Global Basic Petrochemical Market Size, Share, Growth, and Industry Analysis, By Type of Chemical (Propylene, Butadiene, Ethylene, Benzene, Toluene, Xylene, Methanol, Ammonia), By Application (Plastic, Paint and Coating, Solvent, Rubber, Adhesive and Sealant, Surfactant, Dyes), By End-Use (Automotive, Packaging, Construction, Electronics Consumer) By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Chemicals & MaterialsGlobal Basic Petrochemical Market Insights Forecasts to 2033

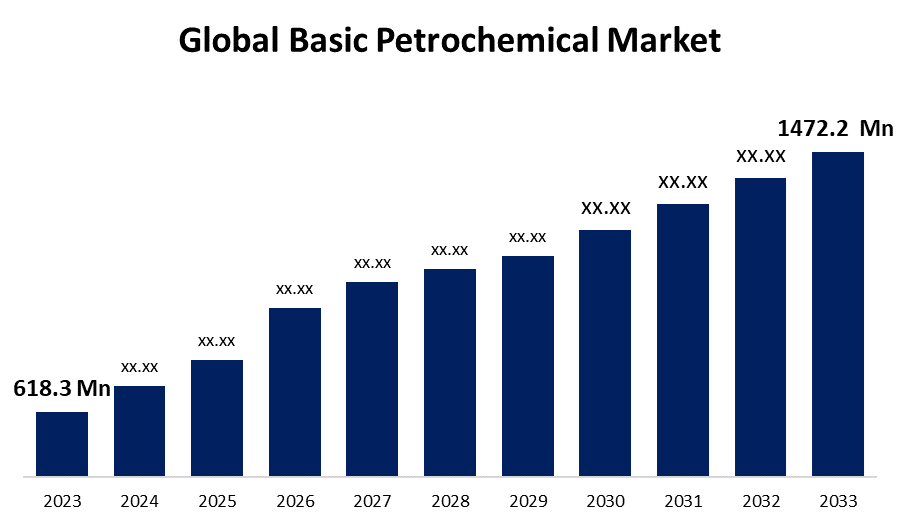

- The Global Basic Petrochemical Market Size was Valued at USD 618.3 Million in 2023

- The Market Size is Growing at a CAGR of 9.06 % from 2023 to 2033

- The Worldwide Basic Petrochemical Market Size is Expected to Reach USD 1472.2 Million by 2033

- Europe is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Basic Petrochemical Market Size is Anticipated to Exceed USD 1472.2 Million by 2033, Growing at a CAGR of 9.06 % from 2023 to 2033.

BASIC PETROCHEMICAL MARKET REPORT OVERVIEW

Chemicals made from natural gas or petroleum are known as petrochemicals. Given the constant growth in demand for synthetic materials and their significant role in the modern economy and society. A vast range of petrochemicals are produced using natural gas liquids and naphtha, which is produced from crude oil during the refining process, as feedstocks. The term "conventional routes" refers to the most widely followed paths that make use of the traditional primary energy sources such as crude oil that are currently predominant in the manufacturing of fundamental petrochemicals. To evaluate the best petrochemical chain for a given final petrochemical have utilized multicriteria decision analysis. Many facets of contemporary life depend on the ingredients and products that come from petrochemicals. The two biggest categories of products produced by the chemical industry are plastics and fertilizers, both of which are essential to daily life. Almost half of the world's food production is based on synthetic nitrogen fertilizers and plastics are the bulk material category with the greatest rate of growth. Polymers and chemicals including rubber, plastics, resins, synthetic fibers, and synthetic lubricants are produced using petrochemicals. These products are all necessities for modern living, and petrochemicals play a major role in their manufacture. They even serve as a feedstock for detergent and dye production. Since petrochemicals are needed to make materials like plastics, resins, and adhesives, they are necessary to produce packaging materials. Thus, they have a secondary role in the production of common household products and medical equipment. In Mexico, one of the biggest industries was the petrochemical sector. When this sector was producing at its highest level, up to 35% of Mexican industries needed petrochemicals in their operations.

