Global B2B Payments Market Size, Share, and COVID-19 Impact Analysis, By Payment Type (Domestic Payments, and Cross-Border Payments), By Payment Method (Bank Transfer, Card, and Online Payments), By Verticle Type (BFSI, IT and ITES, Retail and E-commerce, Travel and Hospitality, Healthcare, Media and Entertainment, Transportation and Logistics, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Banking & FinancialGlobal B2B Payments Market Insights Forecasts to 2033

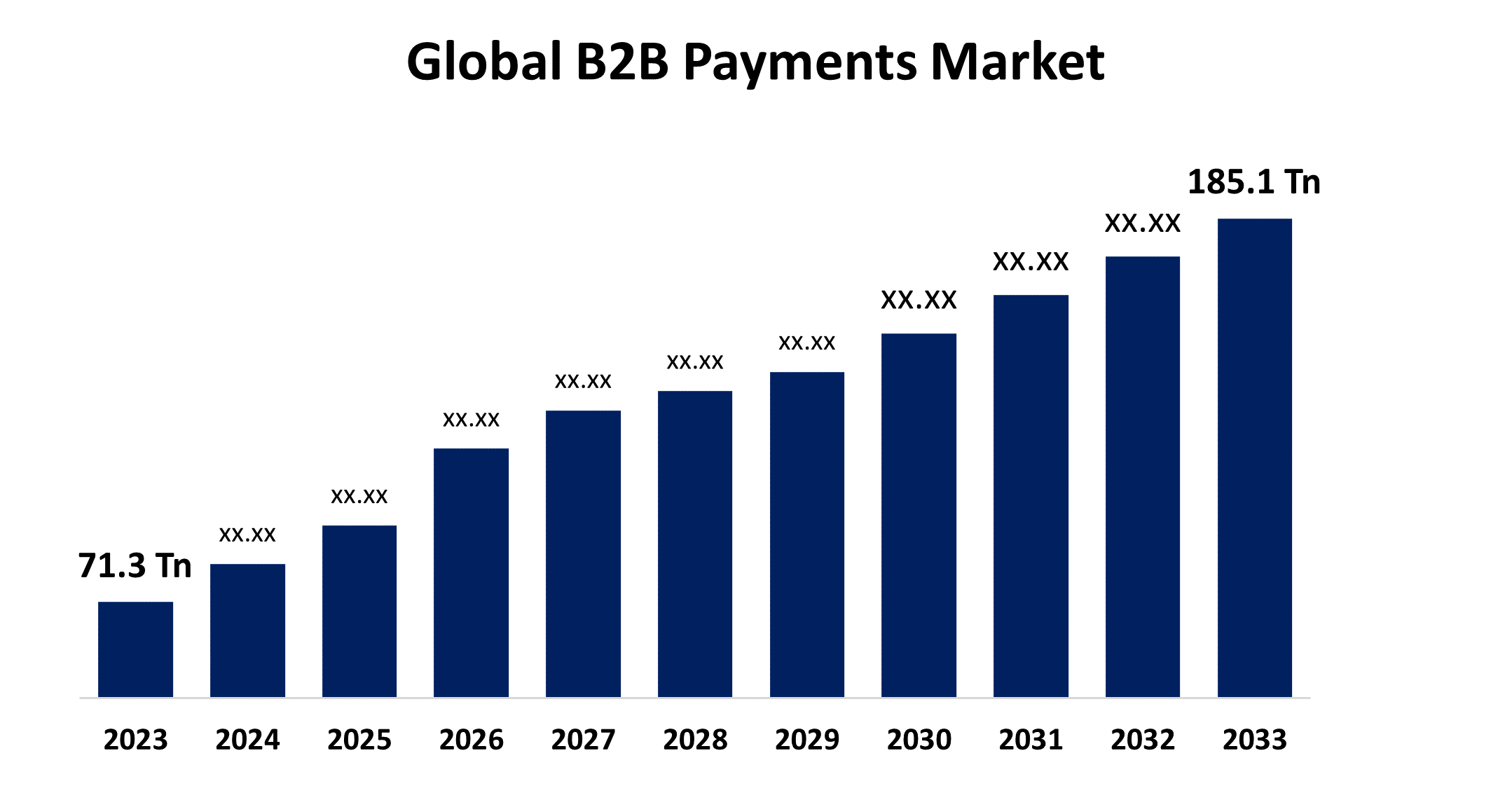

- The Global B2B Payments Market Size was Valued at USD 71.3 Trillion in 2023

- The Market Size is Growing at a CAGR of 10.01% from 2023 to 2033

- The Worldwide B2B Payments Market Size is Expected to Reach USD 185.1 Trillion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global B2B Payments Market Size is Anticipated to Exceed USD 185.1 Trillion by 2033, Growing at a CAGR of 10.01% from 2023 to 2033.

