Global Bank Risk Management Software Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Financial, Operational, Credit, Enterprise, Market, and Compliance), By Industry (Banking, Financial Services, and Insurance (BFSI), Healthcare, IT and Telecom, Government and Defense, Energy and Utilities, Manufacturing, and Retail), By Deployment Mode (On-Premises, and Cloud Based), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: Banking & FinancialGlobal Bank Risk Management Software Market Insights Forecasts to 2033

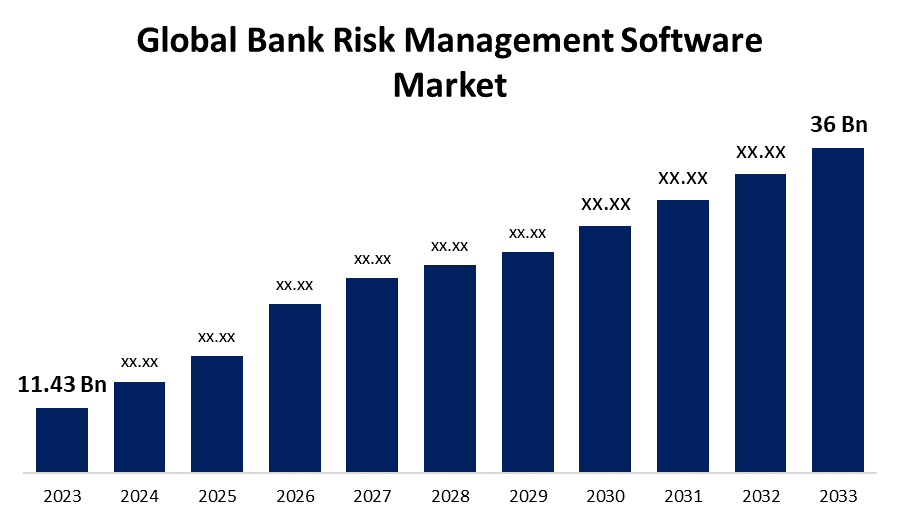

- The Global Bank Risk Management Software Market Size was Valued at USD 11.43 Billion in 2023

- The Market Size is Growing at a CAGR of 12.16% from 2023 to 2033

- The Worldwide Bank Risk Management Software Market Size is Expected to Reach USD 36 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Bank Risk Management Software Market Size is Anticipated to Exceed USD 36 Billion by 2033, Growing at a CAGR of 12.16% from 2023 to 2033.

Market Overview

The bank risk management software is designed to help financial institutions identify, assess, manage, and mitigate the various risks they face, including credit, market, operational, and compliance risks. These software are essential for banks to maintain financial stability, and regulatory compliance, and to safeguard against the growing complexities of modern financial markets.

The bank risk management software offers benefits like improved decision-making capabilities due to better insights, easier compliance with regulatory standards, and mitigation of potential financial losses through accurate risk management. Stringent regulations drive the market's growth as it requires advanced risk management solutions. Rising cases of cyber threat generate the demand for risk insurance and robust security measures. The continuous technological advancements in risk management software are improving its efficiency and effectiveness.

For instance, in March 2024, Compliance, credit risk, and lending solutions provider Abrigo boosted its accounting and risk management capabilities by acquiring TPG Software, a financial software developer headquartered in Houston, USA, for an undisclosed sum.

Report Coverage

This research report categorizes the market for the global bank risk management software market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global bank risk management software market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global bank risk management software market.

Global Bank Risk Management Software Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 11.43 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 12.16% |

| 2033 Value Projection: | USD 36 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 230 |

| Tables, Charts & Figures: | 140 |

| Segments covered: | By Product Type, By Industry, By Deployment Mode, By Region |

| Companies covered:: | Abrigo, Active Risk, Oracle, Ernst & Young Global Limited (EY), Kyriba, Experian, LogicGate Inc., Riskonnect, Comarch SA, S&P Global Inc, SAP, SAS, Pegasystems, Accenture, Fiserv, Temenos, IBM, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Several key driving factors drive the growth of the global bank risk management software market. The driving factor is the stringent regulatory requirements, as financial institutions must adhere to comprehensive compliance mandates to avoid penalties and maintain operational integrity. The rising number of cyber threats is forcing banks to invest heavily in advanced risk management solutions to safeguard their and users’ data and financial assets.

Additionally, technological advancements play a pivotal role, with innovations in artificial intelligence, big data analytics, and blockchain offering improved capabilities for real-time risk assessment and mitigation. Global banking operations require robust risk management frameworks to manage the complexities and risks of cross-border transactions and international regulations.

The shift towards digitalization in the banking sector supports market growth, as more banks and financial institutions seek scalable, efficient, and embedded risk management solutions to streamline their operations and improve decision-making.

Restraining Factors

The global bank risk management software market could face several challenges, restraining the market growth. High implementation costs and fees are major barriers, particularly for smaller financial institutions that might struggle to afford the initial risk management solutions. The technical complexity of these systems requires trained personnel, which escalates costs and operational challenges. Another factor is the data privacy concerns, as regulations like the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA) mandate strict compliance. These factors pose a challenge to the widespread adoption and seamless integration of risk management software across the banking sector.

Market Segmentation

The global bank risk management software market share is classified into product type, industry, and deployment mode.

- The credit segment is expected to hold the largest share of the global bank risk management software market during the forecast period.

