Global Autonomous Mobile Robot Market Size, Share, and COVID-19 Impact Analysis, By Component (Hardware, Software, and Services), By Type (Goods-to-person picking robots, Self-driving Forklifts, Autonomous Inventory Robots, and Unmanned Aerial Vehicles), By Battery Type (Lead Battery, Lithium-Ion Battery, Nickel-based Battery, and Others), By End-Use (Manufacturing and Wholesale & Distribution), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 - 2032.

Industry: Semiconductors & ElectronicsGlobal Autonomous Mobile Robot Market Insights Forecasts to 2032

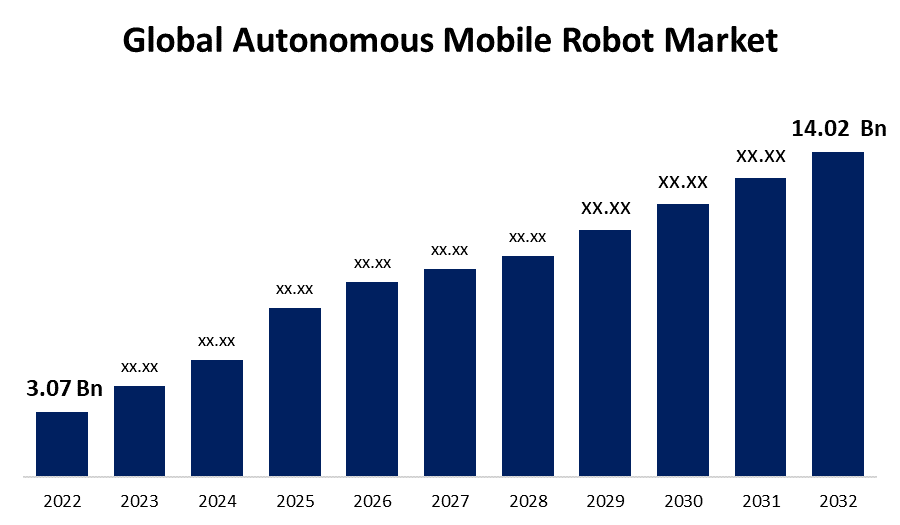

- The Autonomous Mobile Robot Market Size was valued at USD 3.07 Billion in 2022.

- The Market is Growing at a CAGR of 16.4% from 2022 to 2032

- The Worldwide Autonomous Mobile Robot Market Size is expected to reach USD 14.02 Billion by 2032

- Asia-Pacific is expected to Grow the fastest during the forecast period

Get more details on this report -

The Global Autonomous Mobile Robot Market Size is expected to reach USD 14.02 Billion by 2032, at a CAGR of 16.4% during the forecast period 2022 to 2032.

Market Overview

Autonomous mobile robots (AMRs) are self-guided robotic systems that can navigate and operate in various environments without human intervention. These robots employ a combination of sensors, algorithms, and artificial intelligence to perceive their surroundings, plan their movements, and execute tasks autonomously. AMRs are used in a wide range of industries including warehousing, logistics, manufacturing, and healthcare. They can perform tasks such as material handling, inventory management, and transportation, bringing increased efficiency, flexibility, and productivity to these sectors. By utilizing advanced technologies like computer vision, machine learning, and path planning algorithms, AMRs can adapt to dynamic environments, avoid obstacles, and collaborate with human workers, enabling a seamless and efficient workflow.

Report Coverage

This research report categorizes the market for autonomous mobile robot market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the autonomous mobile robot market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the autonomous mobile robot market.

Global Autonomous Mobile Robot Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 3.07 Billion |

| Forecast Period: | 2022 – 2032 |

| Forecast Period CAGR 2022 – 2032 : | 16.4% |

| 022 – 2032 Value Projection: | USD 14.02 Billion |

| Historical Data for: | 2019 - 2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Component, By Type, By Battery Type, By End-User, By Region. |

| Companies covered:: | ABB, Bleum, Boston Dynamics, Clearpath Robotics, Inc., GreyOrange, Harvest Automation, IAM Robotics, inVia Robotics, Inc., KUKA AG, Teradyne Inc., Conveyco Technologies, Geekplus Technology Co. Ltd., Locus Robotics, MHS Global, Omron Group. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

There are several drivers of the autonomous mobile robot (AMR) market. One of the primary drivers is the increasing demand for automation in various industries to improve efficiency and productivity. AMRs offer a flexible and cost-effective solution for material handling and logistics operations. Additionally, advancements in AI and robotics technology have led to the development of more sophisticated and capable AMRs. The rise of e-commerce has also fueled the demand for AMRs in warehouses and fulfillment centers. Moreover, the COVID-19 pandemic has further accelerated the adoption of automation, as companies look for ways to reduce the risk of infection and maintain social distancing. Finally, government initiatives to promote the use of robotics and automation in manufacturing and logistics are expected to further drive the growth of the AMR market.

Restraining Factors

While the autonomous mobile robot (AMR) market is growing rapidly, there are also some restraints to its adoption. One of the primary restraints is the high initial cost of AMR systems, which can be a barrier for small and medium-sized businesses. Additionally, concerns around cybersecurity and data privacy may hinder the widespread adoption of AMRs in sensitive environments. Another challenge is the need for specialized skills to operate and maintain AMRs, which could limit the pool of available talent. Finally, regulatory hurdles and legal uncertainties surrounding the use of AMRs may also pose a challenge to the growth of the market in some regions.

