Global Belgian Beer Market Size, Share, and COVID-19 Impact Analysis, By Type (Trappist Beer, Abbey Beer, Blonde Ale, White Beer, Lambic), By Distribution Channel (Supermarket, Retail Store, Online), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Food & BeveragesGlobal Belgian Beer Market Insights Forecasts to 2033

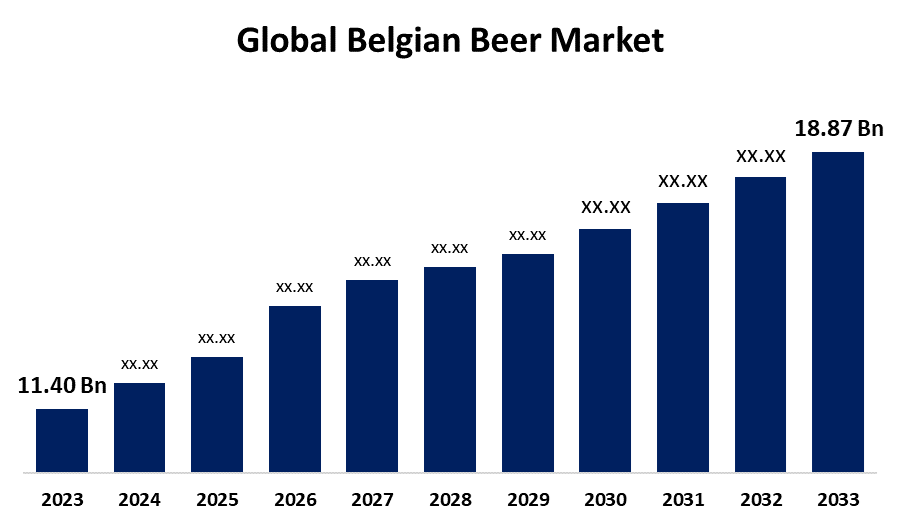

- The Global Belgian Beer Market Size Was Estimated at USD 11.40 Billion in 2023

- The Market Size is Expected to Grow at a CAGR of around 5.17% from 2023 to 2033

- The Worldwide Belgian Beer Market Size is Expected to Reach USD 18.87 Billion By 2033

- North America is Expected to Grow the Fastest during the Forecast period.

Get more details on this report -

The Global Belgian Beer Market size Was worth around USD 11.40 Billion in 2023 and is Predicted to Grow to around USD 18.87 Billion By 2033 with a Compound Annual Growth at (CAGR) of 5.17% between 2023 and 2033. The Belgian beer industry is fueled by premium quality, distinctive brewing culture, and an extensive variety of beer styles. Craft beer culture, increased international awareness, innovation, robust export demand, and Belgium's beer tourism culture are all factors contributing to the rising popularity and global growth of Belgian beer.

Market Overview

The belgian beer market is the industry engaged in the brewing, distribution, and consumption of beer produced in Belgium. Famous for its long brewing tradition, the market boasts a rich variety of beer types such as Trappist, Lambic, Abbey beers, and Blond ales. Belgian beers are highly appreciated for their quality, variety of flavors, and traditional brewing methods and are widely popular both domestically and internationally. The market includes breweries, distributors, retailers, and consumers, with belgian beer being a flagship product in international beer markets. Additionally, the growth of online shopping and e-commerce websites has increased the availability of Belgian beers to consumers globally. Online websites enable customers to buy high-quality Belgian beers from the comfort of their homes, expanding the market. Belgian brewers are always innovating with new recipes, flavors, and styles of beer, and that keeps the market fresh and interesting. Limited batches, seasonal beers, and brewery collaborations further stimulate interest in Belgian beers.

Report Coverage

This research report categorizes the belgian beer market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the belgian beer market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the belgian beer market.

Global Belgian Beer Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 11.40 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 5.17% |

| 2033 Value Projection: | USD 18.87 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Type, By Distribution Channel, By Region and COVID-19 Impact Analysis |

| Companies covered:: | InBev, Bosteels Brewery, Lindemans Brewery, Dubuisson Brewery, Palm Breweries, Brouwerij Van Steenberge, Verhaeghe Brewery, Huyghe Brewery, Brouwerij Van Steenberge, Alken-Maes (Heineken) and others key players. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Belgian beers are renowned for their superior quality, robust flavors, and conventional brewing practices. The cultural heritage and originality of belgian beer, such as world-famous styles Trappist, Lambic, and Abbey, make them greatly sought after among beer consumers across the globe fuelling demand for the belgian beer market. Additionally, belgian breweries have a vast array of beer styles that suit diverse tastes, such as pale ales, blonde ales, sours, dark ales, wheat beers, and Lambics. The diversity appeals to a wide clientele, ranging from occasional beer consumers to serious aficionados further increasing its demand.

