Global Autonomous Farm Equipment Market Size, Share, and COVID-19 Impact Analysis, By Technology (Partially Autonomous, Fully Autonomous), By Product Type (Harvesters, Tractors, Unmanned Aerial Vehicles (UAVs), and Others), By Application (Horticulture, Agriculture, Animal Husbandry, Forestry, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 - 2032

Industry: AgricultureGlobal Autonomous Farm Equipment Market Insights Forecasts to 2032

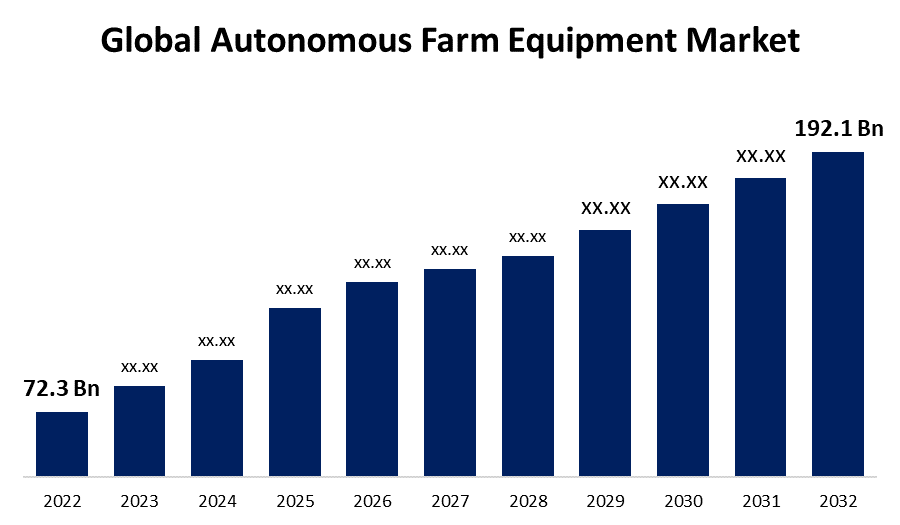

- The Global Autonomous Farm Equipment Market Size was valued at USD 72.3 Billion in 2022.

- The Market is Growing at a CAGR of 10.2% from 2022 to 2032

- The Worldwide Autonomous Farm Equipment Market Size is expected to reach USD 192.1 Billion by 2032

- Asia Pacific is expected to grow the fastest during the forecast period

Get more details on this report -

The Global Autonomous Farm Equipment Market is projected to exceed USD 192.1 Billion by 2032, growing at a CAGR of 10.2% from 2022 to 2032. The use of autonomous equipment in cultivating land processes such as harvesting, seed sowing, fertilization, and scarifying is one of the market's major driving factors. Partially, autonomous equipment reduces human effort by assisting the driver in specific actions. While autonomous equipment is driverless, numerous software and hardware components completely replace the driver. These are the primary factors expected to drive the Global Autonomous Farm Equipment Market during the forecast period.

Market Overview

The autonomous farm equipment includes agricultural, horticultural, animal husbandry, and forestry equipment. Autonomous farming is the modelling and regulation of agricultural machinery within a unified framework. To achieve agronomy-based targets, these technologies for agriculture make use of the on-farm sensing and control power of automated farming equipment.

The global autonomous farm equipment market is a rapidly growing industry that is transforming the agriculture sector by revolutionizing traditional farming practices. Autonomous farm equipment uses advanced technologies such as artificial intelligence (AI), sensors, and GPS to enable machines to operate independently with minimal human intervention. The market is primarily driven by the increasing demand for food due to the growing global population, the need to increase agricultural productivity, and the shortage of skilled labor in the farming sector. Autonomous farm equipment offers several benefits such as reduced labor costs, increased efficiency, and improved crop yields, making it an attractive investment for farmers.

Key players in the autonomous farm equipment market include AGCO Corporation, Verdant Robotics, John Deere, CNH Industrial N.V., and Kubota Corporation. These companies are investing heavily in research and development to improve the capabilities of autonomous farm equipment and expand their product portfolio to meet the evolving needs of farmers.

For instance, Verdant Robotics, a US-based robotics system manufacturer, developed its robot-as-a-service (RaaS) model in February 2022 with autonomous farm robots that include artificial intelligence, computer vision, GPS (global positioning system)-denied navigation, robotics, chemistry, and soil as well as plant sciences to accomplish the next phase of crop production.

Report Coverage

This research report categorizes the market for the global autonomous farm equipment market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the autonomous farm equipment market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the autonomous farm equipment market.

