Global Autonomous Warehouse Robot Market Size, Share, and COVID-19 Impact Analysis, By Type (Autonomous Mobile Robots (AMRs), Automated Guided Vehicles (AGVs), and Robotic Arms), By End-Use Industry (E-commerce, Retail, Automotive, and Healthcare), and By Region (North America, Europe, Asia Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Semiconductors & ElectronicsGlobal Autonomous Warehouse Robot Market Insights Forecasts to 2033

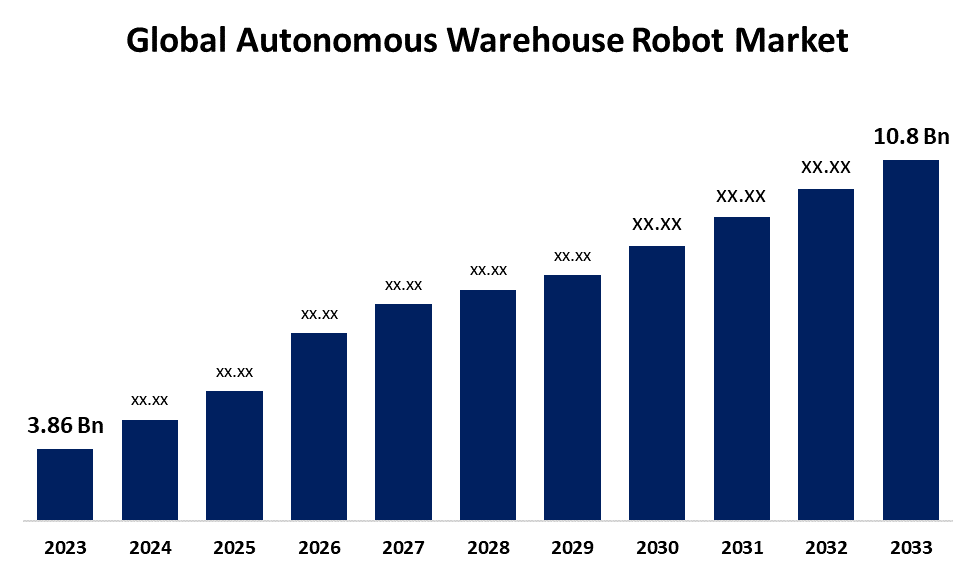

- The Global Autonomous Warehouse Robot Market Size was Valued at USD 3.86 Billion in 2023

- The Market Size is Growing at a CAGR of 10.84 % from 2023 to 2033

- The Worldwide Autonomous Warehouse Robot Market Size is Expected to Reach USD 10.8 Billion by 2033

- North America is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Autonomous Warehouse Robot Market Size is Anticipated to Exceed USD 10.8 Billion by 2033, Growing at a CAGR of 10.84 % from 2023 to 2033. The global autonomous warehouse robot market has seen rapid growth over the years mainly based on surging e-commerce and technology, particularly AI and robotics. The main regions driven by industrial demand are Asia Pacific and other regions. Asian Pacific leads because of increased AMRs and retail logistics, which is thereby boosting adoption despite high costs.

Market Overview

The autonomous warehouse robot refers to developing and deploying robotic systems that will operate independently in warehouses to take on tasks like picking, sorting, and goods transportation. Basic growth factors are the rapid adoption of e-commerce and demand for improved warehouse efficiency, along with advancements in artificial intelligence and machine learning. Companies are increasingly turning to automation to meet their high-speed order fulfilment requirements, eliminate labour costs, and eradicate errors. Key regions such as North America and Asia-Pacific are leaders in technology adoption, which further drives the market to robust expansion. Furthermore, product launches and partnerships aiming at improved operational efficiency in order to counter workforce issues related to logistics have lately spurred massive growth in the Autonomous Warehouse Robot market around the globe. Growth in e-commerce, increasing labour costs, and demands for faster deliveries drive the expansion mainly within the retail, healthcare, and automotive sectors.

