Global Big Data in the Automotive Industry Market Size, Share, and COVID-19 Impact Analysis, By Software Deployment Type (Cloud-Based, On-Premise), By Application (Product Development, Supply Chain Management, Aftermarket, Connected Vehicles & Intelligent Transportation, Manufacturing), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: Automotive & TransportationGlobal Big Data in the Automotive Industry Market Insights Forecasts to 2033

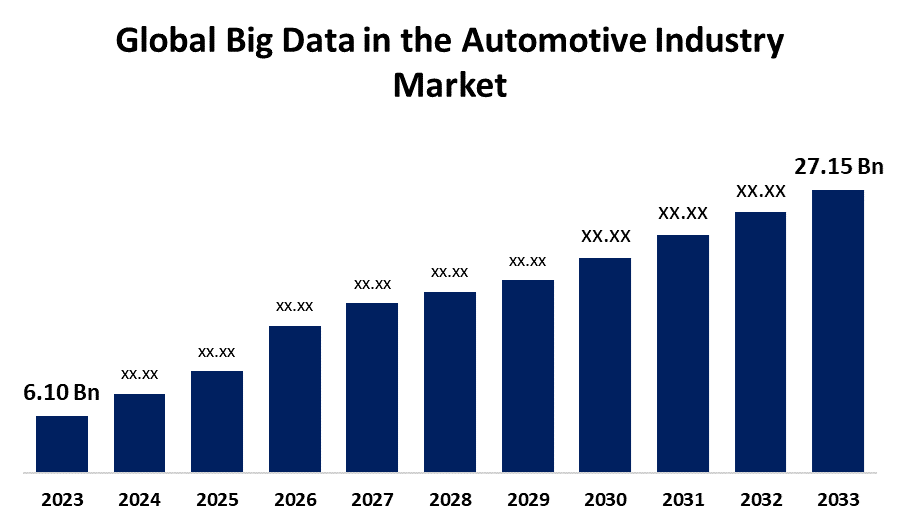

- The Global Big Data in the Automotive Industry Market Size was Valued at USD 6.10 Billion in 2023

- The Market Size is Growing at a CAGR of 16.15% from 2023 to 2033

- The Worldwide Big Data in the Automotive Industry Market Size is Expected to Reach USD 27.15 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Big Data in the Automotive Industry Market Size is Anticipated to Exceed USD 27.15 Billion by 2033, Growing at a CAGR of 16.15% from 2023 to 2033.

Market Overview

Big data in the automotive industry is a vast volume of structured and unstructured data generated from various sources, including vehicles, manufacturing processes, customer interactions, and external environmental factors. Big data is revolutionizing the automotive industry by enhancing safety, performance, autonomous driving, predictive maintenance, customer insights, driver-assistance systems, and environmental compliance. It optimizes supply chain processes, supports fleet management, and monitors emissions and fuel efficiency.

IoT devices in vehicles collect vast data for real-time performance monitoring, predictive maintenance, and personalized services, enhancing driver experience and enhancing overall vehicle experience. The automotive industry is transforming due to the adoption of technology, applications, and services like sensors, artificial intelligence, and big data analysis, leading to continuous evolution. The automobile industry is preparing for Industry 4.0, utilizing IoT, networked systems, and M2M communication. Robots, RFIDs, and sensors increase data generation, impacting the market through big data analytics.

Report Coverage

This research report categorizes the market for big data in the automotive industry based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the big data in the automotive industry market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of big data in the automotive industry market.

Global Big Data in the Automotive Industry Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 6.10 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 16.15% |

| 2033 Value Projection: | USD 27.15 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 230 |

| Tables, Charts & Figures: | 98 |

| Segments covered: | By Software Deployment Type, By Application, By Region and COVID-19 Impact Analysis |

| Companies covered:: | N-iX LTD, Reply SpA, Phocas Ltd, iSoftStone, QBurst Technologies Private Limited, Monixo, Traffilog Ltd, Driver Design Studio Limited, Mayato GmbH, Sight Machine Inc., SAS Institute Inc., IBM Corporation, SAP SE, Microsoft Corporation, and Others key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of big data in the automotive industry market propelled by several key factors including the increasing generation of data from connected vehicles and IoT devices necessitates advanced analytics to derive valuable insights. Companies are leveraging big data to enhance customer experiences by personalizing services and understanding consumer preferences. Furthermore, big data helps optimize operational efficiency in supply chain management and production processes, leading to cost reductions. It plays a crucial role in improving vehicle safety and ensuring regulatory compliance. The rise of autonomous vehicles further relies on big data for real-time decision-making and navigation.

