Global Automotive Wire and Cable Materials Market Size, Share, and COVID-19 Impact Analysis, By Product Type (PVC, XLPE, TPU, PPE, and Others), By Vehicle Type (Passenger Vehicles, LCV, and HCV), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: Advanced MaterialsGlobal Automotive Wire and Cable Materials Market Insights Forecasts to 2033

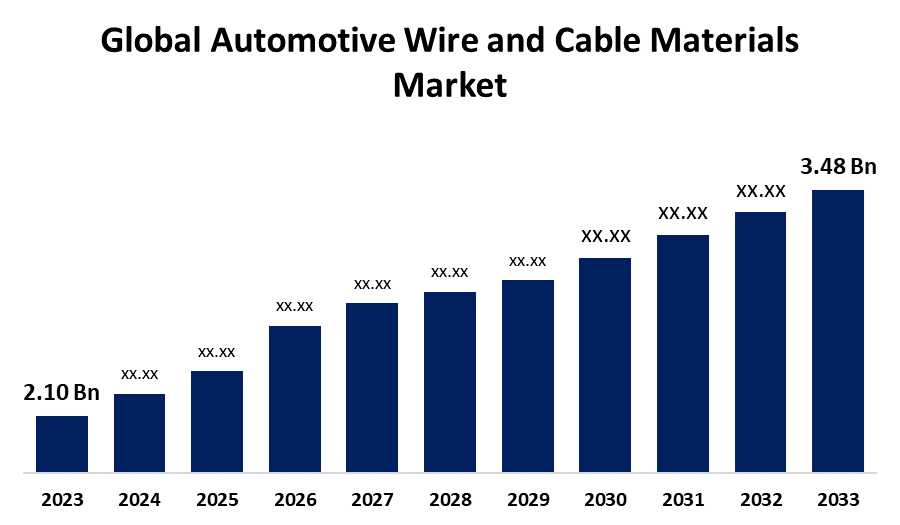

- The Global Automotive Wire and Cable Materials Market Size was Valued at USD 2.10 Billion in 2023

- The Market Size is Growing at a CAGR of 5.18% from 2023 to 2033

- The Worldwide Automotive Wire and Cable Materials Market Size is Expected to Reach USD 3.48 Billion by 2033

- North America is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Automotive Wire and Cable Materials Market Size is Anticipated to Exceed USD 3.48 Billion by 2033, Growing at a CAGR of 5.18% from 2023 to 2033.

Market Overview

Automotive wire and cable materials refer to the various components used in the making an electrical wiring systems within vehicles. These materials are chosen based on their electrical properties, mechanical durability, and ability to resist environments typically found in automotive applications. Commonly used materials in wire and cable are insulation material (PVC, XLPE, PP, others), copper, and aluminum. The performance and operation of numerous electrical and electronic components found in cars depend heavily on automotive wire and cable materials. The automotive industry is changing quickly because of new technical developments and in-vehicle innovations. These developments have also been influenced by the automobile industry's voluntary environmental commitments and stricter safety regulations. High-temperature automotive wires and cables are currently necessary parts in the automotive industry. Wires and cables are necessary for the operation of the engine, gearbox, brakes, lighting, air conditioners, seat heaters, and several dashboard applications including the fuel meter and speedometer. The demand for automotive safety systems and the growth of electronic components used in automobiles are the main drivers of the automotive wire and cable market.

Report Coverage

This research report categorizes the market for automotive wire and cable materials market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the automotive wire and cable materials market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the automotive wire and cable materials market.

Global Automotive Wire and Cable Materials Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 2.10 Billion |

| Forecast Period: | 2023 to 2033 |

| Forecast Period CAGR 2023 to 2033 : | 5.18% |

| 2033 Value Projection: | USD 3.48 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 95 |

| Segments covered: | By Product Type, By Vehicle Type, By Region and COVID-19 Impact Analysis |

| Companies covered:: | Leoni AG, Sumitomo Electric Industry Ltd., Lear Corporation, Allied Wire & Cable Inc., Yazaki Corporation, Delphi Automotive PLC, Draka Holding N.V., ITC Thermo Cable GmbH, Coroplast Fritz Müller GmbH & Co. KG, Coficab Tunisie SA, Dow Inc., Furukawa Electric Co., Ltd., and other key vendors |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growing adoption of electric vehicles is predicted to drive the demand for high-temperature automotive wire and cable materials. Electric vehicles (EVs) rely extensively on wire and cable networks as the electronics landscape for electric cars evolves, and this reliance has risen as a result of technical advancements in the automotive industry. Technological innovations are incorporated into automobiles to make them safer, and more user-friendly, and to allow for the addition of features that increase their value and use for car owners. The development of digital technology is enabling the use of autonomous driving and accident avoidance in automobiles. Additionally helping drivers to maintain control of their car while driving are the anti-lock braking system and traction control. As a result, the demand for automotive wire and cables has greatly increased for automotive wire and cable materials.

Restraining Factors

The automotive wire and cable materials market faces several challenges that can hinder its growth including fluctuating raw material prices, stringent regulatory requirements, and technological advancements demanding higher performance standards. Intense competition, potential for substitution by alternative materials, and supply chain complexities further complicate the landscape.

