Global Automotive Ultrasonic Technologies Market Size, Share, and COVID-19 Impact Analysis, By Vehicle Type (ICE, and Electric Vehicle), By Application (Parking Assistance System, Blind Spot Detection, Collision Avoidance System, Adaptive Cruise Control, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Automotive & TransportationGlobal Automotive Ultrasonic Technologies Market Insights Forecasts to 2033

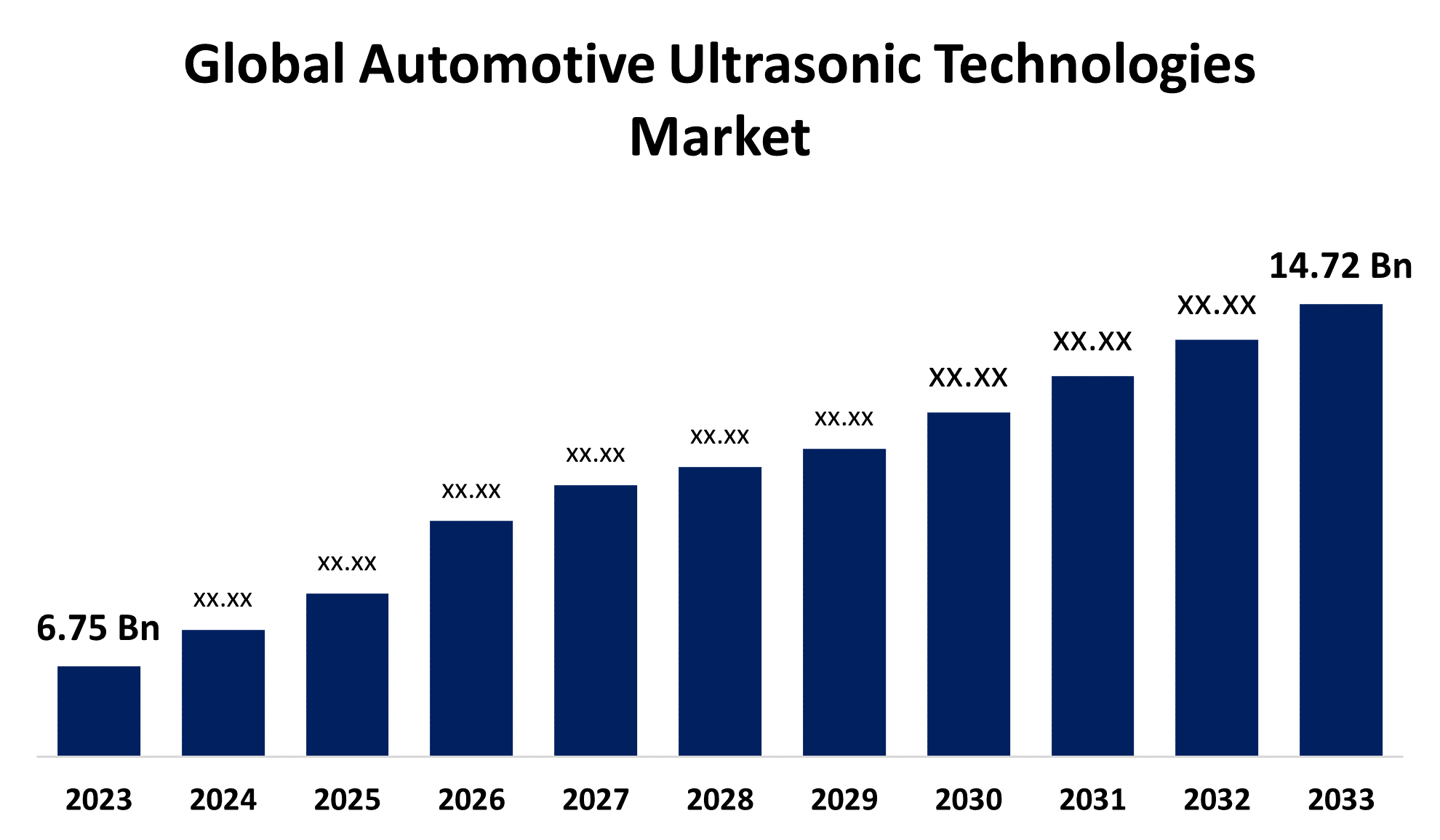

- The Global Automotive Ultrasonic Technologies Market Size was Valued at USD 6.75 Billion in 2023

