Global Avionics Market Size By System (Flight management and control, Health monitoring, Electrical and emergency, Communication, Navigation, Others), By Fit (Retrofit, Line Fit), By Platform (Commercial, General, Military), By Region, And Segment Forecasts, By Geographic Scope And Forecast to 2033

Industry: Aerospace & DefenseGlobal Avionics Market Insights Forecasts to 2033

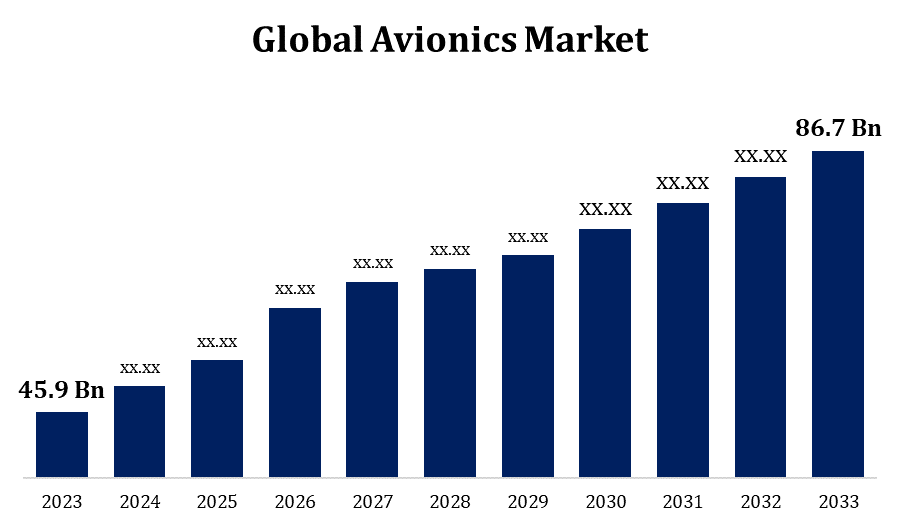

- The Global Avionics Market Size was valued at USD 45.9 Billion in 2023.

- The Market Size is Growing at a CAGR of 6.57% from 2023 to 2033.

- The Worldwide Avionics Market Size is expected to reach USD 86.7 Billion by 2033

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

The Global Avionics Market is expected to reach USD 86.7 Billion by 2033, at a CAGR of 6.57% during the forecast period 2023 to 2033.

Innovation in avionics has been fueled by technological advancements including automation, artificial intelligence, and the integration of digital systems. Instead of buying brand-new aircraft, airlines and the military frequently spend money on avionics upgrades to increase the longevity and capabilities of their current fleets. The need for new aircraft has increased due to the expansion of international air travel, which has further stimulated the avionics market. This demand has been fueled in part by emerging markets, particularly in Asia and the Middle East. A large portion of the avionics market comes from the defence industry, which has a need for sophisticated avionic systems for military aircraft, drones, and helicopters. For precise and dependable navigation, avionics now typically use satellite-based navigation systems like GPS.

Avionics Market Value Chain Analysis

R&D efforts are concentrated on integrating the most recent technical developments, decreasing weight, increasing dependability, and improving functionality. Specialised businesses produce avionics components such sensors, displays, communication systems, and navigational apparatus. By being included into a bigger structure, avionics systems guarantee interoperability and smooth communication between different parts. Aviation manufacturers and avionics providers collaborate extensively to incorporate these technologies into the aircraft's overall design. Following manufacture and delivery to the customer, avionics equipment might need to be installed or upgraded. To guarantee the appropriate usage and maintenance of avionics equipment, training programmes are crucial for pilots, maintenance staff, and other aviation professionals. Businesses may provide aftermarket services, such as avionics system replacements, upgrades, and modifications for current aircraft.

Avionics Market Opportunity Analysis

Determine whether cutting-edge technologies like artificial intelligence, machine learning, sophisticated sensors, and connectivity could have an influence on avionics. Keep up with the latest developments in the market, such as the need for avionic systems that are more networked and integrated, improved navigational features, and the usage of touchscreens and digital displays. Investigate business potential in developing aviation markets where demand for new and upgraded avionics is rising. Analyse the need for avionics systems designed specifically for drone applications as well as the growing usage of unmanned aerial vehicles (UAVs). In light of the growing digitization of avionics systems, evaluate prospects for offering resilient cybersecurity solutions to safeguard aircraft against cyberattacks. Examine the possibilities for using data analytics to predict avionics system repair.

Global Avionics Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 45.9 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 6.57% |

| 2033 Value Projection: | USD 86.7 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By System, By Fit, By Platform, By Region, By Geographic |

| Companies covered:: | Teledyne Technologies Inc., General Electric, Panasonic Corporation, L3 Harris Technologies, Universal Avionics Systems Corporation, BAE Systems PLC, Meggitt PLC, Raytheon Technologies Corporation, Thales Group, Honeywell International Inc., and other key companies. |

| Pitfalls & Challenges: | Covid-19 Empact,Challenges,Growth, Analysis. |

Get more details on this report -

Market Dynamics

Avionics Market Dynamics

Increasing demand for commercial aircraft deliveries

The need for new commercial aircraft is rising due to factors including economic expansion, middle-class population growth, and greater tourism, which are driving up global air travel overall. Airlines frequently make fleet expansion investments or swap out their ageing aircraft for newer, fuel-efficient models. The demand for avionics equipment to outfit these new aircraft is rising as a result of this trend. Environmental sustainability and fuel economy are becoming more and more important to airlines. Modern avionics systems on newer aircraft models help to minimise environmental impact and fuel efficiency. Modern commercial aeroplanes are outfitted with cutting-edge avionics equipment for communication, surveillance, and navigation. These systems improve both safety and operational efficiency. The need for connectivity and entertainment during flights is only increasing.

