Global Automotive Wheels Aftermarket Market Size, Share & Trends, Covid-19 Impact Analysis Report, By Vehicle Type (Passenger Cars, And Commercial Vehicles), By Aftermarket Type (New Wheel Replacement, And Refurbished Wheel Fitment), By Material Type (Alloy, Steel, And Others), By Product Type (Regular Wheels, And High-Performance Wheels), By Rim Size (13”–15” Inch, 16”–18” Inch, 19”–21” Inch, And Above 21” Inch), And By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, And Africa), Analysis And Forecast 2021 – 2030

Industry: Automotive & TransportationAUTOMOTIVE WHEELS AFTERMARKET MARKET: OVERVIEW

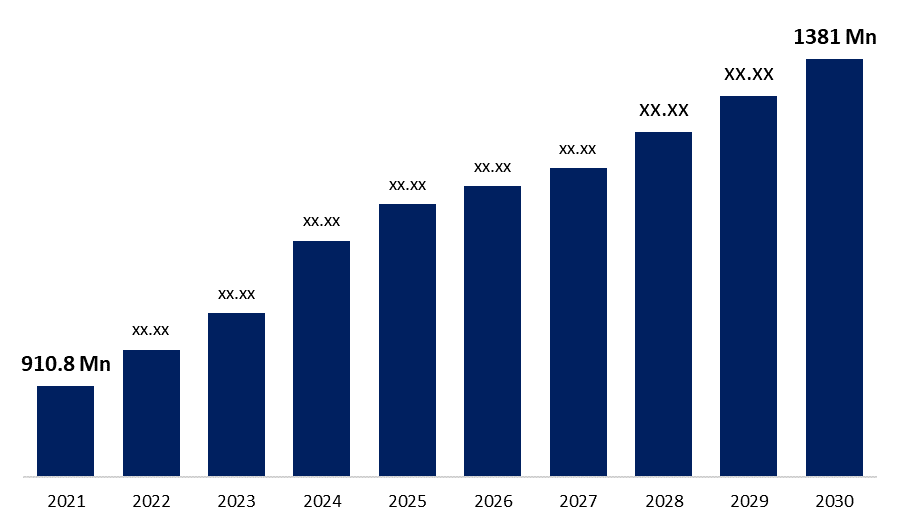

The Global Automotive Wheels Aftermarket Market was valued at USD 910.8 Million in 2021, the market is projected to grow USD 1381 Million in 2030, at a CAGR of 5.77 %. A wheel is a circular object that allows a vehicle or other object to move easily. They spin on an axle, and the wheel material is tough and long-lasting. A good set of wheels gives the vehicle stability and traction. Camber, caster, and toe are three important wheel components. Alloy wheels are made of a magnesium and aluminum alloy and are a combination of different metals and elements. They are much lighter than steel wheels and are used to improve the appearance of a vehicle.

Get more details on this report -

Furthermore, as a result of the government-mandated mileage goals, automakers are using more carbon-based and aluminum wheels. Furthermore, the new material requires much less energy to produce and results in a more precisely formed wheel with better-defined and sharper body lines, making part replacement easier. However, alloy wheels have the largest market share due to properties such as durability, corrosion resistance, density, high tensile strength, malleability, and ductility. Furthermore, as hybrid electric vehicle models proliferate, the demand for unique wheels incorporated into these vehicles has skyrocketed

COVID-19 ANALYSIS

The COVID-19 outbreak will have a huge impact on global industrial expenditure over the next several years because a large number of businesses that governments throughout the globe have deemed non-essential are currently inactive and suffering enormous losses. Through the end of 2021, this will have an impact on their tech spending. COVID-19 is also pushing various manufacturers to depend more heavily on digitalization and automation for long-term operations in order to decrease the cost effect of the pandemic and other potential economic crises. It is believed that the COVID-19 outbreak would have a brief effect before going away. However, in light of the current pandemic, COVID-19 offers businesses the chance to make much-needed operational improvements with an emphasis on developing networking technologies.

