Global Axial Flow Pump Market Size, Share & Trends, COVID-19 Impact Analysis Report, By Product Type (Horizontal and Vertical), Application (Water Treatment, Irrigation, Evaporators, and Others) and End-Use (Chemical, Municipal, Pulp & Paper, Food & Beverage, Agriculture, and Others): By Region (U.S., Canada, Mexico, Rest of North America, The UK, France, Germany, Italy, Spain, Nordic Countries (Denmark, Finland, Iceland, Sweden, Norway), Benelux Union (Belgium, the Netherlands, Luxembourg), Rest of Europe, China, Japan, India, New Zealand, Australia, South Korea, Southeast Asia (Indonesia, Thailand, Malaysia, Singapore, Rest of Southeast Asia), Saudi Arabia, UAE, Egypt, Kuwait, South Africa, Rest of Middle East & Africa, Brazil, Argentina, Rest of Latin America) - Global Insights, Growth, Size, Comparative Analysis, Trends and Forecast, 2021-2030

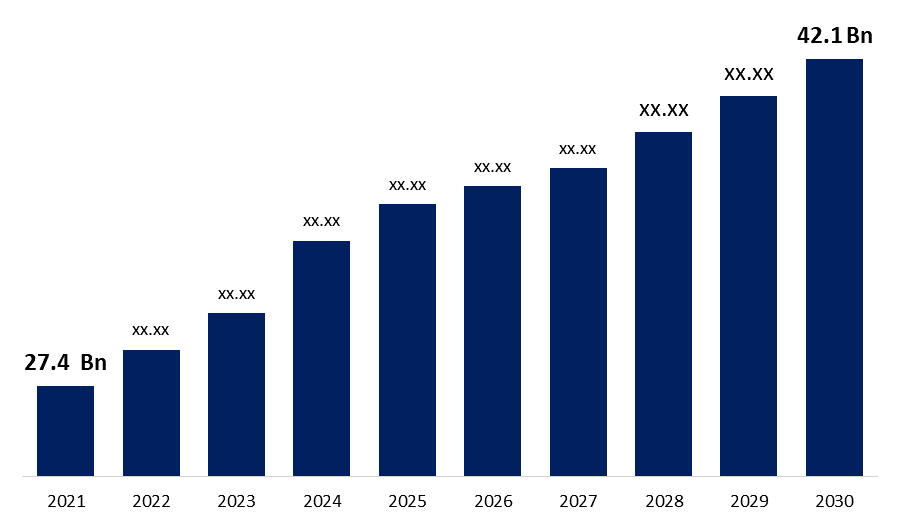

Industry: Energy & PowerThe Global Market For Axial Flow Pump estimated at US$ 27.4 Bn in the year 2021, is projected to reach a revised size of US$ 42.1 Billion by 2030, growing at a CAGR of 4.4%. Axial flow pumps are utilized in sewage irrigation, treatment plants, and flood control systems. These pumps are used in farming to pump water through reservoirs to farms and to eliminate harmful or excess water from farm fields. Furthermore, it can be utilized in municipal water treatment to help pump the water or chemicals to various conveyor systems or reservoirs. These factors are projected to boost the growth of the axial flow pump market. Furthermore, benefits such as high low rate with minimal pressure need, enhanced flow rates with the relatively low speed of head, and they can be regulated to run efficiently and effectively with negligible aerodynamic loss are contributing to the growth of the worldwide axial flow pumps market.

Get more details on this report -

Different types of impellers used to move fluids from one place to the other at lower heads have drawbacks such as decreased efficiency and a high energy use need. However, axial flow pumps are used to pump water from reservoirs such as canals and drain water from low-land areas to save crops. This application is often carried out with a low head level, and the use of an axial flow pump with the addition of power tillers is an appropriate choice. It is a critical factor that is expected to create new opportunities in the global axial flow pump market.

The need for energy fuel has risen dramatically in recent years because of factors such as increased industrialization, technological advancements, and fast urbanization. This is expected to increase the product's penetration in a variety of end-use industries, including oil and gas, power, and water and wastewater treatment.

According to a DownToEarth report, the gross value added (GVA) by agriculture sectors in India increased by 3.4 percent between April and June 2020. As a result, expanding agricultural sectors where axial flow pumps are commonly utilized for irrigation may boost the performance of the axial flow pump market post-COVID-19.

