Global Bio Polypropylene Market Size, Share, and COVID-19 Impact Analysis, By Production Process (Melt Mass Polymerization (MMP), Solution Polymerization, and Gas Phase Polymerization), By Extrusion Type (Sheet Extrusion, Film Extrusion, and Pipe Extrusion), By Application (Building & Construction, Automotive, Consumer Goods, Packaging, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Chemicals & MaterialsGlobal Bio Polypropylene Market Insights Forecasts to 2033

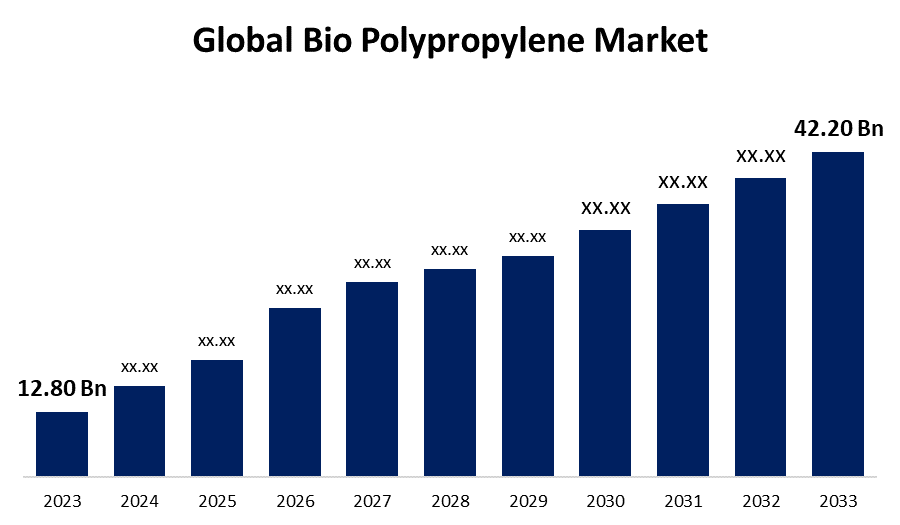

- The Global Bio Polypropylene Market Size was Estimated at USD 12.80 Billion in 2023

- The Market Size is Expected to Grow at a CAGR of around 12.67% from 2023 to 2033

- The Worldwide Bio Polypropylene Market Size is Expected to Reach USD 42.20 Billion by 2033

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

The Global Bio Polypropylene Market Size is anticipated to exceed USD 42.20 Billion by 2033, growing at a CAGR of 12.67% from 2023 to 2033. The rising consumer awareness about environmental sustainability and government regulations that promote the use of renewable materials is driving the growth of bio polypropylene market.

Market Overview

The bio polypropylene market refers to the market of plastic derived from renewable resources such as corn, sugarcane, and soybeans. Bio polypropylene (Bio-PP) is a type of plastic polymer, that serves as a sustainable alternative to traditional polypropylene made from fossil fuels and has similar properties to regular polypropylene. These polymers are progressively replacing traditional plastics. The market for bio polypropylene is expanding significantly due to government policies encouraging the use of renewable resources and growing consumer awareness of environmental sustainability. Because bio-based plastics are recyclable, biodegradable, and have a lower carbon impact, it is projected that demand is expected to increase. The demand for sustainable packaging is significantly rising as consumers and industries are seeking eco-friendly alternatives to traditional plastics which leads to the substantial rise in the use of bio-based polypropylene in packaging applications, thereby escalating the lucrative market growth opportunities. The adoption of bio polypropylene is further fuelled by the feasible and more affordable alternative to conventional plastics as production costs reduce and technology advances.

Report Coverage

This research report categorizes the bio polypropylene market based on various segments and regions forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the bio polypropylene market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the bio polypropylene market.

Global Bio Polypropylene Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 12.80 Billion |

| Forecast Period: | 2023 – 2033 |

| Forecast Period CAGR 2023 – 2033 : | 12.67% |

| 023 – 2033 Value Projection: | USD 42.20 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 124 |

| Segments covered: | By Production Process, By Extrusion Type, By Application, By Region |

| Companies covered:: | Borealis LyondellBasell Industries Mitsubishi Chemical Braskem Sabic TotalEnergies Versalis Reliance Industries Indorama Ventures Formosa Plastics Sinopec Kuraray Covestro Lotte Chemical Showa Denko Others |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growing consumer inclination towards sustainable and eco-friendly products in the consumer goods sector is propelling the market. The increasing concerns regarding the petrochemical toxicity and depletion of crude oil reserves surge the development of bio-based polymer which leads to drive the bio polypropylene market. In order to meet government laws that limit the use of petroleum-based plastics in food and automobile packaging sectors, as well as in medical devices, boosting the production of bioplastics, which is expected to drive the market growth.

Restraining Factors

The competition from alternative forms of bioplastic is hindering the market growth. Further, the slower development of production technologies for bio polypropylene is challenging the market.

Market Segmentation

The bio polypropylene market share is classified into production process, extrusion type, and application.

- The melt mass polymerization (MMP) segment held the largest market share in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on the production process, the bio polypropylene market is classified into melt mass polymerization (MMP), solution polymerization, and gas phase polymerization. Among these, the melt mass polymerization (MMP) segment held the largest market share in 2023 and is expected to grow at a significant CAGR during the forecast period. The process includes polymerization of propylene monomers into polypropylene by heating the monomer to its molten state and then initiating polymerization within that molten phase. The increasing demand for bio-based polymers from various industries such as automotive, packaging, and consumer goods is driving the market demand.

