Global Battery Swapping Market Size, Share, and COVID-19 Impact Analysis, By Battery (Lithium-ion, Lead-acid), By Services (Subscription, On-Demand), By Vehicle (2-Wheeler, 3-Wheeler, 4-Wheeler), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Automotive & TransportationGlobal Battery Swapping Market Insights Forecasts to 2033

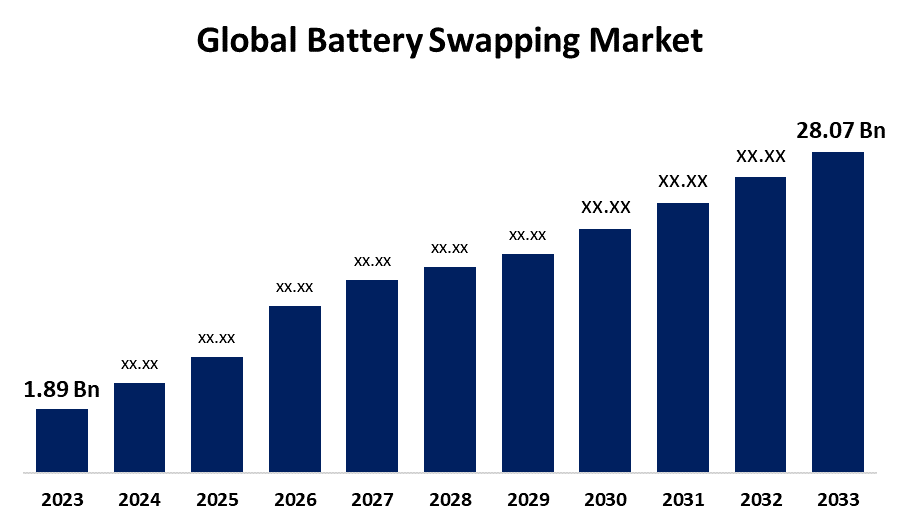

- The Global Battery Swapping Market Size was Valued at USD 1.89 Billion in 2023

- The Market Size is Growing at a CAGR of 30.97% from 2023 to 2033

- The Worldwide Battery Swapping Market Size is Expected to Reach USD 28.07 Billion by 2033

- Europe is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Battery Swapping Market Size is Anticipated to Exceed USD 28.07 Billion by 2033, Growing at a CAGR of 30.97% from 2023 to 2033.

Market Overview

Electric vehicle battery swapping is a site where a drained battery or battery pack in an electric vehicle can be rapidly swapped for a fully charged one, avoiding the need to wait for the car's battery to charge. Battery swapping stations offer a faster solution to range concerns because each battery change takes less than 10 minutes and requires far less room to install than charging stations. Furthermore, battery-as-a-service (BaaS) is another solution gaining interest in the battery switching sector due to its ability to reduce the high initial cost of electric vehicles by decoupling battery ownership. For instance, October 2023. Battery Smart, SUN Mobility, RACEnergy, Echargeup, Esmito, Batterypool, Mooving, and others are among the prominent startups in the field. Indeed, investor interest in this field has surged in recent years, with Tracxn statistics showing that around $135 million has been raised over 17 fundraising rounds since 2021. Although battery-swapping technology is still in its early phases in India and has had limited success outside of Taiwan, its prospects for acceptance in the Indian market, particularly for two- and three-wheelers, are promising. Battery-as-a-service (BaaS) allows consumers to lease batteries separately from their vehicles, reducing the requirement for an upfront battery purchase in conjunction with the vehicle. The battery would be rented from a charging infrastructure provider under the BaaS model, and it would be swapped out at a station whenever it needed to be recharged. Thus, such factors are fueling market growth in the forecast period.

Report Coverage

This research report categorizes the market for the global battery swapping market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global battery swapping market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global battery swapping market.

Global Battery Swapping Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 1.89 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 30.97% |

| 2033 Value Projection: | USD 28.07 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Battery, By Services, By Vehicle, By Region and COVID-19 Impact Analysis |

| Companies covered:: | Pushme Inc., BattSwap Inc., GreenPack GmbH, Gogoro Inc, NIO Technologies, Immotor Inc., Oyika Pte. Ltd, Kwang Yang Motor Co., Ltd., and Others Key Vendors |

| Growth Drivers: | Regional Segment Analysis of the Global Battery Swapping Market |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The use of EVs in micro mobility is becoming more common, with many countries supporting micromobility companies by providing infrastructure, allocating specific locations in cities for service trials, and collaborating with these companies to build micromobility in their country. The durability and safety of shared e-scooters have increased in recent years. However, one issue stands out: recharging. While the electric vehicle sector faces challenges such as range, recharge times, and infrastructure, micromobility may make it much easier.

Restraining Factors

The success of such a market depends on the participation of a large number of automakers, at least during the system's creation and launch, who will determine the technical specifications and establish the standardized parameters. Currently, this kind of coordination across automakers appears to be quite difficult, especially given the countless previous failed attempts in a variety of different industrial sectors.