Restraining Factors

The growth of big data in the automotive industry market is hindered by several restraining factors including data privacy concerns and stringent regulations, such as GDPR, which complicate the management and utilization of customer data. High implementation costs for big data infrastructure and skilled personnel can be prohibitive, especially for smaller companies.

Market Segmentation

The big data in the automotive industry market share is classified into software deployment type and application.

- The cloud-based segment is estimated to hold the highest market revenue share through the projected period.

Based on the software deployment type, the big data in the automotive industry market is classified into cloud-based and on-premise. Among these, the cloud-based segment is estimated to hold the highest market revenue share through the projected period. The segment dominance is propelled due to several advantages that cloud-based offer, such as scalability, flexibility, and cost-effectiveness. Cloud-based platforms allow automotive companies to easily manage and analyze large volumes of data without the need for extensive on-site infrastructure. As the automotive industry increasingly embraces digital transformation and the Internet of Things (IoT), the demand for cloud-based big data in automotive is expected to grow significantly.

- The supply chain management segment is anticipated to hold the largest market share through the forecast period.

Based on the application, the big data in the automotive industry market is divided into product development, supply chain management, aftermarket, connected vehicles & intelligent transportation, and manufacturing. Among these, the supply chain management segment is anticipated to hold the largest market share through the forecast period. The rapid prominence is attributed to the increasing demand for optimization and efficiency in supply chain operations, which can significantly reduce costs and improve delivery times. The use of big data analytics allows companies to gain insights into inventory management, logistics, and supplier performance, enabling them to make informed decisions and enhance overall supply chain resilience.

Regional Segment Analysis of the Big Data in the Automotive Industry Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Europe is anticipated to hold the largest share of the big data in the automotive industry market over the predicted timeframe.

Get more details on this report -

Europe is anticipated to hold the largest share of the big data in the automotive industry market over the predicted timeframe. The region's well-established automotive sector with major manufacturers investing in data technologies to enhance production efficiency and innovation. The region's strong focus on sustainability and green technologies, along with significant R&D investments in smart mobility solutions, further boosts the demand for big data in automotive. Growing consumer demand for connected and automated vehicles also increases the demand for advanced data analytics, reinforcing Europe’s leading position in this market.

Asia Pacific is expected to grow at the fastest CAGR growth of the big data in the automotive industry market during the forecast period. Rapid urbanization increases demand for smart transportation, while significant vehicle production in countries like China and India necessitates advanced data analytics for optimizing manufacturing and supply chains. Technological advancements, such as IoT and AI integration in vehicles, are enhancing user experiences and safety.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the big data in the automotive industry market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- N-iX LTD

- Reply SpA

- Phocas Ltd

- iSoftStone

- QBurst Technologies Private Limited

- Monixo

- Traffilog Ltd

- Driver Design Studio Limited

- Mayato GmbH

- Sight Machine Inc.

- SAS Institute Inc.

- IBM Corporation

- SAP SE

- Microsoft Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In March 2023, Arm announced new automotive technologies to accelerate the development of ai-enabled vehicles by up to two years.

- In January 2024, Qualcomm introduced several automotive products based on its Snapdragon Digital Chassis platform, including next-generation digital cockpits, connected car technologies, connected services, improved driver assistance, and autonomous driving systems.

- In January 2023, Intel announced an agreement to acquire Silicon Mobility SAS for advanced EV energy management and a new AI-enhanced family of software-defined vehicle SoCs.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the big data in the automotive industry market based on the below-mentioned segments:

Global Big Data in the Automotive Industry Market, By Software Deployment Type

- Cloud-Based

- On-Premise

Global Big Data in the Automotive Industry Market, By Application

- Product Development

- Supply Chain Management

- Aftermarket

- Connected Vehicles & Intelligent Transportation

- Manufacturing

Global Big Data in the Automotive Industry Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the big data in the automotive industry market over the forecast period?The big data in the automotive industry market is projected to expand at a CAGR of 16.15% during the forecast period.

-

2. What is the market size of big data in the automotive industry market?The Global Big Data in the Automotive Industry Market Size is Expected to Grow from USD 6.10 Billion in 2023 to USD 27.15 Billion by 2033, Growing at a CAGR of 16.15% during the forecast period 2023-2033.

-

3. Which region holds the largest share of the big data in the automotive industry market?Europe is anticipated to hold the largest share of the big data in the automotive industry market over the predicted timeframe.

Need help to buy this report?