Report Coverage

This research report categorizes the market for the global basic petrochemicals market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global basic petrochemicals market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global basic petrochemicals market.

Global Basic Petrochemical Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 618.3 Million |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 9.06 % |

| 2033 Value Projection: | USD 1472.2 Million |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 269 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type of Chemical, By Application, By End-Use, By Region |

| Companies covered:: | Mitsubishi Chemical Corporation, Formosa Plastics Corporation, INEOS Group, Chevron Phillips Chemical Company, LG Chem Ltd., Sumitomo Chemical Co., Ltd., Braskem S.A., Huntsman Corporation, Lotte Chemical Corporation, Reliance Industries Limited, Tosoh Corporation, Arkema Group, LyondellBasell Industries, Royal Dutch Shell plc, Others, and |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, and Analysis |

Get more details on this report -

DRIVING FACTORS:

The packaging and automotive industries' growing needs could drive market expansion.

The need to make tires, bumpers, interior pieces, and everything in between is driving up the production of fundamental petrochemicals by the automotive sector. Basic petrochemical demand should expand in tandem with rising vehicle sales in emerging nations due to the fact that plastic films, bottles, containers, and other forms of packaging are made from basic petrochemicals from the packaging industry. Furthermore, rising rates of urbanization and population growth in many places, most notably developing countries, are predicted to raise demand for ever-increasing commodities. Production methods have advanced significantly, and the cost of producing basic petrochemicals has decreased with the discovery of more energy-efficient catalysts and processes. These elements support the basic petrochemical market industry's strong growth by offering high production capacity and cost-effectiveness.

RESTRAINING FACTORS

The stringent government regulations and environmental issues could restrict the market growth.

The manufacture and burning of single-use plastics accounts for the majority of petrochemical emissions that contribute to global warming. According to Beyond Plastics, the plastics industry is accountable for a minimum of 232 million tons of pollutants that contribute to global warming annually, with single-use plastics accounting for almost 40% of these emissions. A significant inquiry into the fossil fuel and petrochemical companies' roles in creating and escalating the worldwide plastics pollution catastrophe was announced by the California State Attorney General in April 2022. These are some of the key factors responsible for restricting the market growth.

Market Segmentation

The basic petrochemicals market share is classified into the type of chemical, application, and end-use.

The ethylene segment has the highest share of the market over the forecast period.

Based on the type of chemical, the basic petrochemicals are classified into propylene, butadiene, ethylene, benzene, toluene, xylene, methanol, and ammonia. As a result of heating or distilling the oil, ethylene is one of the most important ingredients in petrochemical oil, which is used to manufacture trash bags, film for cameras, milk crates, bags, and other products. The most common building component for petrochemicals is ethylene. Ethylene is a colorless gas with a slight odor that isn't harmful to the respiratory system or eyes, making it a minor asphyxiant as well. Petrochemicals are also used to make plastic bottles. Most plastic products are made of polyester. Additionally, petrochemical or polyester oil is used to make cassettes and compact disks.

The plastic segment has the largest of the market during the forecast period.

Based on application, the basic petrochemicals are classified into plastic, paint and coating, solvent, rubber, adhesive and sealant, surfactant, and dyes. Plastics had the biggest revenue share due to their widespread use in the construction, automotive, and packaging industries. Plastic consumption is expected to continue to be high due to urbanization and population growth. Another important application area is fertilizers, whose use is being driven by rising worldwide food demand. Benefiting from increased consumer spending and infrastructural development, textiles, detergents, paints, and coatings also contribute to the market's expansion.

The automotive segment is expected to dominate the market throughout the forecast period.

