Global Bactericide Market Size, Share, and COVID-19 Impact Analysis, By Type (Bactericides, Amide Bactericides, Copper-Based, Dithiocarbamate, Bactericides, and Others), By Crop Type (Cereals & Grains, Oilseeds & Pulses, and Fruits & Vegetables), By Form (Liquid and Dry), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: AgricultureGlobal Bactericide Market Insights Forecasts to 2033

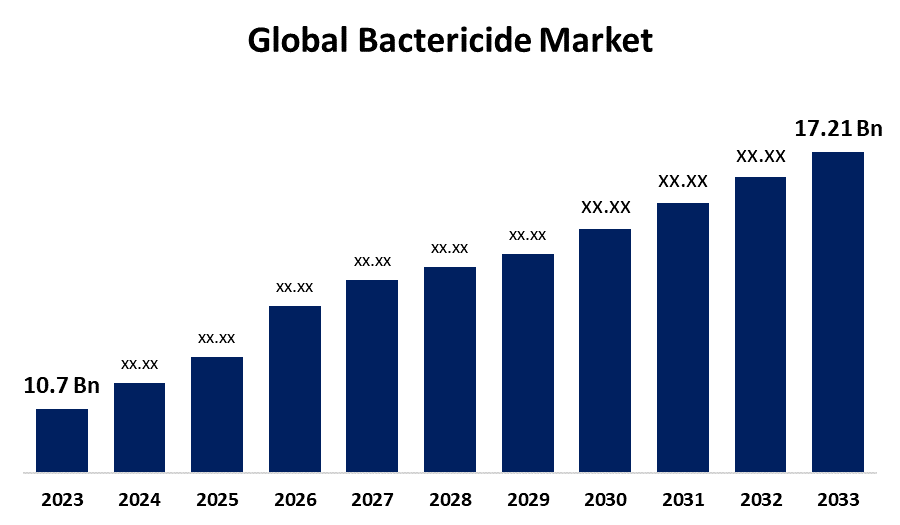

- The Global Bactericide Market Size was Valued at USD 10.7 Billion in 2023

- The Market Size is Growing at a CAGR of 4.8% from 2023 to 2033

- The Worldwide Bactericide Market Size is Expected to Reach USD 17.21 Billion by 2033

- North America is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Bactericide Market Size is Anticipated to Exceed USD 17.21 Billion by 2033, Growing at a CAGR of 4.8% from 2023 to 2033.

Market Overview

Any synthetic or biological agent that inhibits or eliminates the growth and spread of bacteria is called a bactericide. Bactericide can be chemically produced or developed from natural chemicals, certain pesticides known as "biopesticides" are made from naturally occurring substances like bacteria, plants, animals, and minerals. however, the majority of newly developed products are heterocyclic, carbon-based compounds that biodegrade naturally. In modern agriculture, pesticides must generally be highly effective and play a vital part in advancing society by increasing crop yields and lowering the labor required to generate food.

For Instance, in November 2023, Magic Gardener Biological Disease Treat, a broad-spectrum biological fungicide and bactericide for home and garden usage, was introduced to Mycorrhizal Applications. Its purpose is to treat or suppress diseases brought on by plant-pathogenic bacteria.

The primary drivers propelling the growth of the agricultural bactericides market are the increased use of these pesticides to improve crop growth and increase crop nutritional value by averting pest infestations.

Report Coverage

This research report categorizes the market for the bactericide market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the bactericide market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the bactericide market.

Global Bactericide Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 10.7 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 4.8% |

| 2033 Value Projection: | USD 17.21 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 227 |

| Tables, Charts & Figures: | 109 |

| Segments covered: | By Type, By Crop Type, By Form, By Region and COVID-19 Impact Analysis. |

| Companies covered:: | FMC Corporation, Biostadt India Limited, Aries Agro Ltd., Nippon Soda Co. Ltd., Syngenta AG, Adama Agricultural Solutions Ltd., BASF SE, American Vanguard Corporation, Nufarm Limited, PI Industries, Sumitomo Chemical, GREENCHEM BIOTECH, Dow AgroSciences LLC, Bayer CropScience AG, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The expanding requirement to meet the rising global consumer demand for food. Market expansion is being driven by an increase in food security and quality concerns, as well as growing regulatory interventions in the agricultural sectors to support safe and sustainable farming practices. The market is impacted by the growing use of bactericides to improve crop yields and quality, lower losses from bacterial infections, and adapt farming practices and technology. Furthermore, the expansion of the bactericide market is bolstered by the decline in arable land, the adoption of contemporary agricultural methods, advancements in agrochemical products, new technologies, and substantial returns on investment. According to Research Gate, between 59% and 98% more food will be consumed by humans by the year 2050. Agricultural markets will change as a result in ways that we have never seen. Farmers everywhere will need to boost food yields, either by adding more area for crops to grow on or by improving the productivity of already-existing agricultural lands using irrigation and fertilizer and by implementing innovative techniques like precision farming.

Restraining Factors

One of the main obstacles to the global bactericide market's expansion is the adverse consequences of these products. Chemicals called "bacteriacide" are used to destroy bacteria. They are most frequently utilized in agriculture where there is a significant chance of bacterial diseases. Although fungicides are very successful at treating or preventing bacterial infections in plants, farmers should be aware of their adverse effects.

Market Segmentation

The bactericide market share is classified into type, crop type, and form.

- The copper-based segment is estimated to hold the highest market revenue share through the projected period.