- The Market Size is Growing at a CAGR of 8.11% from 2023 to 2033

- The Worldwide Automotive Ultrasonic Technologies Market Size is Expected to Reach USD 14.72 Billion by 2033

- North America is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Automotive Ultrasonic Technologies Market Size is Anticipated to Exceed USD 14.72 Billion by 2033, Growing at a CAGR of 8.11% from 2023 to 2033.

Market Overview

Automotive ultrasonic technologies use ultrasonic sensors and systems in automobiles to provide a variety of safety, convenience, and automation features. Ultrasonic technology detects things and measures distances using sound waves with frequencies that are beyond the range of human hearing. The automotive ultrasonic technologies market is growing rapidly owing to rising demand for advanced driver assistance systems (ADAS). This improves driving safety and simplicity. Many ADAS features rely heavily on ultrasonic technology, such as adaptive cruise control, lane-keeping assistance, and automatic parking. Ultrasonic sensors are one of many different types of sensors used to improve the safety of modern cars. These sensors identify objects in the immediate environment of the vehicle using ultrasonic principles. These sensors emit high-frequency sound waves that individuals cannot hear, similar to how bats utilize echolocation. Ultrasonic transducers and ultrasonic sensors are devices that produce or detect waves containing ultrasound. They can be categorized into three types: transmitters, receivers, and transceivers. Transceivers are capable of both transmitting and receiving ultrasound, while receivers transform ultrasound back into electrical impulses. Automobile ultrasonic technologies are used for identifying things in a vehicle's path. Automotive ultrasonic technology is frequently discovered in vehicles equipped with the most advanced driver assistance features, such as parking aid systems, blind spot detection systems, height and pressure monitoring systems, and self-opening drives. Governments and regulatory bodies around the world continually push for improved automobile safety standards. The continuous advancement of automotive technology strives to provide even better safety benefits than previous innovations.

In March 2023, Pepperl+Fuchs, a leading German sensor pioneer, created ultrasonic sensor technology for mobile machine applications that involve CAN integration. Machine makers can now incorporate E1-approved ultrasonic sensors with a built-in CAN interface into their mobile machines.

The significant automotive ultrasonic technologies market share of the companies included in this report is Continental AG, Texas Instruments Incorporated, AG Electronics, Hyundai Mobis Co. Ltd., Magna International Inc., Murata Manufacturing Co. Ltd, Manufacturing Co. Ltd, Panasonic Holdings Corporation, Elmos Semiconductor SE, Valeo SA., MInpin, Robert Bosch GmbH, TDK Corporation, Texas Instruments Inc., and others.

Report Coverage

This research report categorizes the market for the automotive ultrasonic technologies market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the digital signage media player market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the automotive ultrasonic technologies market.

Global Automotive Ultrasonic Technologies Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 6.75 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 8.11% |

| 2033 Value Projection: | USD 14.72 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 179 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Vehicle Type, By Application, By Region |

| Companies covered:: | Continental AG, Texas Instruments Incorporated, AG Electronics, Hyundai Mobis Co. Ltd., Magna International Inc., Murata Manufacturing Co. Ltd, Manufacturing Co. Ltd, Panasonic Holdings Corporation, Elmos Semiconductor SE, Valeo SA., MInpin, Robert Bosch GmbH, TDK Corporation, Texas Instruments Inc., and Others Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Ultrasonic sensors, particularly are used in many safety systems such as parking assistance, blind-spot recognition, and collision avoidance, and are in great demand. This emphasis on safety is a major driver of the rise of ultrasonic technology in the automotive industry. These ultrasonic sensors can identify things from a short distance, making them ideal for low-speed autonomous actions such as parking and navigating in tight places. Ultrasonic ADAS sensors may significantly decrease the stress of parallel parking. The increase in traffic accidents worldwide has led to a strong demand for safety technology such as telematics, traction control, electronic stability control, tire pressure monitors, parking aids, and collision avoidance systems this also drive the market of automotive ultrasonic technologies market. Furthermore, as work to make self-driving cars a reality and widely available, several technologies such as sensors and communication systems continue to advance. One essential technology is Ultrasonic Parking Assist, which aids with autonomous driving and parking.

