Global Bicycle Market Size, Share, and COVID-19 Impact Analysis, By Product (Mountain, Hybrid, Road, Cargo), By Technology (Electric, Conventional), By Distribution Channel (Online, Offline), By End User (Men, Women, Kids), By Region (North America, Europe, Asia Pacific, Middle East & Africa, and South America) - Market Size & Forecasting To 2030

Industry: Automotive & TransportationMARKET OVERVIEW

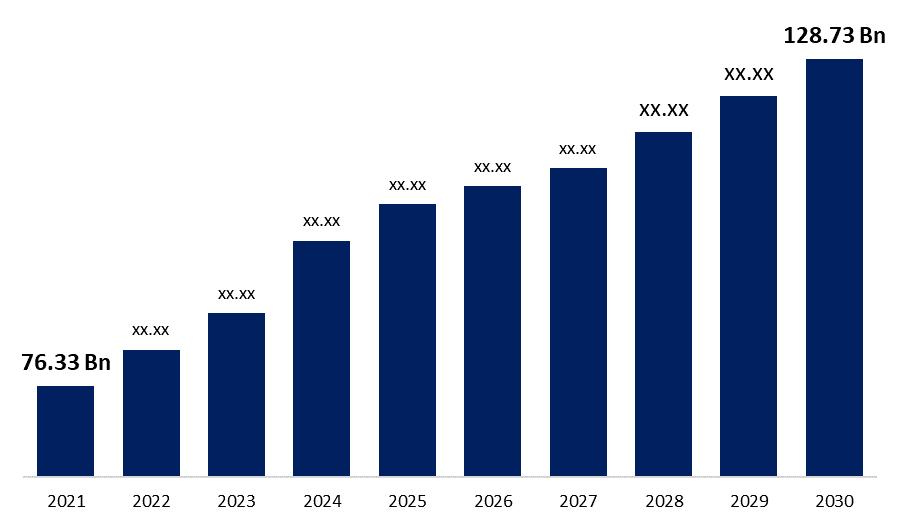

The Global Bicycle Market Size was valued at USD 76.33 billion in 2021 and is expected to reach at a CAGR of 6.5% from 2022 to 2030. The global bicycle market is projected to grow from USD 81.50 billion in 2022 to USD 128.73 billion by 2030. Many governments are launching programmes to reduce carbon footprints by promoting the use of bicycles, electric vehicles, and other forms of personal transportation. This tendency is also being fueled by the growing understanding of the negative impacts of fossil fuel-powered cars. Governments are also concentrating on building bicycle-friendly roadways, which promotes the use of bicycles as a means of transportation.

Get more details on this report -

Recent developments in GPS technology and mobile app development have led to dockless bicycle sharing systems that are app-based. Furthermore, it is anticipated that the widespread use of such dockless bicycle-sharing systems will significantly increase demand for bicycles. To take advantage of market prospects, Chinese bicycle companies are rapidly investing in and growing their operations in European countries. This should accelerate market expansion in the upcoming years.

DRIVING FACTORS

People are considering using bicycles to commute for short distances in order to save time because of the increasing traffic congestion and lack of parking, especially in metropolitan areas. The infrastructure required to facilitate bicycle commuting is aggressively being built by many governments at the same time, which encourages people to choose bicycles.

The increase in the fuel prices is influencing the people to opt for e-mobility as an alternative solution fossil fuel-powered transportation. Moreover, the cost of li-ion batteries has also drastically reduced owing to latest technological development in li-ion batteries. Thus, rising adoption of e-bikes has transformed as an alternate solution to fossil fuel powered bikes that is expected to boost the market over the forecast period.

