Global Bill of Materials (BOM) Software Market Size, Share, and COVID-19 Impact Analysis, By Type (Engineering BOM, Manufacturing BOM, Others), By Application (Food Industry, Chemical Industry, Electronics Industry, Aerospace and Defense, Business Logistics, Other), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Advanced MaterialsGlobal Bill of Materials (BOM) Software Market Insights Forecasts to 2033

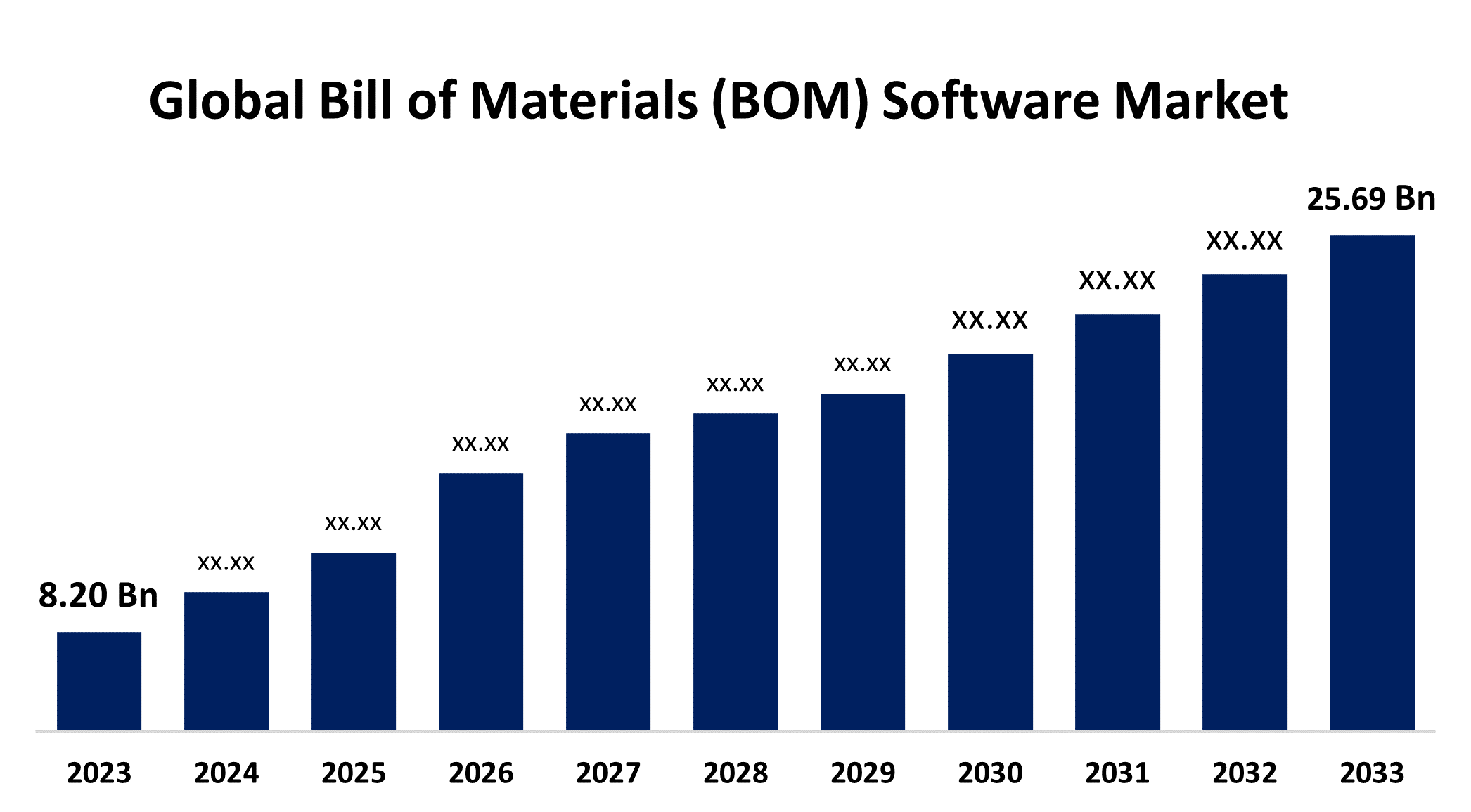

- The Global Bill of Materials (BOM) Software Market Size was Valued at USD 8.20 Billion in 2023