Based on the product type, the global bank risk management software market is divided into financial, operational, credit, enterprise, market, and compliance. Among these, the credit segment is expected to hold the largest share of the global bank risk management software market during the forecast period. This large share of this segment is due to the need for banks to manage credit risk effectively, given the substantial financial implications of credit defaults and non-performing loans. Credit risk management software enables banks to evaluate the creditworthiness of borrowers, set appropriate credit limits, and monitor exposures in real time, thereby minimizing potential financial losses. Banks are forced to invest in advanced solutions to ensure compliance, as regulatory bodies impose strict guidelines on credit risk management software. The credit risk management tools offer benefits like improved loan portfolio quality, enhanced decision-making capabilities, and the ability to identify and react quickly to potential credit risks, making this segment.

- The banking, financial services, and insurance (BFSI) segment is expected to hold the largest share of the global bank risk management software market during the forecast period.

Based on this, the global bank risk management software market is divided into banking, financial services, and insurance (BFSI), healthcare, IT and telecom, government and defense, energy and utilities, manufacturing, and retail. Among these, the banking, financial services, and insurance (BFSI) segment is expected to hold the largest share of the global bank risk management software market during the forecast period. This segment's large market share is because of the nature of the BFSI industry, where risk management is a critical operational component. Financial institutions in the BFSI sector face numerous risks, including credit, market, operational, and compliance-related challenges, necessitating sophisticated risk management solutions. The regulatory pressure on these institutions to maintain transparent and compliant operations further drives the demand for advanced software. Additionally, the large volume of transactions and the high complexity of financial products generate the need for robust risk management frameworks. The benefits include better risk identification and mitigation, regulatory compliance, and risk-adjusted returns, all of which highlight the importance of risk management software in the BFSI sector.

- The cloud-based segment is expected to grow at the fastest CAGR in the global bank risk management software market during the forecast period.

Based on the business model, the global bank risk management software market is divided into on-premises, and cloud based. Among these, the cloud-based segment is expected to grow at the fastest CAGR in the global bank risk management software market during the forecast period. This rapid growth is because cloud-based deployment offers benefits such as scalability and cost-effectiveness. Banks and financial firms are adopting cloud technology to scale resources up or down based on the demand in real-time without significant capital expenditure. Cloud-based risk management solutions offer better accessibility, enabling real-time risk monitoring and decision-making from anywhere, which is beneficial in the current era of remote and hybrid work environments. The seamless integration capabilities of cloud solutions allow interoperability with other systems, improving overall operational efficiency. Furthermore, continuous advancements in data security on the cloud position them as the preferred choice for financial institutions seeking agility and innovation.

Regional Segment Analysis of the global bank risk management software market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the global bank risk management software market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the global bank risk management software market over the predicted timeframe. The region's well-established financial sector includes leading global and regional banks that require advanced risk management solutions. The strict regulatory frameworks in North America, like Dodd-Frank, Basel III, and the Sarbanes-Oxley Act, generate the requirement for robust compliance and risk management systems. The North American region is also a hub of technological innovation, resulting in the early adoption of advanced risk management technologies with artificial intelligence, machine learning, and big data analytics. The presence of several leading risk management software vendors in North America also drives market growth. Furthermore, investments in cybersecurity to fight cyber threats boost the demand for comprehensive risk management solutions.

Asia Pacific is expected to grow at the fastest pace in the global bank risk management software market during the forecast period. This rapid growth is due to the region's exponential economic growth and increasing digitalization of the financial sector. Governments across the Asia-Pacific region are promoting financial inclusivity and digitization, accelerating the adoption of risk management software solutions. The rapidly growing fintech industry and rising cyber threats boost the demand for robust risk management frameworks and software. Regulatory authorities are also narrowing oversight, forcing financial institutions to invest in sophisticated risk management software to ensure compliance.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global bank risk management software market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Abrigo

- Active Risk

- Oracle

- Ernst & Young Global Limited (EY)

- Kyriba

- Experian

- LogicGate Inc.

- Riskonnect

- Comarch SA

- S&P Global Inc

- SAP

- SAS

- Pegasystems

- Accenture

- Fiserv

- Temenos

- IBM

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In August 2024, Treasury Prime, a leading embedded banking software company, announced the addition of Kobalt Labs, an AI-powered copilot for risk and compliance teams, to the Treasury Prime Partner Marketplace. Banks in Treasury Prime’s network now have the option to leverage Kobalt Labs to better manage their third-party diligence with AI, including the ability to streamline legal, compliance, and infosec diligence in one platform.

- In December 2023, Treasury Prime, a leading embedded banking software company, announced its strategic partnership with Effective, a fraud and risk management platform for financial institutions and fintech companies.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global bank risk management software market based on the below-mentioned segments:

Global Bank Risk Management Software Market, By Product Type

- Financial

- Operational

- Credit

- Enterprise

- Market

- Compliance

Global Bank Risk Management Software Market, By Industry

- Banking, Financial Services, and Insurance (BFSI)

- Healthcare

- IT and Telecom

- Government and Defense

- Energy and Utilities

- Manufacturing

- Retail

Global Bank Risk Management Software Market, By Deployment Mode

- On-Premises

- Cloud Based

Global Bank Risk Management Software Market, Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. Which are the key companies that are currently operating within the market?Abrigo, Active Risk, Oracle, Ernst & Young Global Limited (EY), Kyriba, Experian, LogicGate Inc., Riskonnect, Comarch SA, S&P Global Inc, SAP, SAS, Pegasystems, Accenture, Fiserv, Temenos, IBM, and Others.

-

2. What is the size of the global bank risk management software market?The Global Bank Risk Management Software Market is expected to grow from USD 11.43 Billion in 2023 to USD 36 Billion by 2033, at a CAGR of 12.16% during the forecast period 2023-2033.

-

3. Which region is holding the largest share of the market?North America is anticipated to hold the largest share of the global bank risk management software market over the predicted timeframe.

Need help to buy this report?