Restraining Factors

The implementation of complex system is more expensive because it requires wireless equipment to be put in vehicles for it to operate correctly. As a result, the high initial implantation cost and design complexity of ultrasonic technology in cars restrict its market growth.

Market Segmentation

The automotive ultrasonic technologies market share is classified into vehicle type and application.

- The ICE segment is dominating the market with the largest revenue share through the forecast period.

Based on the vehicle type, the automotive ultrasonic technologies market is categorized into ICE, and electric vehicle. Among these, the ICE segment is dominating the market with the largest revenue share through the forecast period. ICE vehicles tend to have lower initial purchase prices than EVs, making them more appealing to budget-conscious consumers. Continuous developments in ICE technology, such as increased fuel efficiency, lower emissions, and enhanced driver assistance systems, have contributed to its acceptance.

- The parking assistance system segment is expected to hold a significant market share through the forecast period.

Based on the application, the automotive ultrasonic technologies market is categorized into parking assistance system, collision avoidance system, blind spot detection, adaptive cruise control, and others. Among these, the parking assistance system segment is expected to hold a significant market share through the forecast period. Ultrasonic sensors are most widely utilized in parking assistance systems, which have become practically standard in modern passenger vehicles. These sensors assist drivers in navigating parking spaces by sending proximity alerts, lowering the chance of colliding with obstacles, other vehicles, or individuals. Ultrasonic parking assistance systems require ultrasonic sensor disks, which detect and determine the distance to an impediment.

Regional Segment Analysis of the Automotive Ultrasonic Technologies Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

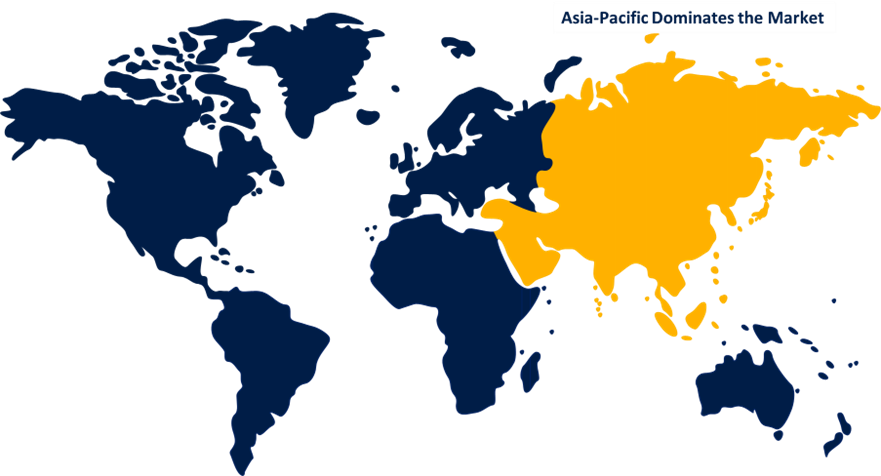

Asia Pacific is anticipated to hold the largest share of the automotive ultrasonic technologies market over the predicted timeframe.

Get more details on this report -

Asia Pacific is projected to hold the largest share of the automotive ultrasonic technologies market over the forecast period. The Asia-Pacific region's automobile sector has grown. The region is one of the most profitable investment regions and has made a significant contribution to global vehicle sales. The main automobile corporations have focused on growth in Asia, establishing corporate offices or manufacturing sites in countries such as China, Japan, and India, which are the region's automotive hubs. The Asia Pacific market is expected to see an increase in demand for luxury vehicles as a result of the strong economic situation and rising disposable income.

