Global Avionics Data Loaders Market Size, By Type (Airborne Data Loader (ADL), Portable Data Loader (PDL)), By Application (Airlines, MROs, Avionics Equipment Suppliers, Aircraft Manufactures), By Region, And Segment Forecasts, By Geographic Scope And Forecast to 2033

Industry: Aerospace & DefenseGlobal Avionics Data Loaders Market Insights Forecasts to 2033

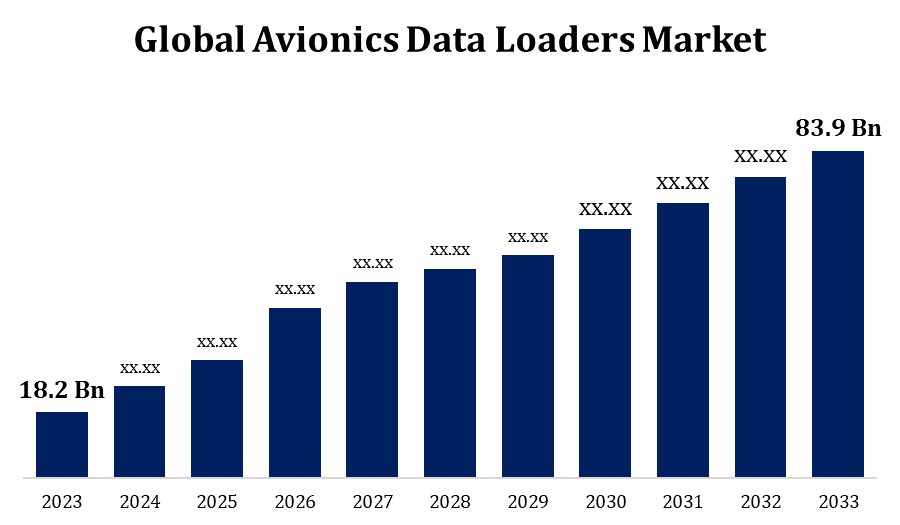

- The Global Avionics Data Loaders Market Size was valued at USD 18.2 Billion in 2023.

- The Market is Growing at a CAGR of 16.51% from 2023 to 2033

- The Worldwide Avionics Data Loaders Market Size is expected to reach USD 83.9 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period

Get more details on this report -

The Global Avionics Data Loaders Market Size is Expected to reach USD 83.9 Billion by 2033, at a CAGR of 16.51% during the forecast period 2023 to 2033.

The need to upgrade and modernise aircraft systems is expanding as avionics technology continues to progress. Avionics data loaders make it possible to add new databases and software updates to these systems quickly, securely, and efficiently. As more and more aeroplanes become networked and outfitted with sophisticated communication and navigation systems, reliable data loading solutions will be needed to maintain these systems compatible and current. The need for avionics data loaders to support avionics system maintenance, upgrades, and customisation is driven by the growth of airline fleets globally and the rise in commercial flights. Optimising operating performance and increasing fuel efficiency are top priorities for airlines and aircraft operators. These goals are furthered by the use of avionics data loaders, which update flight plans and performance databases.

Avionics Data Loaders Market Value Chain Analysis

The actual data loading devices are designed, developed, and manufactured by avionics data loader manufacturers. To produce goods that adhere to legal criteria and industry norms, they integrate software, firmware, and componentry. In order to satisfy particular client needs, manufacturers could also provide customisation services. The firmware, software programmes, and interfaces used in avionics data loaders are created by software developers. This entails setting up the loaders to communicate with different aircraft systems and guarantee data transfer security, dependability, and compatibility. Avionics data loaders are integrated into aircraft by manufacturers as part of the production process. To guarantee that data loaders are installed appropriately and adhere to aircraft performance and safety standards, they collaborate closely with avionics system integrators. Avionics data loaders' final consumers are airlines and aircraft operators. In order to update, repair, and customise the avionics systems on their fleets, they buy or lease data loading equipment.

Avionics Data Loaders Market Opportunity Analysis

The proliferation of networked aircraft, featuring sophisticated communication and data-sharing functionalities, presents prospects for the smooth integration of avionics data loaders with onboard systems. In order to enable real-time data interchange between aircraft systems, ground-based operations centres, and other aircraft in the airspace network, data loaders might be extremely important. The growth of commercial aircraft fleets is being driven by the rising demand for air travel globally. Manufacturers of avionics data loaders now have the chance to supply parts for brand-new aircraft deliveries as well as for updating data loading systems on older aircraft. For military aircraft to support mission-critical operations, strong and secure data loading capabilities are required. There are chances to create customised avionics data loaders that meet the particular needs of military aircraft.

Global Avionics Data Loaders Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 18.2 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 16.51% |

| 2033 Value Projection: | USD 83.9 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Type, By Application, By Region. |

| Companies covered:: | Teledyne Technologies (US), Astronics Corporation (US), MBS Electronic Systems GmbH & Co. KG, Techsat GmbH Avionica (US), Collins Aerospace (US), Honeywell International Inc., L3Harris Technologies (US), and other key vendors. |

| Growth Drivers: | Increasing Productivity and Safety Technologies to Enhance Aircraft Performance |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Avionics Data Loaders Market Dynamics

Increasing Productivity and Safety Technologies to Enhance Aircraft Performance

Advanced data loading methods can improve productivity by drastically cutting down on the amount of time needed to update avionics systems. Airlines are able to reduce aircraft downtime during repair and make sure that aircraft spend more time in revenue-generating operations thanks to faster data transmission rates and improved processes. When it comes to improving efficiency and security in avionics data loading procedures, automation is essential. Software upgrades, database synchronisation, and configuration modifications can all be completed by automated data loading systems with little assistance from humans, lowering the possibility of mistakes and increasing productivity. Airlines can upgrade avionics systems and carry out maintenance without physically visiting the aircraft owing to remote data loading capabilities. Fleet operators whose aircraft are stationed in distant areas or are operating in demanding conditions will find this to be especially helpful.

