Global Bancassurance Market Size, Share, and COVID-19 Impact Analysis, By Type (Life Insurance and Non-Life Insurance), By Model Type (Pure Distributor, Exclusive Partnership, Financial Holding, and Joint Venture), By Distribution Channel (Traditional Banks, Digital Platforms, and Insurtech Startups), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Banking & FinancialGlobal Bancassurance Market Insights Forecasts to 2033

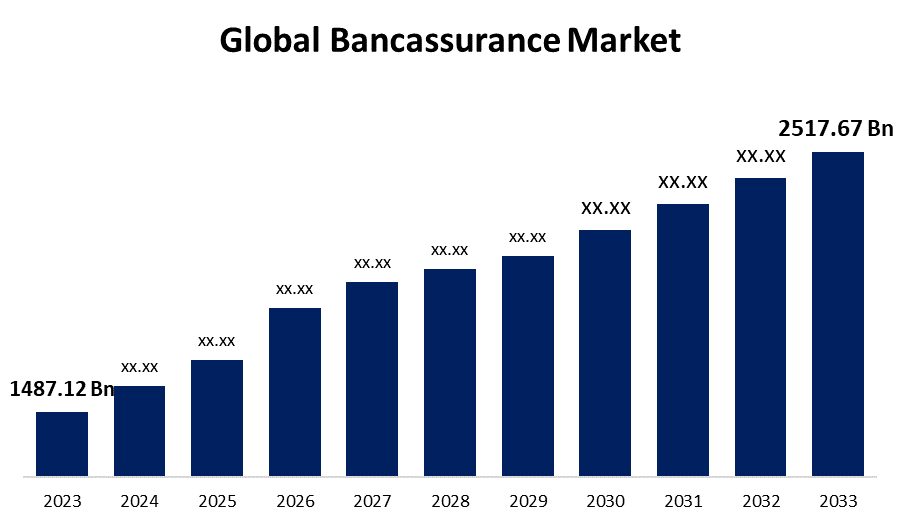

- The Global Bancassurance Market Size was Valued at USD 1487.12 Billion in 2023

- The Market Size is Growing at a CAGR of 5.41% from 2023 to 2033

- The Worldwide Bancassurance Market Size is Expected to Reach USD 2517.67 Billion by 2033

- Middle East & Africa is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Bancassurance Market Size is Anticipated to Exceed USD 2517.67 Billion by 2033, Growing at a CAGR of 5.41% from 2023 to 2033.

Market Overview

The term "bancassurance" refers to a contract that permits an insurance provider to offer its products and services to bank clients. Both banks and insurance firms stand to gain from such an arrangement. This arrangement enables banks to provide a range of insurance products, including annuities, health, and life insurance, as well as mortgages. This broadens their market reach, increases equity returns, and improves their overall financial portfolio. In the end, banks that sell insurance plans might increase their profits and bring in additional cash. However, insurance businesses can increase their customer base without spending money on hiring more salespeople or giving brokers and agents commissions. Due to the client's loyalty to their banks and their purchase of policies based on the financial advice provided by their banks, retention rates are greater. As a result, this element fuels the expansion of the bancassurance sector. Additionally, a significant portion of the bancassurance market's client base is provided by the expanding number of bank clients, primarily in developing nations, which drives the market's expansion. Over the projected time, the worldwide bancassurance industry is anticipated to rise significantly. The BFSI sector's explosive growth and the fact that many banks are choosing to form strategic alliances to increase their market share are the main factors propelling the global bancassurance market

Report Coverage

This research report categorizes the market for the global bancassurance market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global bancassurance market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global bancassurance market.

Global Bancassurance Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 1487.12 Billion |

| Forecast Period: | 2023 – 2033 |

| Forecast Period CAGR 2023 – 2033 : | 5.41% |

| 023 – 2033 Value Projection: | USD 2517.67 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Model Type, By Distribution Channel, By Region |

| Companies covered:: | AXA, Allianz, ING Group, BNP Paribas Cardif, Aviva, Prudential plc, MetLife, Zurich Insurance Group, Assicurazioni Generali S.p.A., Ping An Insurance, China Life Insurance Company, HSBC Insurance, Others |

| Pitfalls & Challenges: | Covid-19 Impact, Challenge, Future,Growth and Analysis |

Get more details on this report -

Driving Factors

The number of people in need of financial services, such as insurance, rises with economies. Higher income levels are often the result of economic progress, making insurance products more accessible to a wider range of consumers. Furthermore, when governments and organizations step up their financial literacy initiatives, consumers become more conscious of the value of insurance and seek out such services. Given their existing reputation and customer base, banks are well-positioned to efficiently cross-sell insurance products. In emerging economies, where insurance penetration is typically low, banks can be essential in facilitating public access to insurance products. Increased financial literacy and economic growth serve as market catalysts, propelling the global bancassurance market growth. The sector for bancassurance is also significantly influenced by the rapid advancement of digital technologies. Technological developments in data analytics, AI, and machine learning allow banks and insurance providers to provide more efficient and customized products.

Restraining Factors

The number of insurance policies sold in a bank branch is determined by the footfall of customers; if there are fewer customers in that branch than in other branches with higher footfall, then fewer insurance policies are sold there. As a result, the bancassurance market is severely constrained by this. Additionally, cross-selling insurance products and services alongside bank products are challenging for bank staff. These, then, are the primary factors impeding the market share of bancassurance.