- The Market Size is Growing at a CAGR of 12.10% from 2023 to 2033

- The Worldwide Bill of Materials (BOM) Software Market Size is Expected to Reach USD 25.69 Billion by 2033

- Aisa Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Bill of Materials (BOM) Software Market Size is Anticipated to Exceed USD 25.69 Billion by 2033, Growing at a CAGR of 12.10% from 2023 to 2033.

Market Overview

Bill of materials (BOM) software refers to specialized computer programs or applications designed to manage and organize bills of materials in various industries, particularly manufacturing and product development. A bill of materials is a comprehensive list of components, parts, sub-assemblies, and raw materials required to manufacture a product. The market's expansion is being driven by rising demand for BOM management software from manufacturers across a variety of industries, including automotive, aerospace, and electronics. BOM management software is used to generate and manage bills of materials. BOM software can assist manufacturers in creating correct and up-to-date BOMs, which can help to increase efficiency and lower costs. For Instance, in April 2024, the Open Source Security Foundation (OpenSSF), in collaboration with the Cybersecurity and Infrastructure Security Agency (CISA) and the Department of Homeland Security (DHS) Science and Technology Directorate (S&T), announced the release and availability of Protobom, a new and innovative open source software supply chain tool and generate software bill of materials (SBOMs) and file data, as well as translate them into common industrial SBOM forms.

Report Coverage

This research report categorizes the market for bill of materials (BOM) software based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the bill of materials (BOM) software market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the bill of materials (BOM) software market.

Global Bill of Materials (BOM) Software Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 8.20 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 12.10% |

| 2033 Value Projection: | USD 25.69 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 194 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Type, By Application, By Region |

| Companies covered:: | TGI, MasterControl, SMe Software, Autodesk, PDXpert, SiliconExpert Technologies, IQMS Manufacturing Software, SAP, Oracle, Arena Solutions, Upchain, Epicor, Spartan Software, Emadata, and Others Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The bill of materials (BOM) software market is propelled by several key factors, including increased automation and digitalization in manufacturing processes drive the need for efficient BOM management tools, which simplifies the development, management, and sharing of BOMs, reducing errors and improving efficiency. The complexity of modern product designs necessitates robust BOM software capable of handling large data volumes and ensuring accuracy throughout the product lifecycle. Regulatory compliance requirements in industries like aerospace and automotive further boost demand for BOM software to maintain accurate records and facilitate traceability. Cost reduction, efficiency improvements, and enhanced collaboration through cloud-based solutions and integration with PLM systems also contribute significantly to market growth. Technological advancements in AI, machine learning, and IoT further enhance BOM software capabilities, supporting predictive analytics and customization demands in manufacturing.

Restraining Factors

The growth of the bill of materials (BOM) software market is hindered by several restraining factors including resistance to change in traditional manufacturing sectors, concerns over the high costs of implementation and integration, and complexities associated with data security and industry-specific requirements that pose significant challenges. Data accuracy issues, security concerns around intellectual property, and scalability limitations also pose significant barriers. Additionally, the lack of standardized BOM formats across industries complicates interoperability.

Market Segmentation

The bill of materials (BOM) software market share is classified intotype and application.

- The engineering BOM segment is estimated to hold the highest market revenue share through the projected period.

Based on the type, the bill of materials (BOM) software market is classified into engineering BOM, manufacturing BOM, and others. Among these, the engineering BOM segment is estimated to hold the highest market revenue share through the projected period. EBOM software plays a pivotal role in the initial stages of product development by capturing detailed design specifications and facilitating collaboration among design teams. Its functionality supports design validation, iteration, and integration with CAD and PLM systems, ensuring alignment with product requirements from conception to implementation. Industries such as automotive, aerospace, and consumer electronics rely extensively on EBOM solutions to manage complex product structures and meet stringent regulatory standards. As industries continue to prioritize innovation and efficiency in product design, the dominance of the engineering BOM segment is expected to persist, driven by its foundational role in facilitating accurate and streamlined product development processes.