Europe is expected to grow at the fastest CAGR growth of the automotive ultrasonic technologies market during the forecast period. The automotive ultrasonic technologies market in Europe is undergoing significant expansion. Technological advancements in the automotive sector, which enable the effective implementation of safety measures and improved driving quality in automobiles, contributed to the spread of the industry throughout Europe. Supportive laws and readily priced vehicles enhance the adoption of safety equipment in automobiles to increase safety and comfort. In addition, Germany is home to major technology-focused corporations, including Continental AG and Robert Bosch GmbH. These companies have used product launches and other market-development methods to help the market expand.

North America is expected to grow significantly over the forecast period. The development of semi-autonomous vehicles in the region, combined with technological advancements, has raised demand for efficient vehicle safety measures. This is a significant factor in the market expansion of automotive ultrasonic technologies. Companies such as Texas Instruments and Honeywell International have been active across the United States. Magna International has decided to develop efficient automotive ultrasonic technology for enterprises across Canada, thereby contributing to the market's national growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the automotive ultrasonic technologies market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Continental AG

- Texas Instruments Incorporated

- AG Electronics

- Hyundai Mobis Co. Ltd.

- Magna International Inc.

- Murata Manufacturing Co. Ltd

- Manufacturing Co. Ltd

- Panasonic Holdings Corporation

- Elmos Semiconductor SE

- Valeo SA.

- MInpin

- Robert Bosch GmbH

- TDK Corporation

- Texas Instruments Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In April 2024, Micron Technology, Inc. confirmed an entire portfolio of vehicle-grade memory and storage solutions for Qualcomm Technologies Inc.'s Snapdragon Digital Chassis, an extensive range of cloud-connected platforms designed to power data-rich, intelligent vehicle applications.

- In January 2024, At CES 2024, Qualcomm Technologies, Inc. and Robert Bosch GmbH unveiled the automotive industry's first central vehicle computer capable of operating entertainment and advanced driver assistance system (ADAS) functionality on a single system-on-chip. Bosch revealed its new central vehicle computer, the cockpit & ADAS integration platform, which is built on the Snapdragon Ride Flex System-on-Chip.

- In July 2023, Valeo, a global automotive technology company, launched its second Ultrasonic Sensors production line in Sanand, Gujarat, India. Marc Vrecko, President of Valeo's Comfort and Driving Assistance Business Group, and Jayakumar G, Group President and Managing Director of Valeo India, attended the inaugural ceremony.

- In June 2023, Murata Manufacturing, a leading electronics firm, announced the launch of a new ultrasonic sensor device designed for automotive applications. The MA48CF15-7N known as excellent sensitivity and rapid responsiveness and is contained in a hermetically sealed housing to guard against liquid infiltration.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the automotive ultrasonic technologies market based on the below-mentioned segments:

Global Automotive Ultrasonic Technologies Market, By Vehicle Type

- ICE

- Passenger Vehicles

- Commercial Vehicles

- Electric Vehicles

Global Automotive Ultrasonic Technologies Market, By Application

- Parking Assistance System

- Blind Spot Detection

- Collision Avoidance System

- Adaptive Cruise Control

- Others

Global Automotive Ultrasonic Technologies Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the automotive ultrasonic technologies market over the forecast period?The automotive ultrasonic technologies market is to expand at 8.11% during the forecast period.

-

2. Which region is expected to hold the largest share of the automotive ultrasonic technologies market?The Asia Pacific region is expected to hold the largest share of the automotive ultrasonic technologies market.

-

3. Who are the top key players in the automotive ultrasonic technologies market?The key players in the automotive ultrasonic technologies market are Continental AG, Texas Instruments Incorporated, AG Electronics, Hyundai Mobis Co. Ltd., Magna International Inc., Murata Manufacturing Co. Ltd, Manufacturing Co. Ltd, Panasonic Holdings Corporation, Elmos Semiconductor SE, Valeo SA., MInpin, Robert Bosch GmbH, TDK Corporation, Texas Instruments Inc., and others.

Need help to buy this report?