Global Automotive Viscosity Index Improvers Market Size, Share, and COVID-19 Impact Analysis, By Type (Polymethacrylate, Olefin Copolymer, and Polyisobutylene), By End-Users (Manufacturing, Food Processing, Mining, Construction, and Power Generation), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Chemicals & MaterialsGlobal Automotive Viscosity Index Improvers Market Insights Forecasts to 2033

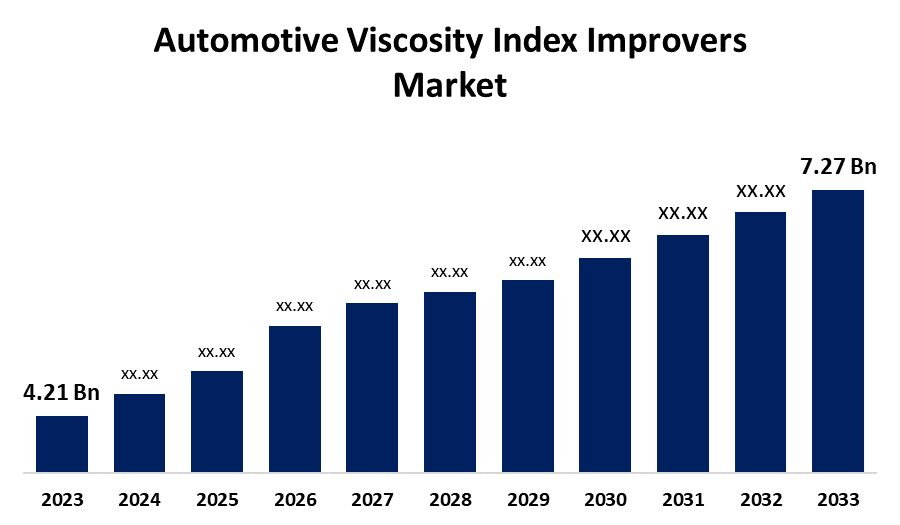

- The Global Automotive Viscosity Index Improvers Market Size was Valued at USD 4.21 Billion in 2023

- The Market Size is Growing at a CAGR of 5.61% from 2023 to 2033

- The Worldwide Automotive Viscosity Index Improvers Market Size is Expected to Reach USD 7.27 Billion by 2033

- Europe is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Automotive Viscosity Index Improvers Market Size is Anticipated to Exceed USD 7.27 Billion by 2033, Growing at a CAGR 5.61% from 2023 to 2033.

Market Overview

Automotive viscosity index improver is an innovative polymer addition that expands at high temperatures, thickening the lubricant and ensuring more stable and consistent viscosity. This assures that the lubricant completely protects the equipment at high as well as low temperatures. Viscosity improvers in gearboxes should be utilized with extreme caution. These polymer additions significantly increase the viscosity index and prolong the temperature operating range of oil. However, these polymers are not Newtonian fluids, and their viscosity decreases with shearing. A gear drive is a high-shear application; therefore using excessive polymer reduces viscosity quickly. Lubricants reduce breakdowns while extending the life of machinery. As a result, the need for lubricants rises, propelling growth in the viscosity index improvers market. Automobiles require braking fluids, transmission lubricants, engine lubricants, and other components that must be supplied regularly to ensure optimal performance and longevity. Consequently, there is a growing need for premium lubricants that can function at different temperatures, which enhances the need for viscosity index improvers and drives the market expansion. These lubricants are generally recommended in long-life gear drives. Polyisobutylene, olefin copolymer, and polymethacrylate are some of the most common product categories found in the worldwide viscosity index improvers market. Furthermore, their products are progressively being utilized in a variety of end-use industries, including off-road vehicles, industrial machines, and the automobile industry. This vast range of applications for the product creates significant commercial opportunities in the viscosity index improvers industry. Growing awareness of environmental issues and sustainability norms presents an opportunity to produce and apply bio-based viscosity index improvers. To promote environmentally friendly activities, producers may investigate sustainable alternatives made from renewable sources.

Report Coverage

This research report categorizes the market for the automotive viscosity index improvers market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the automotive viscosity index improvers market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the automotive viscosity index improvers market.

Automotive Viscosity Index Improvers Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 4.21 Billion |

| Forecast Period: | 2023 to 2033 |

| Forecast Period CAGR 2023 to 2033 : | 5.61% |

| 2033 Value Projection: | USD 7.27 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 98 |

| Segments covered: | By Type, By End-Users, By Region and COVID-19 Impact Analysis |

| Companies covered:: | The Lubrizol Corporation, Infineum International Limited, Chevron Oronite Company LLC, Evonik Industries AG, Afton Chemical Corporation, Asian Oil Company, BARIYAN’S GROUP, BPT Chemicals Co Ltd., Sanyo Chemical Industries, Ltd., Chetas Biochem, Croda International Plc., BASF SE, Innov Oil Pte Ltd., Shenyang Great Wall Lubricating Oil Manufacturing Co., Ltd., and Others Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Due to the increased environmental concerns and technical advancements, consumers' preferences have shifted from gasoline-powered autos to electric hybrid vehicles. Several e-vehicle manufacturing facilities are being established. The growing automotive industry is a significant driver of the viscosity index improvers market. As commercial vehicle production increases, so does the demand for high-quality lubricants, particularly those with effective viscosity index improvers, to fulfill the needs of modern machines.

Restraining Factors

The price and availability of crude oil-derived base oils have a considerable impact on the viscosity index improver market. Changes in crude oil prices can have a significant impact on the cost of developing viscosity index improvers.

Market Segmentation

The automotive viscosity index improvers market share is classified into type and end-users.