- The electronics industry segment is anticipated to hold the largest market share through the forecast period.

Based on the application, the bill of materials (BOM) software market is divided into the food industry, chemical industry, electronics industry, aerospace and defense, business logistics, and others. Among these, the electronics industry segment is anticipated to hold the largest market share through the forecast period. This leadership is driven by the sector's complex and diverse component needs, stringent regulatory requirements, and intricate global supply chains. BOM software plays a crucial role in managing these challenges by facilitating efficient component tracking, ensuring regulatory compliance, optimizing supply chain operations, and supporting agile product lifecycle management. Electronics manufacturers rely heavily on BOM software to enhance productivity, reduce costs, and maintain a competitive edge in a fast-paced industry marked by rapid technological advancements and short product lifecycles.

Regional Segment Analysis of the Bill of Materials (BOM) Software Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

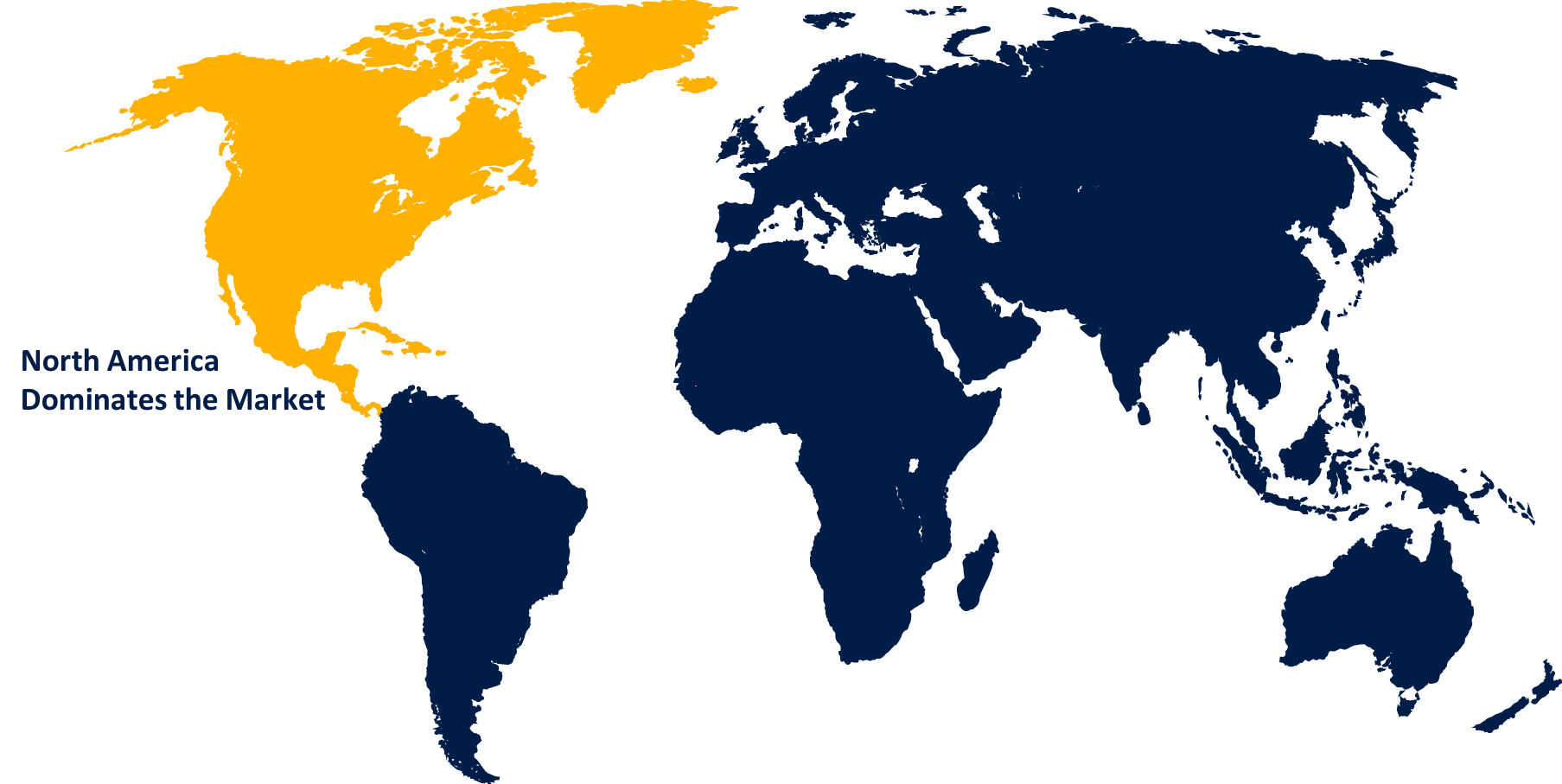

North America is anticipated to hold the largest share of the bill of materials (BOM) software market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the bill of materials (BOM) software market over the predicted timeframe. North America region attributed to a strong technological infrastructure and a robust manufacturing base across industries like aerospace, automotive, and electronics, which heavily rely on advanced BOM software for managing complex product designs and supply chains. The adoption of technology and a high concentration of major software providers further bolster North America's dominance in the market. Additionally, stringent regulatory requirements in sectors such as healthcare and aerospace drive the need for BOM software to ensure compliance and optimize manufacturing processes.Top of Form

Asia Pacific is expected to grow at the fastest CAGR growth of the bill of materials (BOM) software market during the forecast period. The region is thriving by rapid industrialization, increasing adoption of advanced technologies, and expanding automotive and electronics sectors. Emerging economies like China, India, and Southeast Asian nations are becoming major manufacturing hubs, prompting higher demand for BOM software to streamline operations and manage complex supply chains. Government initiatives, strategic partnerships, and a supportive business environment further contribute to the region's accelerated adoption of BOM software solutions in Asia Pacific regions.