Market Segmentation

The global bancassurance market share is segmented into type, model type, and distribution channel.

- The life insurance segment dominates the market with the largest market share through the forecast period

Based on the type, the global bancassurance market is segmented into life insurance and non-life insurance. Among these, the life insurance segment dominates the market with the largest market share through the forecast period. A big contributing factor is the growing understanding of the value of life planning and financial stability. Growing in financial literacy, consumers understand the importance of life insurance plans for safeguarding their families' future, particularly in the event of unanticipated events such as incapacity or death. Banks are in a good position to launch these essential products due to their current customer base. Furthermore, a larger portion of the population might now purchase life insurance due to the rise in dual-income households and higher discretionary income. The ability for consumers to quickly compare and purchase life insurance policies using online banking platforms is another way that technological improvements have made the process easier.

- The pure distributor segment is anticipated to grow at the fastest CAGR growth through the forecast period.

Based on the model type, the global bancassurance market is segmented into pure distributor, exclusive partnership, financial holding, and joint venture. Among these, the pure distributor segment is anticipated to grow at the fastest CAGR growth through the forecast period. In the bancassurance sector, the pure distributor model is becoming more popular as a result of several market forces. This strategy is quite attractive to financial institutions looking to expand their offers without taking on additional liabilities, as the bank only functions as a distributor of insurance products, not engaging in any underwriting risk. The cheap operating cost is one of the main driving forces. Banks don't need to make large additional investments due to they might make use of their current infrastructure, clientele, and routes of communication. The strategy is very appealing to both larger banks and smaller, regional institutions owing to its cost-effectiveness.

- The traditional banks segment accounted for the largest revenue share through the forecast period.

Based on the distribution channel, the global bancassurance market is segmented into traditional banks, digital platforms, and insurtech startups. Among these, the traditional banks segment accounted for the largest revenue share through the forecast period. As well-known and seasoned participants in the financial sector, traditional banks have effectively included insurance products in their service portfolios. Traditional banks have been able to secure a sizable portion of the bancassurance industry owing to their broad network of branches and consumer base.

Regional Segment Analysis of the Global Bancassurance Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the global bancassurance market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the global bancassurance market over the predicted timeframe. Numerous economic variables are driving the swift development of the bancassurance sector in the Asia Pacific region. A major contributing aspect is the growing middle class, which has more disposable income and financial literacy. This group is becoming increasingly engaged in a wider range of financial products, such as insurance. The region is also distinguished by a comparatively low occurrence of insurance services, thus generating a substantial unexplored market for bancassurance to service. Banks and insurance companies are increasingly partnering as a result of regulatory developments in some Asia Pacific nations that are more favorable to the bancassurance model. Moreover, the rapid use of digital technology in nations like China, South Korea, and Singapore has made it possible for bancassurance to gain from new developments in technology.

Middle East & Africa is expected to grow at the fastest CAGR growth of the global bancassurance market during the forecast period. Although Bancassurance is still in its infancy in this region in comparison to other regions of the world, it has grown significantly in the last few years. A growing middle class, rising disposable incomes, and more understanding of insurance products and their advantages are some of the factors driving this expansion. Furthermore, the increase in Bancassurance's offerings has been driven by strategic alliances between banks and insurance providers, giving clients easy access to insurance products via bank channels.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global bancassurance market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- AXA

- Allianz

- ING Group

- BNP Paribas Cardif

- Aviva

- Prudential plc

- MetLife

- Zurich Insurance Group

- Assicurazioni Generali S.p.A.

- Ping An Insurance

- China Life Insurance Company

- HSBC Insurance

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In June 2023, Admiral Seguros and the ING Group unveiled a state-of-the-art digital bancassurance partnership. The collaboration is the outcome of Admiral Group's desire to support the expansion of its distribution network with premium insurance products and ING's dedication to effectively meeting the needs of its clients.

- In June 2023, The Bancassurance agreement between Allianz Egypt and Crédit Agricole Egypt, a subsidiary of the Crédit Agricole Group, has been extended. The partnership agreement will be renewed in order to expand Allianz Egypt's clientele and provide the best insurance services to the bank's customers.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global bancassurance market based on the below-mentioned segments:

Global Bancassurance Market, By Type

- Life Insurance

- Non-Life Insurance

Global Bancassurance Market, By Model Type

- Pure Distributor

- Exclusive Partnership

- Financial Holding

- Joint Venture

Global Bancassurance Market, By Distribution Channel

- Traditional Banks

- Digital Platforms

- Insurtech Startups

Global Bancassurance Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. Which are the key companies that are currently operating within the market?AXA, Allianz, ING Group, BNP Paribas Cardif, Aviva, Prudential plc, MetLife, Zurich Insurance Group, Assicurazioni Generali S.p.A., Ping An Insurance, China Life Insurance Company, HSBC Insurance, and Others.

-

2. What is the size of the global bancassurance market?The Global Bancassurance Market Size is Expected to Grow from USD 1487.12 Billion in 2023 to USD 2517.67 Billion by 2033, at a CAGR of 5.41% during the forecast period 2023-2033.

-

3. Which region is holding the largest share of the market?Asia Pacific is anticipated to hold the largest share of the global bancassurance market.

Need help to buy this report?