Restraints & Challenges

Global aviation authorities have severe regulatory standards that avionics equipment must follow. Thorough testing and validation are necessary during the certification process, which can be costly and time-consuming. This is done to make sure that safety and performance standards are being met. Technology is advancing quickly in the avionics sector, and businesses need to keep up with the latest developments to be competitive. This might make it difficult for companies to maintain the relevance and currency of their offerings. Cybersecurity risks rise as avionics systems become more networked and reliant on digital technologies. One of the most important challenges in maintaining the integrity and safety of avionic systems is protecting against cyberattacks. Because aircraft have lengthy lifespans, avionics systems need to be made to be both functional and current for a long time.

Regional Forecasts

North America Market Statistics

North America is anticipated to dominate the Avionics Market from 2023 to 2033. The defence industry in the United States, in particular, is vast and highly developed technologically. The avionics market in North America as a whole is mostly driven by systems used in military aircraft, unmanned aerial vehicles, and other defence applications. The need for avionics systems is fueled by the rise of the commercial aviation industry, which is a result of factors like economic growth and rising demand for air travel. The airlines in the area frequently spend money on new planes and avionics improvements. In North America, avionics would not exist without the invention and application of satellite navigation systems, such as the Global Positioning System (GPS). These technologies are essential for surveillance and navigation. In North America, there is a sizable aftermarket for avionics upgrades, retrofits, and maintenance services.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. The demand for air travel has increased as a result of the Asia-Pacific region's strong economic growth. Airlines make investments in new aircraft and avionics technologies to keep up with the growing demand as economies grow. The demand for air travel is driven by the growing middle class and rising urbanisation in Asia-Pacific nations. Thus, in both commercial and regional aircraft, there is an increased requirement for sophisticated avionics equipment. In order to accommodate the increasing volume of passengers, airlines operating in the Asia-Pacific area are enlarging their fleets. The demand for avionics systems and components for newly delivered aircraft is increased by this expansion. A number of Asia-Pacific nations maintain ongoing military aviation and defence initiatives. This raises the need for avionics equipment in the defence industry as well as for drones and military aircraft.

Segmentation Analysis

Insights by System

The navigation system segment accounted for the largest market share over the forecast period 2023 to 2033. Due to factors including economic expansion, the growing middle class, and greater travel, there is an overall increase in air traffic worldwide, which has raised the demand for sophisticated navigation systems to accommodate the increasing number of flights. A lot of nations and areas are updating their air traffic control and airspace systems. The implementation of satellite-based technologies in advanced navigation systems is crucial for boosting airspace control, decreasing traffic, and increasing efficiency. Aircraft can navigate more accurately and efficiently due to Performance-Based Navigation (PBN) systems, which rely on cutting-edge navigation technologies. The need for advanced navigation systems has been fueled by the aviation industry's transition to PBN.

Insights by Fit

The line fit segment accounted for the largest market share over the forecast period 2023 to 2033. The increasing demand for air travel, which propels the aviation industry's overall expansion, leads to a rise in the number of new aircraft produced year. Growth is observed in the line fit segment when more aeroplanes are produced. For both avionics producers and aircraft OEMs, line fit installation offers financial and operational advantages. When avionics equipment are integrated during manufacturing, it can be more efficient and economical than retrofitting already-built aircraft. The line fit segment grows as a direct result of the need for new aircraft, which is fueled by factors such low-cost carrier growth, airline fleet expansion, and the need to replace outdated aircraft.

Insights by Platform

The commercial segment accounted for the largest market share over the forecast period 2023 to 2033. In order to accommodate the rising demand for air travel, airlines all over the world are constantly looking to enlarge their fleets. The requirement for avionics equipment for these commercial aircraft is influenced by the purchase of new aircraft. Growth in the commercial category is driven by the launch of new types of commercial aircraft that are outfitted with the newest avionics technologies. Manufacturers of aircraft work with suppliers of avionics to incorporate contemporary equipment into newly delivered aircraft. In-flight entertainment systems and passenger connectivity are becoming more and more in demand. Systems that offer internet access, streaming services, and other entertainment alternatives to passengers are examples of commercial avionics, which enhance the overall traveller experience.

Recent Market Developments

- In January 2022, Anthem, a cloud-connected integrated avionics system, was introduced by Honeywell. It enhances comfort, safety, operations, and efficiency of flight.

Competitive Landscape

Major players in the market

- Teledyne Technologies Inc

- General Electric

- Panasonic Corporation

- L3 Harris Technologies

- Universal Avionics Systems Corporation

- BAE Systems PLC

- Meggitt PLC

- Raytheon Technologies Corporation

- Thales Group

- Honeywell International Inc

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Avionics Market, System Analysis

- Flight management and control

- Health monitoring

- Electrical and emergency

- Communication

- Navigation

- Others

Avionics Market, Fit Analysis

- Retrofit

- Line Fit

Avionics Market, Platform Analysis

- Commercial

- General

- Military

Avionics Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- UAE

- Saudi Arabia

- South Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Avionics Market?The global Avionics Market is expected to grow from USD 45.9 billion in 2023 to USD 86.7 billion by 2033, at a CAGR of 6.57% during the forecast period 2023-2033.

-

2. Who are the key market players of the Avionics Market?Some of the key market players of the market are Teledyne Technologies Inc, General Electric, Panasonic Corporation, L3 Harris Technologies, Universal Avionics Systems Corporation, BAE Systems PLC, Meggitt PLC, Raytheon Technologies Corporation, Thales Group, Honeywell International Inc.

-

3. Which segment holds the largest market share?The commercial segment holds the largest market share and is going to continue its dominance.

-

4. Which region is dominating the Avionics Market?North America is dominating the Avionics Market with the highest market share.

Need help to buy this report?