Global Aviation Service For Oil & Gas Sector Market Size, Share, and COVID-19 Impact Analysis, By Service Type (Crew Movements, Cargo Charters, Air Ambulance, Onboard Couriers, and Fuel Transfer Services), By Oil & Gas Sector Type (Offshore and Onshore), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Automotive & TransportationGlobal Aviation Service For Oil & Gas Sector Market Insights Forecasts to 2033

- The Global Aviation Service For Oil & Gas Sector Market Size is Expected to hold a significant share by 2023

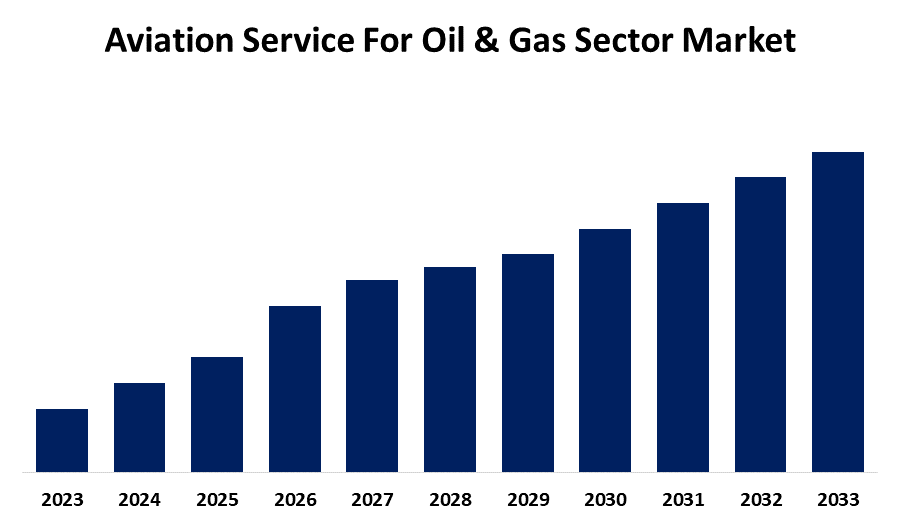

- The Market Size is Growing at a CAGR of 16.02% from 2023 to 2033

- The Worldwide Aviation Service For Oil & Gas Sector Market Size is Expected to Hold a Significant Share by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Aviation Service For Oil & Gas Sector Market Size is Expected to Hold a Significant Share by 2033, Growing at a CAGR of 16.02% from 2023 to 2033. The aviation service for oil & gas sector market has benefited from an increase in the number of middle-class households, strong competition among low-cost carriers, the development of infrastructure at major airports, and a favorable legislative environment. Increased passenger traffic, traffic in emerging and developing nations, and a major change in infrastructure are some of the major factors propelling the industry.

Market Overview

Aviation solutions for the oil and gas industry include crew transportation, cargo charters, air ambulances, and fuel transfer operations. The market for these services is divided into two segments: the kind of oil and gas and the kind of service. Air transport suppliers prioritize the deployment of a larger fleet of aircraft to meet increased passenger demand. During the anticipated period, there is expected to be a significant growth in demand for aircraft in the regions, particularly in countries with expanding air traffic, such as China and India. Over the last three years, India's civil aviation industry has emerged to become one of the country's fastest expanding industries. The middle class is also predicted to expand dramatically, increasing purchasing power. As a result, an increase in aircraft and passengers will drive worldwide industry growth. The rising per capita income of the middle class has increased the demand for luxury and comfort in the aviation industry, which is another factor fueling the expansion of the global aviation fuel market.

Report Coverage

This research report categorizes the market for the aviation service for oil & gas sector market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the aviation service for oil & gas sector market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the aviation service for oil & gas sector market.

Opportunities

Rising Need for Alternative Aviation Fuel by Airlines

While development provides tremendous opportunities for airlines, airports, aircraft manufacturers, and aviation financing providers, growth strategies require taking into account the growing risk of a sustainable environment. Investors, lenders, and insurers are increasingly recognizing sustainability as a critical component to financial risk evaluation and capital distribution choices.

Challenges

Potential shortages or delays in the supply

Potential shortages or delays in the supply of various materials and equipment could present challenges for the oil and gas sector. These consist of cranes, chemicals, cement, pipes, valves, gloves, specialized labor, pumps, and electronics. Furthermore, during the anticipated time, effective logistics in the aircraft services sector may pose difficulties. The difficulties related to industry expansion may also be made worse by the rising expense of water management services.