Global Axial Flow Pump Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2021 |

| Market Size in 2021: | USD 27.4 Billion |

| Forecast Period: | 2021-2030 |

| Forecast Period CAGR 2021-2030 : | 4.4% |

| 2030 Value Projection: | USD 42.1 Billion |

| Historical Data for: | 2017-2020 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 119 |

| Segments covered: | By Product, By Application, By Region |

| Companies covered:: | Ebara Corporation, Flowserve Corporation, Grundfos Holdings A/S, Handol Pumps Limited, Hitachi Industrial Products Ltd, ITT Goulds Pump, Pentair PLC, Sulzer Ltd, The Weir Group PLC, Xylem Inc, YURONG Spring. |

| Growth Drivers: | 1) The water treatment segment dominated the global axial flow pump market 2)The agriculture segment dominated the global axial flow pump market |

| Pitfalls & Challenges: | COVID-19 has the potential to impact the global market |

Get more details on this report -

Product Type Outlook

The horizontal segment dominated the global axial flow pump market owing to important features, including easy assembly, and disassembling, high discharge rates, simple routine inspections, changeable pump housing, and others, which make it an excellent choice for a wide range of fluid transport applications. The use of horizontal axial flow pumps in industries such as agriculture, chemical manufacture, and water treatment. This element is fueling the global market's expansion of horizontal product types.

Application Outlook

The water treatment segment dominated the global axial flow pump market owing to several important characteristics, such as high discharge rate, adjustable pitch, low hydrodynamic losses, and others, which make them suitable for applications such as fisheries, sewage digesters, high volume mixing, heat recovery systems, and others. The increasing global power consumption has increased the demand for heat recovery systems, where axial flow pumps are frequently employed for process fluid circulation in power plants.

End-Use Outlook

The agriculture segment dominated the global axial flow pump market owing to use of axial flow pumps in agricultural sectors such as irrigation, fisheries, and drainage is a prominent market trend in the global market. Furthermore, rising population has increased demand for crop production, where axial flow pumps are commonly used for irrigation.

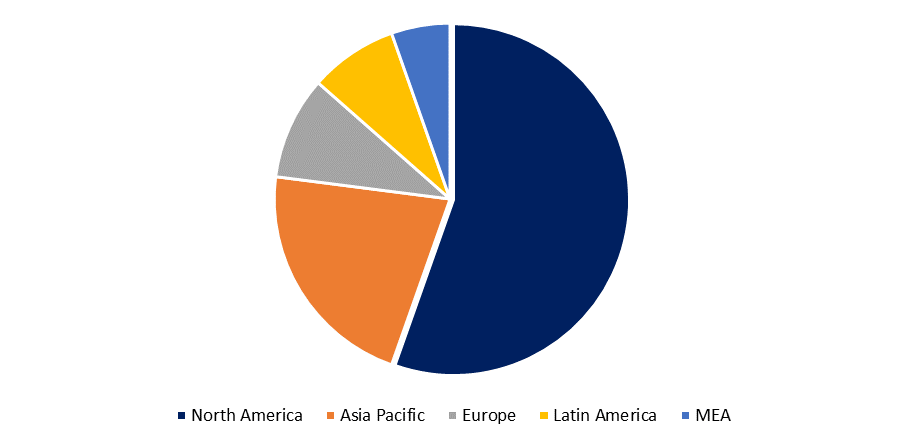

Regional Outlook

Asia Pacific region is dominating the market share of the global axial flow pump market owing due to the growing agricultural and exploratory operations occurring in the region China and India have dominated the agricultural and industrial sectors in the area, making them the primary countries for the axial flow pump market. Increased energy consumption and expanding exploration operations have been driving factors in the worldwide axial flow pumps market in North America and Europe. The expanding chemical sector and power plants have also fueled market growth.

Get more details on this report -

Key Companies & Recent Developments

Partnerships, strategic mergers, and acquisitions are expected to be the most successful strategies for industry participants to get speedy access to growing markets while also improving technological capabilities. In addition, product differentiation and developments, as well as service expansion, are projected to help organizations thrive in the market. Generic strategies adopted by the companies usually include mergers & acquisitions, distribution network expansion, and product portfolio expansion. For instance, May 2019, Dover Corporation has acquired All-Flo Pump Company, and All-Flo Pump Company products are now part of pump solutions group units under Dover's Fluids business. Dover Corporation will benefit from the acquisition by broadening its product portfolio and expanding its global reach. In April 2019, SFA Group has acquired Zehnder Pumpen GmbH, a German pump manufacturer. With the support of 60 distributors globally, the acquisition will help SFA boost its revenues, notably in Germany, as well as its global footprint. The major companies profiled in this report include

Segmentation:

By Product Type

- Horizontal

- Vertical

By Application

- Water Treatment

- Irrigation

- Evaporators

- Others

By End-Use

- Chemical

- Municipal

- Pulp & Paper

- Agriculture

- Food & Beverage

- Others

By Region

- North America- U.S., Mexico, Canada

- Europe- UK, France, Germany, Italy

- Asia-Pacific- China, Japan, India

- Latin America- Brazil, Argentina, Colombia

- The Middle East and Africa- United Arab Emirates, Saudi Arabia

Key Players

- Ebara Corporation

- Flowserve Corporation

- Grundfos Holdings A/S

- Handol Pumps Limited

- Hitachi Industrial Products Ltd.

- ITT Goulds Pump

- Pentair PLC

- Sulzer Ltd.

- The Weir Group PLC

- Xylem Inc.

Need help to buy this report?