Global Belt Loader Market Size, By Ownership (New Delivery, Resale, and Lease/Rent), By System (Self-Propelled, Electric, Towable, Diesel, and Other), By Weight (0-1000 Kg, 1000 - 5000 Kg, and <5000 Kg), By Region, And Segment Forecasts, By Geographic Scope And Forecast to 2033

Industry: Aerospace & DefenseGlobal Belt Loader Market Insights Forecasts to 2033

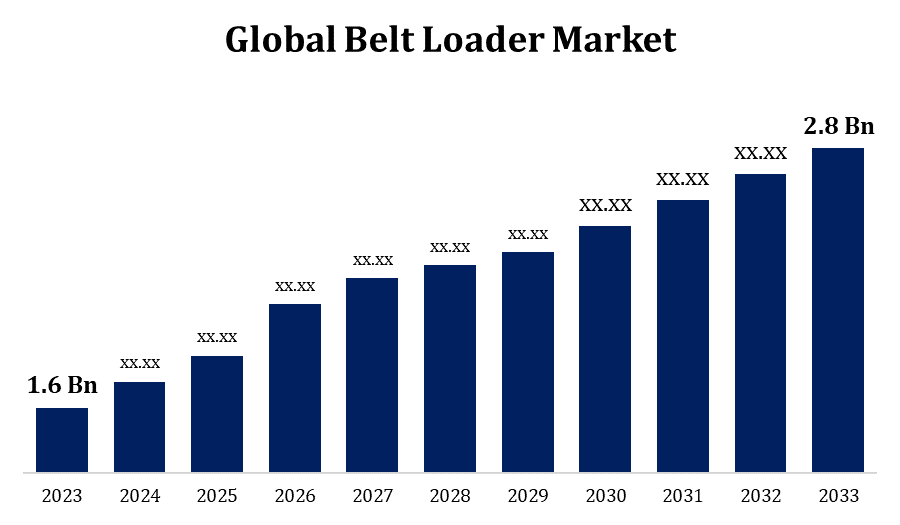

- The Global Belt Loader Market Size Was valued at USD 1.6 Billion in 2023.

- The Market Size is Growing at a CAGR of 5.76% from 2023 to 2033.

- The Worldwide Belt Loader Market Size is expected to reach USD 2.8 Billion by 2033.

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

The Global Belt Loader Market Size is expected to reach USD 2.8 Billion by 2033, at a CAGR of 5.76% during the forecast period 2023 to 2033.

The production of machinery for loading goods and passengers onto aeroplanes drives the majority of the belt loader market. These loaders provide effective and secure loading and unloading procedures at airports. Typically, they are made of conveyor belts fixed on a car chassis. Belt loaders are in high demand as the need for air travel grows and more efficient luggage handling procedures are required. Worldwide airport modernization and expansion projects frequently include the purchase of new ground support machinery, such as belt loaders. The airport industry is experiencing expansion due to innovations including automated loading systems, electric belt loaders, and improved safety features, which aim to improve efficiency and safety standards. Adoption of electric or hybrid belt loaders over traditional fuel-powered ones is encouraged by the growing emphasis on sustainability and lowering carbon footprint.

Belt Loader Market Value Chain Analysis

Supply components for belt loaders, including rubber, steel, aluminium, and electronic elements. Utilising suppliers' raw materials, design, engineer, and build belt loaders. Include safety regulations, technology features, and alternatives for customisation in accordance with client needs. Implement quality control procedures to guarantee product dependability and adherence to industry guidelines. Deliver belt loaders to rental companies, dealerships, and end customers like airports, airlines, and ground handling businesses directly. Organise product storage, shipping, and transportation to effectively reach international markets. Create marketing plans to reach your target audience and promote belt loaders. Sales teams interact with prospective customers, answer questions about products, and handle contract negotiations. To assist airport ground handling operations, buy or rent belt loaders.