Market Overview

The B2B payments market is attributed to the system of financial transactions and payment solutions particularly designed for business-to-business (B2B) transactions. Business-to-business (B2B) payments are the transmission of goods and services offered for a precise value in currency. Business-to-business (B2B) payment encourages safer transactions for traders requiring recurring, periodic transactions and provides a variety of tasks to end users, including accounts receivable, accounts payable, payroll, and acquisition departments. Furthermore, business-to-business (B2B) payment might contain a one-time or recurring transaction constructed on the buyer and seller's contractual system. Business-to-business (B2B) payments are more compound than business-to-consumer (B2C) payments because B2B payment processing receipts longer to approve and settle the transaction. The B2B payments market assists industries of all dimensions, from small and medium-sized enterprises (SMEs) to big corporations, across several industry verticals such as Manufacturing, IT and telecom, BFSI, energy and utilities, government sector, and more. Moreover, the swift digitalization and mechanization of business-to-business (B2B) payment solutions have raised the demand from business owners for networking and linking with numerous suppliers, distributors, and retailers globally, which propel the market growth. The increasing tendency of real-time payment and growing investments in technology-based payment solutions propel the industry's growth. In addition, the development of worldwide trade and the rise in cross-border transactions including numerous suppliers, wholesalers, retailers, and businesses are the prime forces propelling the global market.

Report Coverage

This research report categorizes the market for the global B2B payments market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global B2B payments market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global B2B payments market.

B2B Payments Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 71.3 Trillion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 10.01% |

| 2033 Value Projection: | USD 185.1 Trillion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 187 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Payment Type, By Payment Method, By Verticle Type, By Region |

| Companies covered:: | PayPal Holdings, Inc., Stripe, Inc., Square, Inc., Adyen NV, TransferWise Ltd. (now known as Wise), Bill.com Holdings, Inc., Payoneer Inc., Worldpay, Inc., Fiserv, Inc., Visa Inc., JPMorgan & Chase, American Express, Paystand Inc., Mastercard, and Others Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The implementation of electronic B2B payment solutions is being boosted by the constant digital transformation happening across many businesses. Administrations are fluctuating from orthodox paper-based procedures to electronic payment systems to enhance workflow, boost productivity, and cut expenditures. Moreover, to streamline their financial operations, industries are looking for further economical and effective payment selections. The implementation of electronic B2B payment systems is powered by advantages such as advanced transaction processing, fewer human errors, compact processing costs, and improved cash flow management. Furthermore, the B2B payments environment is fluctuating as an effect of the extensive implementation of fintech solutions and cutting-edge payment technologies. Fintech industries are encouraging competition and innovation in the industry by delivering a broad range of B2B payment solutions, such as supply chain finance platforms, digital wallets, blockchain-based payments, and real-time payment networks. In addition, the surge in the implementation of AI has improved the financial workflows to transform the payment processes by fetching digitalization and automation in the business-to-business (B2B) payments solution.

Restraining Factors

B2B payments are striking targets for fraudsters and hackers owing to their high regulatory amounts and number of transactions. Payment scams, identity theft, and data breaches are instances of security flaws in payment structures that can challenge corporate confidence and foil the adoption of digital payment solutions. Moreover, adherence to numerous regulatory orders, such as data privacy laws, anti-money laundering (AML) rules, and payment card industry standards (PCI DSS), contributes to the complexity and expenses of business-to-business payment procedures. Vigorous risk management and compliance procedures are essential to guarantee conformity to regulatory outlines across different jurisdictions, which can present difficulties for multinational companies.

Market Segmentation

The global B2B payments market share is classified into payment type, payment method, and verticle type.

- The cross-border payments segment is expected to grow at the fastest CAGR in the global B2B payments market during the forecast period.

Based on the payment type, the global B2B payments market is divided into domestic payments and cross-border payments. Among these, the cross-border payments segment is expected to grow at the fastest CAGR in the global B2B payments market during the forecast period. This can be attributed to increasing worldwide trade and growing cross-border transactions including several buyers, suppliers, wholesalers, retailers, and enterprises, which are the crucial drivers pouring into the global market. Therefore, the increasing saturation of technologies and growth in demand for raw materials from businesses across the world lift the demand for cross-border transactions during the forecast period. Hence, the demand for the implementation of cross-border payments is high owing to a surge in international import-export businesses compared to domestic payment solutions during the forecast period.