Global Autonomous Farm Equipment Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 72.3 Billion |

| Forecast Period: | 2022 – 2032 |

| Forecast Period CAGR 2022 – 2032 : | 10.2% |

| 022 – 2032 Value Projection: | USD 192.1 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Technology, By Product Type, By Application and By Regio. |

| Companies covered:: | Bobcat, Autonomous Solutions, Clearpath Robotics, Agrobot, New Holland, Case IH, John Deere, AGCO Corporation, Yanmar, ClaasKGaA GmbH, Iseki & Co., Kubota, Kinze Manufacturing, Energid, Deutz-Fahr, Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The farming industry is facing a shortage of skilled labor, particularly in developed countries. The average age of farmers is increasing, and younger generations are less interested in pursuing careers in agriculture. This shortage of skilled labor is driving the need for autonomous farm equipment, which can help to reduce the reliance on human labor and improve efficiency. Autonomous equipment can perform tasks such as planting, harvesting, and monitoring crops, reducing the need for manual labor and allowing farmers to operate more efficiently with fewer workers.

The rapid advancement of technology is driving innovation in the agriculture sector, including the development of autonomous farm equipment. Advances in artificial intelligence, sensors, and GPS technology have enabled machines to operate independently with minimal human intervention, increasing efficiency and reducing costs. The use of autonomous equipment also allows farmers to collect and analyze data on crop health, soil conditions, and weather patterns, leading to more informed decision-making and improved crop yields.

Governments around the world are promoting the adoption of autonomous farm equipment as part of their efforts to promote sustainable agriculture practices. This includes initiatives such as subsidies and incentives for farmers to invest in new technologies that can help to increase productivity while reducing the environmental impact of farming. Government support is a key driver of the autonomous farm equipment market, as it can help to accelerate adoption and reduce the financial risk for farmers who invest in new technology. These are the primary drivers projected to influence the global autonomous farm equipment market in the coming years.

Restraining Factors

The initial investment cost of autonomous farm equipment is typically higher than that of traditional farm equipment. This high cost can be a barrier to entry for farmers, particularly small farmers who may not have the resources to invest in new technology. The high initial investment cost can also lead to longer payback periods, which may make it difficult for farmers to justify the investment in the short term. Many farmers may be unaware of the benefits of autonomous farm equipment or may not fully understand how it works. This lack of awareness and understanding can be a barrier to adoption, as farmers may be hesitant to invest in new technology that they are not familiar with. Education and training initiatives can help to address this issue, but they require time and resources to implement effectively.

Market Segmentation

The Global Autonomous Farm Equipment Market share is classified into technology, product type, and application.

- The partially autonomous segment is anticipated to hold the largest share of the global autonomous farm equipment market during the forecast period.

Based on the technology, the global autonomous farm equipment market is segmented into partially autonomous and fully autonomous. Among these, the partially autonomous segment is anticipated to hold the largest share of the global autonomous farm equipment market during the forecast period. The expansion can be attributed to the farm equipment that is partially autonomous is designed to operate with some human intervention. These machines may be equipped with sensors and software that enable them to perform specific tasks autonomously, such as planting or spraying crops, but still require human oversight and control. Partially autonomous equipment can provide farmers with increased efficiency and productivity, but they may not be as flexible or versatile as fully autonomous equipment.

- The tractors segment is expected to hold the largest share of the global autonomous farm equipment market over the study period.

On the basis of product type, the global autonomous farm equipment market is segmented into harvesters, tractors, unmanned aerial vehicles (UAVs), and others. Among these, the tractors segment is expected to hold the largest share of the global autonomous farm equipment market over the study period. The reason for the increase is, tractors are essential equipment for most farming operations, and the adoption of autonomous technology in tractors can significantly improve efficiency and productivity. Autonomous tractors are designed to perform tasks such as plowing, planting, and spraying crops without the need for human operators. These machines can use sensors and GPS technology to navigate fields, identify obstacles, and optimize planting and spraying patterns for greater efficiency and precision. Autonomous tractors can also be programmed to operate in fleets, allowing farmers to manage large fields or multiple crops at once.

- The agriculture segment is anticipated to hold the largest share of the global autonomous farm equipment market over the projected period.

Based on the application, the global autonomous farm equipment market is segmented into horticulture, agriculture, animal husbandry, forestry, and others. Among these, the agriculture segment is anticipated to hold the largest share of the global autonomous farm equipment market over the projected period. The growth can be attributed due to the agriculture is the largest sector of the global economy and the demand for food and agricultural products continues to grow. The agriculture segment of the autonomous farm equipment market includes equipment designed for the cultivation of crops such as grains, oilseeds, and pulses. This equipment includes autonomous tractors, drones for crop monitoring, and precision irrigation systems. The adoption of autonomous technology in agriculture can help farmers optimize their crop yields, reduce labor costs, and improve resource efficiency. Additionally, advances in GPS and sensor technology have made it easier and more cost-effective for farmers to retrofit their existing equipment with autonomous capabilities.