Belt Loader Market Opportunity Analysis

With the focus on environmental responsibility and sustainability growing, belt loaders that are electric or hybrid have a lot of potential for manufacturers. Airports and ground handling businesses can lower their operational expenses and carbon emissions by implementing these environmentally beneficial substitutes. It might be profitable to provide customised belt loader solutions that are tailored to the unique requirements of various airports and airlines. Flexibility and extra value can be achieved with modular designs that make it simple to modify and customise them in accordance with client specifications. Belt loaders and other ground support equipment are in high demand as international aviation travel continues to rise. Large market expansion prospects can be found by investigating emerging markets and growing distribution networks to reach new clients in areas where airport infrastructure is developing.

Global Belt Loader Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 1.6 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 5.76% |

| 2033 Value Projection: | USD 2.8 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Ownership, By System, By Weight, By Region, By Geographic |

| Companies covered:: | Aero Specialties Inc. (U.S.), Charlatte Manutention SA (France), Darmec Technologies Srl (Italy), ERSEL TECHNOLOGY (Turkey), FAST Global Solutions (WASP Inc.) (US), JIANGSU TIANYI AVIATION INDUSTRY CORPORATION LIMITED (China), Sinfonia Technology Co. Ltd. (Japan), Textron Ground Support Equipment Inc. (U.S.), TLD Group (France), Weihai Guangrai Airport Equipment Co. Ltd. (China), and other key companies. |

| Pitfalls & Challenges: | Covid-19 Empact,Challenges,Growth, Analysis. |

Get more details on this report -

Market Dynamics

Belt Loader Market Dynamics

Growing Use of Self-Propelled Loaders Will Fuel the Growth of the Belt Loader Market

Self-propelled loaders simplify loading and lessen reliance on extra equipment by doing away with the need for a separate towing vehicle. Faster aircraft turnaround times result from this efficiency, which enhances the overall operational efficiency of the airport. Self-propelled loaders may initially cost more than towed machines, but over time, they may end up being less expensive. Self-propelled loaders present a strong cost-saving option for airports and ground handling businesses by doing away with the requirement for a separate towing vehicle and lowering fuel, maintenance, and labour expenses related to towing operations. Innovative ground support equipment, like self-propelled loaders, is becoming more and more in demand as airports look to enhance operational efficiency, safety, and passenger experience.

Restraints & Challenges

Manufacturers face a problem in keeping up with the rapid improvements in technology. It takes constant innovation and R&D expenditure to include cutting-edge technology like automation, IoT connection, and predictive maintenance into belt loader designs. There are several well-established competitors and recent newcomers fighting for market share in the fiercely competitive belt loader market. In order to stay ahead of the competition, manufacturers must differentiate their products through innovation, quality, and value-added services. Belt loader production schedules and lead times can be impacted by delays in shipping, shortages of raw materials, or geopolitical crises, among other disruptions in the global supply chain. Strong supply chain management techniques are necessary for manufacturers to reduce these risks and guarantee business continuity.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Belt Loader Market from 2023 to 2033. Some of the busiest airports in the world are located in North America; each year, these airports handle millions of passengers and a substantial amount of cargo. Due to causes like globalisation, tourism, and economic growth, air travel is increasing, which increases the need for ground support equipment like belt loaders. In order to handle an increase in travellers and boost operational effectiveness, several airports in North America are expanding and modernising. Belt loader manufacturers now have the chance to provide equipment that adapts to airports' changing needs due to these infrastructure advancements. The North American belt loader market is fiercely competitive, with numerous well-known suppliers and manufacturers fighting for market dominance. A number of variables, including product quality, dependability, technical innovation, cost, and after-sale service, influence competition.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. Due to growing middle-class populations, increased disposable incomes, and an increase in corporate travel, the Asia-Pacific area is seeing a major increase in air travel. Airports throughout the region are in greater need of ground support machinery, such as belt loaders, as a result of the increase in passenger traffic. The Asia-Pacific area is seeing a significant increase in airport building and expansion as a result of the rising demand for air travel. Belt loader manufacturers now have the chance to supply equipment for newly constructed airport terminals, runways, and cargo facilities due to these infrastructure initiatives. There is fierce competition among domestic and foreign producers in the Asia-Pacific belt loader market as they compete for market share. A number of variables, including product quality, dependability, innovation, cost, and after-sale service, influence competition.

