Global AVAS Market Size, Share, and COVID-19 Impact Analysis, By Vehicle (Passenger Cars, Commercial Vehicles, Two Wheelers), By Propulsion (BEVs, PHEVs, FCEVs), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Automotive & TransportationGlobal AVAS Market Insights Forecasts to 2033

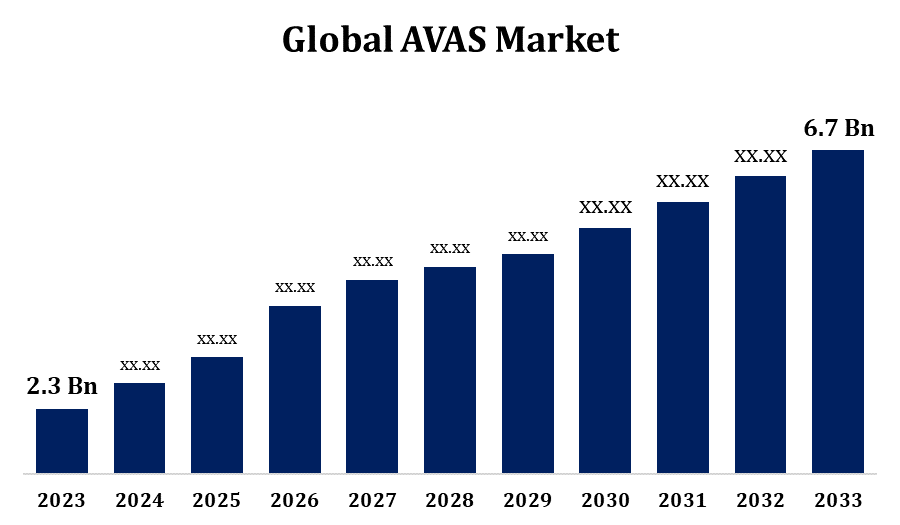

- The Global AVAS Market Size was valued at USD 2.3 Billion in 2023.

- The Market Size is growing at a CAGR of 11.28% from 2023 to 2033.

- The Worldwide AVAS Market Size is expected to reach USD 6.7 Billion By 2033.

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

The Global AVAS Market Size is expected to reach USD 6.7 Billion By 2033, at a CAGR of 11.28% during the forecast period 2023 to 2033.

The Acoustic Vehicle Alerting System (AVAS) market is experiencing significant growth driven by increasing safety regulations and the rise in electric vehicle (EV) adoption. AVAS is designed to enhance pedestrian safety by emitting sound at low speeds, alerting individuals to the presence of otherwise silent EVs. In response to global regulatory mandates, such as those from the European Union and the U.S., automakers are incorporating AVAS in their vehicles to comply with noise emission standards. Additionally, the growing demand for EVs and hybrid vehicles is accelerating AVAS market expansion. The market is also influenced by advancements in sound technology, offering more customizable and distinctive alert sounds. Key players are investing in research and development to meet both regulatory requirements and consumer preferences, ensuring sustained growth in the AVAS market.

AVAS Market Value Chain Analysis

The AVAS (Acoustic Vehicle Alerting System) market value chain involves several key stages, starting with raw material suppliers, providing components such as speakers, transducers, and microprocessors. These components are sourced by OEMs (Original Equipment Manufacturers) and suppliers who design and integrate the systems into electric and hybrid vehicles. Automakers then collaborate with AVAS solution providers to meet regulatory standards and enhance vehicle safety. Following integration, the finished AVAS-equipped vehicles are distributed through dealerships and sold to consumers. After-sales services, including maintenance and updates, also contribute to the value chain. Additionally, regulatory bodies play a crucial role by setting noise emission standards that drive demand for AVAS systems. The entire process is supported by continuous R&D to improve the system’s performance, customization, and compliance.

AVAS Market Opportunity Analysis

The AVAS (Acoustic Vehicle Alerting System) market presents substantial growth opportunities, fueled by the global surge in electric and hybrid vehicle adoption. As regulatory bodies enforce stricter noise emissions standards for EVs and hybrids, the demand for AVAS is increasing, particularly in regions like the EU and the U.S. The growing focus on pedestrian and cyclist safety offers an avenue for manufacturers to innovate with more customizable, distinct, and adaptive alert sounds. Additionally, the integration of AVAS into a broader range of vehicles, including public transport and two-wheelers, presents untapped market potential. Technological advancements, such as AI-driven sound generation and smart systems, offer opportunities to enhance the functionality and user experience. Companies investing in eco-friendly, low-energy AVAS solutions can also capitalize on the market's sustainability trends.

Global AVAS Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 2.3 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 11.28% |

| 2033 Value Projection: | USD 6.7 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 190 |

| Tables, Charts & Figures: | 165 |

| Segments covered: | By Vehicle, By Propulsion |

| Companies covered:: | Continental AG (Germany), Hella GMBH & CO. KGAA (Germany), Kendrion N. V. (Netherlands), Harman International (US), Denso Corporation (Japan), and other key companies. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

AVAS Market Dynamics

Rising regulatory mandates requiring the installation of AVAS in electric and hybrid vehicles

The AVAS market is experiencing significant growth due to increasing regulatory mandates that require the installation of Acoustic Vehicle Alerting Systems (AVAS) in electric and hybrid vehicles. These regulations are driven by safety concerns, as EVs and hybrids are quieter at low speeds, posing a risk to pedestrians and cyclists. In response, countries like the U.S. and EU have implemented stringent noise emission standards that necessitate the integration of AVAS in these vehicles. This has led to a surge in demand for AVAS solutions among automakers to ensure compliance with these regulations. Additionally, the rise in EV adoption further accelerates this trend, as more vehicles on the road are required to meet noise emission requirements, creating a strong market opportunity for AVAS manufacturers.