Companies, like Toyota Industries and KION Group, have also come up with automated forklifts that speed up material handling with higher precision. Other companies, like Omron Corporation, have come up with robots with a payload capacity that is higher than ever to meet the needs of various industries that require high-strength automation for larger goods. These innovations in mobile and collaborative robots position autonomous robots as crucial tools for productivity and fulfilment speed in warehouses, creating a sustainable framework for future logistics.

Opportunities and Trends in the Autonomous Warehouse Robot Market:

Trends in the autonomous warehouse robot market include AI-powered automation, faster order fulfilment, and the rise of AMRs to reduce manual handling. Opportunities in this market will be expansion in e-commerce applications, increased demand for enhanced logistics efficiency, and regional growth in Asia-Pacific driven by industrial automation. The robots can also be customized as the need arises to suit industry-specific needs in warehousing.

Challenges in the Market for the Autonomous Warehouse Robot Market:

The autonomous warehouse robot market has several issues. Among them are high costs to set up, intricate integration with the existing systems, and skilled labour in the management and maintenance of robotic fleets. Interoperability and security as well as data privacy are also the factors that add complexity to its widespread implementation.

Report Coverage

This research report categorizes the global autonomous warehouse robot market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global autonomous warehouse robot market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global autonomous warehouse robot market.

Global Autonomous Warehouse Robot Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 3.86 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 10.84% |

| 2033 Value Projection: | USD 10.8 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 228 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By End-Use Industry, By Region |

| Companies covered:: | Amazon Robotics, KUKA AG, Fetch Robotics, Locus Robotics, GreyOrange, Geek+ Inc., Swisslog Holding AG, Clearpath Robotics, IAM Robotics, Seegrid Corporation, 6 River Systems, Vecna Robotics, and Others. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

Major growth drivers for the autonomous warehouse robot market include better efficiency in operations in warehouses, increased e-commerce activities, and smart factories. Advances in AI and machine learning, in conjunction with steadily declining prices for sensor technology, further improve the viability of robotics. This makes it increasingly feasible for large and mid-sized companies to become adopters of autonomous robots in pursuit of the demands for faster order fulfilment and lower operational costs. Additionally, companies like Geek+ and KUKA have integrated more complex AI algorithms that make their robots capable of working in difficult environments, dynamically adapting to changing inventories, lessening the demand for labour, and increasing productivity.

E-commerce Growth and Demand for Faster Fulfillment:

The increase in global e-commerce volumes is forcing companies like Amazon and Walmart to invest in warehouse automation to efficiently process higher volumes of orders. In this regard, Amazon has recently partnered with Covariant for AI-powered robotic systems to meet these demands and improve picking accuracy and speed.

Restraining Factors

Restraining factors in the autonomous warehouse robot market include high initial costs in the range of hundreds of thousands to millions of dollars and also integration difficulties with legacy systems. These are some of the factors together with data security concerns which are slowing adoption, particularly in warehouses that have outdated infrastructure.

Market Segmentation

The global autonomous warehouse robot market share is classified into type and end-use industry.

- The autonomous mobile robots (AMRs) segment is expected to hold the largest share of the global autonomous warehouse robot market during the forecast period.

Based on type, the global autonomous warehouse robot market is categorized as autonomous mobile robots (AMRs), automated guided vehicles (AGVs), and robotic arms. Among these, the autonomous mobile robots (AMRs) segment is expected to hold the largest share of the global autonomous warehouse robot market during the forecast period. This growth is driven by versatility, such as the ability of the AMR to deal with multiple tasks- material handling, picking orders, and transportation-all making them usable in multiple industries. Compared to other warehouse equipment, AMRs are more robust and adaptive to dynamic warehouses, hence improving operational flexibility and efficiency. The surge in e-commerce fulfilment where speed and accuracy are called for and the emergence of smart warehouses also contribute to the adoption of AMRs.

- The e-commerce segment is expected to grow at the fastest CAGR during the forecast period.

