Global Automotive Turbocharger Market Size, Share, and COVID-19 Impact Analysis, By Technology Type (Variable Geometry Turbocharger, Twin Turbochargers, Wastegate Turbocharger, and Electric Turbocharger), By Fuel Type (Gasoline, Diesel, and Others), By Vehicle Type (Passenger Car, Light Commercial Vehicle, and Heavy Commercial Vehicle), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Automotive & TransportationGlobal Automotive Turbocharger Market Insights Forecasts to 2033

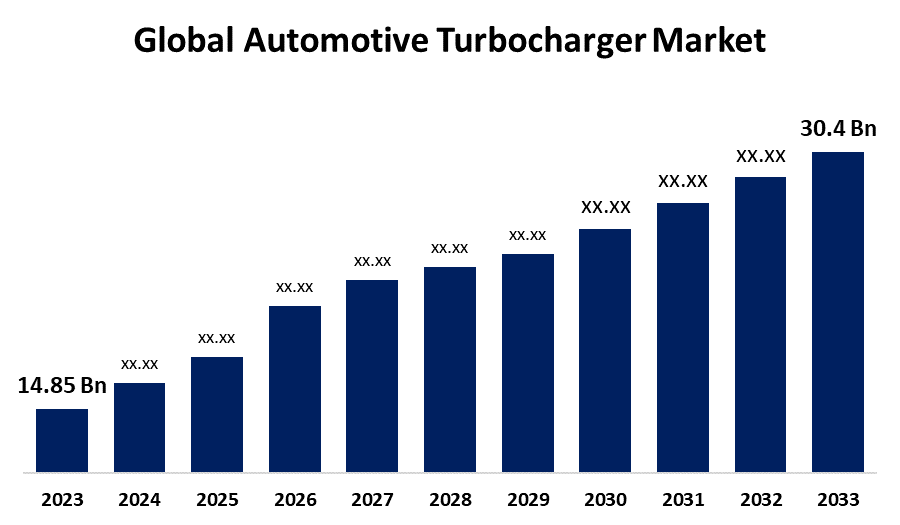

- The Global Automotive Turbocharger Market Size was Valued at USD 14.85 Billion in 2023

- The Market Size is Growing at a CAGR of 7.43% from 2023 to 2033

- The Worldwide Automotive Turbocharger Market Size is Expected to Reach USD 30.4 Billion by 2033

- Europe is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Automotive Turbocharger Market Size is Anticipated to Exceed USD 30.4 Billion by 2033, Growing at a CAGR of 7.43% from 2023 to 2033.

Market Overview

Automotive turbochargers are turbine-driven induction devices that increase the engine efficiency and output of internal combustion engines. These devices are used to direct more fuel into the combustion chamber if the vehicle's atmospheric pressure is insufficient to produce the desired results. Car manufacturers consider turbochargers to be a viable commodity that can help keep fossil fuel engines clean. Engine downsizing has become the most profitable aspect of the automotive industry. The use of small engines in automobiles is gaining popularity in the market because it allows for more efficient fuel emission control. Turbochargers assist the automotive industry in meeting government standards and regulations governing the emissions of exhaust gases such as carbon dioxide and other harmful gases from vehicles. Turbochargers are thought to be more economical and environmentally friendly. Furthermore, the major players are currently developing better turbos for fuel cell and electric vehicles, resulting in a sizable potential market that could be served during the projection period. A rapid increase in vehicle production and sales will improve the outlook for the automotive industry. Over the last few decades, the automotive industry has become more adaptable, reliable, efficient, and robust. Automakers and automotive product manufacturers invest a lot of resources and money all over the world, particularly in developed countries.

Report Coverage

This research report categorizes the market for the global automotive turbocharger market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global automotive turbocharger market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global automotive turbocharger market.

Global Automotive Turbocharger Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 14.85 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 7.43% |

| 2033 Value Projection: | USD 30.4 Billion |

| Historical Data for: | 2020-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Technology Type, By Fuel Type, By Vehicle Type, By Region and COVID-19 Impact Analysis |

| Companies covered:: | Continental GT, Garrett Motion, Turbonetics, Aptiv PLC, Precision Turbo and Engine Inc., Cummins Inc., ABB, Ningbo Motor Industrial Co. Ltd., Mahle, Robert Bosch GmbH, Mitsubishi Heavy Industries. Ltd, Turbo Dynamics, Rotomaster International, Kompressorenbau Bannewitz GmbH, IHI Corporation, Marelli Corporation, Fuyuan Turbocharger Co, Ltd, Others, and Others Key Vendors |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The adoption of automotive turbochargers, which improves vehicle fuel efficiency, is a significant factor driving market growth. It will increase the internal combustion and power output of engines by allowing more air intake into the combustion engine of powertrains. These turbochargers provide high engine power without increasing piston displacement, making them both efficient and environmentally friendly. Furthermore, the market has a stable economic state with strong sales forecasts in the medium run to accommodate the potentially high demand for premium and performance cars. To preserve long-term relationships, players in the industry look to form beneficial alliances with OEM and turbocharger suppliers. For instance, SuperTurbo Technologies Inc. and Linamar Corp. formed an arrangement in February 2022, to commercialize the new car turbocharger technology. Furthermore, McLaren Engineering, a branch of Linamar, declared that it will soon start producing prototypes and manufacturing and testing SuperTurbos for the worldwide market. Furthermore, the growing popularity of gasoline-powered vehicles is driving up demand for turbochargers designed specifically for petrol engines. To meet this rising demand, turbocharger manufacturers are likely to shift their focus and resources to developing and manufacturing gasoline turbochargers.