Market Segmentation

The automotive wire and cable materials market share is classified into product type and vehicle type.

- The PVC segment is estimated to hold the highest market revenue share through the projected period.

Based on the product type, the automotive wire and cable materials market is classified into PVC, XLPE, TPU, PPE, and others. Among these, the PVC segment is estimated to hold the highest market revenue share through the projected period. Vinyl and chloride are polymerized to create Polyvinyl Chloride (PVC), a synthetic thermoplastic substance. The most popular product categories are PVC wire and cable insulation materials because of their advantageous physical attributes and broad temperature range of use. PVC is perfect for cars, trucks, trailers, marine, construction, and many other vehicle electrical connections because of its extremely strong insulation that is resistant to oil, grease, and acids. PVC is crucial for shock-absorbing auto parts like "soft" dashboards that lessen impact-related injuries. While PVC-coated fabrics are frequently employed in life-saving car airbags, their fire-retardant qualities also add to a vehicle's overall safety.

The passenger vehicles segment is anticipated to hold the largest market share through the forecast period.

Based on the vehicle type, the automotive wire and cable materials market is divided into passenger vehicles, LCV, and HCV. Among these, the passenger vehicles segment is anticipated to hold the largest market share through the forecast period. The passenger vehicle demand is attributed due to customer demand, rising disposable income, and increasing population. Furthermore, more complex electrical systems, such as those for entertainment, safety, and comfort features, are driving passenger vehicle segment growth. The rising popularity of passenger vehicles also increases the need for certain wire and cable materials that can withstand greater voltage and current specifications.

Regional Segment Analysis of the Automotive Wire and Cable Materials Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the automotive wire and cable materials market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the automotive wire and cable materials market over the predicted timeframe. The Asia Pacific region is attributed to the expansion of end-use industries such as cars, electronics, and automotive. Demand will be significantly impacted by the introduction of car safety laws and the growing emphasis on functionality and safety. The region is a hub for automotive production, with countries like China, Japan, South Korea, and India experiencing robust growth in vehicle manufacturing. The increasing adoption of electric vehicles (EVs) in countries like China is also a significant driver, as EVs require extensive wiring and specialized materials. The effort of locally-owned automakers co-funded car factories, and foreign wire harness manufacturers take advantage of the lucrative Chinese market by purchasing or forming wholly-owned businesses or joint ventures with local firms. Moreover, the region benefits from technological advancements and a strong focus on cost-effective manufacturing processes, enhancing its competitive edge in the market. Additionally, supportive government initiatives and investments in automotive infrastructure further bolster Asia Pacific's position as a key player in the automotive wire and cable materials market

Bottom of Form

North America is expected to grow at the fastest CAGR growth of the automotive wire and cable materials market during the forecast period. The automobile industry's technical developments, the rising popularity of electric automobiles (EVs), and strict laws relating to pollution and vehicle safety are some of the reasons driving this growth. Furthermore, the region's fast expansion in this market segment is attributed to North America's strong automotive manufacturing industry and the presence of significant market players driving the growth of the automotive wire and cable materials market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the automotive wire and cable materials market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Leoni AG

- Sumitomo Electric Industry Ltd.

- Lear Corporation

- Allied Wire & Cable Inc.

- Yazaki Corporation

- Delphi Automotive PLC

- Draka Holding N.V.

- ITC Thermo Cable GmbH

- Coroplast Fritz Müller GmbH & Co. KG

- Coficab Tunisie SA

- Dow Inc.

- Furukawa Electric Co., Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In July 2024, Dow announced at the German Rubber Conference (DKT) 2024 the launch of NORDELREN Ethylene Propylene Diene Terpolymers (EPDM), a bio-based variant of Dow’s EPDM rubber material. This rubber material is used in automotive, infrastructure, and consumer applications.

- In October 2023, Sumitomo Electric Industries, Ltd. established Judd Wire Mexico, S.A. de C.V. (JMEX), a subsidiary focused on the manufacturing of tab leads for automotive lithium-ion batteries, as well as high-functionality and high heat-resistant electric wires.

- In May 2022, Leoni AG and Stark Corporation Public Company Limited entered into a contract to sell the Wire & Cable Solutions (WCS) Division's Business Group Automotive Cable Solutions.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the automotive wire and cable materials market based on the below-mentioned segments:

Global Automotive Wire and Cable Materials Market, By Product Type

- PVC

- XLPE

- TPU

- PPE

- Others

Global Automotive Wire and Cable Materials Market, By Vehicle Type

- Passenger Vehicles

- LCV

- HCV

Global Automotive Wire and Cable Materials Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the automotive wire and cable materials market over the forecast period?The automotive wire and cable materials market is projected to expand at a CAGR of 5.18% during the forecast period.

-

2. What is the market size of the automotive wire and cable materials market?The Global Automotive Wire and Cable Materials Market Size is Expected to Grow from USD 2.10 Billion in 2023 to USD 3.48 Billion by 2033, at a CAGR of 5.18% during the forecast period 2023-2033.

-

3. Which region holds the largest share of the automotive wire and cable materials market?Asia Pacific is anticipated to hold the largest share of the automotive wire and cable materials market over the predicted timeframe.

Need help to buy this report?