Based on the end-use industry, the global autonomous warehouse robot market is categorized as e-commerce, retail, automotive, and healthcare. Among these, the e-commerce segment is expected to grow at the fastest CAGR during the forecast period. This sector is growing because of the rising demand for fast and efficient order fulfilment and inventory management in online retail. E-commerce companies have been increasingly adopting autonomous mobile robots (AMRs) to streamline operations, cut costs, and meet increasingly high customer expectations for rapid delivery. Growth in this trend is driven by the global e-commerce market, especially in the North American and Asia-Pacific regions.

Regional Segment Analysis of the Global Autonomous Warehouse Robot Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is projected to hold the largest share of the global autonomous warehouse robot market over the forecast period.

Get more details on this report -

Asia Pacific is projected to hold the largest share of the global autonomous warehouse robot market over the forecast period. Growth has been induced due to rapid uptake in automation among countries such as China, Japan, and South Korea, primarily on account of industrialization, increasing e-commerce activities, and government programs focused on encouraging robotics innovation. Furthermore, a strong manufacturing base coupled with increasing investment in logistics automation further strengthens its market position. Moreover, JD.com was the leading warehouse automation company, using AMRs for its fulfilment centers to fuel efficiency and to keep abreast of growing e-commerce demand. This is consistent with the overall trend to automate logistics in China. Giants such as Panasonic and Toyota have been making huge strides in robotics to automate forklifts and automated systems in warehouses, useful in overcoming labor shortages to increase efficiency. Furthermore, South Korea was a strong manufacturing country that had major players like LG Electronics increasingly applying AMRs to enable better inventory management and order pickings, thus driving its market.

North America is expected to grow at the fastest CAGR growth of the global autonomous warehouse robot market during the forecast period. The growing pace of e-commerce in the U.S. has led to greater demands for efficient, automated solutions that can handle heavy volumes of orders and improve the speed of fulfillment. The North American companies like Amazon and Walmart are spending big bucks on robotics to enhance warehouse operations. For instance, leadership in the region is shown by its acceptance of advanced technologies, including Amazon's collaboration with Covariant to advance AI-powered robots. Also, labour shortages in logistics and warehouses have created pressure for the implementation of automation for continuous smooth operations in the region.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global autonomous warehouse robot market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Amazon Robotics

- KUKA AG

- Fetch Robotics

- Locus Robotics

- GreyOrange

- Geek+ Inc.

- Swisslog Holding AG

- Clearpath Robotics

- IAM Robotics

- Seegrid Corporation

- 6 River Systems

- Vecna Robotics

- Others

Key Market Developments

- In October 2023, Amazon launched two new robots: Sequoia and Digit. Sequoia is a combination of various robotic systems that can be used to make inventory storage and order fulfilment more efficient. Digit is a robot that collaborates with humans, ensuring greater safety and efficiency in warehouses.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global autonomous warehouse robot market based on the below-mentioned segments:

Global Autonomous Warehouse Robot Market, By Type

- Autonomous Mobile Robots (AMRs)

- Automated Guided Vehicles (AGVs)

- Robotic Arms

Global Autonomous Warehouse Robot Market, By End-Use Industry

- E-commerce

- Retail

- Automotive

- Healthcare

Global Autonomous Warehouse Robot Market, By Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the global autonomous warehouse robot market over the forecast period?The global autonomous warehouse robot market size is expected to grow from USD 3.86 Billion in 2023 to USD 10.8 Billion by 2033, at a CAGR of 10.84% during the forecast period 2023-2033.

-

2. Which region is expected to hold the highest share of the global autonomous warehouse robot market?Asia Pacific is projected to hold the largest share of the global autonomous warehouse robot market over the forecast period.

-

3. Who are the top key players in the global autonomous warehouse robot market?Amazon Robotics, KUKA AG, Fetch Robotics, Locus Robotics, GreyOrange, Geek+ Inc., Swisslog Holding AG, Clearpath Robotics, IAM Robotics, Seegrid Corporation, 6 River Systems, Vecna Robotics, and Others.

Need help to buy this report?