- The bank transfer segment is expected to hold the largest share of the global B2B payments market during the forecast period.

Based on the payment method, the global B2B payments market is divided into bank transfer, card, and online payments. Among these, the bank transfer segment is expected to hold the largest share of the global B2B payments market during the forecast period. This is attributed to various businesses still paying with bank transfers for fast-moving modern business workflows, which further involves a transaction fee for both sender and receiver. Furthermore, business owners use numerous conventional payment methods, including cash and paper checks, when making payments to suppliers. In addition, business owners' increased use of paper checks owing to lesser transaction fees is an important factor driving the development of the B2B payment market in this area. Cash is one of the most commonly familiar and hassle-free payment methods. therefore, most business owners have used cash payment methods to advance the money transaction service, hence driving market expansion.

- The IT and ITES segment is expected to hold the largest share of the global B2B payments market during the forecast period.

Based on the verticle type, the global B2B payments market is divided into BFSI, IT and ITES, retail and e-commerce, travel and hospitality, healthcare, media and entertainment, transportation and logistics, and others. Among these, the IT and ITES segment is expected to hold the largest share of the global B2B payments market during the forecast period. This is attributed to the IT and ITES sector has been a pouring force in the development of the B2B digital payment market. Through technological innovation, IT companies have advanced secure payment gateways, innovative APIs, and software solutions that allow seamless and secure transactions among businesses. These expansions have assumed rise to dedicated B2B payment platforms providing features like real-time tracking, automated invoicing, and integration with accounting software.

Regional Segment Analysis of the Global B2B Payments Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