Restraints & Challenges

One major hurdle is the high cost of developing and integrating AVAS technology into electric and hybrid vehicles, which may increase vehicle prices and affect consumer adoption. Additionally, the lack of standardization across different regions can lead to complexities in compliance with varying noise emission regulations. Technological limitations in sound customization and quality may also hinder manufacturers from meeting diverse consumer preferences. Furthermore, the market faces competition from alternative safety technologies, such as advanced driver-assistance systems (ADAS), which could potentially reduce the perceived necessity for AVAS. Lastly, automakers may encounter challenges in balancing noise levels to ensure pedestrian safety without causing noise pollution, as excessive sound may also have negative environmental and social impacts.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the AVAS Market from 2023 to 2033. The AVAS market in North America is expanding rapidly due to increasing electric vehicle (EV) adoption and stringent regulatory requirements. The U.S. National Highway Traffic Safety Administration (NHTSA) mandates that all electric and hybrid vehicles sold in the country must be equipped with Acoustic Vehicle Alerting Systems (AVAS) to enhance pedestrian safety. This regulation has accelerated the integration of AVAS technology by automakers, driving demand across the region. Furthermore, with the growing number of EVs on the road, consumer awareness and demand for safety features, including AVAS, are on the rise. Key players in the North American market are investing in innovative solutions that offer customizable sounds to meet both regulatory and consumer needs. The region's strong automotive industry presence and commitment to sustainability further fuel the market’s growth.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. The AVAS market in the Asia-Pacific (APAC) region is experiencing rapid growth, driven by the rising adoption of electric and hybrid vehicles, particularly in China, Japan, and South Korea. China, as the largest EV market, has implemented regulations requiring AVAS installation in electric vehicles to ensure pedestrian safety, boosting demand for AVAS technology. Japan and South Korea are also increasing their focus on EVs, with stringent noise emission standards encouraging automakers to integrate AVAS systems. Additionally, the region’s growing environmental awareness and government incentives to promote EV adoption are accelerating the demand for these systems. Leading automakers and suppliers in APAC are investing in advanced AVAS solutions that cater to both regulatory compliance and consumer preferences, making the region a key growth hub for the global AVAS market.

Segmentation Analysis

Insights by Vehicle

The passenger cars segment accounted for the largest market share over the forecast period 2023 to 2033. As governments worldwide impose stricter regulations requiring Acoustic Vehicle Alerting Systems (AVAS) to enhance pedestrian safety, passenger cars are at the forefront of compliance. With rising environmental awareness and the shift toward sustainable transportation, the demand for electric vehicles (EVs) is expanding rapidly, directly influencing the need for AVAS in passenger cars. Consumers are also more conscious of safety features, making AVAS a crucial selling point. The segment's growth is further fueled by advancements in AVAS technology, enabling automakers to offer customizable and more attractive alert sounds. As automakers focus on meeting safety regulations and improving consumer experience, the passenger car segment remains a key driver in the AVAS market's expansion.

Insights by Propulsion

The Battery Electric Vehicles (BEVs) segment accounted for the largest market share over the forecast period 2023 to 2033. The Battery Electric Vehicles (BEVs) segment is a major driver of growth in the AVAS market. As the adoption of BEVs accelerates globally, driven by environmental regulations and consumer demand for eco-friendly vehicles, the need for Acoustic Vehicle Alerting Systems (AVAS) has become critical. BEVs, being inherently quieter than traditional internal combustion engine vehicles, require AVAS to enhance pedestrian safety, particularly at low speeds. Strict regulatory requirements in regions like the EU, U.S., and Japan mandate the installation of AVAS in BEVs, pushing automakers to incorporate this technology into their vehicles. This regulatory pressure, coupled with the growing focus on EV safety features, positions the BEV segment as a key growth area for AVAS manufacturers. The segment's expansion is further supported by continued innovation in AVAS technology, including customizable sounds and energy-efficient solutions.

Recent Market Developments

- In January 2024, UNO Minda is set to present its cutting-edge automotive solutions at ACMA Automechanika 2024.

Competitive Landscape

Major players in the market

- Continental AG (Germany)

- Hella GMBH & CO. KGAA (Germany)

- Kendrion N. V. (Netherlands)

- Harman International (US)

- Denso Corporation (Japan)

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

AVAS Market, Vehicle Analysis

- Passenger Cars

- Commercial Vehicles

- Two Wheelers

AVAS Market, Propulsion Analysis

- BEVs

- PHEVs

- FCEVs

AVAS Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1 What is the market size of the AVAS Market?The global AVAS Market is expected to grow from USD 2.3 billion in 2023 to USD 6.7 billion by 2033, at a CAGR of 11.28% during the forecast period 2023-2033.

-

2.Who are the key market players of the AVAS Market?Some of the key market players of the market are Continental AG (Germany), Hella GMBH & CO. KGAA (Germany), Kendrion N. V. (Netherlands), Harman International (US), and Denso Corporation (Japan).

-

3.Which segment holds the largest market share?The passenger cars segment holds the largest market share and is going to continue its dominance.

-

4. Which region dominates the AVAS Market?North America dominates the AVAS Market and has the highest market share.

Need help to buy this report?