Global Battery Production Machine Market Size, Share, and COVID-19 Impact Analysis, By Machine Type (Mixing Machines, Coating & Drying Machines, Calendaring Machines, Slitting Machines, Electrode Stacking Machines, Assembling & Handling Machines, and Formation & Testing Machines), By Battery Type (Nickel Cobalt Aluminum, Nickel Manganese Cobalt, and Lithium Iron Phosphate), By Application (Automotive, Renewable Energy, and Industrial), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2032

Industry: Semiconductors & ElectronicsGlobal Battery Production Machine Market Insights Forecasts to 2032

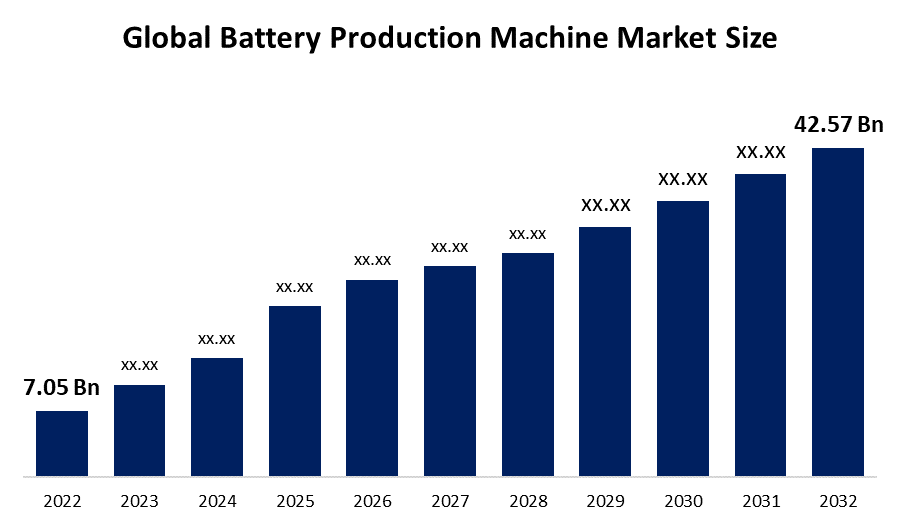

- The battery production machine market was valued at USD 7.05 billion in 2022.

- The market is growing at a CAGR of 19.7% from 2023 to 2032

- The global battery production machine market is expected to reach USD 42.57 billion by 2032

- Europe is expected to grow the significant during the forecast period

Get more details on this report -

The Global Battery Production Machine Market Size is expected to reach USD 42.57 billion by 2032, at a CAGR of 19.7% during the forecast period 2023 to 2032.

Market Overview

Battery production machines are essential equipment used in the manufacturing of batteries, enabling efficient and precise production processes. These machines are designed to automate various stages of battery production, including electrode preparation, assembly, testing, and packaging. They employ advanced technologies such as robotics, precision control systems, and quality assurance mechanisms to ensure consistent and high-quality battery output. Battery production machines play a crucial role in meeting the growing demand for batteries in various industries, including automotive, energy storage, and consumer electronics. They enable manufacturers to increase production capacity, improve product quality, and reduce manufacturing costs. As the demand for batteries continues to rise with the increasing adoption of electric vehicles and renewable energy storage systems, battery production machines are instrumental in supporting the transition to a more sustainable and energy-efficient future.

Report Coverage

This research report categorizes the market for global battery production machine market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global battery production machine market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the global battery production machine market.

Global Battery Production Machine Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 7.05 Billion |

| Forecast Period: | 2022 - 2032 |

| Forecast Period CAGR 2022 - 2032 : | 19.7% |

| 2032 Value Projection: | USD 42.57 Billion |

| Historical Data for: | 2018 - 2021 |

| No. of Pages: | 215 |

| Tables, Charts & Figures: | 125 |

| Segments covered: | By Machine, Type By Battery Type, By Application |

| Companies covered:: | Wuxi Lead Intelligent Equipment Co., Ltd., Shenzhen Yinghe Technology Co., Ltd., Hitachi, Ltd., Schuler Group, Durr Group, Sachuler AG, The Buhler Holding AG, Manz AG, Nordson Corporation, Rosendahl Nextrom GmbH. |

Get more details on this report -

Driving Factors

The battery production machine market is influenced by several key drivers due to the growing demand for batteries in various industries, such as electric vehicles, consumer electronics, and renewable energy storage, is a significant driver. As these sectors continue to expand, the need for efficient battery production machines rises. Technological advancements play a crucial role in driving market growth. Manufacturers are constantly seeking innovative solutions that enhance automation, precision, and production efficiency. The government initiatives and policies promoting the adoption of electric vehicles and renewable energy sources are driving the demand for batteries and, subsequently, battery production machines. Additionally, increasing investments in research and development activities focused on battery technologies fuel the market's growth. Furthermore, the emphasis on sustainable and environmentally friendly manufacturing processes and materials is creating a demand for advanced battery production machines that contribute to reducing carbon footprints. Lastly, the global push towards achieving energy independence and reducing reliance on fossil fuels is a significant driver, propelling the demand for batteries and, consequently, battery production machines.