Global Automotive Wheels AfterMarket Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2021 |

| Market Size in 2021: | USD 910.8 Million |

| Forecast Period: | 2021 - 2030 |

| Forecast Period CAGR 2021 - 2030 : | 5.77 % |

| 2030 Value Projection: | USD 1381 Million |

| Historical Data for: | 2017 - 2020 |

| No. of Pages: | 196 |

| Tables, Charts & Figures: | 138 |

| Segments covered: | By Vehicle Type, By Aftermarket Type, By Material Type, By Rim Size, By Region |

| Companies covered:: | Iochpe-Maxion, Citic Dicastal Wheel Manufacturing, Hitachi Metals, Steel Strips Wheels, American Eagle Wheels, Superior Industries, Cln Group, Borbet, Topy Industries, Accuride Corporation, Others |

| Growth Drivers: | Improved Vehicle Dynamics and Increased Demand for Lightweight Materials to Boost Wheel Aftermarket |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

AUTOMOTIVE WHEELS AFTERMARKET MARKET: TREND

Growing vehicle production Propel Market Growth

Growing vehicle production is a critical factor accelerating market growth; additionally, alloys can improve breaking performance, which in turn increases product demand; recent rising trend of aluminum vehicles in low commercial vehicles, rising sales of passenger cars with changing consumer preferences, increasing proliferation of hybrid electric automobile models, rising stringent vehicle efficiency norms, rising demand for small and mid-sized SUVs, increasing demand for small and mid-sized SUVs, increasing demand for small and mid-sized SUVs, increasing demand for small and mid-sized SUVs, increasing demand for Furthermore, rising advanced materials and new wheel compositions, rising research and development activities, and rising modernization and technological advancements in market products will all contribute to further create new opportunities for automotive wheels aftermarket market in the forecast period.

AUTOMOTIVE WHEELS AFTERMARKET MARKET: DRIVERS

Improved Vehicle Dynamics and Increased Demand for Lightweight Materials to Boost Wheel Aftermarket

The development of lightweight materials has seen constant innovation in the automotive industry. Over the years, the average percentage of carbon fibre reinforced composites and aluminium used in automobiles has steadily increased. Because of lighter, faster, and better-performing vehicles, as well as rising fuel costs, aftermarket players are focusing on developing light-weighting technologies. The use of lightweight materials will increase dramatically across industries. The aviation industry has the highest share of lightweight materials (80%), but the automotive industry is rapidly increasing its share from 30% to 70%. All lightweight materials have the potential to reduce weight at a higher cost. Carbon fibre has the greatest potential for weight reduction because it is 50% lighter than steel. As a result, the use of advanced materials presents significant opportunities for the automotive industry, as they can play an important role in reducing overall vehicle weight, increasing fuel efficiency, and lowering harmful emissions.

AUTOMOTIVE WHEELS AFTERMARKET MARKET: RESTRAIN

Engineering barriers in use of lightweight materials Limit Market Growth

Technological constraints, such as the difficulty of forging magnesium and its alloys to meet a specific need, have also hampered the growth of the market for these materials. In fact, magnesium reduces weight better than aluminium or high-strength steel. It weighs 33 percent less than aluminium and 75 percent less than steel. Magnesium alloys, on the other hand, are currently used in very small quantities in vehicles and are limited to die castings such as housings.

AUTOMOTIVE WHEELS AFTERMARKET MARKET: SEGMENTATION

The global Automotive Wheels Aftermarket Market is segmented by Vehicle Type (Passenger Cars, and Commercial Vehicles), Aftermarket Type (New Wheel Replacement, and Refurbished Wheel Fitment), Material Type (Alloy, Steel, and Others), Product Type (Regular Wheels, and High-Performance Wheels), Rim Size (13”–15” inch, 16”–18” inch, 19”–21” inch, and Above 21” inch), and Region (North America, Europe, Asia-Pacific, Latin America, and the Middle East and Africa).

By Material Type

The alloy segment held the largest share of the market. The aluminum segment is expected to grow at a rapid pace during the forecast period. With the future commercialization of the wheels, the market is expected to be driven by the increasing applicability of various material types in dynamic environments. However, the high maintenance and replacement costs of carbon wheels are expected to drive alloy material market growth. Alloy wheels have become popular over the years due to their shape and performance. As the automotive industry focuses on energy savings, wheel manufacturers are focusing on lightweight design. These wheels are made of aluminum, carbon fiber, and steel; additionally, material prices influence the economic scenario of the aftermarket.

By Rim Size

The market has been divided into three sections based on rim size 13 to 19 inches, 19 to 21 inches, and 21 inches and above. The 13-19 inches held the largest market share. The market is expected to grow significantly in the 21-inch and above segment. Because of the rapidly increasing adoption of designed wheels with large rim sizes, the Asia-Pacific regional market is expected to grow rapidly over the forecast period. The market is expected to be driven by the rising ASEAN and China markets, which have the largest distribution network for alloy wheel rims. The rising trend of larger rim size is expected to increase demand for 19 to 21 and 21 size rims. These rim sizes vary.

