Global Bioactive Formulation for Functional F&B Market Size, Share, and COVID-19 Impact Analysis, By Ingredient Type (Prebiotics, Probiotics, Adaptogens, Polyphenols, Omega-3 Fatty Acids, and Antioxidants), By Formulation Technology (Encapsulation, Microemulsions, and Liposomal Delivery), By Application (Food & Beverages, Nutraceuticals and Sports Nutrition), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: HealthcareGlobal Bioactive Formulation for Functional F&B Market Insights Forecasts to 2033

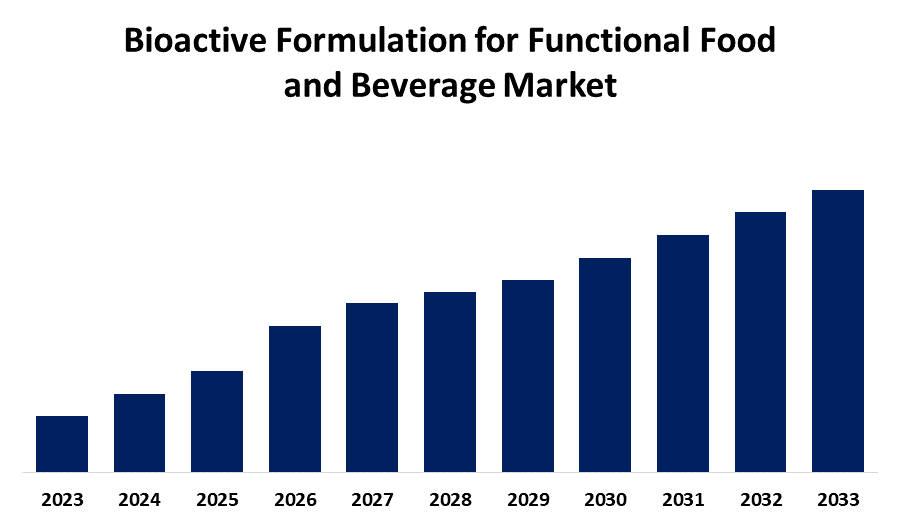

- The Global Bioactive Formulation for Functional F&B Market Size is Expected to hold a significant share by 2023

- The Market Size is Growing at a CAGR of 8.28% from 2023 to 2033

- The Worldwide Bioactive Formulation for Functional F&B Market Size is Expected to Hold a Significant Share by 2033

- North America is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Bioactive Formulation for Functional F&B Market Size is Anticipated to Hold a Significant Share by 2033, at 8.28% CAGR from 2023 to 2033. The increased demand for functional foods and beverages as people become more aware of the need to eat a well-balanced diet rich in important nutrients. Because of their increased use in functional foods and beverages, as well as nutritional supplements, the market provides significant growth potential for producers of these compounds.

Market Overview

Biologically active substances that offer health advantages beyond simple nourishment are used in bioactive compositions in functional food and drinks (F&B). Polyphenols, prebiotics, probiotics, vitamins, peptides, and dietary fibers are common constituents in these products, which are intended to improve gut health, immunity, cognitive function, and athletic performance. The development of functional foods is being fueled by consumer demand for diets high in bioactive chemicals to improve well-being, avoid disease, and improve health. Dietary substances probiotics, fibers, and bioactive plant ingredients such vitamins, peptides, omega-3 fatty acids, phenolic compounds, and antioxidants are examples of these bioactive substances. The bioactive formulation for functional F&B market for functional beverages is growing rapidly owing to developments in energy-boosting, anti-aging, and cognitive-enhancing beverages. The relevance of gut health is being studied more and more, which is driving up demand for bioactive like probiotics, prebiotics, and postbiotics.

Report Coverage

This research report categorizes the market for the bioactive formulation for functional F&B market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the bioactive formulation for functional F&B market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the bioactive formulation for functional F&B market.

Bioactive Formulation for Functional Food and Beverage Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 8.28% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 260 |

| Tables, Charts & Figures: | 125 |

| Segments covered: | By Ingredient Type, By Formulation Technology, By Application and By Region |

| Companies covered:: | Turtle Tree Labs, Ingredion, Ocean Spray Cranberries, Inc., Howtian, Arla Foods, Sabinsa, DSM, Cargill, Fonterra, Archer Daniels Midland Company, DuPont de Nemours, Inc., Kerry Group, BASF SE, Hansen Holding A/S, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The bioactive formulation for functional F&B market propelled by several factors including bioactive substances in the food and beverage industry improve flavor, increase nutritional value, prolong shelf life, and offer health advantages. The need for bioactive compounds in this business has been driven by rising consumer awareness of the value of a balanced diet and their preference for natural components. Another driving factor is a growing need for meals and drinks that deal with age-related health issues like heart health, joint health, and cognitive loss as a result of the world's population aging.

Restraints & Challenges

The bioactive formulation for functional F&B market constrained by several factors including maintaining both the stability and the effectiveness of these compounds over the product's shelf life may prove challenging. Furthermore, guaranteeing the bioavailability or the extent to which biological agents are absorbed and utilized by the body, is a significant problem because many compounds breakdown before reaching their target locations.

Market Segmentation

The bioactive formulation for functional F&B market share is classified into ingredient type, formulation technology, and application.