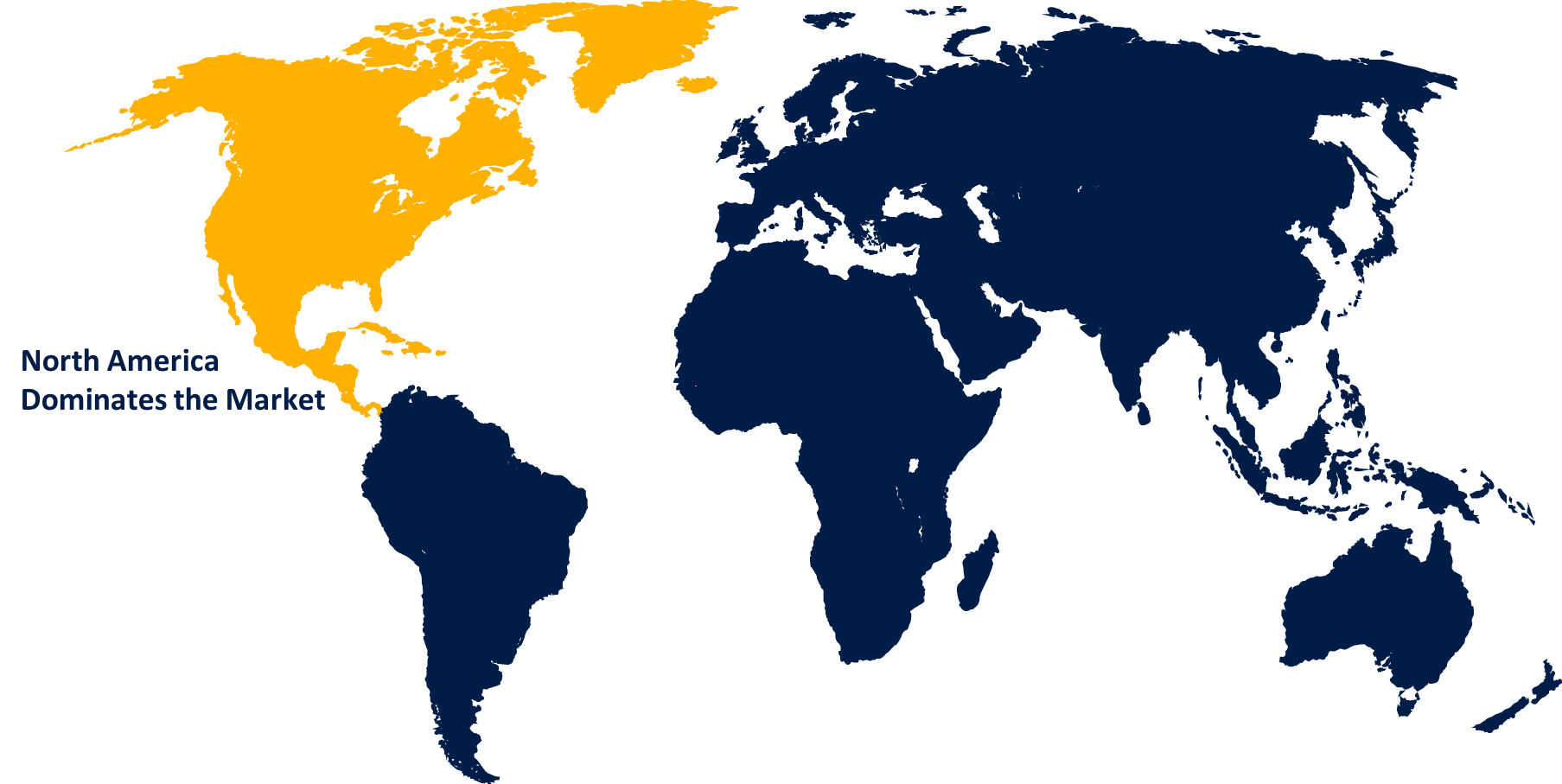

North America is anticipated to hold the largest share of the global B2B payments market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the global B2B payments market over the predicted timeframe. The reason behind this is the growing investments in the expansion of reliable and efficient payment solutions to achieve the cash flow and keep relationships with the material suppliers present across the U.S. and Canada lift the market development. Furthermore, the presence of large-sized B2B type of payment solution providers in countries, such as the U.S. and Canada. Moreover, most of the world's major payment solutions providers have opened new headquarters in the United States to deliver complete payment services to small and medium-sized industries.

Asia-Pacific is expected to grow at the fastest pace in the global B2B payments market during the forecast period. This is attributed to numerous enterprises from China, Japan, and India specifying in financial technology that have offered advanced payment technologies to industries. For instance, in April 2020, Harbour and Hills, a significant B2B cross-border payment provider in China, developed an 828 payments gateway that expands the corporate sector's commercial payment transaction process, pouring market growth in this area. In addition, cheques, bank transfers, demand draughts, and third-party gateways are protruding traditional commercial payment methods widely accepted by Asia-Pacific enterprises. This is viewed as a vital aspect of growing the regional market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global B2B payments market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- PayPal Holdings, Inc.

- Stripe, Inc.

- Square, Inc.

- Adyen NV

- TransferWise Ltd. (now known as Wise)

- Bill.com Holdings, Inc.

- Payoneer Inc.

- Worldpay, Inc.

- Fiserv, Inc.

- Visa Inc.

- JPMorgan & Chase

- American Express

- Paystand Inc.

- Mastercard

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In March 2023, Mastercard combined with Bahrain-based fintech company Infinios Financial Services to hasten the digitization of B2B portable payments in the Middle East and North Africa (MENA) region.

- In September 2023, Sprinque, a Netharlands-based payment service provider company, prolonged its geographical occurrence in Germany and Spain to overcome the European market by increasing the cross-border B2B payments platform portfolio.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global B2B payments market based on the below-mentioned segments:

Global B2B Payments Market, By Payment Type

- Domestic Payments

- Cross-Border Payments

Global B2B Payments Market, By Payment Method

- Bank Transfer

- Card

- Online Payments

Global B2B Payments Market, By Verticle Type

- BFSI

- IT and ITES

- Retail and E-commerce

- Travel and Hospitality

- Healthcare

- Media and Entertainment

- Transportation and Logistics

- Others

Global B2B Payments Market, Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1.Which are the key companies that are currently operating within the market?PayPal Holdings, Inc., Stripe, Inc., Square, Inc., Adyen NV, TransferWise Ltd. (now known as Wise), Bill.com Holdings, Inc., Payoneer Inc., Worldpay, Inc., Fiserv, Inc., Visa Inc., JPMorgan & Chase, American Express, Paystand Inc., Mastercard, and others.

-

2.What is the size of the global B2B payments market?The Global B2B payments Market is expected to grow from USD 71.3 Trillion in 2023 to USD 185.1 Trillion by 2033, at a CAGR of 10.01% during the forecast period 2023-2033.

-

3.Which region is holding the largest share of the market?North America is anticipated to hold the largest share of the global B2B payments market over the predicted timeframe.

Need help to buy this report?