Regional Segment Analysis of the Autonomous Farm Equipment Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

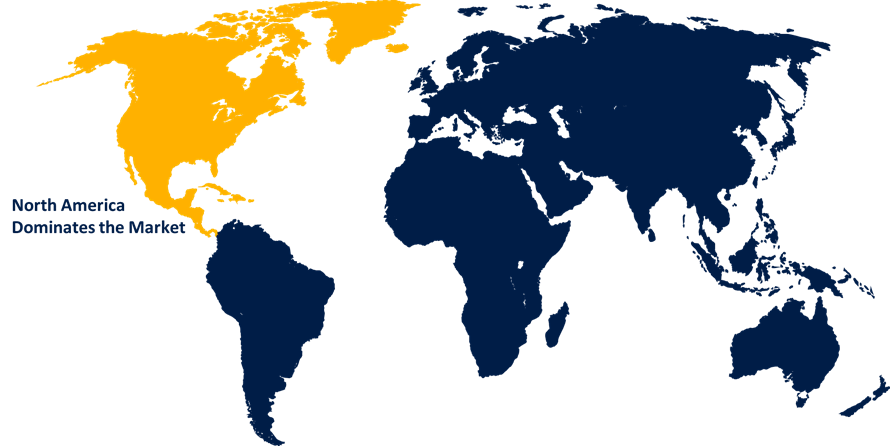

North America is estimated to hold the largest share of the autonomous farm equipment market during the predicted timeframe.

Get more details on this report -

North America is estimated to hold the largest share of the global autonomous farm equipment market during the predicted timeframe. The growth is primarily driven by the increasing adoption of precision agriculture practices and the presence of major agricultural equipment manufacturers in the region. The United States and Canada are the key markets for autonomous farm equipment in North America, with a focus on equipment for crop cultivation, such as autonomous tractors and drones for crop monitoring. The high adoption rate of advanced technologies in the agricultural sector and the presence of major autonomous equipment manufacturers in the region are some of the key factors driving the market growth.

The Asia Pacific market for autonomous farm equipment is expected to grow at the fastest rate during the forecast period, driven by the increasing adoption of precision agriculture practices and the rising demand for food and agricultural products in the region. The key markets for autonomous farm equipment in the Asia Pacific are China, India, Japan, and Australia, with a focus on equipment for crop cultivation and animal husbandry. China is one of the largest markets for autonomous farm equipment in the Asia Pacific region, driven by the government's initiatives to promote sustainable agriculture practices and the increasing adoption of advanced farming technologies by farmers. The country has a large agricultural sector, and the adoption of autonomous farm equipment is expected to help farmers improve their crop yields and reduce labor costs.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global autonomous farm equipment along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Bobcat

- Autonomous Solutions

- Clearpath Robotics

- Agrobot

- New Holland

- Case IH

- John Deere

- AGCO Corporation

- Yanmar

- ClaasKGaA GmbH

- Iseki & Co.

- Kubota

- Kinze Manufacturing

- Energid

- Deutz-Fahr

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In March 2023, Ouster & Fieldin Announces the Largest Retrofit Autonomy Kit Deployment for Autonomous Tractors.

- In December 2022, CNH has released numerous new autonomous features for its equipment, as well as a full-electric tractor with autonomous capabilities, to help farmers enhance their yields.

- In October 2022, John Deere has announced the release of fully autonomous tractors.At CES 2022, John Deere unveiled a fully autonomous version of its 8R tractor that is ready for mass production.

- In August 2022, The Case IH Trident 5550 applicator with Raven Autonomy was introduced by Case IH and its company partner Raven as the first autonomous spreader. The new machine appears less than a year after Case IH corporate parent CNH Industrial completed its purchase of Raven Industries, indicating the new machine's rapid development.

- In August 2021, Bear Flag Robotics was acquired for $250 million by John Deere, a US-based manufacturer of agricultural, construction, and forestry machinery. John Deere intends to strengthen its position in the agricultural sector through this acquisition. Bear Flag Robotics is an autonomous tractor startup based in the United States.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2032. Spherical Insights has segmented the Global Autonomous Farm Equipment Market based on the below-mentioned segments:

Global Autonomous Farm Equipment Market, By Technology

- Partially Autonomous

- Fully Autonomous

Global Autonomous Farm Equipment Market, By Product Type

- Harvesters

- Tractors

- Unmanned Aerial Vehicles (UAVs)

- Others

Global Autonomous Farm Equipment Market, By Application

- Horticulture

- Agriculture

- Animal Husbandry

- Forestry

- Others

Global Autonomous Farm Equipment Market, By Region

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa.

Need help to buy this report?