- The probiotics segment accounted for the largest revenue share over the forecast period.

Based on the ingredient type, the bioactive formulation for functional F&B market is categorized into prebiotics, probiotics, adaptogens, polyphenols, omega-3 fatty acids, and antioxidants. Among these, the probiotics segment accounted for the largest revenue share over the forecast period. This dominance is due to probiotics are easily adapted and can be added to a variety of products, such as dairy products yogurt, drinks, snacks, and nutritional supplements. Because of their wide range of applications, producers are able to include them into a variety of product categories, which boosts their market share.

- The encapsulation segment holds the highest market share through the forecast period.

On the basis of formulation technology, the bioactive formulation for functional F&B market is categorized by encapsulation, microemulsions, and liposomal delivery. Among these, the encapsulation segment holds the highest market share through the forecast period. The segment prominence is attributed to the technique is often used in the functional food and beverage industry to ensure that sensitive bioactive substances are released at the appropriate location in the body and to prevent their degradation. Encapsulation is especially popular because it makes it possible to effectively add probiotics and other delicate nutrients to foods and drinks without sacrificing their effectiveness.

- The food & beverages segment is estimated to hold the largest market share through the forecast period.

Based on the application, the bioactive formulation for functional F&B market is categorized into food & beverages, nutraceuticals and sports nutrition. Among these, the food & beverages segment is estimated to hold the largest market share through the forecast period. The food & beverages segment dominance is due to a wide range of products, an increasing interest in functional foods, and the acceptance of preventive healthcare. Preventive healthcare has gained international attention due to its intrinsic benefits, and functional foods assist consumers in putting preventive healthcare into practice.

Regional Segment Analysis of the Bioactive Formulation for Functional F&B Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the bioactive formulation for functional F&B market over the predicted timeframe.

Get more details on this report -

Asia Pacific is projected to hold the largest share of the bioactive formulation for functional F&B market over the predicted timeframe. The region's dominance is attributed to the continued presence of several manufacturing firms in nations like China and India. The APAC region's governments are promoting the creation of functional foods by enacting advantageous laws and funding food innovation. Additionally, it is projected that the region's growing need for functional ingredients will fuel market expansion throughout the projection period. The growing demand for functional additives is prompting several businesses to expand their product offerings.

North America is expected to grow at the fastest CAGR growth in the bioactive formulation for functional F&B market during the forecast period. The region's rapid expansion is due to Consumers are avoiding synthetic substances due to growing health concerns. The need for bioactive compounds in the area is being directly increased by this. The market for bioactive compounds in the North America region is also growing as a result of the presence of numerous market participants.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the bioactive formulation for functional F&B market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Turtle Tree Labs

- Ingredion

- Ocean Spray Cranberries, Inc.

- Howtian

- Arla Foods

- Sabinsa

- DSM

- Cargill

- Fonterra

- Archer Daniels Midland Company

- DuPont de Nemours, Inc.

- Kerry Group

- BASF SE

- Hansen Holding A/S

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In February 2024, Kerry Group has announced the launch of Plenibiotic, a rice-derived postbiotic for human and pet supplementation. Scientific studies back up the ingredient's benefits for digestive and skin health, since it is temperature-tolerant, resilient in a variety of conditions, shelf-stable, and requires just a tiny amount to be effective.

- In April 2022, Royal DSM launched a long-term initiative to replace fish oil with omega-3 fatty acids derived from algae. This program seeks to maintain quality and potency while reducing damage on marine life. DSM expands their product line with products such as life'sOMEGA and life'sDHA in response to consumer demand for environmentally friendly bioactive components.

- In May 2021, Hansen Holding A/S developed an innovative probiotic therapy that enhances the health and production of dairy and meat cattle. This adaptable probiotic provides farmers with a straightforward and efficient solution to increasing animal welfare and production in the bioactive ingredient market by incorporating it into various feed compositions.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the bioactive formulation for functional F&B market based on the below-mentioned segments:

Global Bioactive Formulation for Functional F&B Market, By Ingredient Type

- Prebiotics

- Probiotics

- Adaptogens

- Polyphenols

- Omega-3 Fatty Acids

- Antioxidants

Global Bioactive Formulation for Functional F&B Market, By Formulation Technology

- Encapsulation

- Microemulsions

- Liposomal Delivery

Global Bioactive Formulation for Functional F&B Market, By Application

- Food & Beverages

- Nutraceuticals

- Sports Nutrition

Global Bioactive Formulation for Functional F&B Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the global bioactive formulation for functional F&B market?The global bioactive formulation for functional F&B market is projected to expand at 8.28% during the forecast period.

-

2. Who are the top key players in the global bioactive formulation for functional F&B market?The key players in the global bioactive formulation for functional F&B market are Turtle Tree Labs, Ingredion, Ocean Spray Cranberries, Inc., Howtian, Arla Foods, Sabinsa, DSM, Cargill, Fonterra, Archer Daniels Midland Company, DuPont de Nemours, Inc., Kerry Group, BASF SE, Hansen Holding A/S, and others.

-

3. Which region is expected to hold the largest share of the global bioactive formulation for functional F&B market?The Asia Pacific region is expected to hold the largest share of the global bioactive formulation for functional F&B market.

Need help to buy this report?