Global Bicycle Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2021 |

| Market Size in 2021: | USD 76.33 Billion |

| Forecast Period: | 2022-2030 |

| Forecast Period CAGR 2022-2030 : | 6.5% |

| 2030 Value Projection: | USD 128.73 Billion |

| Historical Data for: | 2019-2021 |

| No. of Pages: | 170 |

| Tables, Charts & Figures: | 116 |

| Segments covered: | Product, Technology, Distribution Channel End User, and Region |

| Companies covered:: | Trek Bicycle Corporation, Accell group, SCOTT Sports SA, Atlas Cycles Ltd., Specialized Bicycles Components, Inc., Avon Cycles Ltd., Merida Industry Co. Ltd., Cervel, Giant Bicycles, and Dorel Industries Inc |

| Growth Drivers: | Rise in the number of cycling events is a major trend in the market which is expected to accelerate the growth of the market during the forecast period. |

| Pitfalls & Challenges: | The market is expansion is expected to be hampered by the impending poor infrastructure required to enable and promote bicycle commuting |

Get more details on this report -

RESTRAINING FACTORS

The availability of alternate mode transportation solutions like scooters, motorcycles, and other micro mobility solutions having a long travel range than bicycles is anticipated to restrain the market growth over the forecast period. Additionally, the market's expansion is expected to be hampered by the impending lack of the infrastructure required to support and promote bicycle commuting, particularly in developing economies like India.

COVID-19 IMPACT

The COVID-19 outbreak is undoubtedly predicted to aid the market expand in the upcoming years because numerous governments globally are actively promoting bicycles as one of the safest modes of transportation that enables people to keep social distance. Additionally, during the pandemic, governments in important nations like the U.K. and Italy are offering subsidies for the purchase of new bicycles. Therefore, growing awareness of the benefits bicycles provide, together with government support in the form of programmes and subsidies, bode well for the market's growth in the upcoming years.

WORLD MARKET SEGMENTATION

The global bicycle market is segmented into product, technology, distribution channel end user, and region.

GLOBAL BICYCLE MARKET, BY PRODUCT

Based on product, the global bicycle market is segmented into mountain, hybrid, road, and cargo. Among these, road bicycle segment is dominating the market holding around 40% of the overall market share. The fact that these are the most essential vehicles and don't require any high-tech extras, such those needed by racing, mountain, or other specialty bicycles, can be credited to the increase. In the upcoming years, the growing trend of people personalising road bicycles for certain uses is also anticipated to add to the segment's growth.

Over the course of the projection period, the mountain bicycle segment is anticipated to expand significantly as consumers, particularly millennials, continue to choose mountain biking as a form of adventure and leisure. Additionally, the number of women and children participating in sports is growing gradually, which is anticipated to have an impact on the segment's expansion globally. In addition, the development of new mountain biking circuits and increasing media attention to such events are anticipated to accelerate segment expansion.

GLOBAL BICYCLE MARKET, BY TECHNOLOGY

Based on technology, the global bicycle market is bifurcated into electric and conventional. Among these, conventional segment holds the largest market share holding 80% of the overall market share. The significant market share is ascribed to a number of factors, including the lower cost of maintenance and repair for traditional bicycles when compared to electric bicycles. Additionally, during the past few decades, cycling has emerged as a major sport and leisure activity, particularly among women, while still being a practical form of transportation. In terms of technology, traditional bicycles for women currently rule the market.

GLOBAL BICYCLE MARKET, BY DISTRIBUTION CHANNEL

Based on the distribution channel, the global bicycle market is segmented into online and offline. Among these, offline distribution segment is dominating the market. Due to the availability of test drives, a significant portion of consumers choose to make purchases from offline channels or stores, which is the cause of the huge market share. Customers can select their personalized/customized bicycle designs and colours in offline establishments that also offer personalized/customized purchasing choices. Additionally, the availability of several bicycle brands at adjacent supermarkets or other merchants is probably going to increase demand for this channel in the upcoming years.

GLOBAL BICYCLE MARKET, BY END USER

On the basis of end user, the global bicycle market is segmented into men, women, and kids. Among these, the men segment is the fastest growing segment holding 40% of the overall market share. The rising adoption of adoption of bicycles among men for gymming, exercising, commutation, sports as well as recreational activities have boosted the growth of this segment.