Restraining Factors

The battery production machine market faces several restraints, due to high initial investment required for setting up a battery production facility poses a challenge, especially for small and medium-sized enterprises. The complex and evolving regulatory landscape related to environmental and safety standards adds compliance burdens to manufacturers. The limited availability of skilled labor with expertise in battery production machinery operation and maintenance can hinder market growth. Additionally, the volatility in raw material prices, especially for key components like lithium and cobalt, can impact the profitability of battery production. Overall, the intense competition among market players and the presence of established manufacturers can make it challenging for new entrants to gain market share.

Market Segmentation

- In 2022, the nickel manganese cobalt segment accounted for around 38.6% market share

On the basis of the battery type, the global battery production machine market is segmented into nickel cobalt aluminum, nickel manganese cobalt, and lithium iron phosphate. The nickel manganese cobalt (NMC) segment has emerged as the dominant player in the battery production machine market. This dominance can be attributed to several factors, such as NMC batteries are widely used in various applications, including electric vehicles, consumer electronics, and energy storage systems, due to their high energy density and improved thermal stability. The increasing adoption of these applications has significantly driven the demand for NMC batteries and, consequently, the demand for battery production machines specifically designed for NMC battery production. The ongoing research and development efforts to enhance the performance and cost-effectiveness of NMC batteries have further boosted their demand. Overall, the NMC segment has witnessed advancements in manufacturing processes and techniques, leading to improved production efficiencies and economies of scale.

- In 2022, the formation & testing machines segment held the largest market share with more than 29.2%.

Based on the type of machine, the global battery production machine market is segmented into mixing machines, coating & drying machines, calendaring machines, slitting machines, electrode stacking machines, assembling & handling machines, and formation & testing machines. The formation & testing machines segment has emerged as the largest market share holder in the battery production machine market. This segment's dominance can be attributed to several key factors, because the formation process is a critical stage in battery production, where cells are charged and conditioned to ensure optimal performance and longevity. Formation machines play a vital role in automating and controlling this process, enabling efficient and consistent battery formation. The testing machines are essential for assessing battery performance, capacity, and safety parameters. With the increasing demand for high-quality and reliable batteries in industries like automotive, consumer electronics, and energy storage, the need for accurate and comprehensive testing machines has grown significantly. The stringent quality standards and regulations related to battery performance and safety have further driven the demand for advanced formation and testing machines. These factors collectively contribute to the formation & testing machines segment's largest market share in the battery production machine market.

Regional Segment Analysis of the Battery Production Machine Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