- The olefin copolymer segment accounted for the largest revenue share over the forecast period.

Based on the type, the automotive viscosity index improvers market is categorized into polymethacrylate, olefin copolymer, and polyisobutylene. Among these, the olefin copolymer segment accounted for the largest revenue share over the forecast period. Olefin copolymer viscosity index improvers are a different kind of synthetic polymer frequently used in lubricants. These copolymers can improve oil viscosity-temperature characteristics, leading to stable lubrication throughout a wide temperature range. Olefin copolymer viscosity index improvers are recognized for their versatility and efficacy in raising the viscosity index of lubricating oils.

- The manufacturing segment is expected to hold a significant market share through the forecast period.

Based on the end-users, the automotive viscosity index improvers market is categorized into manufacturing, food processing, mining, construction, and power generation. Among these, the manufacturing segment is expected to hold a significant market share through the forecast period. The industrial business relies heavily on machinery and equipment hence, proper lubrication is crucial for maintaining operational efficiency. Viscosity index improvers ensure that lubricants used in manufacturing procedures maintain adequate viscosity throughout a wide temperature range. This is particularly important in high-speed, high-temperature industrial applications.

Regional Segment Analysis of the Automotive Viscosity Index Improvers Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the automotive viscosity index improvers market over the predicted timeframe.

Get more details on this report -

North America is projected to hold the largest share of the automotive viscosity index improvers market over the forecast period. The auto industry has grown steadily. Increased commercial vehicle sales, notably light trucks and pick-up trucks used for short-distance trading and transportation are expected to drive up demand for automotive lubricants in the country. The use of viscosity index improvers will increase over the projection period as the automobile industry grows. Furthermore, increasing chemical and pharmaceutical production and exports, and enhanced industrial output, are expected to boost demand for lubricant additives such as viscosity index improvers.

Europe is expected to grow at the fastest CAGR growth in the automotive viscosity index improvers market during the forecast period. The increasing use of high-performance engines has raised the demand for high-performance lubricants with the proper viscosity. Viscosity affects important elements such as wear, contamination acceptance, energy consumption, oil and gas, automotive, metals and fabrication, power and energy transmission, chemicals, and general manufacturing, all of which depend upon lubricants. These industries use transmission oils, process oils, metalworking fluids, drilling fluids, and other lubricants. Growing output and the launch of new projects in Russia are expected to increase demand for viscosity index improvers in the industry.

The Asia Pacific holds a significant market share over the forecast period. With the strong economic growth in emerging countries and growing disposable income, Asia Pacific is an attractive market for the lubricating business. The region's high lubricating oil consumption is mostly due to the rapid development of industrial production, which extended commerce and the increased number of automobiles. In addition, rising investments in India's industrial sector are driving up demand for lubricating oil in the region. Furthermore, government legislation and policies supporting environmental sustainability have an impact on the lubricating oil additives market, which is expected to increase demand throughout the forecast period.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the automotive viscosity index improvers market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- The Lubrizol Corporation

- Infineum International Limited

- Chevron Oronite Company LLC

- Evonik Industries AG

- Afton Chemical Corporation

- Asian Oil Company

- BARIYAN’S GROUP

- BPT Chemicals Co Ltd.

- Sanyo Chemical Industries, Ltd.

- Chetas Biochem

- Croda International Plc.

- BASF SE

- Innov Oil Pte Ltd.

- Shenyang Great Wall Lubricating Oil Manufacturing Co., Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In January 2024, Evonik introduced VISIOMER HEMA-P 100, a high-performance phosphate methacrylate monomer with nonmigratory properties and long-lasting effects. Polymerization incorporates HEMA-P, which gives clear flame retardancy, enhances adhesion, and decreases corrosion. It is a powerful adhesion booster and anti-corrosive agent. VISIOMER HEMA-P can enhance dispersibility and serve as a complexing agent.

- In July 2023, Chevron Phillips Chemical ("CPChem") announced intentions to expand its polyalphaolefins (PAO) facility in Beringen, Belgium. Once local approvals are approved, this major investment Increased production from this investment will be important to fulfill expanding demand during a period of considerable innovation in various areas that use PAOs.

- In April 2023, Lubrizol announced a new range of viscosity index improvers (VIIs) for vehicle lubricants, offering increased performance such as oxidation resistance and thermal resistance.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the automotive viscosity index improvers market based on the below-mentioned segments:

Global Automotive Viscosity Index Improvers Market, By Type

- Polymethacrylate

- Olefin Copolymer

- Polyisobutylene

Global Automotive Viscosity Index Improvers Market, By End-Users

- Manufacturing

- Food Processing

- Mining

- Construction

- Power Generation

Global Automotive Viscosity Index Improvers Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the global automotive viscosity index improvers market?The global automotive viscosity index improvers market is projected to expand at 5.61% during the forecast period.

-

2. Who are the top key players in the global automotive viscosity index improvers market?The key players in the automotive viscosity index improvers market The Lubrizol Corporation, Infineum International Limited, Chevron Oronite Company LLC, Evonik Industries AG, Afton Chemical Corporation, Asian Oil Company, BARIYAN’S GROUP, BPT Chemicals Co Ltd., Sanyo Chemical Industries, Ltd., Chetas Biochem, Croda International Plc., BASF SE, Innov Oil Pte Ltd., Shenyang Great Wall Lubricating Oil Manufacturing Co., Ltd., and Others.

-

3. Which region is expected to hold the largest share of the global automotive viscosity index improvers market?The North America region is expected to hold the largest share of the global automotive viscosity index improvers market.

Need help to buy this report?