Tyre & Rubber Company, Apollo Tires, Bridgestone Corporation, Maxxis International, Cooper Tire & Rubber Company, Continental Corporation, Madras Rubber Factory Limited, Toyo Tire & Rubber Co. Ltd., CEAT Ltd., MRF Limited, Yokohama Tire Corporation, Kumho Tire Co., Inc., and other key companies. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis |

Get more details on this report -

Driving Factors

Tubeless tires became the favored choice for both car manufacturers and consumers due to their various benefits over traditional tube-type tires. Slow air leak enables consumers to travel short distances with a puncture. Although a tubed tire flattens in a matter of minutes, tubeless tires leak air at a far slower rate which is one of reason for the expansion of the automotive tubeless tire market. To enhance production and satisfy expanding demand, manufacturers in the automotive tubeless tire market are automating the tire manufacturing process. The automotive tubeless tire industry is expected to be driven by increased automobile production along with elevated demand for passenger cars.

Restraining Factors

The comparatively high initial cost of tubeless tires is one of the issues that hinder the automobile tubeless tire market from growing. Some customers and businesses may find this disappointing, which may affect their decision to select tires. Furthermore, the procedure of retrofitting older cars with tubeless tire systems can be difficult and expensive because the wheel rims and tire mounting surfaces typically need to be substantially modified.

Market Segmentation

The automotive tubeless tire market share is classified into type and application.

- The radial segment accounted for the largest revenue share over the forecast period.

Based on the type, the automotive tubeless tire market is categorized into radial and bias. Among these, the radial segment accounted for the largest revenue share over the forecast period. The rising need for radial tires in the bus and truck sector of the automotive industry, together with the introduction of fuel-efficient materials and the development of road infrastructure, drives market growth. Radial tires provide greater stability and grip on the road because their layers of cords are structured perpendicular to the direction of movement. They are currently gaining widespread recognition in the automotive industry as the preferred option for both manufacturers and customers.

- The passenger car segment dominates the market with the highest market share through the forecast period.

Based on the application, the automotive tubeless tire market is categorized into two- wheeler, passenger car, and commercial vehicle. Among these, the passenger car segment dominates the market with the highest market share through the forecast period. The passenger car tubeless tire market attracts innovation targeted at enhancing sustainability, safety, and performance. Manufacturers are designing advanced materials and tread designs to improve traction, long-term reliability, and fuel efficiency.

Regional Segment Analysis of the Automotive Tubeless Tire Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the automotive tubeless tire market over the predicted timeframe.

Get more details on this report -

North America is projected to hold the largest share of the automotive tubeless tire market over the predicted timeframe. North America is the market leader for tubeless tires, primarily due to rising electric car sales and the technologically complex development of self-driving automobiles. This has raised the need for tubeless tires for motor vehicles in the area. Furthermore, rising demand for pickup trucks and other similar light commercial vehicles, along with increasing production, would help to drive regional market growth. Tubeless tires are standard on most compact trucks and cars in North America. They are highly valued for their security, resistance to punctures, and more accurate fuel efficiency. Tubeless tires for bicycles and motorcycles are also becoming more prevalent.

Europe is expected to grow at the fastest CAGR growth in the automotive tubeless tire market during the forecast period. This is due to the increasing popularity of electric vehicles and the advancement of automotive technology. Furthermore, the European market for tubeless tires was growing rapidly in the United Kingdom, with Germany having the largest market share. This is due to the increasing number of electric vehicles and technological breakthroughs in the automotive sector. Furthermore, the German automobile tubeless tire market held the largest market share, while the UK tubeless tire industry was the fastest growing in Europe.

Asia-Pacific automotive tubeless tire market generates the second-highest revenue due to the presence of the largest automotive tubeless tire market and the increasing penetration of passenger vehicles and two-wheelers in the region as consumer per capita capital rises. The Asia Pacific region has a large number of tire manufacturing factories due to high rubber output, low labor costs, and government regulations that are favorable. Furthermore, India had the fastest-growing tubeless tire industry in Asia-Pacific, with China maintaining the largest market share.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the automotive tubeless tire market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Sumitomo Rubber Industries Ltd.

- Cheng Shin Rubber Industry Co.

- The Goodyear Tyre & Rubber Company

- Apollo Tires

- Bridgestone Corporation

- Maxxis International

- Cooper Tire & Rubber Company

- Continental Corporation

- Madras Rubber Factory Limited

- Toyo Tire & Rubber Co. Ltd.

- CEAT Ltd.

- MRF Limited

- Yokohama Tire Corporation

- Kumho Tire Co., Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In October 2023, CEAT, an Indian tire producer, released a new line of Milaze Tubeless tyres, according to a press release. The tyre meets the demands of the country's scooter market. Milaze Tubeless Tyre is specifically intended to meet the needs of the business community who use scooters for day-to-day operations.

- In June 2023, Hankook Tire, a leading global tire manufacturer, announced the iON EVO and iON EVO SUV, the latest additions to its iON range of tires built exclusively for electric vehicles (EVs). The all-new tires provide uncompromising summer performance for high-performance EVs and are constructed with iON technology, which focuses on tread wear, noise reduction, and EV-specific grip performance.

- In August 2022, Bridgestone moved a significant step forward in its efforts to market guayule, a woody desert shrub, as a domestic source of natural rubber and a more environmentally sustainable crop in America's drought-stricken southwest. Bridgestone is to invest an additional $42 million to launch commercial operations; a further investment and expansion are expected. The company intends to cooperate and partner with local US farmers and Native American tribes to improve the capacity of up to 25,000 acres of farmland for large-scale guayule planting and harvesting. Bridgestone intends toward sustainable commercial production of guayule-derived natural rubber by the end of the decade.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the automotive tubeless tire market based on the below-mentioned segments:

Global Automotive Tubeless Tire Market, By Type

- Radial

- Bias

Global Automotive Tubeless Tire Market, By Application

- Two- Wheeler

- Passenger Car

- Commercial Vehicle

Global Automotive Tubeless Tire Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the global automotive tubeless tire market?The global automotive tubeless tire market is projected to expand at 7.12% during the forecast period.

-

2. Who are the top key players in the global automotive tubeless tire market?The key players in the automotive tubeless tire market are Sumitomo Rubber Industries Ltd., Cheng Shin Rubber Industry Co., The Goodyear Tyre & Rubber Company, Apollo Tires, Bridgestone Corporation, Maxxis International, Cooper Tire & Rubber Company, Continental Corporation, Madras Rubber Factory Limited, Toyo Tire & Rubber Co. Ltd., CEAT Ltd., MRF Limited, Yokohama Tire Corporation, Kumho Tire Co., Inc., and others.

-

3. Which region is expected to hold the largest share of the global automotive tubeless tire market?The North America region is expected to hold the largest share of the global automotive tubeless tire market.

Need help to buy this report?