Get more details on this report -

SEGMENTATION: BY REGION

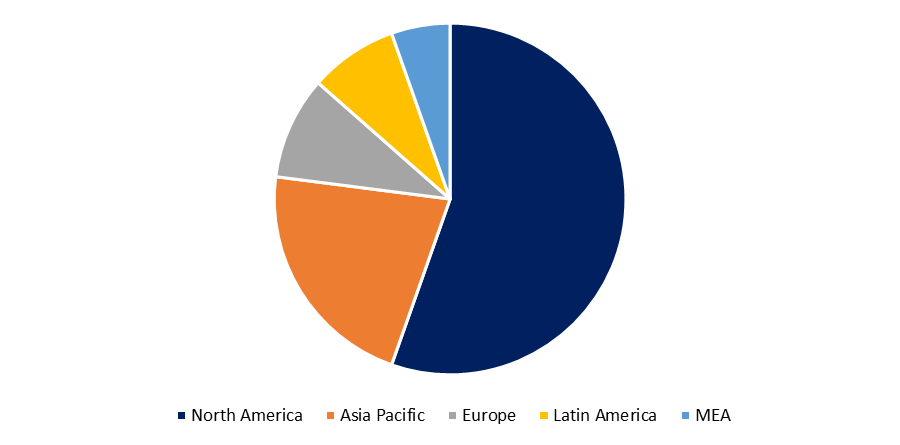

Based on the Region, the Global Automotive Wheels Aftermarket Market is categorized into North America, Europe, Asia-Pacific, Latin America, the Middle East and Africa.

North America region is dominating share of the global Automotive Wheels Aftermarket market due to the increasing adoption of luxury wheels in various passenger car segments. The recent rising trend of aluminum vehicles in low commercial vehicles in the North America Region are rising sales of passenger cars with changing consumer preferences and increasing proliferation of hybrid electric automobile models. Rising stringent vehicle efficiency norms in the North America region also dominates the automotive wheels aftermarket market.

The Asia Pacific region's industry growth is being driven by rising demand in emerging economies such as India, Japan, and China. Favorable government regulations and a growing automotive industry are also major factors driving the growth of the Asia-Pacific wheels aftermarket. Low labor costs and economic production conditions in Asian countries are also among the factors driving the aftermarket's current growth. The emerging trend for high-end brand wheels that are both high-performance and affordable is also expected to drive market growth in the coming years.

AUTOMOTIVE WHEELS AFTERMARKET MARKET: KEY PLAYERS

- Iochpe-Maxion

- Citic Dicastal Wheel Manufacturing

- Hitachi Metals

- Steel Strips Wheels

- American Eagle Wheels

- Superior Industries

- Cln Group

- Borbet

- Topy Industries

- Accuride Corporation.

- Others

AUTOMOTIVE WHEELS AFTERMARKET MARKET: RECENT DEVELOPMENT

- November 2021- Maxion Wheels announced the use of Digital Twin technology to create a virtual duplicate of its Limeira, Brazil, light vehicle aluminum wheel production plant. Maxion Wheels can use the technology to predict and plan how the plant will operate under various conditions in order to improve efficiency. It intends to eventually roll out the technology to its other plants around the world.

- February 2022- Ronal Group has signed a Memorandum of Understanding (MoU) with Eccomelt, a company that manufactures secondary aluminum from used tires. The Ronal Group secured a preferential supply of Eccomelt's post-consumer material, which has an extremely low carbon footprint, by signing this MoU.

AUTOMOTIVE WHEELS AFTERMARKET MARKET: REPORT OVERVIEW

The scope of the report includes a detailed study of regional markets for Global Automotive Wheels Aftermarket Market. The Global Automotive Wheels Aftermarket Market is segmented by Vehicle Type, Aftermarket Type, Material Type, Product Type, Rim Size, and Region. It reveals the market situation and future forecast. The study also covers the significant data presented with the help of graphs and tables. The report covers information regarding the competitive outlook including the market share and company profiles of the key participants operating in the Global Automotive Wheels Aftermarket Market.

SEGMENTATION

By Vehicle Type

- Passenger Cars

- Commercial Vehicles

By Aftermarket Type

- New Wheel Replacement

- Refurbished Wheel Fitment

By Material Type

- Alloy

- Steel

- Others

By Product Type

- Regular Wheels

- High-Performance Wheels

By Rim Size

- 13”–15” inch

- 16”–18” inch

- 19”–21” inch

- Above 21” inch

By Region

- North America- U.S., Mexico, Canada

- Europe- UK, France, Germany, Italy, Spain, Rest of Europe

- Asia-Pacific- China, Japan, India, South Korea, Rest of Asia Pacific

- South America- Brazil, Argentina, Colombia, Rest of South America

- The Middle East and Africa- GCC, South Africa, Rest of Middle East & Africa

Need help to buy this report?