Global Aviation High Speed Motor Market Size by Type (AC Motor, DC Motor), by End-Use (Commercial Aviation, General Aviation, Others) and by Application (Propulsion System, Flight Control System, Fuel Management System, Others), By Region, And Segment Forecasts, By Geographic Scope And Forecast to 2033

Industry: Aerospace & DefenseGlobal Aviation High Speed Motor Market Insights Forecasts to 2033

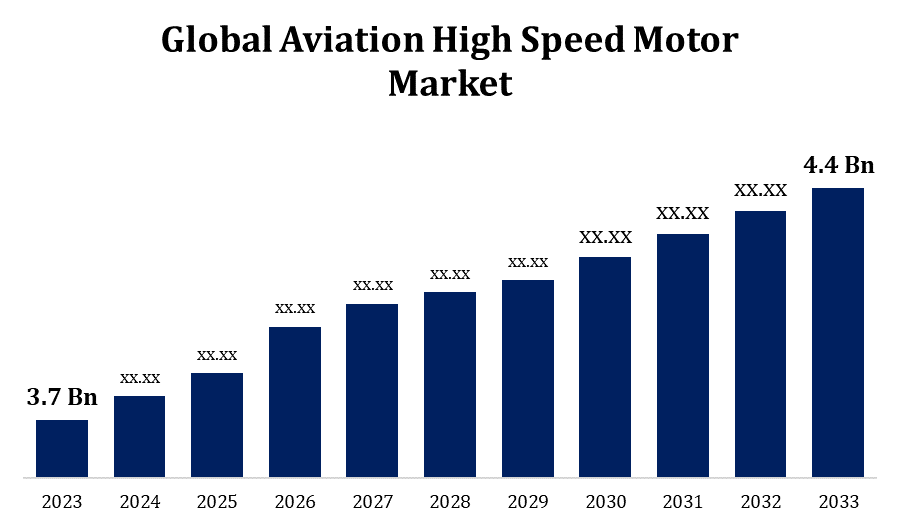

- The Global Aviation High Speed Motor Market Size was valued at USD 3.7 Billion in 2023.

- The Market Size is Growing at a CAGR of 1.75% from 2023 to 2033.

- The Worldwide Aviation High Speed Motor Market Size is expected to reach USD 4.4 Billion by 2033.

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

The Global Aviation High Speed Motor Market Size is expected to reach USD 4.4 Billion by 2033, at a CAGR of 1.75% during the forecast period 2023 to 2033.

High-speed electric motors made especially for different aviation applications are produced and supplied, which is what the aviation high speed motor market consists of. In aircraft, these motors are essential for powering the auxiliary systems, landing gear mechanisms, flight control surfaces, and propulsion systems. The market is mostly driven by the increasing trend of electrifying aeroplanes in an effort to increase sustainability, lower emissions, and maximise fuel efficiency. The market is expanding due to advancements in motor technology, which have led to increased power density, enhanced efficiency, and increased dependability. Market expansion is also being driven by rising demand for electric propulsion systems, especially in developing industries like urban air mobility (UAM) and electric vertical takeoff and landing (eVTOL) aircraft.

Aviation High Speed Motor Market Value Chain Analysis

Designing and developing electric motors that are suited for aviation applications is the focus of the Research and Development (R&D) phase of the market for high-speed aircraft motors. In order to meet the strict demands of the aviation industry, these efforts prioritise improving motor efficiency, power density, dependability, and other performance factors. Manufacturing procedures are started as soon as the design is complete in order to mass produce high-speed electric motors. Advanced manufacturing technologies, including automated assembly, precise machining, and quality control systems, are employed by manufacturers to guarantee the creation of motors of superior quality. Several parts, such as stators, rotors, bearings, housings, and electrical wiring, are needed to produce high-speed electric motors. High-speed electric motor distribution to aircraft manufacturers, maintenance, repair, and overhaul (MRO) facilities, and other end users is facilitated by distributors and supply chain partners. High-speed electric motors are used by airlines and aircraft operators in their fleet of aircraft for either military or commercial purposes. High-speed electric motors used in aviation applications can have their maintenance, repair, and overhaul (MRO) needs met by aftermarket service providers.