Segmentation Analysis

Insights by Ownership

The new deliveries segment accounted for the largest market share over the forecast period 2023 to 2033. The demand for air travel is rising worldwide, which is driving up the need for additional belt loaders to assist airport ground handling operations. The need for additional ground support equipment, such as belt loaders, is rising in tandem with the growth in air traffic, particularly in emerging economies. New belt loaders are required as a result of infrastructure development initiatives, such as the building of new airports and the expansion of existing facilities. Airports frequently buy new equipment to improve operational efficiency as they upgrade their infrastructure to handle rising passenger and cargo volumes. The need for new belt loaders is driven by manufacturers' competition to provide cutting-edge products at reasonable prices. Consumers have the option to buy new equipment from suppliers who offer exceptional quality, dependability, and value-added services.

Insights by System

The self propelled system segment is dominating the market with the largest market share over the forecast period 2023 to 2033. Self-propelled belt loaders speed up loading and cut down on turnaround times by doing away with the requirement for a separate towing vehicle. Airports and ground handling businesses looking to streamline their operations are drawn to this enhanced productivity and efficiency. When compared to towed variants, self-propelled belt loaders are more manoeuvrable, making it easier for operators to manoeuvre in confined spaces and crowded locations. This adaptability is especially helpful in crowded airport terminals where space is at a premium. Airports and ground handling firms are beginning to favour self-propelled belt loaders because of their increased efficiency, safety, and technological developments. To accommodate this need, manufacturers are investing in the creation of novel self-propelled technologies.

Insights by Weight

The 1000-5000 kg segment accounted for the largest market share over the forecast period 2023 to 2033. The surge in international trade and e-commerce has resulted in a growth in air freight shipments. Medium-sized cargo shipments are a good fit for belt loaders in the 1000–5000 kg segment, which is why their demand is rising. This segment's belt loaders are made to load and unload cargo and baggage quickly, which helps aeroplane turnaround times. Their easy handling of medium-sized goods improves airport operational efficiency. Numerous clients, including as freight operators, low-cost airlines, and rural airports, are served by the 1000–5000 kg segment. The need for belt loaders in this capacity range grows along with various aircraft sector segments.

Recent Market Developments

- In October 2021, the new TUG 660Li Belt Loader from Textron Ground Support Equipment Inc. is a high-performance, energy-efficient, lithium-ion electric deviant that guarantees minimal operating costs.

Competitive Landscape

Major players in the market

- Aero Specialties Inc. (U.S.)

- Charlatte Manutention SA (France)

- Darmec Technologies Srl (Italy)

- ERSEL TECHNOLOGY (Turkey)

- FAST Global Solutions (WASP Inc.) (US)

- JIANGSU TIANYI AVIATION INDUSTRY CORPORATION LIMITED (China)

- Sinfonia Technology Co. Ltd. (Japan)

- Textron Ground Support Equipment Inc. (U.S.)

- TLD Group (France)

- Weihai Guangrai Airport Equipment Co. Ltd. (China)

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Belt Loader Market, Ownership Analysis

- New Delivery

- Resale

- Lease/Rent

Belt Loader Market, System Analysis

- Self-Propelled

- Electric

- Towable

- Diesel

- Other

Belt Loader Market, Weight Analysis

- 0-1000 Kg

- 1000 – 5000 Kg

- <5000 Kg

Belt Loader Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Belt Loader Market?The global Belt Loader Market is expected to grow from USD 1.6 billion in 2023 to USD 2.8 billion by 2033, at a CAGR of 5.76% during the forecast period 2023-2033.

-

2. Who are the key market players of the Belt Loader Market?Some of the key market players of the market are Aero Specialties Inc. (U.S.), Charlatte Manutention SA (France), Darmec Technologies Srl (Italy), ERSEL TECHNOLOGY (Turkey), FAST Global Solutions (WASP Inc.) (US), JIANGSU TIANYI AVIATION INDUSTRY CORPORATION LIMITED (China), Sinfonia Technology Co. Ltd. (Japan), Textron Ground Support Equipment Inc. (U.S.), TLD Group (France), Weihai Guangrai Airport Equipment Co. Ltd. (China).

-

3. Which segment holds the largest market share?The new deliveries segment holds the largest market share and is going to continue its dominance.

-

4. Which region is dominating the Belt Loader Market?North America is dominating the Belt Loader Market with the highest market share.

Need help to buy this report?