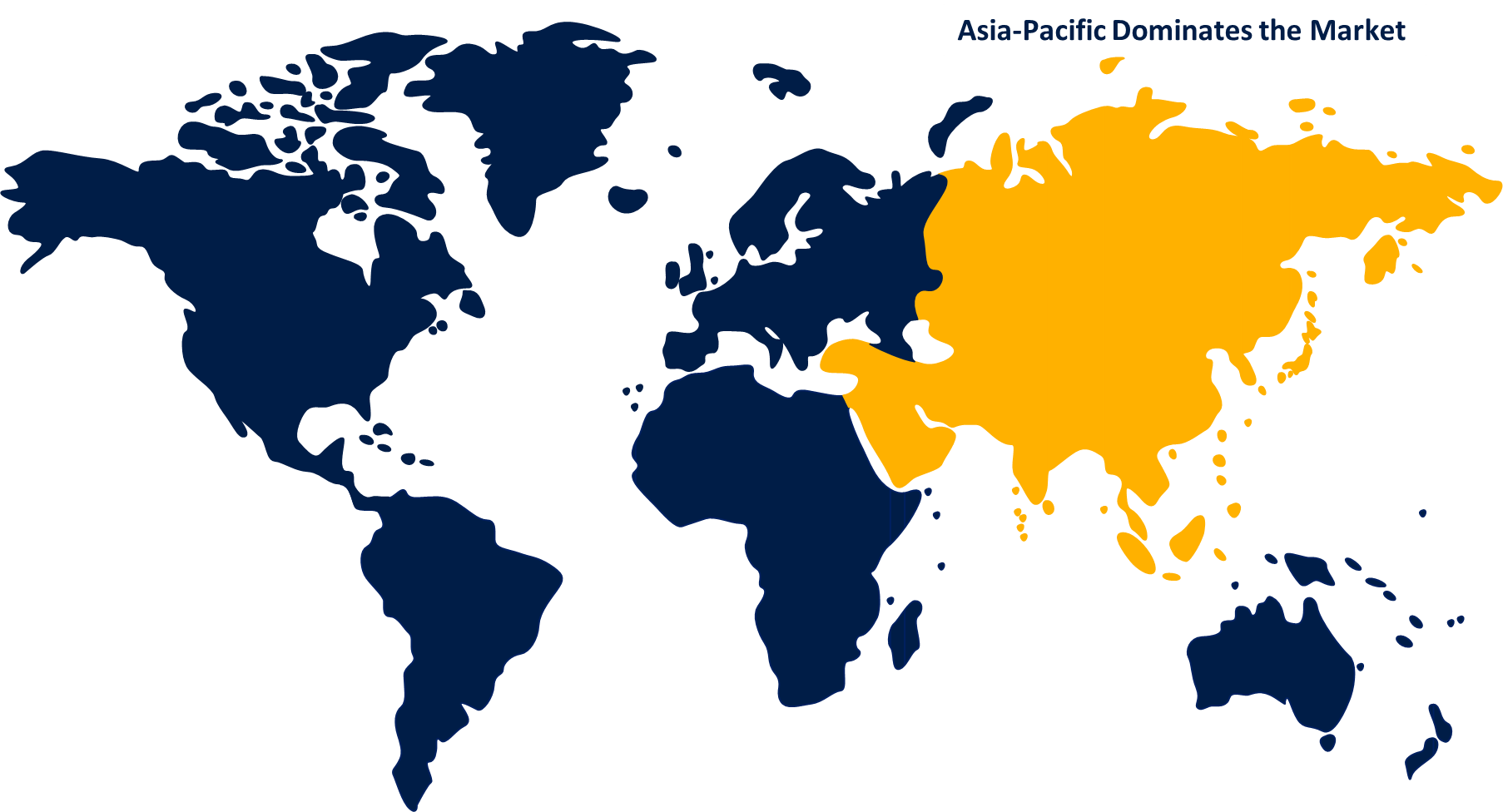

Asia-Pacific dominated the market with more than 42.7% revenue share in 2022.

Get more details on this report -

Based on region, the Asia-Pacific region has emerged as the dominant market share holder in the battery production machine market. Several factors contribute to this dominance because Asia-Pacific is home to some of the world's largest manufacturers of batteries, consumer electronics, and electric vehicles. The region's robust industrial base and manufacturing capabilities have fueled the demand for battery production machines. Additionally, the rapid growth of the electric vehicle market in countries like China, Japan, and South Korea has further boosted the need for battery production machines in the region. Moreover, favorable government policies and incentives promoting the adoption of electric vehicles and renewable energy have propelled the demand for batteries and, consequently, battery production machines. Furthermore, the presence of a vast pool of skilled labor, along with lower production costs, has made the Asia-Pacific region a preferred destination for battery production machine manufacturing and assembly.

Recent Developments

- In September 2022, Durr Group, Manz AG, and GROB-WERKE GmbH & Co.KG have entered into a strategic partnership aimed at collaboratively acquiring and executing projects related to battery production facilities. This partnership enables them to work together in acquiring and managing projects involving battery production facilities, combining their expertise and resources to deliver comprehensive solutions in the field.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global battery production machine market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Companies:

- Wuxi Lead Intelligent Equipment Co., Ltd.

- Shenzhen Yinghe Technology Co., Ltd.

- Hitachi, Ltd.

- Schuler Group

- Durr Group

- Sachuler AG

- The Buhler Holding AG

- Manz AG

- Nordson Corporation

- Rosendahl Nextrom GmbH.

Key Target Audience

- Market Players

- Investors

- End-Users

- Government Authorities

- Consulting and Research Firm

- Venture Capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2019 to 2032. Spherical Insights has segmented the global battery production machine market based on the below-mentioned segments:

Battery Production Machine Market, By Machine Type

- Mixing Machines

- Coating & Drying Machines

- Calendaring Machines

- Slitting Machines

- Electrode Stacking Machines

- Assembling & Handling Machines

- Formation & Testing Machines

Battery Production Machine Market, By Battery Type

- Nickel Cobalt Aluminum

- Nickel Manganese Cobalt

- Lithium Iron Phosphate

Battery Production Machine Market, By Application

- Automotive

- Renewable Energy

- Industrial

Battery Production Machine Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Need help to buy this report?