- The sheet extrusion segment accounted for the largest share of the bio polypropylene market in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on the extrusion type, the bio polypropylene market is classified into sheet extrusion, film extrusion, and pipe extrusion. Among these, the sheet extrusion segment accounted for the largest share of the bio polypropylene market in 2023 and is expected to grow at a significant CAGR during the forecast period. Sheet extrusion of bio polypropylene involves the creation of continuous plastic sheet, essentially a flat film, through an extrusion machine. The increasing demand for bio-based packaging solutions in food and beverage, healthcare, and consumer goods sectors is propelling the market.

- The packaging segment dominated the market accounting for a major market share and is expected to grow at a significant CAGR during the forecast period.

Based on the application, the bio polypropylene market is classified into building and construction, automotive, consumer goods, packaging, and others. Among these, the packaging segment dominated the market accounting for a major market share and is expected to grow at a significant CAGR during the forecast period. Bio polypropylene is primarily used in packaging applications such as food containers, films, caps, and flexible packaging owing to its lightweight, durability, and ability to be derived from renewable resources. The growing awareness about the use of biomass and industrial residue for plastic production is contributing to driving the market growth.

Regional Segment Analysis of the Bio Polypropylene Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

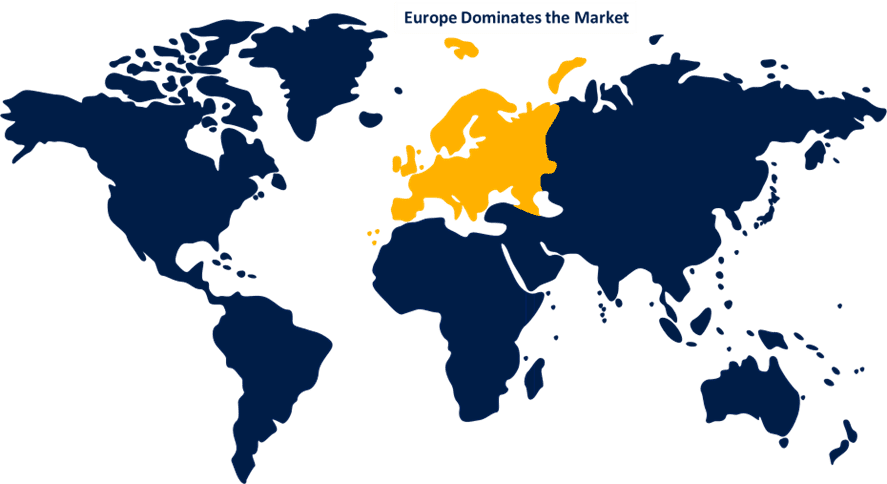

Europe is anticipated to hold the largest share of the bio polypropylene market over the predicted timeframe.

Get more details on this report -

is anticipated to hold the largest share of the bio polypropylene market over the predicted timeframe. Germany is the major automaker and consumer, and as the country’s automotive sector expands, it is expected that demand for bio-based PP would rise. The increasing need for bio-PP in the automotive industry is propelling the bio polypropylene market in the region. The European Commission’s implementation of a number of regulations that encourage the use of bio-based polymers in a variety of applications, due to high biomass content and low greenhouse gas emissions during manufacturing, is driving the regional market growth.

Asia Pacific is expected to grow at the fastest CAGR growth of the bio polypropylene market during the forecast period. The increasing polypropylene demand from automotive and building and construction sectors is driving the market for bio polypropylene. Further, the high demand for sustainable and eco-friendly materials, technological advancements in bio-polymerization, and increasing environmental awareness are the factors propelling the bio polypropylene market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the bio polypropylene market along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers and acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Borealis

- LyondellBasell Industries

- Mitsubishi Chemical

- Braskem

- Sabic

- TotalEnergies

- Versalis

- Reliance Industries

- Indorama Ventures

- Formosa Plastics

- Sinopec

- Kuraray

- Covestro

- Lotte Chemical

- Showa Denko

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In September 2024, Citroniq, a Houston-based company specializing in carbon-negative materials, announced the successful completion of a $12 million Series A funding round. This investment round was notably supported by Lummus Technology, a key partner that previously revealed plans to construct four bio-based polypropylene (PP) plants in the United States in collaboration with Citriniq.

- In September 2024, Braskem, the largest polyolefins producer in the Americas, as well as a global market leader and pioneer producer of biopolymers on an industrial scale, announced the launch of its innovative bio-circular polypropylene (PP), which it sells under the brand name WENEW.

- In December 2023, LyondellBasell and Pigeon Singapore – a market leader producing high quality mother and baby care products for Southeast Asia, Middle East, Africa and Oceania regions - announced their collaboration on advancing the sustainable research and development efforts in baby nursing bottles. The renewed series of the Pigeon nursing bottles would use the LyondellBasell bio-based CirculenRenew polypropylene polymers, as part of Pigeon’s transitioning away from using 100% virgin polypropylene resins.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the bio polypropylene market based on the below-mentioned segments:

Global Bio Polypropylene Market, By Production Process

- Melt Mass Polymerization (MMP)

- Solution Polymerization

- Gas Phase Polymerization

Global Bio Polypropylene Market, By Extrusion Type

- Sheet Extrusion

- Film Extrusion

- Pipe Extrusion

Global Bio Polypropylene Market, By Application

- Building and Construction

- Automotive

- Consumer Goods

- Packaging

- Others

Global Bio Polypropylene Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East and Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East and Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the bio polypropylene market over the forecast period?The bio polypropylene market is projected to expand at a CAGR of 12.67% during the forecast period.

-

2. What is the market size of the bio polypropylene market?The Bio Polypropylene Market Size is Expected to Grow from USD 12.80 Billion in 2023 to USD 42.20 Billion by 2033, at a CAGR of 12.67% during the forecast period 2023-2033.

-

3. Which region holds the largest share of the bio polypropylene market?Europe is anticipated to hold the largest share of the bio polypropylene market over the predicted timeframe.

Need help to buy this report?