Global Barley Tea Market Size, Share, and COVID-19 Impact Analysis, By Flavor (Original and Flavored), By Form (Instant and Ready-to-drink), By Distribution Channel (Offline and Online), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Consumer GoodsGlobal Barley Tea Market Insights Forecasts to 2033

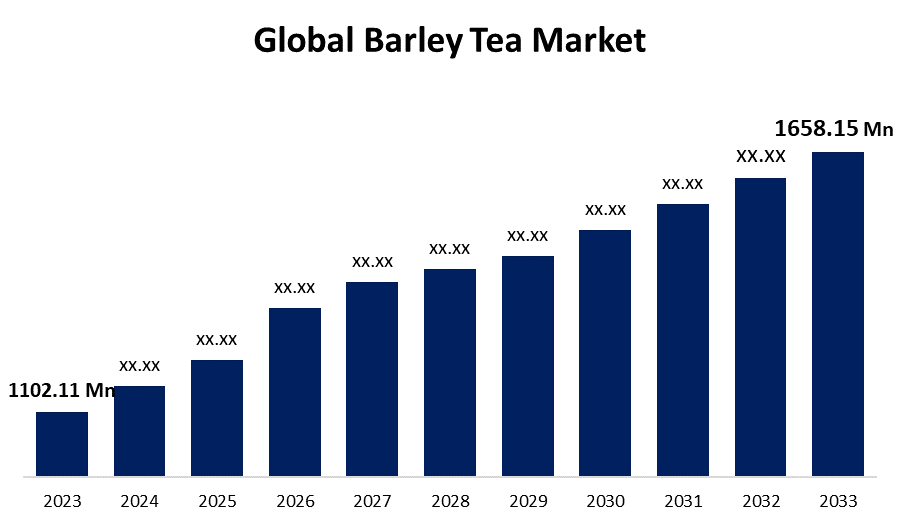

- The Global Barley Tea Market Size was Valued at USD 1,102.11 Million in 2023

- The Market Size is Growing at a CAGR of 4.17% from 2023 to 2033

- The Worldwide Barley Tea Market Size is Expected to Reach USD 1,658.15 Million by 2033

- Europe is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Barley Tea Market Size is Anticipated to Exceed USD 1,658.15 Million by 2033, Growing at a CAGR 4.17% from 2023 to 2033.

Market Overview

Barley tea is free of tea leaves and is not a proper tea like black, green, or white tea. This is also regular tisane made with roasted grains rather than an herbal tea. Roasted barley seeds are used to make barley tea, an infusion. Because of its high fiber content and moderate flavor, barley is a staple whole grain that may be found in many different dishes and drinks, including beer. Though it can be brewed hot or cold, barley tea is most often drunk cold for its appealing qualities. The two regions where barley tea is most frequently grown are Japan and Korea, where it is an immensely popular summertime and wintertime beverage. Roasted barley grains are used to make barley tea, which is also referred to as boricha in Korea and mugicha in Japan. Barley tea attracts those people who are health-conscious because it is high in antioxidants and free of caffeine. It is recognized for facilitating improved digestion, encouraging rest, and maybe supporting blood sugar regulation. The recognition of herbal tea blends as a high-end and healthful beverage alternative has been made possible by the movement towards specialty beverages including craft beers and artisanal drinks. Furthermore, growth in the tea sector has been driven by rising health consciousness and rising disposable income. Leading players' summaries of various healthful additions to barley tea are among the other factors propelling the market's expansion.

Report Coverage

This research report categorizes the market for the barley tea market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the barley tea market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the barley tea market.

Global Barley Tea Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 1,102.11 Million |

| Forecast Period: | 2023 – 2033 |

| Forecast Period CAGR 2023 – 2033 : | 4.17% |

| 023 – 2033 Value Projection: | USD 1,658.15 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 245 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Flavor, By Form, By Distribution Channel, By Region |

| Companies covered:: | Ito En, Suntory Beverage & Food, Kirin Holdings, Otsuka Pharmaceutical, Jinjja Barley Tea, Haitai, The Republic of Tea, Odani kokufun, Lotte, Ten Ren Tea Company, Ladakhi Foods Pvt. Ltd, Java Tea Company, Sanei Kosan Co., Ltd., Nikken Foods, Others |

| Pitfalls & Challenges: | Covid-19 Impact, Challenge, Future,Growth and Analysis |

Get more details on this report -

Driving Factors

One of the primary factors influencing the consumption of barley tea is its popularity for health benefits, which include the tea's ability to aid with digestion and antioxidant qualities. The demand for natural and caffeine-free beverages is on the rise, which makes barley tea becoming increasingly popular.