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the bill of materials (BOM) software market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- TGI

- MasterControl

- SMe Software

- Autodesk

- PDXpert

- SiliconExpert Technologies

- IQMS Manufacturing Software

- SAP

- Oracle

- Arena Solutions

- Upchain

- Epicor

- Spartan Software

- Emadata

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In April 2024, Sonatype launched the industry's first integrated system of record for the management of software bills of materials.

- In December 2024, Lynx Software Technologies announced the acquisition of Timesys Corporation, a provider of development tools, cybersecurity solutions, and specialized software engineering services for software composition analysis (SCA) tools that enable the production and management of software bill of materials (SBOM) and managed service offers related to Linux Distribution and open-source software lifecycle management.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the bill of materials (BOM) software market based on the below-mentioned segments:

Global Bill of Materials (BOM) Software Market, By Type

- Engineering BOM

- Manufacturing BOM

- Others

Global Bill of Materials (BOM) Software Market, By Application

- Food Industry

- Chemical Industry

- Electronics Industry

- Aerospace and Defense

- Business Logistics

- Other

Global Bill of Materials (BOM) Software Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1.What is the CAGR of the bill of materials (BOM) software market over the forecast period?The bill of materials (BOM) software market is projected to expand at a CAGR of 12.10% during the forecast period.

-

2.What is the market size of the bill of materials (BOM) software market?The Global Bill of Materials (BOM) Software Market Size is Expected to Grow from USD 8.20 Billion in 2023 to USD 25.69 Billion by 2033, at a CAGR of 12.10% during the forecast period 2023-2033.

-

3.Which region holds the largest share of the bill of materials (BOM) software market?North America is anticipated to hold the largest share of the bill of materials (BOM) software market over the predicted timeframe.

Need help to buy this report?