Based on end-use, the basic petrochemicals are classified into automotive, packaging, construction, and electronics consumer. The automotive industry commanded a sizable portion of the market due to the growing number of cars being produced and the growing need for strong, lightweight materials. Petrochemicals play a major role in the automobile industry by producing synthetic rubber, which is used in tires, plastics for car interiors and exteriors, and other fluids like lubricants and antifreeze. Petrochemicals aid in lowering vehicle weight and increasing fuel efficiency. Basic petrochemicals are also widely used by the packaging sector, especially in the manufacture of plastic packaging solutions. Basic petrochemicals are used in the construction sector for a variety of products, including insulation, fittings, and pipelines. Basic petrochemicals are used extensively in the electronics sector to manufacture circuit boards, semiconductors, and other components.

Regional Segment Analysis of the Global Basic Petrochemical Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America has the biggest share of the basic petrochemical market throughout the forecast period.

Get more details on this report -

The expansion of the petrochemicals sector in North America is anticipated to be fuelled by the rising shale gas development operations in the United States and Canada. These nations' increasing shale gas production offers the chance to use shale gas instead of conventional feedstock to produce a range of petrochemicals. Over the projection period, significant capacity additions are anticipated to drive growth in the United States and Canada. The North American petrochemicals market is rising rapidly, propelled by the nation's growing manufacturing and industrial sectors as well as significant investments made by major companies in capacity expansions and technology improvements.

The Europe is fastest growing region over the projected timeframe.

The European manufacturing sector is still recovering from the global epidemic, and the expansion of the oil and gas capacity in the area is expected to fuel the industry's expansion. The region's major nations Germany, France, and the United Kingdom are producing more ethylene, which has increased demand for petrochemicals from producers of different industrial chemicals.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global basic petrochemical market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Mitsubishi Chemical Corporation

- Formosa Plastics Corporation

- INEOS Group

- Chevron Phillips Chemical Company

- LG Chem Ltd.

- Sumitomo Chemical Co., Ltd.

- Braskem S.A.

- Huntsman Corporation

- Lotte Chemical Corporation

- Reliance Industries Limited

- Tosoh Corporation

- Arkema Group

- LyondellBasell Industries

- Royal Dutch Shell plc

- Others

Key Market Developments

- In July 2024, the privately held Chinese petrochemical and oil refiner Hengli Group announced that it would invest 9.2 Billion yuan (USD 1.3 Billion) in shipbuilding in northeastern China.

- In May 2023, India bids an investment break of USD 30 Billion in the petrochemical division over the next span as the world's third-largest energy consumer looks to meet growing demand.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global basic petrochemical market based on the below-mentioned segments:

Global Basic Petrochemical Market, By Type of Chemical

- Propylene

- Butadiene

- Ethylene

- Benzene

- Toluene

- Xylene

- Methanol

- Ammonia

Global Basic Petrochemical Market, By Application

- Plastic

- Paint and Coating

- Solvent

- Rubber

- Adhesive and Sealant

- Surfactant

- Dyes

Global Basic Petrochemical Market, By End-Use

- Automotive

- Packaging

- Construction

- Electronics Consumer

Global Basic Petrochemical Market, By Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1.What is the CAGR of the global fluorochemicals market over the forecast period?The global fluorochemicals market size is expected to grow from USD 618.3 Million in 2023 to USD 1472.2 Million by 2033, at a CAGR of 9.06% during the forecast period 2023-2033.

-

2.Which region is expected to hold the highest share in the global fluorochemicals market?North America is projected to hold the largest share of the global fluorochemicals market over the forecast period.

-

3.Who are the top key players in the fluorochemicals market?Mitsubishi Chemical Corporation, Formosa Plastics Corporation, NEOS Group, Chevron Phillips Chemical Company, LG Chem Ltd, Sumitomo Chemical Co., Ltd, Braskem S.A, Huntsman Corporation, Lotte Chemical Corporation, Reliance Industries Limited, Tosoh Corporation, Arkema Group, LyondellBasell Industries. Royal Dutch Shell plc, and Others.

Need help to buy this report?