Based on the type, the bactericide market is classified into bactericides, amide bactericides, copper-based, dithiocarbamate, bactericides, and others. Among these, the copper-based segment is estimated to hold the highest market revenue share through the projected period. Due to the products being easier to use, having a longer shelf life than aqueous fungicides/bactericides, and being designed with a higher concentration of active ingredients. Dry bactericides can be kept in storage for extended periods and at a wide range of temperatures without compromising the formulation's stability. Dry formulations of bactericides also reduce shipping costs. Although copper compounds have a reputation for being able to manage bacteria and fungi, the copper components that are used on plants need to be generally non-toxic. While most organic copper compounds have been proven to be phytotoxic, particularly when applied topically, inorganic copper compounds are usually utilized due to their apparent non-phytotoxicity.

- The fruits & vegetables segment is anticipated to hold the largest market share through the forecast period.

Based on the crop type, the bactericide market is divided into cereals & grains, oilseeds & pulses, and fruits and vegetables. Among these, the fruits & vegetables segment is anticipated to hold the largest market share through the forecast period. A variety of fruits (such as grapes and pineapples) and vegetables (like tomatoes and cabbages) are grown in these crops. Bacterial infestations are causing a decline in fruit and vegetable production. Therefore, growers of fruits and vegetables need to use crop bactericides. Sales of bactericides are anticipated to increase since fruits and vegetables have high profit margins. To boost the sales of bactericides, growth companies are always looking for effective agricultural inputs. Due to the diversity of fruits and vegetables in this subsegment, it is possible to develop bactericides that address the unique issues of bacterial infections affecting these crops.

For instance, in March 2023, Syngenta announced that Storen, a brand-new maize herbicide, is now in development. Farmers will be able to take advantage of up to three weeks longer residual weed control than previous leading corn herbicides once the new pre- and post-emergence grass and broadleaf corn herbicide is approved by the Environmental Protection Agency for registration.

- The liquid segment dominates the market with the largest market share through the forecast period.

Based on the form, the bactericide market is categorized into dry and liquid. Among these, the liquid segment dominates the market with the largest market share through the forecast period. Due to liquid crop bactericides being so convenient and simple to apply, there is a great expectation that their use would rise. The markets for crop bactericides are always growing because they are easy to freight and transport in solid containers. Therefore, more applications of liquid crop bactericides for agricultural bactericides contribute to the expansion of the market.

Regional Segment Analysis of the Bactericide Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the Bactericide market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the bactericide market over the predicted timeframe. A significant share of the market is expected to be occupied by Asia-Pacific since crop protection products are being used more often to increase crop yields. The market is expanding due to Asia-Pacific's rapidly expanding population and farmers' preference for efficient crop protection products. An increasing amount of agricultural land is available in countries like China and India, which adds to the growing demand for bactericides in the region.

North America is expected to grow at the fastest CAGR growth of the bactericide market during the forecast period. In this region, market demand increases by the demand for agricultural output. Rising crop quality demands and greater knowledge of the use of bactericides and biorational fungicides to avoid bacterial infections in crop yields are the main drivers of market expansion in the region. And continuous developments by key players in the products resulted in market expansion. For Instance, in May 2024, to manage weeds in non-tolerant and glufosinate-resistant corn, sweet corn, soybean, cotton, and canola, the U.S. Environmental Protection Agency (EPA) submitted its proposed registration decision for pesticide products containing the new active ingredient, glufosinate-P, for public comment. The EPA has published its draft biological evaluation of the pesticide under the Endangered Species Act (ESA), in addition to its proposed registration determination.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the bactericide market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- FMC Corporation

- Biostadt India Limited

- Aries Agro Ltd.

- Nippon Soda Co. Ltd.

- Syngenta AG

- Adama Agricultural Solutions Ltd.

- BASF SE

- American Vanguard Corporation

- Nufarm Limited

- PI Industries

- Sumitomo Chemical

- GREENCHEM BIOTECH

- Dow AgroSciences LLC

- Bayer CropScience AG

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In July 2024, MOA Technology and Nufarm work together to developed a cutting-edge herbicide. Moa will be compensated upfront, at development milestones, and eventually through royalties from herbicide sales.

- In May 2024, leading international agricultural sciences corporation FMC Corporation was granted registration in Brazil for its herbicides Azugro and Ezanya, which are intended for use on cotton, tobacco, and wheat crops. FMC's brand name for bixlozone, Isoflex Active, powers the herbicides Azugro and Ezanya.

- In December 2023, a global pioneer in agriculture, Syngenta, sold the trademark Gramoxone to Crystal Crop Protection Limited, one of the rapidly expanding R&D-based crop protection manufacturing and marketing enterprises in India. The purchase will be effective for the Indian market.

- In July 2023, an NSF grant of US$275,000 was given to Harpe Bioherbicide Biosolutions to research weed resistance. NSF is an independent federal organization that provides funding to scientists who make novel discoveries and fresh information that advances our understanding of the world.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the bactericide market based on the below-mentioned segments:

Global Bactericide Market, By Type

- Bactericides

- Amide Bactericides

- Copper-Based

- Dithiocarbamate

- Bactericides

- Others

Global Bactericide Market, By Crop Type

- Cereals & Grains

- Oilseeds & Pulses

- Fruits & Vegetables

Global Bactericide Market, By Form

- Dry

- Liquid

Global Bactericide Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the bactericide market over the forecast period?The bactericide market is projected to expand at a CAGR of 4.8% during the forecast period.

-

2. What is the market size of the bactericide market?The Global Bactericide Market Size is Expected to Grow from USD 10.7 Billion in 2023 to USD 17.21 Billion by 2033, at a CAGR of 4.8% during the forecast period 2023-2033.

-

3. Which region holds the largest share of the Bactericide market?Asia Pacific is anticipated to hold the largest share of the bactericide market over the predicted timeframe.

Need help to buy this report?