Restraining Factors

Premium belgian beers such as Trappist and Lambic are pricier because they have quality raw materials, classical brewing techniques, and are limited in production. These might be unaffordable to price-sensitive consumers, especially in highly competitive markets where cheaper alternatives exist. Furthermore, trends in consumer preferences are changing toward low-alcohol, non-alcoholic, and healthy drinks. With a greater number of consumers adopting healthier lifestyles, demand for traditional belgian beers that are high in alcohol content may decline.

Market Segmentation

The belgian beer market share is classified into type and distribution channels.

- The trappist beer segment dominated the market in 2023 and is projected to grow at a substantial CAGR during the forecast period.

Based on the product type, the belgian beer market is divided into trappist beer, abbey beer, blonde ale, white beer, lambic. Among these, the trappist beer segment dominated the market in 2023 and is projected to grow at a substantial CAGR during the forecast period. The growth is attributed due to trappist beers are popular for their superior quality, deep flavors, and intricate brewing process. The delicate, small-batch production process ensures consistency and detail that beer connoisseurs and collectors find attractive.

- The supermarkets segment accounted for a significant share in 2023 and is anticipated to grow at a remarkable CAGR during the forecast period.

Based on the distribution channel, the belgian beer market is divided into supermarkets, retail stores, and online. Among these, the supermarkets segment accounted for a significant share in 2023 and is anticipated to grow at a remarkable CAGR during the forecast period. The segmental growth is due to supermarkets often having an extensive selection of belgian beers ranging from Trappist and Abbey beers to usual styles such as Blonde Ale and Lambic. With the wide array of choices, there is something for every taste. Supermarkets are in a position to provide reasonable prices because they purchase goods in bulk and distribute them in large quantities, thereby making belgian beer affordable to frequent shoppers.

Regional Segment Analysis of the Belgian Beer Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Europe is anticipated to hold the largest share of the belgian beer market over the predicted timeframe.

Get more details on this report -

Europe is anticipated to hold the largest share of the belgian beer market over the predicted timeframe. Belgian beer is well-rooted in European beer culture. Belgium boasts centuries of brewing heritage, and there is long-standing European interest in Belgian's distinctive beer styles, including Trappist, Lambic, and Abbey beers.

North America is expected to grow at a rapid CAGR in the belgian beer market during the forecast period. The North American craft beer movement has been characterized by the growing popularity of distinctive and premium beers, including Belgian beers. Customers are looking more and more for distinctive brews, such as Trappist and Abbey beers.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the belgian beer market along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- InBev

- Bosteels Brewery

- Lindemans Brewery

- Dubuisson Brewery

- Palm Breweries

- Brouwerij Van Steenberge

- Verhaeghe Brewery

- Huyghe Brewery

- Brouwerij Van Steenberge

- Alken-Maes (Heineken)

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In February 2025, The Belgian Beer Week was launched in Britain as a way to commemorate the grand tradition of brewing in Belgium. The event features tastings, beer pairings, and learning activities to make Belgian beer culture more popular and familiarize consumers with a plethora of Belgian beers. The activity is meant to increase awareness and sales of Belgian beers in the UK market.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the belgian beer market based on the below-mentioned segments:

Global Belgian Beer Market, By Type

- Trappist Beer

- Abbey Beer

- Blonde Ale

- White Beer

- Lambic

Global Belgian Beer Market, By Distribution Channel

- Supermarket

- Retail Store

- Online

Global Belgian Beer Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the belgian beer market over the forecast period?The global belgian beer market is projected to expand at a CAGR of 5.17% during the forecast period.

-

2. What is the market size of the belgian beer market?The global belgian beer market size is expected to grow from USD 11.40 Billion in 2023 to USD 18.87 Billion by 2033, at a CAGR of 5.17% during the forecast period 2023-2033.

-

3. Which region holds the largest share of the belgian beer market?Europe is anticipated to hold the largest share of the belgian beer market over the predicted timeframe.

Need help to buy this report?