Aviation High Speed Motor Market Opportunity Analysis

There are a lot of potential for high-speed electric motors in the aviation industry, which is rapidly electrifying. It is possible to create motors for aircraft applications that are more dependable, lightweight, and efficient because to advancements in motor design, materials, and manufacturing techniques. The need for electric propulsion systems in aviation is being driven by the growing emphasis on fuel economy and environmental sustainability. Electric propulsion units require high-speed motors for operation, which means that manufacturers can profit from the expanding market for electric aircraft. To increase efficiency, cut emissions, and save operating costs, aircraft operators and manufacturers are spending more in electrification projects. The worldwide scope of the aviation sector offers high-speed motor producers the chance to grow their market share outside of their home countries.

Global Aviation High Speed Motor Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 3.7 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 1.75% |

| 2033 Value Projection: | USD 4.4 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Type, By End-Use, By Application, By Region, By Geographic Scope |

| Companies covered:: | Siemens, Windings Inc., NEMA Ltd., ARC Systems Inc., Safran Electrical & Power, H3X Technologies Inc., Xoar International LLC, Allied Motion Technologies, MagniX, MGM COMPRO, EMRAX d.o.o., and other key companies. |

| Pitfalls & Challenges: | Covid-19 Empact,Challenges,Growth, Analysis. |

Get more details on this report -

Market Dynamics

Aviation High Speed Motor Market Dynamics

Increasing Demand for UAVs & eVTOL Aircraft in Commercial Aviation Industry

The market for UAVs is growing quickly because to the growing number of applications in a variety of industries, such as mapping, agricultural, logistics, surveillance, and surveillance. Powering electric motors and propellers for unmanned aerial platforms, high-speed electric motors are crucial parts of UAV propulsion systems. The need for high-speed motors tailored for UAV applications is rising in tandem with the growing demand for UAVs. The notion of urban transportation is undergoing a revolution with the introduction of electric vehicle-powered transit (eVTOL) aircraft for urban air mobility (UAM), which provide economical and eco-friendly alternatives to conventional forms of transportation. For vertical takeoff and landing, enhanced electric propulsion systems driven by high-speed motors are essential to eVTOL aircraft.

Restraints & Challenges

Aviation high-speed motors have to fulfil strict specifications for safety, power density, dependability, and efficiency. Because aircraft applications involve rigorous operating conditions and environmental considerations, achieving and maintaining these performance criteria can be difficult. In fields including materials science, manufacturing techniques, and motor design, considerable technological skills are needed to develop high-speed motors for aircraft applications. For motor makers, staying up to date with the latest technology developments while maintaining compatibility with legacy aircraft systems is a major task. Supply chain disruptions brought on by events like natural disasters, geopolitical unrest, and uncertain global economies can affect the aviation sector. There are several manufacturers fighting for market share in the fiercely competitive aviation high-speed motor industry.

Regional Forecasts

North America Market Statistics

North America is anticipated to dominate the Aviation High Speed Motor Market from 2023 to 2033. Due to the presence of significant aerospace manufacturers, airlines, and defence contractors, North America is one of the main markets for aviation high-speed motors. Because of the growing need for electric propulsion systems, unmanned aerial vehicles (UAVs), and electric vertical takeoff and landing (eVTOL) aircraft, the market in the region is anticipated to rise steadily. The robust demand for aviation high-speed motors from military and defence customers supports the North American market. For reconnaissance, surveillance, and combat missions, military aircraft, drones, and unmanned aerial systems (UAS) all require high-speed motors as essential parts. High-speed motors for military applications are largely supplied by defence contractors and suppliers.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. In terms of the expansion of the aviation industry, Asia-Pacific is one of the fastest-growing areas. The market for aviation high-speed motors is fueled by the region's growing airline fleets, increased air traveller traffic, and rising defence spending. Furthermore, high-speed motor manufacturers have potential due to the emergence of new aviation segments including electric vertical takeoff and landing (eVTOL) aircraft and urban air mobility (UAM). China, Japan, South Korea, India, Australia, and other nations have made large investments to grow their aircraft sectors. To assist with domestic aircraft production and technological advancement, these nations have set up manufacturing facilities, research institutes, and aerospace clusters. High-speed motors are therefore in greater demand in order to power aircraft systems and components.