Aviation Service For Oil & Gas Sector Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 16.02% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 255 |

| Tables, Charts & Figures: | 125 |

| Segments covered: | By Service Type, By Oil & Gas Sector Type |

| Companies covered:: | Global Vectra Hilcorp Ltd., Air Charter Service, PRIVATEFLY, KEA, Ultimate Helicopter, Reliance Industriesa, Oliver Wyman LLC, Schlumberger, Transocean, PAS, Swire Energy Services Ltd., and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The aviation service for oil & gas sector market is driven by several factors including one of the main numerous airport renovations and new airport building have resulted from the increase in passenger traffic, which further propels market expansion. Additionally, aviation fuel transfer services have a positive impact on the market. The number individuals regularly travel by plane is expected to grow rapidly due to widespread socioeconomic and tourism trends that are driving the expansion of the global aviation service for oil & gas sector market.

Restraining Factors

The price of fuel is anticipated to be the main factor impeding the growth of the aviation service for oil & gas sector market. The market expansion is probably going to be hampered by the high cost. Since aviation fuel is a derivative of Brent crude oil, the higher price of Brent crude oil is the cause of the increased fuel costs.

Market Segmentation

The aviation service for oil & gas sector market share is classified into service type and oil & gas sector type.

- The fuel transfer services segment dominates the market with the highest market share through the forecast period.

Based on the service type, the aviation service for oil & gas sector market is categorized into crew movements, cargo charters, air ambulance, onboard couriers, and fuel transfer services. Among these, the fuel transfer services segment dominates the market with the highest market share through the forecast period. One of the main reasons for the rise in fuel transfer services in the aviation industry for the oil and gas sector is the increasing demand for dependable and effective fuel transportation throughout the industry.

- The onshore segment is anticipated to grow at the highest CAGR during the forecast period.

Based on the oil & gas sector type, the aviation service for oil & gas sector market is categorized into offshore and onshore. Among these, the onshore segment is anticipated to grow at the highest CAGR during the forecast period. Increases in onshore oil and gas production, well stimulation, and drilling activities are driving the global aviation service market for the oil and gas industry. It also includes onshore fuel management, storage, and transfer services to meet onshore facilities' operational needs. Enabling efficient and safe operations at land-based oil and gas facilities requires the onshore aviation service for the oil and gas sector.

Regional Segment Analysis of the Aviation Service For Oil & Gas Sector Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the aviation service for oil & gas sector market over the predicted timeframe.

Get more details on this report -

North America is projected to hold the largest share of the aviation service for oil & gas sector market over the predicted timeframe. The market for aviation services for the oil and gas sector in North America is anticipated to have the largest market share. The growing use of cutting-edge methods and government programs to support environmentally friendly aviation fuel use support the region's market expansion. Low-cost airlines' extensive reach and emerging economies' quick infrastructure development are the main drivers of the expansion.

Asia Pacific is expected to grow at the fastest CAGR growth in the aviation service for oil & gas sector market during the forecast period. The global market for aviation services for the oil and gas sector is expected to expand rapidly in Asia Pacific. Throughout the anticipated period, the expansion of private as well as government investments in the construction of aviation facilities in these emerging economies will further support market growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the aviation service for oil & gas sector market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Global Vectra Hilcorp Ltd.

- Air Charter Service

- PRIVATEFLY, KEA

- Ultimate Helicopter

- Reliance Industriesa

- Oliver Wyman LLC

- Schlumberger

- Transocean

- PAS

- Swire Energy Services Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In October 2024, Honeywell and Air Products revealed that Honeywell decided to buy Air Product' liquefied natural gas (LNG) processing technology and equipment business for $1.81 billion in an all-cash deal. This is nearly 13 times the expected 2024 EBITDA.

- In July 2024, Falcon Aviation, a leading provider of helicopter services, declared that it has strengthened its long-standing cooperation with Leonardo by adding the AW139 intermediate twin engine helicopter to its fleet, which supports the energy sector.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the aviation service for oil & gas sector market based on the below-mentioned segments:

Global Aviation Service For Oil & Gas Sector Market, By Service Type

- Crew Movements

- Cargo Charters

- Air Ambulance

- Onboard Couriers

- Fuel Transfer Services

Global Aviation Service For Oil & Gas Sector Market, By Oil & Gas Sector Type

- Offshore

- Onshore

Global Aviation Service For Oil & Gas Sector Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the global aviation service for oil & gas sector market over the forecast period?The global aviation service for oil & gas sector market is to expand at 16.02% during the forecast period.

-

2. Which region is expected to hold the highest share of the global aviation service for oil & gas sector market?The North America region is expected to hold the largest share of the global aviation service for oil & gas sector market.

-

3. Who are the top key players in the aviation service for oil & gas sector market?The key players in the aviation service for oil & gas sector market are Global Vectra Hilcorp Ltd., Air Charter Service, PRIVATEFLY, KEA, Ultimate Helicopter, Reliance Industriesa, Oliver Wyman LLC, Schlumberger, Transocean, PAS, Swire Energy Services Ltd., and others.

Need help to buy this report?