Market Segmentation

- In 2022, the hardware segment accounted for more than 63.4% market share

On the basis of components, the global autonomous mobile robot market is segmented into hardware, software, and services. The hardware segment is dominating with the largest market share in 2022, due to the crucial role hardware plays in the functioning of AMRs, encompassing sensors, cameras, LiDAR, processors, and other essential components. The hardware enables the perception, navigation, and execution capabilities of AMRs, making it a critical driver of their autonomy and effectiveness. As the demand for AMRs continues to rise across various industries, the hardware segment is expected to maintain its leading position in driving the growth and advancements of the AMR market.

- In 2022, the manufacturing segment dominated the market with around 75.6% revenue share

Based on end-use, the global autonomous mobile robot market is segmented into manufacturing and wholesale & distribution. Out of this, the manufacturing is dominating the market with the largest market share in 2022. This is primarily due to the increasing adoption of these robots in manufacturing facilities to automate material handling, logistics, and assembly processes. They offer enhanced efficiency, flexibility, and safety in manufacturing operations, leading to improved productivity and cost savings. The manufacturing sector's focus on achieving higher operational efficiency and reducing labor costs has driven the demand for autonomous robots. As a result, the manufacturing segment is at the forefront of driving the growth and development of the market during the forecast period.

Regional Segment Analysis of the Autonomous Mobile Robot Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

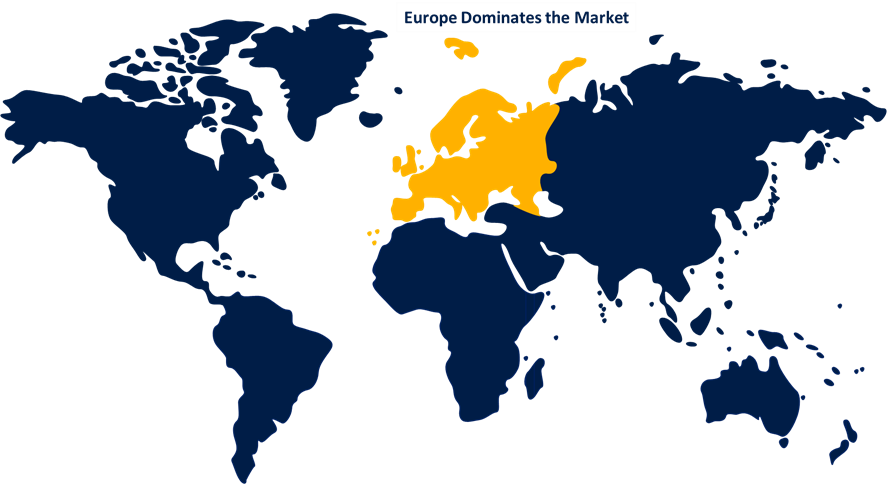

Europe dominated the market with more than 30.5% revenue share in 2022.

Get more details on this report -

Based on region, Europe is currently the largest market for Autonomous Mobile Robots (AMRs) due to several factors. One of the key drivers is the region's strong industrial base, particularly in sectors such as automotive, aerospace, and manufacturing. These industries are increasingly adopting automation technologies to improve productivity and efficiency, which has led to a high demand for AMRs. Moreover, the region's favorable regulatory environment, which promotes the adoption of advanced technologies, has further boosted the growth of the AMR market. Additionally, the presence of several leading AMR manufacturers in Europe has also contributed to the region's dominance in the market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global autonomous mobile robot market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Companies:

- ABB

- Bleum

- Boston Dynamics

- Clearpath Robotics, Inc.

- GreyOrange

- Harvest Automation

- IAM Robotics

- inVia Robotics, Inc.

- KUKA AG

- Teradyne Inc.

- Conveyco Technologies

- Geekplus Technology Co. Ltd.

- Locus Robotics

- MHS Global

- Omron Group

Key Target Audience

- Market Players

- Investors

- End-Users

- Government Authorities

- Consulting and Research Firm

- Venture Capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In July 2022, GXO Logistics, a contract logistics provider, and 6 River Systems announced a global deal to work together for several years. The partnership will enable them to fulfill the requirements for Collaborative Mobile Robots (CMRs) in their logistics operations across Europe and the U.S.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2019 to 2032. Spherical Insights has segmented the global autonomous mobile robot market based on the below-mentioned segments:

Autonomous Mobile Robot Market, By Component

- Hardware

- Software

- Services

Autonomous Mobile Robot Market, By Type

- Goods-to-person picking robots

- Self-driving Forklifts

- Autonomous Inventory Robots

- Unmanned Aerial Vehicles

Autonomous Mobile Robot Market, By Battery Type

- Lead Battery

- Lithium-Ion Battery

- Nickel-based Battery

- Others

Autonomous Mobile Robot Market, By End-Use

- Manufacturing

- Wholesale & Distribution

Autonomous Mobile Robot Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Need help to buy this report?