Restraints & Challenges

Unauthorised access, data breaches, and virus assaults are all potential cybersecurity risks for avionics data loaders. For makers and operators of data loaders, securing data transfer procedures and shielding private data from online attacks is a major concern. The avionics systems on modern aeroplanes are getting more and more complicated, with numerous parts and interfaces. It can be difficult to integrate data loaders into these systems and guarantee compatibility with a variety of hardware and software platforms; this requires a great deal of testing and validation. The global supply chain for materials and components is essential to the avionics data loaders market. Production delays can be caused by supply chain disruptions including material shortages, traffic jams, or geopolitical unrest that affect manufacturing schedules.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Avionics Data Loaders Market from 2023 to 2033. The United States Armed Forces operate a varied fleet of military aircraft in the region, contributing to its robust military aviation presence. Avionics data loaders are essential for maintaining and updating avionics systems on military platforms, hence ensuring operational readiness and mission success. The aftermarket services industry in North America is strong and includes avionics-specific maintenance, repair, and overhaul (MRO) facilities. These MRO companies provide installation, troubleshooting, software updates, and regulatory compliance inspections in addition to other avionics data loader-related services. In North America, there is fierce competition among the established players and specialised suppliers in the avionics data loaders market as they compete for market share. Businesses set themselves apart by their products' functionality, dependability, customer service, and value-added services.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. With growing passenger traffic and a growing need for new aircraft, Asia-Pacific is one of the regions where commercial aviation is expanding the fastest. The need for avionics data loaders for aircraft maintenance and updates is being driven by the growing fleets of airlines in countries like as China, India, and Southeast Asia. Avionics data loaders for military applications are in more demand as a result of investments made by several Asia-Pacific nations in modernising their fleets of military aircraft. The demand for aftermarket services, such as maintenance, repair, and overhaul (MRO) of avionics data loaders, is rising in the region as the installed base of avionics systems grows. MRO facilities serve both local and foreign clients in nations including Singapore, Malaysia, and India.

Segmentation Analysis

Insights by Type

The portable data loader segment accounted for the largest market share over the forecast period 2023 to 2033. Portable data loaders don't need lengthy setup or installation processes, thus they can be quickly deployed in a variety of operational contexts, such as hangars, tarmacs, or field sites. Due to their agility, operators are able to efficiently complete data loading activities and quickly adjust to changing operating needs. When used in transitory settings like airfields without permanent infrastructure, or by small and medium-sized operators, portable data loaders can be more affordable than fixed installations. They lower construction and operating expenses by doing away with the requirement for specialised data loading stations.

Insights by Application

The airlines segment is dominating the market with the largest market share over the forecast period 2023 to 2033. In an effort to increase passenger satisfaction, save operating expenses, and improve efficiency, airlines all over the world are growing their fleets and modernising their aircraft. Avionics data loaders are becoming more and more necessary as airlines purchase new aircraft with sophisticated avionics systems in order to update databases, settings, and software. The aviation sector is seeing a transition towards networked aircraft with sophisticated data-sharing and communication systems. The exchange of data between onboard systems, ground-based operations centres, and other aircraft in the network is made possible by avionics data loaders, which are crucial to the operation of connected aircraft.

Recent Market Developments

- In March 2022, a large operator of A320 series aircraft has contracted with Spectralux Avionics to develop and provide a new adapter for its Portable Data Loader (PDL).

Competitive Landscape

Major players in the market

- Teledyne Technologies (US)

- Astronics Corporation (US)

- MBS Electronic Systems GmbH & Co. KG

- Techsat GmbH Avionica (US)

- Collins Aerospace (US)

- Honeywell International Inc.

- L3Harris Technologies (US)

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Avionics Data Loaders Market, Type Analysis

- Airborne Data Loader (ADL)

- Portable Data Loader (PDL)

Avionics Data Loaders Market, Application Analysis

- Airlines

- MROs

- Avionics Equipment Suppliers

- Aircraft Manufactures

Avionics Data Loaders Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Avionics Data Loaders Market?The global Avionics Data Loaders Market Size is expected to grow from USD 18.2 billion in 2023 to USD 83.9 billion by 2033, at a CAGR of 16.51% during the forecast period 2023-2033.

-

2. Who are the key market players of the Avionics Data Loaders Market?Some of the key market players of the market are Teledyne Technologies (US), Astronics Corporation (US), MBS Electronic Systems GmbH & Co. KG, Techsat GmbH Avionica (US), Collins Aerospace (US), Honeywell International Inc., and L3Harris Technologies (US).

-

3. Which segment holds the largest market share?The airlines segment holds the largest market share and is going to continue its dominance.

-

4. Which region is dominating the Avionics Data Loaders Market?North America is dominating the Avionics Data Loaders Market with the highest market share.

Need help to buy this report?