Segmentation Analysis

Insights by Type

The DC Motor segment accounted for the largest market share over the forecast period 2023 to 2033. DC motors are essential for powering electric propulsion components including distributed propulsion systems, turbofans, and propellers, which are becoming more and more used in aviation propulsion systems. DC motor manufacturers now have the chance to offer motors that are specifically designed for electric propulsion applications as a result of the aviation industry's transition to electrification. Opportunities exist for DC motor producers due to the growing demand for UAVs and electric vertical takeoff and landing (eVTOL) aircraft. For sustained flight operations and vertical takeoff and landing, these aircraft depend on lightweight, high-efficiency motors. A growing number of DC motors are installed in aviation systems, which is driving up demand for aftermarket services and support.

Insights by End Use

The commercial aviation segment accounted for the largest market share over the forecast period 2023 to 2033. Globally, commercial airlines are increasing the size of their fleets in response to the rising demand for air travel. The acquisition of new aircraft outfitted with cutting-edge technology driven by high-speed motors is part of this expansion. The commercial aviation sector is adopting electrification programmes in an effort to lessen its dependency on antiquated hydraulic and pneumatic equipment. Electric actuators, pumps, and other components that improve aircraft performance and efficiency are powered by high-speed electric motors, which are essential parts of electrified aviation systems. The aviation high-speed motor market's commercial aviation segment is expected to grow significantly as long as airlines continue to fund fleet expansion, technological advancements, electrification projects, and aftermarket services.

Insights by Application

The propulsion system segment accounted for the largest market share over the forecast period 2023 to 2033. A major transition to electric propulsion systems is occurring in the aviation sector due to the demand for increased sustainability, lower emissions, and better fuel efficiency. Electric fans, propellers, turbofans, and distributed propulsion systems are all powered by high-speed motors, which are essential parts of these systems. In response to regulatory constraints and environmental concerns, aviation manufacturers are creating designs for hybrid-electric and all-electric aircraft. These aircraft's propulsion systems are powered in large part by high-speed motors, which allow for more economical and environmentally friendly operation while lowering the need for conventional fossil fuels. Hybrid propulsion systems, which mix electric and conventional engines to minimise pollution and increase fuel efficiency, also use high-speed motors.

Recent Market Developments

- In December 2020, MagniX has collaborated with Faradair to offer electric motors for its aircraft fleet of 300.

Competitive Landscape

Major players in the market

- Siemens

- Windings Inc.

- NEMA Ltd.

- ARC Systems Inc.

- Safran Electrical & Power

- H3X Technologies Inc.

- Xoar International LLC

- Allied Motion Technologies

- MagniX

- MGM COMPRO

- EMRAX d.o.o.

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Aviation High Speed Motor Market, Type Analysis

- AC Motor

- DC Motor

Aviation High Speed Motor Market, Application Analysis

- Propulsion System

- Flight Control System

- Fuel Management System

- Others

Aviation High Speed Motor Market, End User Analysis

- Commercial Aviation

- General Aviation

- Others

Aviation High Speed Motor Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- UAE

- Saudi Arabia

- South Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Aviation High Speed Motor Market?The global Aviation High Speed Motor Market is expected to grow from USD 3.7 billion in 2023 to USD 4.4 billion by 2033, at a CAGR of 1.75% during the forecast period 2023-2033.

-

2. Who are the key market players of the Aviation High Speed Motor Market?Some of the key market players of the market are Siemens, Windings Inc., NEMA Ltd., ARC Systems Inc., Safran Electrical & Power, H3X Technologies Inc., Xoar International LLC, Allied Motion Technologies, MagniX, MGM COMPRO, EMRAX d.o.o.

-

3. Which segment holds the largest market share?The propulsion system segment holds the largest market share and is going to continue its dominance.

-

4. Which region is dominating the Aviation High Speed Motor Market?North America is dominating the Aviation High Speed Motor Market with the highest market share.

-

1. What is the market size of the Aviation High Speed Motor Market?The global Aviation High Speed Motor Market is expected to grow from USD 3.7 billion in 2023 to USD 4.4 billion by 2033, at a CAGR of 1.75% during the forecast period 2023-2033.

-

2. Who are the key market players of the Aviation High Speed Motor Market?Some of the key market players of the market are Siemens, Windings Inc., NEMA Ltd., ARC Systems Inc., Safran Electrical & Power, H3X Technologies Inc., Xoar International LLC, Allied Motion Technologies, MagniX, MGM COMPRO, EMRAX d.o.o.

-

3. Which segment holds the largest market share?The propulsion system segment holds the largest market share and is going to continue its dominance.

-

4. Which region is dominating the Aviation High Speed Motor Market?North America is dominating the Aviation High Speed Motor Market with the highest market share.

Need help to buy this report?