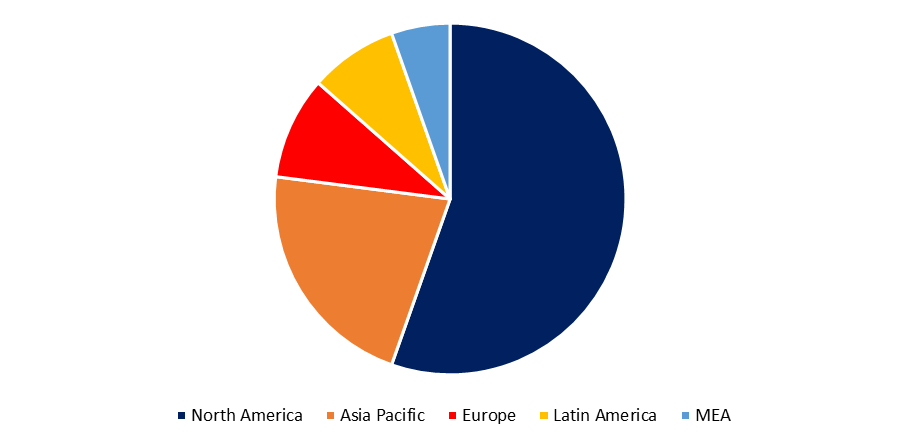

GLOBAL BICYCLE MARKET, BY REGION

Get more details on this report -

On the basis of region, the global bicycle market is segmented into North America, Europe, Asia Pacific, the Middle East and Africa and South America. Among these, Asia Pacific regions holds the highest market share with 30% of the overall market share. Building the infrastructure necessary to encourage and support bicycle commuting is a top priority in China, Singapore, and Japan. Urban bicycling is said to be most popular in Asian cities with the lowest accident rates. Additionally, Chinese bicycle businesses are rapidly expanding their operations in nations like Australia and India. As a result, it is anticipated that the demand for bicycles would increase in the years to come.

RECENT DEVELOPMENTS IN THE GLOBAL BICYCLE MARKET

- April 2022: Hero International (HIT) which is a part of India’s Hero Motors Corporation (HMC) has made an announcement by introducing a new assembly plant in its manufacturing facility in Manchester for e-bikes. The company is aiming to produce high end electric cycles as well as push bikes for its customers in the UK and EU.

- April 2022: Giant Bicycle is going to launch the new model of Giant Cypress DX, Liv Flourish FS1, Giant Escape 3 Comfort, and Liv Alight 3 Comfort bicycles.

- July 2021: Trek Bicycles has established the Trek Foundation that is aimed to support public mountain bike trail development as well as cycling infrastructural projects.

LIST OF KEY MARKET PLAYERS

- Her Cycles Ltd.

- Orbea

- Merida Industry Co. Ltd.

- Giant Bicycles

- Trek Bicycle Corporation

- Derby Cycles

- Accell Group

- Brompton Bikes

- Kona Bikes

- Pon

- Mobility Holdings, Ltd.

Segmentation

By Product

- Mountain

- Hybrid

- Road

- Cargo

By Technology

- Electric

- Conventional

By Distribution Channel

- Online

- Offline

By End User

- Men

- Women

- Kids

By Region:

North America

- North America, by Country

- U.S.

- Canada

- Mexico

- North America, by Product

- North America, by Technology

- North America, by Distribution Channel

- North, America, by End User

Europe

- Europe, by Country

- Germany

- Russia

- U.K.

- France

- Italy

- Spain

- The Netherlands

- Rest of Europe

- Europe, by Product

- Europe, by Technology

- Europe, by Distribution Channel

- Europe, by End User

Asia Pacific

- Asia Pacific, by Country

- China

- India

- Japan

- South Korea

- Australia

- Indonesia

- Rest of Asia Pacific

- Asia Pacific, by Product

- Asia Pacific, by Technology

- Asia Pacific, by Distribution Channel

- Asia Pacific, by End User

Middle East & Africa

- Middle East & Africa, by Country

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

- Middle East & Africa, by Product

- Middle East & Africa, by Technology

- Middle East & Africa, by Distribution Channel

- Middle East & Africa, by End User

South America

- South America, by Country

- Brazil

- Argentina

- Colombia

- Rest of South America

- South America, by Product

- South America, by Technology

- South America, by Distribution Channel

- South America, by End User

Need help to buy this report?