Market Segmentation

The global battery swapping market share is classified into battery, services, and vehicle.

- The lithium-ion segment is expected to hold the largest share of the global battery swapping market during the forecast period.

Based on the battery, the global battery swapping market is categorized into lithium-ion, and lead-acid. Among these, the lithium-ion segment is expected to hold the largest share of the global battery swapping market during the forecast period. Lithium-based solid-state batteries are expected to carry far more energy in the same volume while charging much faster than typical Li-ion batteries. Instead of liquid electrolytes used in traditional batteries, these batteries use solid-state electrolytes such as ceramics or solid polymers. The use of this technology could result in smaller batteries with higher energy densities, longer life spans, and improved safety profiles.

- The subscription segment is expected to grow at the fastest CAGR during the forecast period.

Based on the services, the global battery swapping market is categorized into subscription, and on-demand. Among these, the subscription segment is expected to grow at the fastest CAGR during the forecast period. Subscription services for battery changing are a more sustainable way to employ battery swapping. This allows consumers to switch batteries at significantly lower rates than the pay-per-use approach. Most battery swapping companies give this type of battery swapping service as well as amazing deals to long-term customers. The number of swaps provided each month as part of the battery-swapping subscription service is an important consideration. The 2- and 3-wheeler switching companies offer 12-18 swaps every month, depending on the battery power capacity, number of batteries in the vehicle, and other factors. Four-wheeler battery swap suppliers, on the other hand, offer 4-6 swaps (e.g., NIO Power), which is usually enough for monthly EV usage.

- The 2-wheeler segment is expected to hold a significant share of the global battery swapping market during the forecast period.

Based on the vehicle, the global battery swapping market is categorized into 2-wheeler, 3-wheeler, 4-wheeler. Among these, the 2-wheeler segment is expected to hold a significant share of the global battery swapping market during the forecast period. Electric vehicle adoption is expanding in the commercial and fleet sectors. Battery swapping technology provides faster and more convenient charging alternatives than traditional techniques that require several hours to fully charge the vehicles. The continued development of comprehensive switching station infrastructure, as well as government incentives to boost EV use, will help to expand the market.

Regional Segment Analysis of the Global Battery Swapping Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is projected to hold the largest share of the global battery swapping market over the forecast period.

Get more details on this report -

Asia Pacific is projected to hold the largest share of the global battery swapping market over the forecast period. Considering the alarming rate of climate change caused by the overexploitation of fossil fuel resources like petroleum and gas and their resulting carbon emissions, the demand for electric vehicles in the Asia Pacific region is growing exponentially. China and India, with the world's largest populations, are major contributors to rising global temperatures and must fight for long-term changes to limit the harmful repercussions. With the majority of countries pledging to achieve net zero emissions by 2050, governments must seek alternate fuels to lessen their carbon footprint. Government subsidies and production incentive schemes will push the electric bike market. Furthermore, petroleum prices are approaching new highs.

Europe is expected to grow at the fastest CAGR growth of the global battery swapping market during the forecast period. The European Union has aggressively promoted the growth of a sustainable battery industry through programmers like the European Battery Alliance. The conflict could highlight the need of self-sufficiency in battery supply chains, prompting further investment in European battery manufacturing. Europe was one of the fastest-growing regions in the battery swapping business. NIO Power, a prominent manufacturer of electric vehicles in China, has announced ambitions to expand operations and introduce its electric vehicle line to Europe, including the United Kingdom.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global battery swapping market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Pushme Inc.

- BattSwap Inc.

- GreenPack GmbH

- Gogoro Inc

- NIO Technologies

- Immotor Inc.

- Oyika Pte. Ltd

- Kwang Yang Motor Co., Ltd.

- Others.

Key Market Developments

- On May 2024, NIO and Guangzhou Automobile Group (GAC) have signed a strategic cooperation agreement to collaborate on EV charging and swapping issues such as battery standards, vehicle R&D and customization, battery asset management, swapping network development, and operations.

- On May 2024, Nio and GAC want to collaborate on creating a common battery standard, as well as developing appropriate vehicles and battery interchange stations. Compatibility and standardization are important challenges for partners.

- In December 2023, Motovolt Mobility Pvt. Ltd. has partnered with German climate-tech startup Swobbee in a game-changing attempt to increase access to electric two-wheelers in India. This collaborative project addresses EV-related difficulties, with a primary focus on battery charging time, cost, and life, in order to improve the overall user experience across the country.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global battery swapping market based on the below-mentioned segments:

Global Battery Swapping Market, By Battery

- Lithium-ion

- Lead-acid

Global Battery Swapping Market, By Services

- Subscription

- On-Demand

Global Battery Swapping Market, By Vehicle

- 2-wheeler

- 3-wheeler

- 4-wheeler

Global Battery Swapping Market, By Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?