Restraining Factors

The global automotive industry is transitioning from conventional fuel vehicles to electric vehicles. The increasing emissions from vehicle fuels are contributing to air pollution and the global warming crisis. Leading automotive manufacturers are shifting their focus to more sustainable energy sources. Manufacturers are investing heavily in research to develop vehicles with advanced technology and are transitioning to electric vehicles. Consumer's increasing preference for zero-emission vehicles might have an adverse effect on the market.

Market Segmentation

The global automotive turbocharger market share is classified into technology type, fuel type, and vehicle type.

- The twin turbochargers segment is expected to hold the largest share of the global automotive turbocharger market during the forecast period.

Based on the technology type, the global automotive turbocharger market is divided into variable geometry turbochargers, twin turbochargers, wastegate turbochargers, and electric turbochargers. Among these, the twin turbochargers segment is expected to hold the largest share of the global automotive turbocharger market during the forecast period. This is due to the implementation of stringent emission reduction targets and government standards. These turbochargers provide superior performance while allowing exhaust gases to be recycled. A parallel twin-turbo system provides efficient packaging inside the engine bay and requires the least amount of exhaust piping. They also allow engine manufacturers to use smaller turbos, eliminating the turbo lag associated with larger systems. The growing need for cost-effective engine solutions will drive demand for the twin turbochargers segment in the global automotive turbochargers market.

- The diesel segment is expected to grow at the fastest CAGR in the global automotive turbocharger market during the forecast period.

Based on the fuel type, the global automotive turbocharger market is divided into gasoline, diesel, and others. Among these, the diesel segment is expected to grow at the fastest CAGR in the global automotive turbocharger market during the forecast period. The diesel turbocharger improves transit performance, reduces torque speed, and increases the use of automotive turbochargers, all of which can reduce diesel engine size. Diesel engines emit less carbon dioxide than other fuels, which improves turbo efficiency, increases fuel efficiency, and provides high durability. Due to these factors, the diesel segment is growing fastest in the global automotive turbocharger market.

- The passenger car segment is expected to grow at the fastest CAGR in the global automotive turbocharger market during the forecast period.

Based on the vehicle type, the global automotive turbocharger market is divided into passenger cars, light commercial vehicles, and heavy commercial vehicles. Among these, the passenger car segment is expected to grow at the fastest CAGR in the global automotive turbocharger market during the forecast period. The widespread adoption of turbocharging technology in passenger vehicles, driven by the desire for improved fuel economy and performance, establishes this sector as a major market participant. The increasing demand for turbochargers in passenger cars is driving segment growth in the global automotive turbocharger market.

Regional Segment Analysis of the Global Automotive Turbocharger Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the global automotive turbocharger market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the global automotive turbocharger market over the predicted timeframe. The growing population is driving up demand for automobiles, which is boosting the market for automotive turbochargers. Because of the shift in manufacturing priorities caused by low labor and material costs, the region now has a significant presence from top automakers, which has increased car production, sales, and exports, as well as demand for turbochargers. Furthermore, some of the fastest growing economies, such as India and China, have the highest number of automotive sales and production, which is fueling the growth of the turbocharger market in this region. The major factors contributing to market growth are rapid urbanization, industrialization expansion, infrastructure improvements, and an increase in disposable income.

Europe is expected to grow at the fastest pace in the global automotive turbocharger market during the forecast period. The European automotive market, known for its high diesel engine penetration and strong preference for performance vehicles, naturally gravitates toward turbocharging technologies. Furthermore, the region has advanced automotive technology, which is supported by significant investments in R&D and a well-established automotive industry. For example, in March 2022, Mercedes-Benz announced the launch of sales of its new Mercedes-AMG C 43 4MATIC, which starts at EUR 71,460 for the Saloon and EUR 73,245 for the Estate. An electric exhaust gas turbocharger improves the performance of this completely redeveloped model's agile 300 kW (408 hp) AMG engine. In certain driving conditions, the belt-driven starter generator (RSG) provides an additional 10 kW (14 hp) of power. Furthermore, the European market's shift toward electrification is also significant, with hybrid and electric vehicles increasingly incorporating turbochargers. Furthermore, there is significant aftermarket potential in Europe, driven by an aging vehicle fleet and consumer demand for vehicle upgrades. Government policies and consumer awareness of fuel efficiency and environmental sustainability support the turbocharger market in Europe.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global automotive turbocharger market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Continental GT

- Garrett Motion

- Turbonetics

- Aptiv PLC

- Precision Turbo and Engine Inc.

- Cummins Inc.

- ABB

- Ningbo Motor Industrial Co. Ltd.

- Mahle

- Robert Bosch GmbH

- Mitsubishi Heavy Industries. Ltd

- Turbo Dynamics

- Rotomaster International

- Kompressorenbau Bannewitz GmbH

- IHI Corporation

- Marelli Corporation

- Fuyuan Turbocharger Co, Ltd

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In June 2023, the installation of Garrett Motion's first high-speed automated production line for advanced variable nozzle technology (VNT), which is used in turbo-passenger vehicles, marked the completion of the plant's expansion in Wuhan

- In April 2023, at Auto Shanghai 2023, Garrett Motion Inc. debuted its newest e-mobility and turbocharger technologies. With the help of its cutting-edge E-turbos, cars can now achieve the performance levels of larger engines from earlier generations while using engines that are getting smaller.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global automotive turbocharger market based on the below-mentioned segments:

Global Automotive Turbocharger Market, By Technology Type

- Variable Geometry Turbocharger

- Twin Turbochargers

- Wastegate Turbocharger

- Electric Turbocharger

Global Automotive Turbocharger Market, By Fuel Type

- Gasoline

- Diesel

- Others

Global Automotive Turbocharger Market, By Vehicle Type

- Passenger Car

- Light Commercial Vehicle

- Heavy Commercial Vehicle

Global Automotive Turbocharger Market, Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?