Restraining Factors

The major barrier to barley tea is growth in the market is being hampered by the rising trend in coffee consumption and the fluctuating cost of the raw materials used to make barley tea.

Market Segmentation

The barley tea market share is classified into flavor, form, and distribution channel.

- The flavored segment accounted for the largest revenue share over the forecast period.

Based on the flavor, the barley tea market is categorized into original and flavored. Among these, the flavored segment accounted for the largest revenue share over the forecast period. There are many alternatives in the flavored segment to suit a variety of tastes, ranging from fruity flavors to herbal infusions. To appeal to individuals who might find the original flavor of barley tea too delicate or bland, flavored variants can enhance the natural taste of the tea

- The ready-to-drink segment is anticipated to grow at the highest CAGR during the forecast period.

Based on the form, the barley tea market is categorized into instant and ready-to-drink. Among these, the ready-to-drink segment is anticipated to grow at the highest CAGR during the forecast period. Ready-to-drink barley tea is pre-brewed and ready to drink immediately after brewing, providing the ultimate convenience. Busy customers seeking a simple, quick beverage alternative that requires hardly any preparation may find this appealing. RTD barley tea is perfect for active lives and outdoor activities because it is portable and comes in bottles, cans, and tetra packs

- The offline segment dominates the market with the highest market share through the forecast period.

Based on the distribution channel, the barley tea market is categorized into offline and online. Among these, the offline segment dominates the market with the highest market share through the forecast period. Supermarkets, hypermarkets, convenience stores, and other large retail chains are partners with companies that produce barley tea. These partnerships guarantee barley tea's accessibility to a wide range of consumers. Barley tea businesses can more successfully enter markets and build a solid presence in both urban and rural areas due to these collaborations.

Regional Segment Analysis of the Barley Tea Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the barley tea market over the predicted timeframe.

Get more details on this report -

North America is projected to hold the largest share of the barley tea market over the forecast period. This dominance is due to the growing popularity of barley tea in Asian cultures is influencing consumers in North America, particularly in diverse metropolises where interest in Asian cuisine and wellness practices is on the rise. To appeal to eco-conscious consumers, brands are highlighting sustainable barley sourcing and eco-friendly packaging. Additionally, health professionals, nutritionists, and wellness influencers are promoting barley tea as a healthy substitute for sugary and caffeinated drinks.

Europe is expected to grow at the fastest CAGR growth in the barley tea market during the forecast period. This dominance is due to the demand for functional beverages such as barley tea, which is well-known for its health benefits such as being caffeine-free, promoting digestion, and offering antioxidants. It is being driven by European consumers' growing emphasis on health and wellness. As part of their gastronomic adventure, European consumers are becoming more and more interested in real, genuine Asian beverages, such as barley tea. Additionally, in response to consumer demand for ecologically friendly products, there is a growing focus on sustainable packaging options, such as recyclable and biodegradable materials.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the barley tea market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Market Players

- Ito En

- Suntory Beverage & Food

- Kirin Holdings

- Otsuka Pharmaceutical

- Jinjja Barley Tea

- Haitai

- The Republic of Tea

- Odani kokufun

- Lotte

- Ten Ren Tea Company

- Ladakhi Foods Pvt. Ltd

- Java Tea Company

- Sanei Kosan Co., Ltd.

- Nikken Foods

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In April 2023, a fresh batch of Omi barley tea was released by Shiga Prefecture, which is well-known for housing Lake Biwa, the largest lake in Japan. The remarkable quality of the barley in this region is attributed to its mineral-rich soil and abundance of sunshine.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the barley tea market based on the below-mentioned segments:

Global Barley Tea Market, By Flavor

- Original

- Flavored

Global Barley Tea Market, By Form

- Instant

- Ready-to-drink

Global Barley Tea Market, By Distribution Channel

- Offline

- Online

Global Barley Tea Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the global barley tea market?The global barley tea market is projected to expand at 4.17% during the forecast period.

-

2. Who are the top key players in the global barley tea market?The key players in the barley tea market are Ito En, Suntory Beverage & Food, Kirin Holdings, Otsuka Pharmaceutical, Jinjja Barley Tea, Haitai, The Republic of Tea, Odani kokufun, Lotte, Ten Ren Tea Company, Ladakhi Foods Pvt. Ltd, Java Tea Company, Sanei Kosan Co., Ltd., Nikken Foods, and others.

-

3. Which region is expected to hold the largest share of the global barley tea market?The North America region is expected to hold the largest share of the global barley tea market.

Need help to buy this report?